Buying a Home in America today is Expensive Thanks to the Banking Sector: Examining Income and Home Prices from 1950 to the Present. Can Home Prices Fall Another 38 Percent?

- 20 Comment

A question rarely asked regarding the housing market today is whether prices are affordable. There seems to be this implicit belief that because prices have fallen so drastically that they somehow must reflect a bargain. This is not necessarily true. I think in our consumerist society people are conditioned to automatically assume that a lower price somehow means a good deal. Go to any mall after the Christmas shopping season and you’ll see “amazing” bargains for 50, 60, or even 70 percent off. But is it really a bargain? This question is not often asked yet this is the central tenet to the housing bubble that got many Americans into trouble.

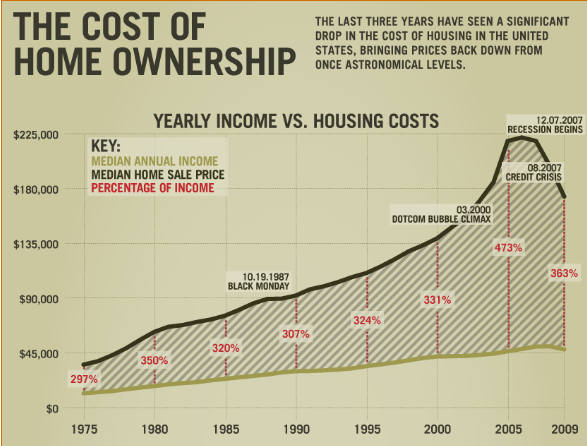

In order to understand the housing market, we need to look at the income of the average American. Yet this is something that is usually removed from the equation when discussing housing policy. How do Americans pay for their mortgage? From an ever scarcer W-2 job yet Wall Street and policy makers have somehow consciously avoided focusing on this connection because headline unemployment is at 10 percent. But let us look at the relation of income to home prices over the decades:

Source:Â Visual Economics

Now this is a critically important chart. At the height of the bubble it took 473 percent of the median household income to purchase a median priced home. Compare this to 297 percent in 1975. The current number is 331 percent. But let us run our own numbers based on Census data. The median U.S. household income is $52,029 according to the 2008 Census (this number is lower for 2009 but data won’t be released until September of 2010). The current median home price is $172,600.

Median Household income:Â Â Â Â Â Â $52,029

Median U.S. home price:Â Â Â Â Â Â Â Â Â Â Â Â $172,600

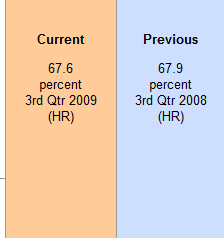

But is this affordable? Not necessarily. First, let us look at the home ownership rate in the U.S.

67.6 percent of U.S. households own their home. The housing situation is very much a majority issue for average Americans. This is where most Americans store their wealth. 51 million households have a mortgage while 23 million live in homes with no mortgage at all (approximately 30 percent). Let us run the numbers for someone looking to buy a home today with a FHA backed loan since this only requires a 3.5 percent down payment. Here are the numbers:

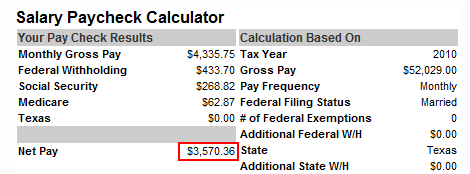

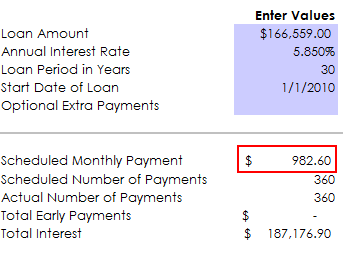

We’ll go ahead and use Texas since there is no state income tax there and it will give a better overall net income to the median income household. After taxes, the family is taking home roughly $3,570 per month. How much money down is need for a FHA backed loan? 3.5 percent and let us use the $172,600 median home price:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $6,041

Now if we run the numbers, things look okay here:

$982.60 / $3,570= 27.5% Debt to Income (DTI)

Many bankers will even go with gross income so you will have a better ratio. However, taxes and insurance are other costs associated with owning a home. In Texas, these run anywhere from 2.5 to 3 percent. Let us add that in as well:

PI ($982.6) + TI ($431.5) = $1,414

Now, your housing payment is eating up nearly 40 percent of your income:

$1,414 / $3,570 = 39.6%

What about repairs? Landscaping? Garbage pickup? These are all other items associated with owning a home. Keep in mind we are using the median priced home in our example and not some extravagant home. This is what the average American is facing.

