Banking Mammoths – Top 10 U.S. banks have $11 trillion of the $13 trillion in total banking assets. The problem? We have over 7,650 banks. The banking oligopoly leads to a concentration of wealth at the top.

- 3 Comment

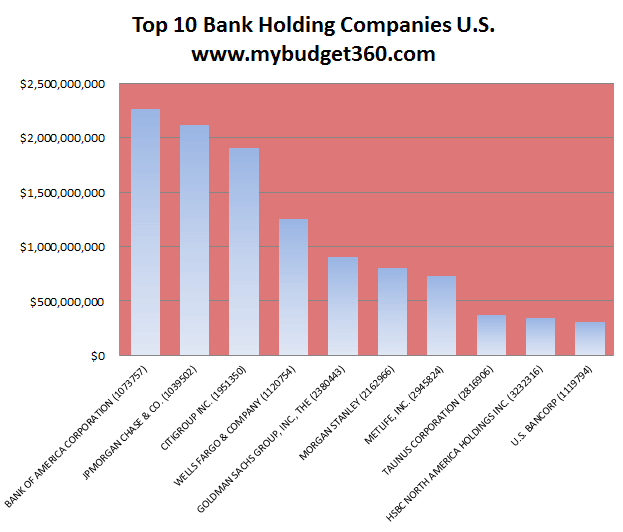

The too big to fail problem is still an issue that needs to be dealt with even though many would like to ignore it like a big dark secret. The FDIC is holding up a system with $5.4 trillion in deposits and no deposit insurance fund. I know a lot of Americans have a hard time believing this but this is a cold hard fact. The entire banking edifice of our nation is held up on pure faith combined with the backing of our largest banks and government. This wouldn’t be such an issue if banks operated as responsible stewards of the economy but instead they have used the taxpayer wallet as some kind of endless buffet piggybank. What is even more troubling is based on the latest data, the top 10 bank holding companies in the United States are reporting $11 trillion dollars in assets. Now why is this a problem? The FDIC insures 7,657 banks with $13 trillion in assets. In other words, over 84 percent of all banking assets are in the hands of the big ten banks. This is a modern day oligopoly. Take a look at this chart for the top 10 banks:

As of Q4 2010

This sort of distribution does not bode well for our economy. We have witnessed what happens when giant banks fail because they were allowed to grow too large for their own good. A sort of disequilibrium occurs and if things collide as they usually do the taxpayer is left holding the bag of junk debt. Every week one or two smaller banks fail almost without any news. This is really how our economy should work. Banking assets should be distributed in a more even fashion where if the biggest bank failed, there would be enough banks with enough assets to make up for the lost services provided by the one bank. It would not be a systemic problem. But many of the too big to fail incur large amounts of leverage so are in debt to even more than the face value of their assets. It is a thinly veiled method of speculation with the implicit support of the American taxpayer. As the gambling gets more intense, so does the wealth evaporation in the real economy.

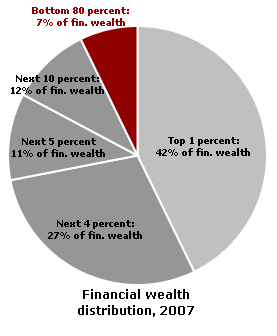

These kinds of distributions create incredible amounts of problems. Take for example how financial wealth is distributed in the U.S.:

Source:Â William Domhoff

The top 1 percent in the United States control 42 percent of all financial wealth. But breaking it down further we realize that the top 10 percent control 93 percent of all financial wealth. This kind of imbalance was last seen in the United States right before the Great Depression hit. It is a historical irony that during the Great Depression many people started feeling wealthier because they were getting into massive amounts of consumer debt (nothing like today) and had the ability to speculate in the stock market on margin. While it was estimated that only 1 million Americans dabbled in the stock market at that time, most of the wealth again was aggregated at the top as it is today. The vast majority where only spectators buying a lottery ticket for the get rich show. Most Americans are leveraged to the hilt with debt while true unencumbered financial wealth keeps trickling to a very small segment of our economy. While some would argue this is the end result of unfettered capitalism the reality is the wealth is being siphoned off from the productive public by this elite class buying off politicians and creating a system favorable to those with means and not with the best or most innovative idea. It is a plutocracy and these kinds of systems do not last. Right now the growth of the plutocracy is occurring on the backs of the dwindling middle class.

