California Budget Miscalculation: The $60 Billion Budget Gap. Cargo Levels near Decade Lows. Why the Financial Recovery will come last to California.

- 4 Comment

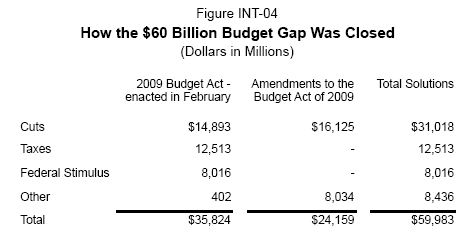

The largest singular economy in the United States is still facing a fiscal mess. California is still trying to grapple with the budget deal that is now in place. The challenging part seemed getting a budget passed but the more challenging aspect of the budget process is enacting the $26 billion in fixes. Over the last two chaotic years, the state of California has had to figure out how to bridge a stunning $60 billion budget gap. Much of this has to do with the 30 year housing bubble that exploited the gold rush mentality of California. Since the bubble burst in 2007, the state’s revenues have fallen off a cliff and with it, taking down most of the money that the 8th largest economy in the world takes in. Many economists are now predicting a peak unemployment rate for the state of 13, 13.5, and 14 percent. There will be tough times ahead for the state and I would expect that come fall and winter, we will be seeing another gap in revenues.

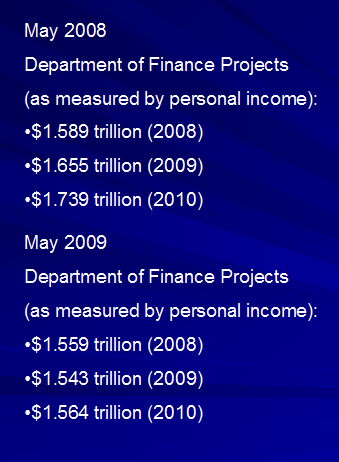

Much of this has to do with projections that were simply too optimistic. Let us take a look between the May 2008 and the May 2009 projections:

Keep in mind that the Department of Finance made these projections during a time when the housing bubble was already contracting and revenues were starting to decline. This was not a sudden stunning revelation of lost revenues. In one year, they were off by the following: $30 billion, $112 billion, and $175 billion. If in a one year estimate you miss your projections by $317 billion you will have major problems. Yet the state was making projections based on bubble economic traffic. The lifeblood of any nation is trade and commerce. We have two of the biggest and busiest ports in the world in the Long Beach and Los Angeles ports. If you want to see the recession in action, let us look at trade traffic:

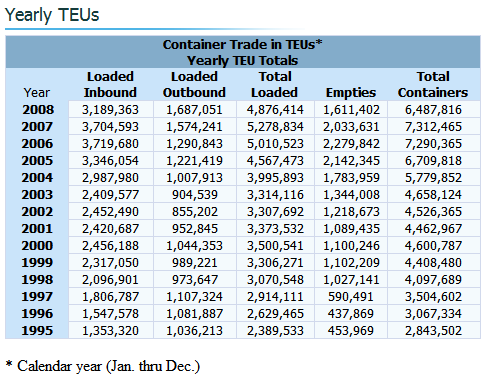

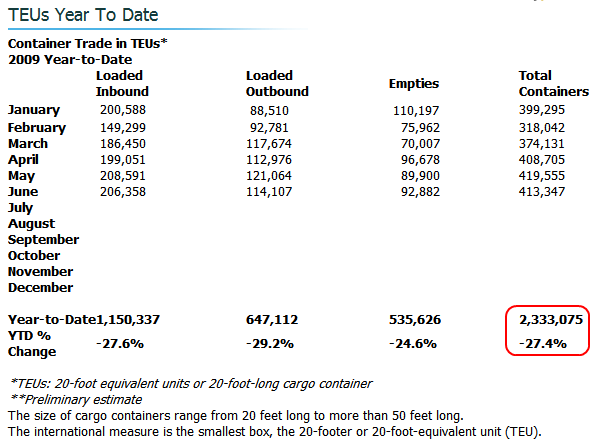

At the peak in 2007 some 7.3 million cargo containers went in and out of the Long Beach port. This was a doubling of cargo traffic since 1997. However, since that time the amount of cargo coming in has stalled. Let us take a look at current traffic:

If the current rate holds, we are now back to a sub-5 million level which can put us back nearly a decade. This is why paying attention to cargo is a solid indicator of measuring the health of an economy. We’ll need to monitor this closely to see what occurs over the next six months.