Even going back to 1975, prices would still need to fall to meet that price to income percentage:

$50,029 x 2.97 = $148,586

The median home price would need to fall an additional 13.9 percent to go back to 1975 affordability levels. I’ve seen a few articles mention home prices falling an additional 10 to 15 percent and this seems to fall in line with the above. Keep in mind this is important because buying a home is now based on income and monthly fixed outlays. The maximum leverage products like option ARMs are now a thing of the past. You now have to demonstrate via reportable income that you can afford a home. With unemployment so high this becomes a challenge.

I always find it fascinating that most charts looking at home prices seem only to go back to the 1970s. This is when the U.S. Treasury and Federal Reserve disconnected the dollar from any connection to the gold standard. But let us look at two other periods of relative good economic times, 1950 and 1960:

1950

Median household income:Â Â Â Â Â Â Â $3,319

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $7,354

Home price / income = Percent of 221

1960

Median household income:Â Â Â Â Â Â Â $5,620

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $11,900

Home price / income = 211 percent

Now this is interesting data. If we use the 1960 ratio home prices today would need to be:

$50,029 x 2.11 = $105,561

A 38.8 percent drop from current levels. The above chart from 1975 to the current housing peak in the late 2000s shows housing prices going up for nearly 30 years. Many average Americans simply assumed this was the normal trajectory of home prices.

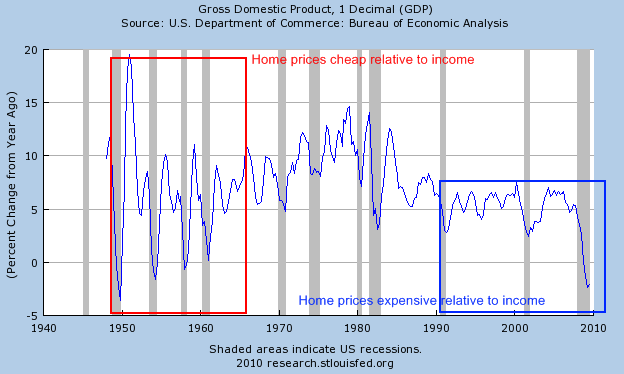

But the 1950 to 1960 example shows that after one decade, relative to income, home prices in 1960 were actually cheaper than they were in 1950. In 1960 the median home price cost about twice the median annual household income. Some can’t even imagine this number and think this would be ruinous for the economy. Nonsense from the banking industry. In fact, the 1950s saw some of the best GDP growth:

Now many would argue that the rise of the two income household has pushed home prices up. But you can easily argue that it now takes two incomes merely to have what those in the 1950s and 1960s had. Of course this comes from the insidious ability of the U.S. Treasury and Federal Reserve to siphon off the earning power of average Americans and give massive handouts to the banking industry. And that is exactly what occurs. Look back up at the mortgage calculation chart. Aside from the monthly payment, notice something else? The “cost” of that cheap 5.85 percent mortgage is going to run you $187,176 after 30 years. In other words, the interest you pay is more than the actual home price. Now if banks are borrowing near zero from the Fed why not allow average Americans to borrow directly from the Fed since virtually every mortgage is now guaranteed by the taxpayers? Because interest and fees, unproductive aspects of our economy are being taken from the banking industry and suffocating the balance sheet of average Americans.

Home prices have gotten more expensive because the crony banking system is hungry for more and more profits. If banks had to lend their own money, home prices would automatically adjust lower. Is that necessarily bad? This would provide more mobility and less of a focus on homes as commodities and more as a place of shelter. Take for example the current bust. Say someone in struggling Detroit finds a job in New York but can’t sell his home. Say that new job utilizes their skills more effectively. How is their inability to move helping the overall prosperity of our economy? It isn’t. Yet this is the position millions now find themselves in.

I would argue that homes are still very expensive yet the propaganda is flying from the banking industry because they want people to buy homes even though they can’t afford them. Ironically cheaper home prices would help our economy in the long term but this would cut into additional banking profits since they currently hold over priced real estate, both residential and commercial, and want to off load the waste at peak prices to the taxpayer. The corporatocracy has caused more and more damage to our economy and inflating home prices has been one of the outcomes of giving too much power to the financial sector.

