Blame the real estate bubble on California and New York. Why the housing bubble centered around 4 states and spread across the nation. The Southwest and Florida sunshine real estate infatuation. 45 percent of foreclosure filings come from 4 states.

- 2 Comment

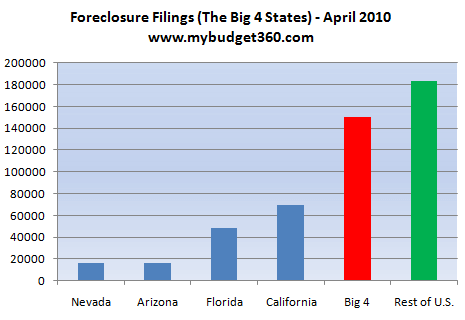

When we hear about the foreclosure crisis we tend to paint with a very broad real estate brush. Without a doubt the housing bubble bursting is rippling throughout the country. Yet to assume all states are being impacted equally is absolutely incorrect yet mainstream media analysis usually talks about the “foreclosure crisis†as if it were hitting each state on an equal footing. For example, 45 percent of all foreclosure filings in April, the last data we have available, all occurred in 4 states; California, Florida, Nevada, and Arizona. This is something that most understand but why did these Southwestern states and Florida lead the charge forward in the housing bubble to begin with? It really is a question that hasn’t been examined. If we look closely, we will find structural but also psychological reasons for why this occurred.

First, let us look at the data:

