Commercial Real Estate Surpassed Residential Real Estate as Worst Performing Property Class in 2009: The $3.5 Trillion Financial Time Bomb is hitting the Economy.

- 2 Comment

Some of you are probably not aware that the commercial real estate market has crossed a dreaded line in the sand. Commercial real estate (CRE) that includes apartments, industrial, office, and retail space is now performing worse than residential real estate. Not just by a little but by a good amount. While the CRE bust took about a year longer than the residential housing bust, once problems started hitting in this market prices have been steadily collapsing. At the peak, it was estimated that CRE values hit $6.5 trillion in the country. With $3.5 trillion in CRE debt outstanding, this seemed to provide a nice equity buffer. That buffer is now erased.

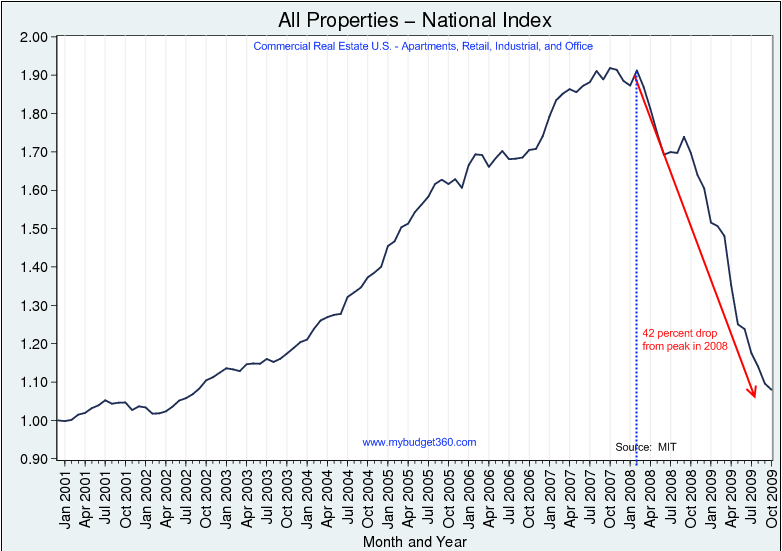

First we, need to examine the actual decline in CRE values by looking at data gathered by MIT:

Putting together all CRE values we find that the market has fallen by a significant 42 percent. Now assuming this figure, that $6.5 trillion is now “worth” approximately $3.7 trillion giving us an equity cushion of $200 billion for all CRE properties in the U.S. I doubt this figure is even that high. It is safe to say that commercial real estate is now in a negative equity position. The U.S. Treasury has discussed plans on bailing out this industry but not much has been done on this front since all the bailout funds have been concentrated on residential real estate and protecting the too big to fail banks. Many CRE loans are held in the smaller regional banks that are actually small enough to fail. The FDIC will be busy in 2010 given the above data.

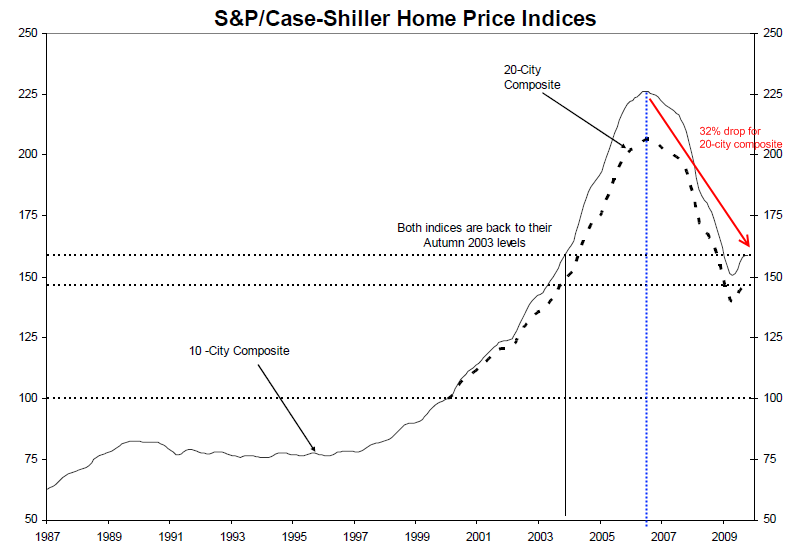

Now looking at the residential market, prices fell earlier but have recently stabilized because trillions of dollars have been used to prop up the system:

If we look at residential real estate, prices are down 32 percent from their peak. Keep in mind it is likely to fall further because many items like the Fed buying up $1.25 trillion in mortgage backed securities and keeping rates artificially low cannot go on forever. Also, is the government going to give our a tax credit forever? This is highly unlikely and when each program is phased out, we can expect minor shocks back into the market. Plus, we have to remember that many homes have been in a state of purgatory because of moratoriums and other patchwork programs. These only delay foreclosure and once they hit the market prices will continue moving lower.