In the 1950s and 1960s when our economy was relatively healthy and booming home prices cost about twice the annual median income. That number sounds about right even for today. Yet the propaganda is strong and many simply want to believe that a big drop in prices means homes are now cheap. Don’t believe it.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!20 Comments on this post

Trackbacks

-

jaime said:

based on the data you presented, I would have to agree that cheaper home prices would help the economy overall, however, if property taxes are “proportional” to house values, what impact would lowering property taxes have on the local municipalities and their ability to offer the same level of services? In Westchester County, NY the median home price is about $540,000 with an average tax rate of about 2%. I’m certain that if property values did go down (which they have), the municipalities will just have to increase the tax rates to compensate for their loss in revenue.

January 5th, 2010 at 8:37 am -

renter said:

What a thorough review of the housing market. Just think of what good you could do and how much more fun memories you could have if you didn’t put all your money into your house. Peace of mind of affordability would be good too.

January 5th, 2010 at 1:52 pm -

Jeff said:

Interesting article – I like reading your stuff. On this one, I don’t think home prices will drop back to match the same relative % of income that was common in the 50’s. I agree that home prices should correlate to incomes, and that they clearly do not. So, I also think prices have some more room to drop.

However, what makes things different now (vs. the 50’s or whatever) is that we’re acclimated to an environment where our homes being a higher % of what we spend. People have accepted it. The other point is that homes today are different than they were back then. We get more from them: big kitchens, nicer finishes and luxury, more square footage, etc. People are willing to pay a little more for that.

Does that mean we can afford it? Not really. Not to the degree we wish we could. Quality will be scaled back. New construction that was in the $500k range offering granite counters, custom woodwork, etc. is giving way to the $300k new home with cheaper materials (e.g., tile in place of granite). We’ll see a big scaleback of luxury, and a return to simplicity in future designs in order to reign in costs. But, I doubt it will ever be in line with income on par with the 50’s.

January 5th, 2010 at 10:22 pm -

DJ said:

I think consumers and the government are much more to blame for the run up in home prices then the banks.

Also, I don’t think your numbers are adjusted for house size. For a single family home, the average size was 1535 sq feet in 1975. In 2008, the average square feet for single family homes was 2215. That is an increase of almost 50% and the amenities quite often are also better.

Consumers are making the somewhat rational decision that they don’t mind spending more then 3x their income to buy a house or upgrade to a bigger house. Given the amount of time one spends in a house, it is somewhat of a very rational decision compared to spending even more on vacations. Vacations can be great but once they are over, you can’t recoup any of those funds. At least money spend on a home can be partially if not fully recouped later in life.

Now if one thinks of a house as an “investment” clearly its a poor decision. But I certainly wouldn’t mind a 3000 sq ft home but I wouldn’t do so until I had less of a need to invest for the future..

January 5th, 2010 at 11:40 pm -

don said:

In 1933, just 4 years after the great stock-market crash of 1929, the average cost of a house in the United States was $5,750. At the same time, the average yearly wage was $1,550. In other words, the average house cost 3.71 times the average yearly wage. Today, just 4 years after what many are calling the 2nd great crash, the average house costs $169,000 and the average household wage is right around $55,000. So the average home price is about 3 times average household income. Good you say, that must mean we are near a housing bottom. Not so fast. Let’s look at another year. In 1948, after WWII when the economy was starting to grow and the baby boom generation was being born, the average cost of a new house was $7,700, but the average wages per year were $2950. So the average house could be bought for just 2.61 times the annual wage.