Source:Â RealtyTrac

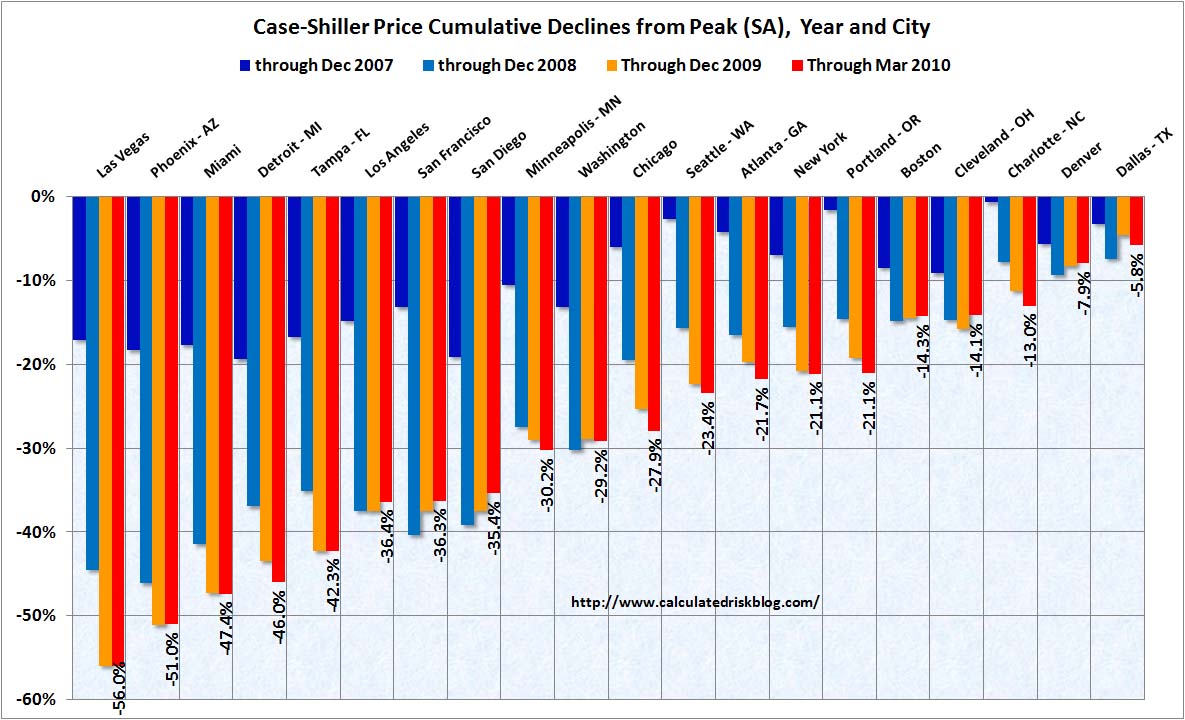

It is incredible that nearly half of all foreclosure filings today are occurring in only 4 states. It would be one thing if we were looking at the most populated states but Arizona and Nevada can hardly fall into that category. The housing bubble expansion was fueled nationwide by a multitude of reasons. But the actual bubble exploded in certain regions for a variety of reasons. Of the top eight markets with the biggest price declines, seven occur in the four states mentioned above:

Source:Â Calculated Risk

The only exception to the top eight comes from Detroit which has had housing and deeper economic issues for two decades. The bubble popped hardest in the following areas:

-1Â Â Â Â Â Â Â Â Â Â Â Las Vegas

-2Â Â Â Â Â Â Â Â Â Â Â Phoenix

-3Â Â Â Â Â Â Â Â Â Â Â Miami

-4Â Â Â Â Â Â Â Â Â Â Â Detroit

-5Â Â Â Â Â Â Â Â Â Â Â Tampa

-6Â Â Â Â Â Â Â Â Â Â Â Los Angeles

-7Â Â Â Â Â Â Â Â Â Â Â San Francisco

-8Â Â Â Â Â Â Â Â Â Â Â San Diego

Something had to be going on in the Southwestern part of the country and Florida that inflated prices so high to begin with. What can this be? Part of the boom in these areas was led by the “sunshine†mentality that also helped create a massive real estate bubble in Florida in the 1920s. The same mentality also created a housing bubble in the late 1980s/early 1990s in California. Yet this can only explain part of the reason why these four states shoulder the bulk of the housing bubble and now face the biggest ramifications from the burst of prices.

California money chasing Arizona and Nevada

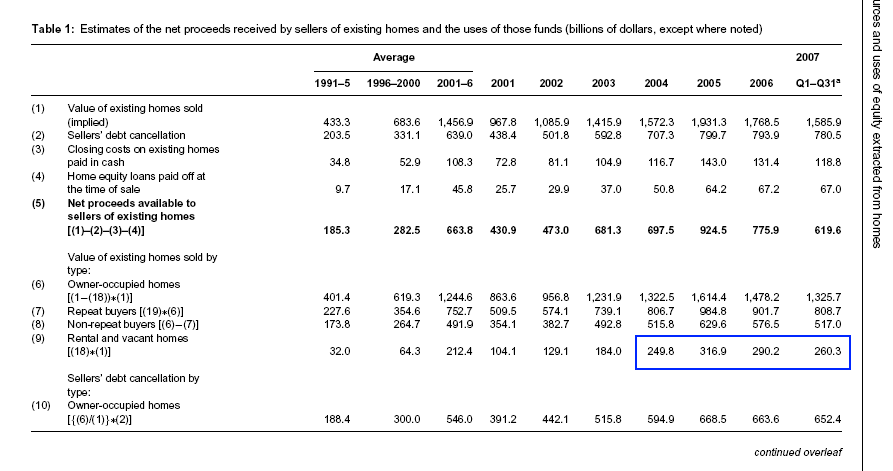

An often cited paper on mortgage equity withdrawals is the Greenspan and Kennedy paper. In this paper, we find the use of home equity extraction. So if we drill down lower, we can safely say that the California housing bubble with equity extraction also helped spur the housing bubbles in neighboring Nevada and Arizona. Let us look at the data carefully:

From 2004 to 2007 over $1 trillion in proceeds either from selling or refinancing went into purchasing rental or vacant homes (including vacation properties). Without a doubt many California homeowners tapped their equity to purchase homes in Arizona and Nevada and pushed prices to absurd levels. At the height of the boom in Las Vegas 4 out of 10 home sales were investment properties:

The current supply of homes is sitting at nearly 24 months, according to Kuptz.

