The burden of unsupportable debt. US debt-to-GDP growing at a pace rivaling certain European nations – The dramatic problems of peak debt in 2012.

- 3 Comment

What makes this global financial crisis unique is that it is based on unsustainable levels of debt. In historical cases you would have sovereign nations defaulting on their debts but these were more isolated and clustered, not global issues. Today virtually every large crisis that is hitting is occurring because of peak debt situations. No one metric can tell you when a country will tip into crisis but there is definitely a combination of confidence breaking down and simply the inability to pay back said debt. Many countries have hit this breaking point; Iceland, Ireland, Greece, and Spain. Many other nations teeter closely on that thin line of solvency. These breaking points do not just happen overnight. They incubate and slowly expand until a pinnacle is achieved only to reach a point where action is necessary. At this point in many cases it is too late. That is why when we look at the debt to GDP ratios of countries we are quickly reminded that most are moving in the wrong direction.

US debt growth outpacing GDP growth

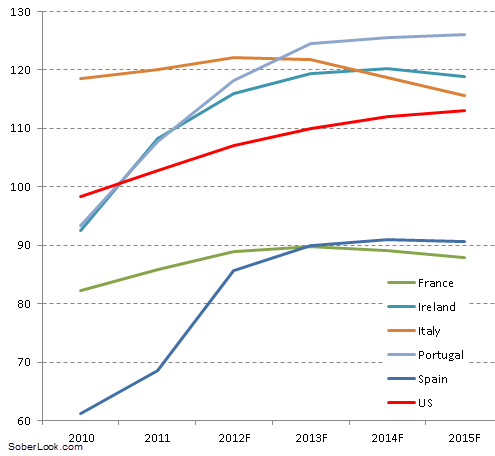

In the simple equation of debt-to-GDP you want GDP to grow much quicker than debt. This is similar to having your income growing quicker than your actual debt. When we look at various countries we realize that the US is facing a much faster growth in debt than our GDP:

Debt to GDP ratio for select countries (source: Barclays Capital)

Now one of the major differences the US currently has is the insatiable appetite for US debt. For the moment, the fear trade is helping the US gain access to globally cheap debt. You also have the world’s most powerful central bank that is willing to step in at any stage of the process. This is good if you are a large bank centered out of the US but is not helpful for the working and middle class. The fact that the Fed can print digital dollars is not necessarily a good thing for the country overall. Slowly, Americans are moving backwards. The nation has lost two decades of wealth growth as demonstrated by figures released from net worth studies. Yet look at the above chart and you will realize that simply increasing debt is not necessarily a recipe for economic success.

The Euro Central Bank has the ability to print but they do not have the common union that the US has. This isn’t to say that one debt is better than the other but when diving into fiat currencies, confidence is a big player and you realize that hunger for Greek and Spanish debt is not unlimited and this is infecting the Euro as a connected system. The issue at hand is that too much debt is floating around in the global system. It is impossible to deal with a debt issue simply by expanding debt. Growth speed is also important. The US has been growing but our debt has been expanding much faster. Much of the recent growth is because of this debt spending but when you run the math you realize that for every dollar in debt brought into the system the corresponding growth is much lower. In other words a dilution and depreciation of the currency occurs.

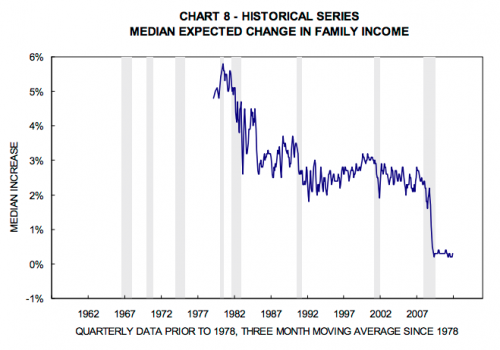

The underlying change has fallen largely on the middle class of the nation as demonstrated by income figures:

This is why net worth figures have fallen by 40 percent for your typical family between 2007 and 2010. For the moment, there is still an appetite for US debt because it is still viewed as the world’s safe haven. Yet we have major political dysfunction and unsustainable costs coming down the pipeline. Will this always be the case? The market is operating currently on the assumption that this will be the case but as we have learned, expect the unexpected especially in a system where central banks can simply print away any financial issues and push the costs to their citizens.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

therooster said:

The blind spot in this debt based paradigm is that everything needs to be done from the top of our historical structure that’s predicated on hierarchy. That’s crap. The age of information now allows up to implement systemic liquidity, debt free, from the grass roots of the marketplace. Precious metals can be monetized and circulated, adding much needed liquidity without adding to debt. If anyone thinks they can extinguish debt with more of the same (debt based fiat currency), then they are in need of a good rest to say the least. Never forget the gifts of the magi.

June 26th, 2012 at 8:47 pm -

Tom Baxter said:

I’d be more impressed if the ‘Debt to GDP ratio for select countries’ went back a few more years and if actual median income was included, instead of just the expected, expected by whom?

June 26th, 2012 at 11:14 pm -

John Berkowitz said:

I have read an interesting post about the debt influencing the prices of housing in Peru. The conclusion was quite simple. When they allowed them to take credit and started to offer it in almost every supermarket in 2000, whole nation took debts. Because that everybody could borrow money, the prices in real estate have tripled since then.

As a Canadian, I can observe very similar scenario in my country, with the difference that it took longer (since mid 80s). I´m glad that I´m one of the few people between 25-34 who still has no debt.If you check the how many Canadians are in debt, you will be astounded. And as your article explains, it is impossible to cure the disease with the same method that got you ill.

July 1st, 2012 at 5:41 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!