It is more likely that homes will revert back to a 2.6 times wage to price level rather than a higher ratio. Not only for the post WWII historic reasons, but also when you consider that interest rates are currently at an all time low and have nowhere else to go but up, a large number of housing inventory still remains, and the previous numbers of move up home buyers- now the baby boom generation will be downsizing, not upsizing in the coming years. So if you combine historical ratios with pragmatic data, the 2.61 ratio falls more in line with what we can expect in the near and distant future. It seems the prudent and wisest decision might be to wait a little while longer before buying that home. Just keep watching the ratio of household average wage to average home price. When it gets closer to 2.61 instead of the current 3.0, that might be a good time to buy a home with less downside risk. By the way, that’s about another 15% drop from where we are today and I’m not alone in believing that another 15% drop in home prices is on the horizon.

spiritnewsdaily.comJanuary 5th, 2010 at 11:45 pm -

DJ said:

Let me add, I don’t think the government should subsidize the purchase of houses via the mortgage interest deduction but they should lower taxes for taxpayers a corresponding amount. This would end up helping renters which isn’t a bad thing. Government spending in virtually all areas need to be dramatically cut back. The salaries for government workers is too high once you factor in very generous pensions as well. It is a crime that many people in the private sector making 40-80k without a good pension are being asked to help federal workers retire at extremely young ages. The wages in the military are sane but the amount spent on too many weapons programs is too high.

January 5th, 2010 at 11:49 pm -

Alberto said:

Very good analysis, but it misses one point: Americans are buying bigger and bigger houses, with more amenities. More space, more bathrooms, fancier appointments, and fancier appliances add up to a more expensive home.

January 6th, 2010 at 7:22 am -

Daniel Kroc said:

Great article.

Year 1968.

I found a ledger from my parents home expenses from 1968 & 1969. My dad was a blue collar worker at the time. My mom was at home with three kids but worked part time.House:

Our house payment was $85 a month (contract for deed). We had what was then a starter home in a very nice suburb of Minneapolis / St. Paul (now a very expensive neighborhood). My dad earned $115 a week! So he could pay the mortgage with less than one week’s work. And my mom earned $35 a week part time. In fact the biggest hurdle to ownership was the down payment – 20%. The house cost about $9000 so they had to come up with $1800 as down payment. I believe my dad earned this by working extra odd jobs and saving.Medical:

Of course we did not have health insurance. I can see in the ledger where my parents are paying the hospital for my birth – $10 a month. They also paid a another clinic $10 a month (not sure what for).We lived fairly well – two cars (used of course), good food, new clothes, etc.

Today:

Now I look at some of my younger relative’s lives. What a big difference. For the blue collar workers there is zero chance to own a home (or even a decent car). Even the white collar workers are struggling. The husband has to work 2 weeks just to pay rent for a place slightly above a dump. The wife has to work full time – not to make ends meet – but to survive. And forget health care – they just can’t go to a doctor – ever.In fact, the only way for them to get health care is to lie and say they are not married so the wife can get free Medicaid for her and the children.

Is this progress?

Daniel Kroc

January 6th, 2010 at 6:16 pm -

Annette said:

Good points, I think I will definitely subscribe!🙂. I’ll go and read some more!

January 6th, 2010 at 6:23 pm -

Tbone said:

My budget 360

Thank you- Your piece was F!@#$%^ brilliant. You captured exactly what I have been trying to articulate for years.

I am a tradesman with twenty years in and I make a fair bit more than your example above. I live in the bay area though and wow there is no way I even considered buying anywhere near where i live.I am intrigued by your ideas and want to subscribe to your news letter.

Tbone

January 6th, 2010 at 9:25 pm -

Curious said:

What was the average sq ft in 1950/1960 vs today? How does that factor into home prices? People want their big homes today after all.

January 6th, 2010 at 9:54 pm -

Tristan said:

Many comments here point out the disparity in size of homes today vs yesterday. But what about the size of the lot? Isn’t the land the real investment?

The house, like most manufactured goods, actually depreciates in value over time. Most people miss this point.

January 7th, 2010 at 3:23 pm -

NightHawk said:

Don – I’d be ecstatic if the average price of a home in my area was $169,000 (you say that’s the average home price). The story says the median home price is $172,000. I live in California on the coast. You can’t hardly find anything under $400,000 in the crappy areas! A decent home in a decent neighborhood is $650,000 minimum. It’s total insanity! I’m not buying. I saving and waiting.

Here’s what I say – the housing bubble insanity warped most peoples’ perception of money and value. People used to think that $500,000 was cheap for a home. Banks were handing out “money” to anybody who walked through their doors. Even a donkey could qualify for a loan in 2005. I know a woman and her husband who paid $525,000 for a new home is a podunk town 6 years ago (it’s in California, but in the dry central valley). It seemed cheap at the time – a house in a nicer town 45 minutes away was $700,000 plus. Now they are walking away, saying the house isn’t even worth $200,000.