“(Nuwireinvestor – Dec 2007) In April 2004 we had 2,100 homes in the MLS, and every person cashing their equity to buy homes is a crazy market,†Kuptz said. “Four in 10 were investment homes with most of the money coming from California. Today we have 27,400 homes in the MLS. More than 48 percent are vacant on the market.â€

With that kind of inventory, builders aren’t building much, and it’s undoubtedly a buyer’s market. (For more information on overbuilding in Las Vegas, see our article on the Top 5 Overbuilt U.S. Markets in 2007.)â€

This is an important distinction because it shows that even at a deeper level, California at least for the Southwest was the absolute nucleus for its own housing bubble but also fueled the bubbles of Arizona and Nevada. Florida had dynamics similar to California and I’m sure if we look at surrounding areas we’ll find similar trends (although nothing close to equity withdrawals like those found in California).

Hub for toxic mortgages and easy financing

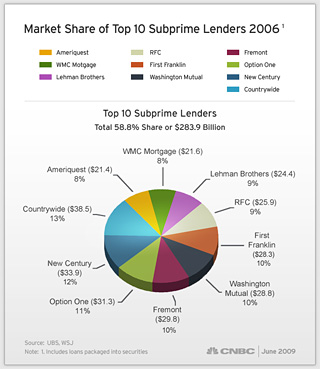

Many of the top toxic lenders found their home in California. New Century Financial was notorious at making horrible loans:

“(Wiki) As of January 1, 2007, New Century was the second-biggest subprime mortgage lender in the United States, and was headed by Brad Morrice, President and CEO. Frederic J. Forster, a lead independent director, served as a non-executive Chairman of the Board. Subprime mortgage loans are riskier loans in that they are made to borrowers unable to qualify under traditional, more stringent criteria due to a limited or blemished credit history. Subprime borrowers are generally defined as individuals with limited income or having FICO credit scores between 500 and 620 on a scale that ranges from 300 to 850. Subprime mortgage loans have a much higher rate of default than prime mortgage loans and are priced based on the risk assumed by the lender.â€

New Century was located in Irvine California and had the glitz to pull off billions of dollars in volume of toxic loans that were then sold off to Wall Street. And if we look at the data even closer, we find most toxic lenders were located in California:

Source:Â CNBC

Not only were the bulk of the toxic lenders in California but many were located in Orange County (Ameriquest, New Century, Option One). When we examine insanely bad products like option ARMs it should come as no surprise that over half of the active loans are in California. Yet the above chart tells us a lot more. It would seem that California was not only one of the states with the biggest housing bubble but this is also a place that spread its toxic lending ideas (i.e., option ARMs, etc) all over the country. When we examine the root causes of the housing bubble, some states do seem more culpable for why the ideas spread as they did.

Wall Street uses California finance machine to spread toxic waste across country

Yet the toxic lenders didn’t hold onto the debt for longer than they could to get it out the door. Instead, they found a place in New York, New York on Wall Street to securitize the mortgages being pumped out by these lenders. The big investment banks used states like California and Florida as their primary funnel sources to juice the entire housing market. The Southwest without a doubt was pumped up predominantly by California including pushing up the markets of Nevada and Arizona. Florida essentially was the California version on the east coast. So when we talk about the toxic mortgage crisis and the root causes we should look at three primary states; New York, California, and Florida. Fix the source and money won’t go chasing easy profits. After all, we didn’t see any housing bubbles in Kentucky, Kansas, or Missouri. Why is that? Some parts of Arizona had developments being built away from city centers in the middle of the desert. Certainly the appeal would have been the same in other states but something kept it confined to certain regions.