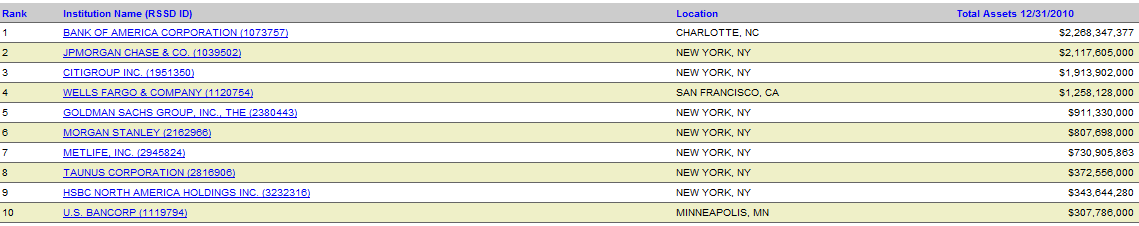

Take a look at the raw number of assets at these top banks:

Bank of America is the leader with $2.2 trillion in assets followed by JP Morgan Chase at $2.1 trillion. CitiGroup has $1.9 trillion and Wells Fargo has $1.2 trillion in assets. It is surprising that Goldman Sachs has $911 billion even though it isn’t even a traditional bank like the first four. But no bank at these levels is really traditional anymore. All of these banks have mixed commercial and investment banking together and that is why you see Morgan Stanley right behind Goldman.

The problem with these “assets†is that many of these banks are claiming commercial real estate and residential real estate at inflated values. A loan to a bank is an actual asset. For example, say an investor purchased $100 million in commercial real estate out in Las Vegas and borrowed the money with Bank of America. $90 million of this was on a loan. Bank of America can claim a $90 million asset. Say this was purchased at the peak and the value of the investment is now $40 million (or less). How is it possible that Bank of America can still claim that this piece of land is worth $90 million just because of the face value of the loan? This is what is going on everyday in America. A large pretend game that everything somehow hasn’t lost its value. But it has.

Many of you can see the absurdity in this kind of accounting. Simply using artificially high values to claim assets at peak levels. In reality, how much of the above asset list is really worth what they say it is? Hard to say but it is likely a lot lower and banks know this so they are systematically leaking out properties onto the market now that they have shored up their capital balance sheets with trillions of taxpayer dollars.   The Federal Reserve is content with the public having the wool pooled over their eyes. This is similar to when gold was confiscated during the 1930s banking crisis yet those that managed to hold onto gold or other valuable commodities did well as the U.S. devalued the dollar during the Great Depression. Bottom line is the government is not going to tell you what is good for you. Even now after a 10 year rally, bubble, or whatever you want to call it you still have Wall Street and government insiders talking ill of commodities. The reason? They cannot print at will when they have to back money with something that is tangible.

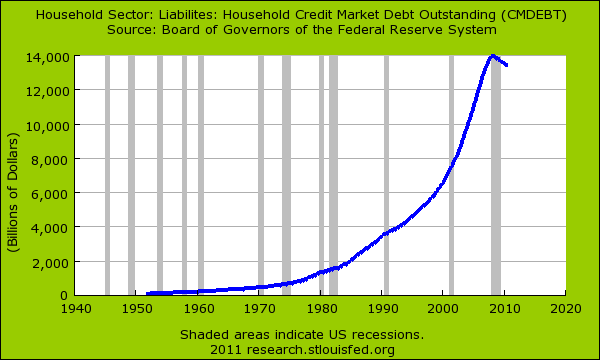

The fact that these banks leverage and borrow from the Federal Reserve and consequently devalue the US dollar of Americans, results in a bad ending for most. The concentration of wealth at the top both in society and with banks is a cautionary sign that we are not out of the woods. There is an enormous amount of debt still out there in the economy. Just look at household debt:

Sure household debt has fallen from the peaks but $13.4 trillion in debt via mortgages, credit cards, auto loans, student loans, and other debt is still attached to average Americans. Interestingly enough the FDIC insured banks have $13.3 trillion in assets. You can do the math here but this is a country largely built on debt and the quality of debt outstanding is questionable at best and you need only look at the millions of foreclosures that will happen this year for that confirmation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

cab said:

This explains why we a 14trillion in debt. This is where our money went!

February 27th, 2011 at 5:11 am -

ordaj said:

Thomas Jefferson said:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered…I believe that banking institutions are more dangerous to our liberties than standing armies… The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.”

–Thomas Jefferson

March 5th, 2011 at 6:58 pm -

Peter said:

You’re missing some zeros in the chart, there. Those should be trillions, not billions.

August 7th, 2018 at 9:24 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!