Back to where I live. Homeowners can’t get the housing bubble out of their heads. They think their house was “worth” $950,000 or $1.2 million 6 years ago. So why should they settle for anything less than, say, $799,000 now (a house which 10 years ago would have sold for maybe $275,000). I’m telling ya – THE HOUSING BUBBLE/BANKING PSYCHOSIS WARPED MOST PEOPLES’ SENSE OF MONEY, VALUE AND REALITY.

We are in the beginning of a depression. The economy is horrible. Jobs are being lost in great numbers. Housing is still WAY OVERPRICED in some areas. I have traveled around and know that some states are very reasonably priced. But some areas like California STILL have INSANE real estate valuations in many areas. With a massive number of foreclosures coming down the pipeline, and massive shadow inventories of homes as well as 10,000 baby boomers retiring PER DAY (and moving in w/ chilren, dying or moving into nursing homes) housing has just one way to go – DOWN, DOWN, DOWN.

January 7th, 2010 at 10:51 pm -

Tom said:

Great Read – I think it is obvious here that the banking – lending industry and the fed were the enablers here. Their greed is and was with out exception.

A note from a builder on today’s homes: These new structures are not your grandfather’s house. Ground source heat pumps, distributed home audio – video, system integration, home theater, low voltage lighting control, structured wiring, security systems, and how about that trash compactor?

Something I found interesting in your articles salary data and your comments about this time frames GDP: from 1950 – 1960 there was a gross percentage increase of 1.693 in median household income in this ten year period. Applying that same index “income adjusted multiplier†(assuming I exercised this math correctly) to both median household incomes for 1960 and median home prices for 1960 I came up with the following adjusted numbers for both median household income and median home prices – Median household income $78,166.00 in 2010 and median home prices $165,512.00. My conclusion is home prices have kept a fairly consistent inflationary trend but wage growth has shown to fall of a cliff.

One other salary data comparison I can share is that in 1980 working as a non union journeyman carpenter with a skill education attainment comparable to a bachelors degree I was making $21,840.00 excluding my employers 10% retirement contribution, and health and welfare contribution. The sum totals of these benefits were approximately 21% as a margin of my gross pre tax salary. Or a total gross compensation salary and benefits of around $26,360.00 Today some thirty years later this same position pays a gross salary and benefit compensation of around $47,000.00 Adjusting for inflation using a CPI calculation for this time period and applying it to my 1980 total gross compensation of $26,360.00 the calculation came to slightly over $70,000,00. Suggesting in my scenario wage growth has been dynamically dysfunctional.

I think had wage growth maintained a reasonable path consistency with inflation home affordability would not be a topic of discussion. What the hell caused this? And who is to blame. (Dysfunctional salary setting and inflationary monitoring employers?)

January 8th, 2010 at 10:48 am -

Daniel Kroc said:

Everyone I forwarded this article to were in agreement. Good work.

Daniel

DanieKroc.comJanuary 19th, 2010 at 7:21 pm -

JP Merzetti said:

Great post.

It’s refreshing to find something that actually reflects accurately the income and price ratios from that long ago.

A number of details come to mind. I’m sure in the 1950’s and 1960’s very few people bought houses, who could not afford them.When contemplating median home prices, it’s easy to see now that developers and everyone else it seems, wanted to get away from basic affordable housing. They were interested in the high-end profits, which resulted in the proliferation of oversizing…households of 2 or 3 people winding up in 4-6 bedroom monsters.

I get a strange picture – that home shopping had become comparable to buying snacks at a cineplex complex….the profits soar when selling supersized popcorn boxes….whether that much popcorn is desired, it’s somehow seen as “cheaper” – a better deal.

So it goes with houses, too. Now that we know how obvious it was that so many bought over their heads, the price to income ratio is revealed for what it was – and as this article points out…we have lost an awful lot of ground in the past 40-50 years.It is true – curiously, no-one ever seemed to want to examine that ratio too closely, or the implications of its true meaning. Had that not been the case, I’m sure many buyers and lenders would have seen how obviously close to the edge that ratio brought home purchasers, and prudence on the part of either the lender or the borrower would have nixed the deal.

For the past 2-3 years I’ve had the nagging suspicion that houses are still too damned expensive….for what the average household actually earns. I get the impression that only those households earning well above 100,000 a year can ralistically buy an average-priced home with any reasonable assurance, based on income to price ratios.

