Bankruptcy filings reflect a weak economy – 9 percent jump in bankruptcy filing in last month of data. Bankruptcy map shows Nevada and South have highest filing rates per capita. $79,000 income and $11 million in debt?

- 0 Comments

Bankruptcies are still plaguing this country and show deeper strain in the fabric of the economy. Average Americans are still very much dealing with the challenges of a deep and profound recession. Filing for bankruptcy is usually the end of the financial line for many Americans. Yet in the last month of data for March of 2010 we saw the highest number of bankruptcy filings in the entire fiscal year. Instead of the rate dropping it has actually increased. Keep in mind that these filings are coming at a time when bankruptcy laws have become tougher and stricter on most Americans. Yet there is only so much you can squeeze out of someone who has entered the last stage of their financial options. This is why even programs that focus on mortgage adjustments don’t help because they don’t drill deep enough into the core of what is happening in our economy. Without a job or adequate income, most will simply default whether it is in bankruptcy or through foreclosure.

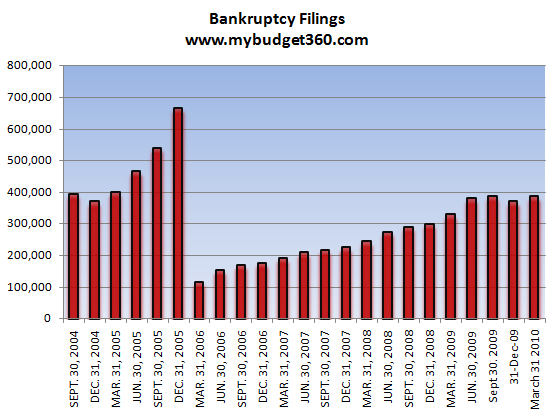

The spike in 2005 below was bankruptcy cases rushing through the system before tougher legislation was enacted:

Source:Â U.S. Courts

The number of filings still remains elevated and is a reflection of the structural problems in the economy. We need to remember that when people file, the vast majority are at a point where they are no longer able to service their debts with their current cash flows. In other words, they are insolvent. It is interesting that the large banks reached this point in 2008 yet were able to muster unlimited access to taxpayer money through the U.S. Treasury and Federal Reserve. Clearly individual Americans don’t have this luxury and must deal with the trappings of a system that is pushing many over the edge. Many have brought this on but others have paid medical bills with credit cards. Either way, there are major losses ahead.

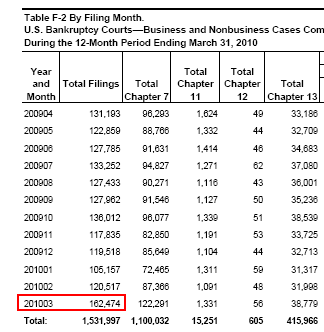

Quarterly data may not show the exact changes or turns in the economy. But if we break down the last fiscal year for bankruptcy filings we see that we end on an extremely high number of filings:

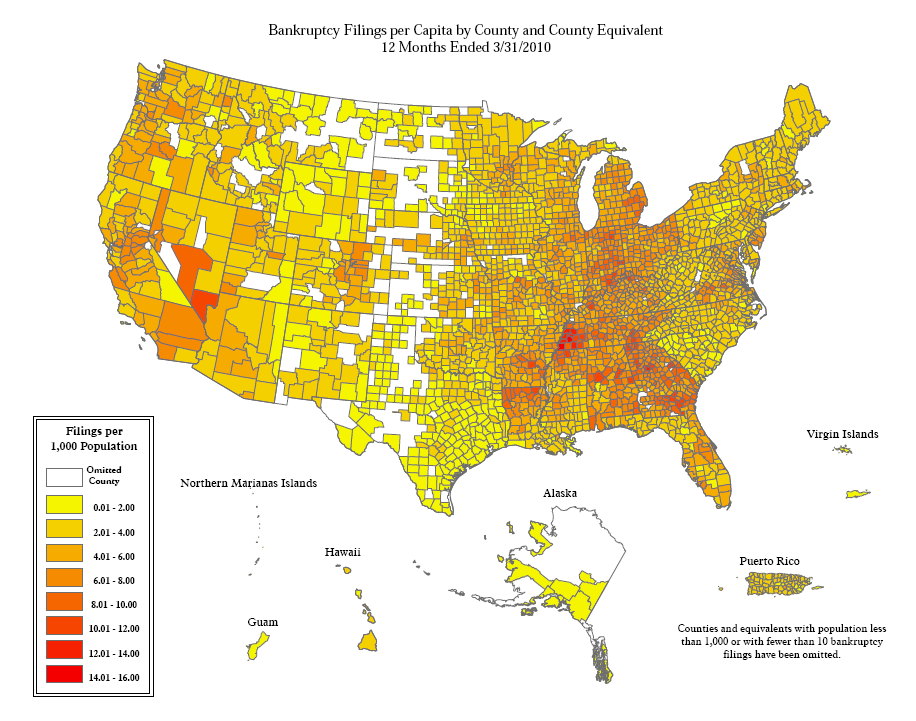

By far the last point was the highest on record. It is likely that this reflects the courts rushing to close the year with later cases but whatever the reason may be, this spike is not a good sign for the financial health of average Americans. The problems of bankruptcy are not limited to one part of the region. Although it would seem that Nevada and the South have larger per capita case filings:

It is clear that bankruptcy hits every part of this country. If we look at the latest data for May, we find the following:

May 2010 filings (personal filings):Â Â Â Â Â Â Â Â Â Â Â 136,142

May 2009 filings (personal filings):Â Â Â Â Â Â Â Â Â Â Â 124,838

This is a solid 9 percent increase over the last year. Keep in mind this latest jump occurred under the notion that the economy is recovering. It also reflects the unwillingness of banks to work with average Americans even though that is specifically what the bailouts were based on. What is occurring unfortunately with banks is the hoarding of bailout funds to speculate on Wall Street while letting American families be crushed by their insurmountable debt. The breathing room they have gotten from the taxpayers is not being given back.

It is a troubling case of do as I say, not as I do. The bottom line with spikes in bankruptcy filings is that the real economy is still mired in deep systemic problems. If we have people anxiously waiting for their food assistance debit cards to refill at midnight simply so they can go to Wal-Mart to buy food, this tells us the economy is anything but solid. Bankruptcy is never the first option and is a long process.

To show you that this can hit everyone even those that appear to be rich a New Jersey “housewife†shows that spending too much can lead many into a precarious financial position:

(NY Post) Spendaholic ‘housewife of NJ’ owes a big-hair-raising $11M

Behind the bankruptcy filing

What the Giudices make a year:

$79,000 (plus $120,000 in “assistance†from family members)

What they owe: $10,853,648.04

Credit Cards

$104,000

including $20,000 to Bloomingdale’s, Neiman Marcus, Nordstrom$1,280 monthly payment for Cadillac Escalade

Mortgages

$2.6M

for eight mortgages on three homes (two have been handed back to lenders)$5.8M Joe’s business investments

$85,600 Home repairs

$12,000 Fertility treatments

$2,300 Phone bill

Now run those numbers. $79,000 annual income and $11 million of debt! Now I’m sure many other families are nowhere close to this but there are many families out in more high cost of living regions that took on say $1 million in debt with a $40,000 income. This was easily done during the credit bubble days. I’m sure the courts are seeing many of these cases as well. In the end, the fact that bankruptcy filings are this high shows that the economy isn’t exactly on the mend.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!