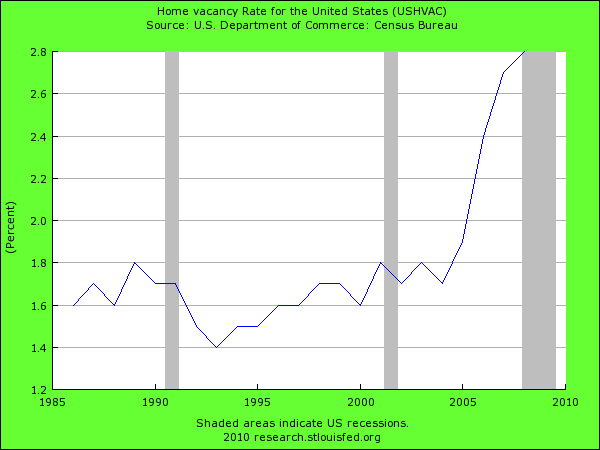

Yet commercial real estate is falling with no support. And what would be the support given that our economy is contracting so viciously? Why would we need any more retail space near sub-divisions where people didn’t even move in? With housing there is a price point where people will move in. Take for example the college student graduate that is only making $10 an hour because of the poor employment situation. He may need to move back home even though this isn’t what they want. If apartment rents are $1,000 a month, then renting on their own won’t make any sense. But if apartment rents are $400 in this area he may consider moving out. This is the new calculus of the market. And apartment pricing is seeing pressure to the downside because of massive vacancies:

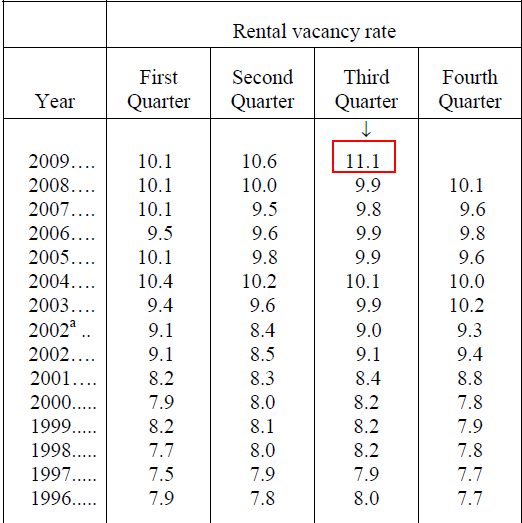

And it gets even worse when we look at rental vacancies and this is where apartments fall under:

This is the highest rate on record and tells us that we have over built and the market is still unable to sop up the excess properties. So what will happen is competition for cheap housing by lowering rents. This is the only way to drive demand in a market where average Americans are becoming more price conscious every day. The problem with many of the CRE projects is that they were expecting peak value rents and will have no ability to service their debt with new market rental rates. That is, they are insolvent. And many bankruptcies will happen because of this. Or if you are a too big to fail bank you can simply walk away from your commitments.

Take a look at some of the ads in the San Diego area in California:

Or if having nearly one month of rent free isn’t enough, how about two flat screens?

These kind of offers are everywhere and speak to a market saturated with inventory. At least with apartments, you will find people at the right price. With some office buildings you won’t find anyone nearly at any price point. Why would someone pay rent if there is simply no business demand in that area? Places like Arizona and Nevada now have countless units just sitting empty because market demand has dried up. The CRE bust is rolling through and it looks like very few Americans actually contemplate how much over building was done in this industry in the last decade.

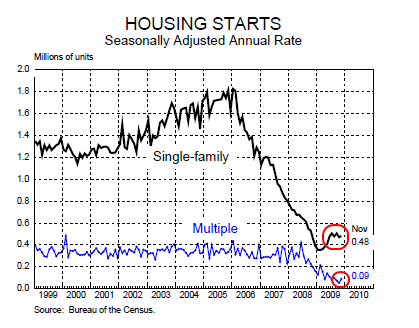

And companies are not building any more properties as you might expect:

This in turn means millions that derived their income from the building and housing industry will have years to wait before any recovery begins to take place. The CRE bust is now in full force even surpassing the disaster in residential housing. What we can get from this massive bubble burst is our near religion with all things real estate has led us to the economic abyss.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

SoYouThink said:

Nice article. One comment though…

“Keep in mind it is likely to fall further because many items like the Fed buying up $1.25 trillion in mortgage backed securities and keeping rates artificially low cannot go on forever. Also, is the government going to give our a tax credit forever?”

Hasn’t the Fed already hinted that they may continue the MBS purchase program once it is set to expire soon? Also, the tax credit has already been extended, so what is stopping the gov from extending again? At the very least, I think these programs continue at least through the elections in November. It will be interesting to see if they start a CMBS purchase program to go along with the MBS program.

January 17th, 2010 at 7:56 am -

Matt said:

Love the article.

I hope to see them start a CMBS purchase program. My company is looking forward to buying distressed commercial property.

January 20th, 2010 at 2:36 am