So clearly, California is not out of the woods simply because they relied so heavily on the housing market. The state boomed with the bubble but is busting with it as well. Subprime lending started in the state and many of the top outfits like Countrywide Financial and New Century Mortgage made their home here. Not only did they make their home in California, but in Southern California. The economic damage is extremely concentrated in certain regions of the state.

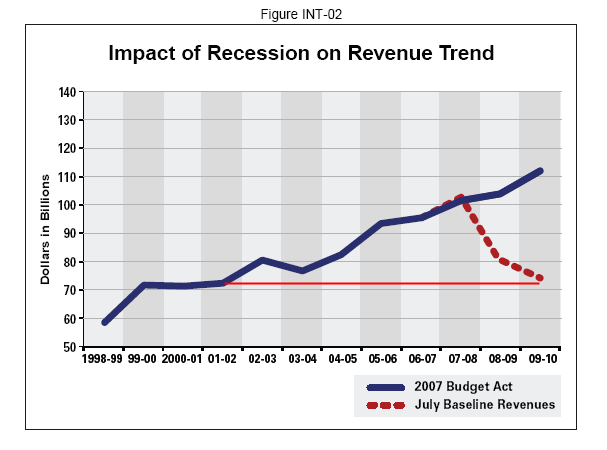

Projections need to be adjusted and the latest Department of Finance report shows how wide this gap is for state spending:

State revenues are heading back to levels not seen in a decade. Keep in mind we are not factoring the inflation over the past decade. Dollar for dollar we are heading back a decade. That is why even though the nationwide employment data may have slightly improved last month California is in a different ball game. Keep in mind that nationwide we still lost 247,000 jobs (a 3 million annual rate) but a big jump occurred because of primarily two reasons. A large number of discouraged workers quit looking for work and employers stopped hiring. So to claim it is a recovery is premature. A state like California that just patched a $26 billion budget deficit with over $15 billion in cuts will expect to see payrolls shrink as the budget is implemented.

The U.S. Treasury and Federal Reserve are missing one crucial point here. That point involves job creation. We keep hearing about this “jobless” recovery when 26,000,000 Americans are unemployed or underemployed. The age-old wisdom comes from the data that shows that most recoveries start in equities and finally, find their way to actual jobs or what most average Americans would call the real economy. This idea has been right in many of the last recessions but this is not your typical recession. There are a few different things in this recession. Many of the economic shocks occurred from non-job related areas. What this means is we have never seen a nationwide housing bubble implode annihilating $13.89 trillion in household wealth that then led to real job losses. In past recessions, even with growing job losses some weakness in the housing market occurred as people lost jobs. This time, the bursting bubble led to job losses related to housing. Given we will have no massive housing bubble again, what is going to make up for that gap?

The housing question probably pertains more to California than any other state. Some 40 percent of industry growth since the beginning of the decade relied on housing related industries. With that market gone, what will make up that void? It is hard to say but patching up $60 billion in gaps in one year is not symptomatic of a healthy state. California is not alone but the problems are deeper here given the structure of the economy.

The actions taken to close the gap will have longer-term consequences:

Until we have stability in the job markets, there is little reason to believe we will have a jobless recovery. Just because it has happened in the past, does not mean it will happen this time.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Ignotz of Angostura said:

When in the course of human events…

No money to eat

And you can’t pay the rent

And you find yourself down

To your last red cent.ObamaShave!

August 10th, 2009 at 12:39 pm -

Dave from NY said:

A jobless recovery… that kind of sounds like a sexless marriage…

August 10th, 2009 at 6:09 pm -

ben said:

Lost decade is right!

August 11th, 2009 at 8:31 am -

RICHARD RALPH ROEHL said:

Humans are clever but they are not very prescient or wise. People too often suppress the bigger picture for the $ake of petty $elfish interests, outdated religious dogma… and ethno-racist tribe-all eeego born from fear and insecurity. There also seems to be a lacuna of common sense and compassion among business and political leaders.

I rest my case here with the DOCTRINE OF PERPETUAL GROWTH of the human population and the global consumer economy on Planet Over-Birth Earth, a fragile HOST ORGANISM of finite space and finite resources. Perpetual growth in a finite system (Earth) cannot be sustained. Perpetual growth is cancer. Full blown cancer. Odd that such a clever species cannot see this… and deal with it.

Needless to say… the same holds true for the mis-managed $tate of California. The dream is dead there… and the Hotel waits for an earthquake causing two trillion in damages.

August 11th, 2009 at 9:11 am