Option ARMs in Financial Pain: 900,000 Mortgages and 1 out of 4 either Seriously Delinquent or in Foreclosure. OCC and OTS Report Shows Foreclosures Still Growing.

- 1 Comment

It is interesting to see new data being published regarding Option ARMs in the new OCC and OTS report. According to the recently released report, there were 900,000 active Payment Option ARMs in the United States. What is troubling about the current report is the performance of these loans. Many of these loans are located in the depressed states of California and Florida that have dealt with record breaking budget problems. These loans have the potential to once again destabilize the housing markets in these regions.

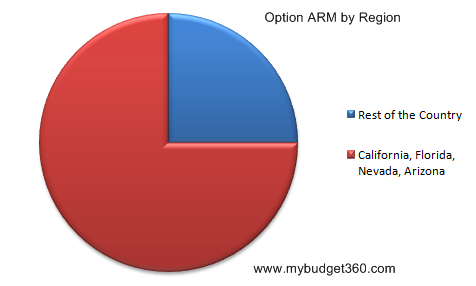

What is interesting to note about this report is that 1 out of 4 of the option ARMs are either in foreclosure or in serious delinquency. The vast majority of these loans will not hit recast dates until 2010 yet the performance of these loans is already disastrous. The difference between a recast and a reset is that a recast is a change in payment irrespective of a low interest rate. Let us first look at their geographic location:

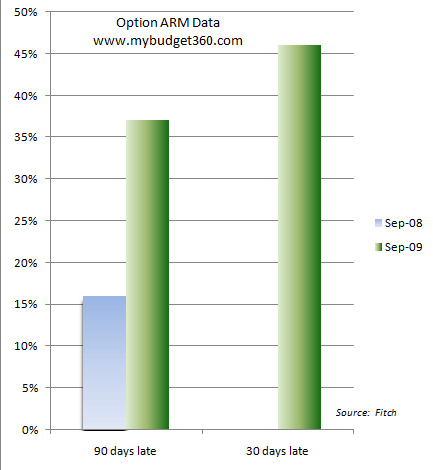

For the most part this mortgage problem will hit certain regions disproportionately. 75 percent of these loans are located in California, Florida, Nevada, and Arizona. The data reported in the OCC and OTS report out on Wednesday falls in line with data provided by Fitch last month:

These loans are going bad and the problem with these loans is they do not qualify (in most cases) for the HAMP program for modifications. The debt-to-income levels are too high and many of these loans are severely underwater. What the data at times fails to acknowledge is the fact that many of these loans were piggybacked with second mortgages of equal repute. For example, someone may have gotten an 80% loan-to-value option ARM but on top of that, took a 10 year ARM second mortgage to cover the other 20%. This was extremely common during the bubble in California.

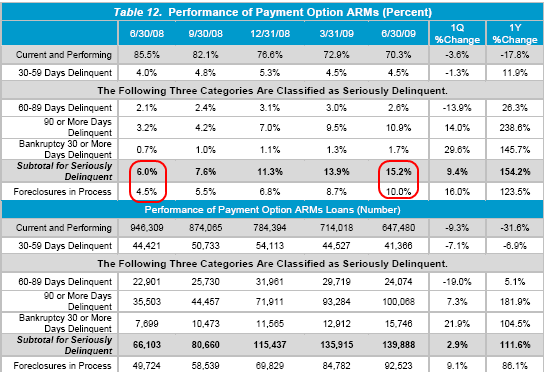

So let us look at this new option ARM data, the first time ever reported in the OCC and OTS data:

Let us examine the above. In one year, you have seem problems for these loans double. In June of 2008 6% of option ARMs were seriously delinquent and 4.5% were in foreclosure. In June of 2009 15.2% of these loans are seriously delinquent and 10% are in some form of foreclosure. Keep in mind that the vast majority of these loans don’t hit recast dates until 2010 to 2012! That is, the inherent structural problems of these loans are still part of the future terms and these problems are occurring more because homeowners over stretched. Add in recasts and you have a recipe for further disaster.

What can we take from the above data? That the vast majority of these option ARMs will become foreclosures. This will further depress housing prices in states like California. It is an interesting mix as well. Many of these option ARMs were made to so-called prime borrowers:

“New to this report are performance data on Payment Option ARMs. Although Payment Option ARMs were made to prime borrowers in nearly the same percentage as the overall portfolio (64% versus 68% overall), the added risk characteristics and geographical concentration of these loans cause them to perform significantly worse than the overall portfolio.”

Now isn’t that something? In terms of the proportion of prime borrowers, there isn’t much of a difference in terms of credit score but the overall risk is vastly different. That is why we have seen the rise of the strategic default where homeowners who can make their payment purposely stop paying on their home.

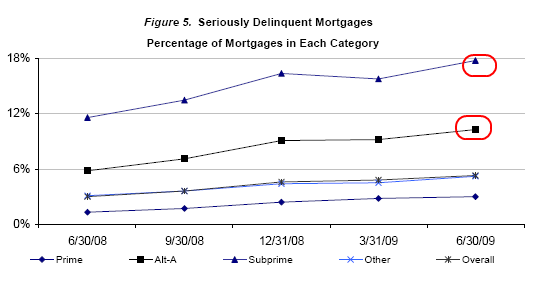

Option ARMs fall under the Alt-A category. Let us look at how loans are performing in the current market:

Every type of loan category is seeing delinquencies rise. Why? This is on top of loan modifications and trillions backing the banking system. The problem as we all know is that a loan modification has little significance if someone is dealing with job loss and rampant unemployment. We are focusing on the wrong things. Instead of looking at loan modifications and other programs that are failing miserably, we should spend the same considerable time examining new sectors of employment for the average American. Yet the tunnel vision focus on helping mortgages is based on the reality that the banking sector relies on this as their cash flow stream. They don’t care how the average American pays their mortgage or even if they have the job. They don’t mind getting taxpayer bailouts or handouts as long as they get paid.

The option ARM is a toxic pariah on the system. These loans never had any right of being in the market. What we need to do is institute claw backs where those who made profits on this criminal product should have all their funds confiscated and property taken back. It is funny how those on Wall Street raise their right hand and say, “I promise never to do that again” and get away with a decade of fraud. This is like a bank robber being allowed to keep his stolen money after promising he will never be able to do it again. We need to gut the system and claw back what was got in a criminal way. Look at what is happening with Bernard Madoff. What is not being said is how many people actually made money with his scheme. Those early in the game made billions. Lawyers are now going to claw back those gains. We should apply the same to the banking and Wall Street sectors. The fact that we have no strong movement on this front is troubling but also tells you who is running the show.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

BJB said:

In your article you talk about how the Option ARMs will create future foreclosures, but with all the shadow inventory that is already not moving off of banking sheets why would they bother to ever move this stuff? Is there a point when the banks actually ever have to unload these foreclosures off of their sheets? Without mark to market there will never be the incentive to realize losses. We have zombified all our major lending institutions and they just are sucking money from congress. I just don’t see a point where they will become motivated to sell.

October 1st, 2009 at 5:12 am