The psychology and culture of certain states

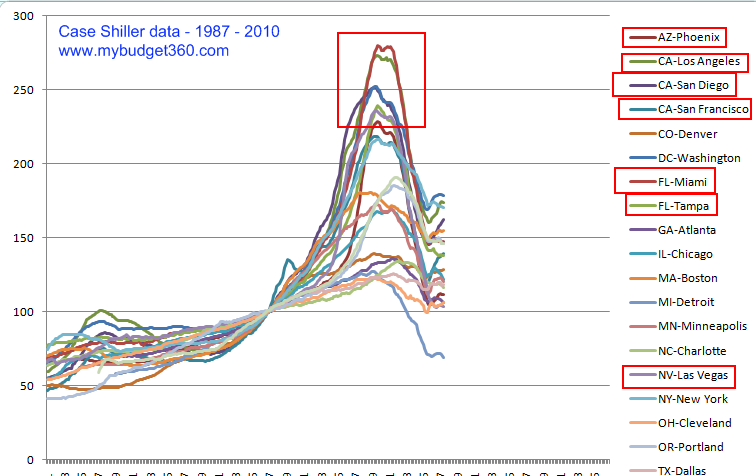

California has an obsession with real estate. The fact that the bubble has burst has brought the state economy down to its knees. It should be obvious as to why. Much of the conspicuous spending came from equity in the massive bubble being tapped out but also, those that were employed at the Option Ones’ and New Centurys’ of the state. These were high paying jobs that paid extremely well and people spent practically every penny that came in. When the bubble burst, the highly dependent real estate economy faced a double hit. Even if we look at the bubble peaks, we find the same four states rising to the top:

Something fueled the bubble much stronger in these locations and we are finding a much more specific answer. If you want so solve a problem you have to find the source. Clearly certain states had much more of a hand in creating the housing bubble and if we nail it down it would revolve around New York (financing), California (toxic loan creation), and Florida. From this triangle the delusion spread.

These states have also experienced housing bubbles in the past so something in their makeup makes them vulnerable to mania and bust. Even the old Lincoln Savings of the notorious Keating Five Savings and Loan scandal is located in Irvine California (Orange County). One of the buildings was then used by New Century. Handing off one crisis to another seems to originate in certain locations. If we drill down even further, we may find that certain counties are even more responsible. For example I doubt much of upstate New York had little understanding of the investment bank shenanigans just like people in central California had little say in developing option ARM loans.

When we look at why the housing bubble grew and expanded into a nationwide problem, we really need to address the financial industry and areas that spawned this mess. The nucleus of the problem becomes clearer once we focus our attention.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

site survey said:

California will be bailed out. Have no fear. And that bailout will come at the expense of Nevadans, Oregonians and Arizonians as well as all the other states too.

June 10th, 2010 at 6:42 am -

theyenguy said:

The bubble came by greed: greed of the toxic mortgage lenders to originate loans; greed of the borrowers as they applied for no-documentation, stated-income loans, greed of debtors for mortgage equity withdrawal to live a surrealistic lifestyle with cosmetic surgery, Botox injections and breast implants as well as to lease automobiles, greed of Wall Street to issue CDOs world-wide at leverage of 30 or 40 to one, greed of owing a second home, and greed of flippers to buy-improve-and-sell properties. It is astounding that many flippers obtained multiple no-documentation loans in Arizona and in Florida. A large part of the bubble came from Option-Arms and Alt-A loans which were used more frequently in the four hardest hit states: Florida, Nevada, Arizona and California.

The Case-Shiller chart suggests an economic collapse in Detroit which came from failure of the auto industry to innovate, an overwhelming yen carry trade, zero interest lending program from overseas auto manufacturers, and allowing outsourcing using a long supply chain to low-cost overseas manufacturers. What a disaster where the manufacturing center of America became its rust belt of dislocation and misery.

I believe cities in Arizona, such Phoenix, cities in Nevada, such as Las Vegas, cities in Florida such as Tampa and Orlando, and cities in Illinois, such as Englewood, to be so devastated by foreclosure, that they are economic dead zones; that is cities so overwhelmed by toxic mortgage lending, that they cannot support economic life; and these cities and states are leaders into debt deflation, that is leading America into Kondratievv winter.

In summary, I look back to the neoliberal philosophy of Milton Friedman and Alan Greenspan to set the stage for the greed motivation to enable the bubble; and also financial deregulation which came by the repeal of the Glass Steagall Act under Bill Clinton. All of these globalists liberated the capitalists and made serfs of the rest resulting in a pyramidal society.

June 10th, 2010 at 8:09 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!