But then…..many who earn that kind of money don’t buy average priced homes….they’re still stretching their debt ratio ever upwards.

(which is where the monster house customers come from.)I don’t know how many forums I’ve read lately, where cautious people chastise buyers who fell for the “buy the highest amount of house you can get” line from real estate agents.

If strict ratios had been adhered to, that wouldn’t have been possible.

(but then – a lot of oversized and overpriced houses would not have been sold.)One thing is for sure – there is another reason why in the 1950’s and 1960’s the income to price ratio was so good. Families of 4-6 people were happy as hell to grab a 1300 square foot home. That size was aways comparably cheaper, than the big boxes of the time.

Interestingly – those big boxes tended to be located in downtowns, whereas the smaller houses were more suburban. Recent building patterns have reversed that motif.The long, sad story reveals some startling consequences. Although smallish bungalows became pricey too, often when asked why the need for houses so large (and relatively expensive) the answer became all too familiar. To hold “stuff.”

I think those two factors play into each other hand in glove.

That is another huge difference between today and 40-60 years ago.March 12th, 2010 at 3:11 pm -

JP Merzetti said:

Great post.

It’s refreshing to find something that actually reflects accurately the income and price ratios from that long ago.

A number of details come to mind. I’m sure in the 1950’s and 1960’s very few people bought houses, who could not afford them.When contemplating median home prices, it’s easy to see now that developers and everyone else it seems, wanted to get away from basic affordable housing. They were interested in the high-end profits, which resulted in the proliferation of oversizing…households of 2 or 3 people winding up in 4-6 bedroom monsters.

I get a strange picture – that home shopping had become comparable to buying snacks at a cineplex complex….the profits soar when selling supersized popcorn boxes….whether that much popcorn is desired, it’s somehow seen as “cheaper” – a better deal.

So it goes with houses, too. Now that we know how obvious it was that so many bought over their heads, the price to income ratio is revealed for what it was – and as this article points out…we have lost an awful lot of ground in the past 40-50 years.It is true – curiously, no-one ever seemed to want to examine that ratio too closely, or the implications of its true meaning. Had that not been the case, I’m sure many buyers and lenders would have seen how obviously close to the edge that ratio brought home purchasers, and prudence on the part of either the lender or the borrower would have nixed the deal.

For the past 2-3 years I’ve had the nagging suspicion that houses are still too damned expensive….for what the average household actually earns. I get the impression that only those households earning well above 100,000 a year can ralistically buy an average-priced home with any reasonable assurance, based on income to price ratios.

But then…..many who earn that kind of money don’t buy average priced homes….they’re still stretching their debt ratio ever upwards.

(which is where the monster house customers come from.)I don’t know how many forums I’ve read lately, where cautious people chastise buyers who fell for the “buy the highest amount of house you can get” line from real estate agents.

If strict ratios had been adhered to, that wouldn’t have been possible.

(but then – a lot of oversized and overpriced houses would not have been sold.)One thing is for sure – there is another reason why in the 1950’s and 1960’s the income to price ratio was so good. Families of 4-6 people were happy as hell to grab a 1300 square foot home. That size was aways comparably cheaper, than the big boxes of the time.

Interestingly – those big boxes tended to be located in downtowns, whereas the smaller houses were more suburban. Recent building patterns have reversed that motif.The long, sad story reveals some startling consequences. Although smallish bungalows became pricey too, often when asked why the need for houses so large (and relatively expensive) the answer became all too familiar. To hold “stuff.”

I think those two factors play into each other hand in glove.

That is another huge difference between today and 40-60 years ago.(second time lucky?)

March 12th, 2010 at 3:16 pm -

Mark AW said:

From what I can find the median income in 2008 was 52,000 and the median new home price was 233,000. In July of 2010 the median home price is 204,000.

So in 2008 we were paying 4.5 times our yearly salary for a new home. No wonder credit card balances went sky high.

In the 50’s and 60’s it was very rare for the company you worked for to not pay health insurance even a family plan. It was common place, if you changed employers your insurance changed but you never had to pay for it.

I think new home building will be very slow for years to come, at least the huge homes that seemed to be the trend in recent years. Apartment and condos will increase, but many are getting tired of working just to pay for their home and barley making it by. It is becoming more advantageous to rent than to buy. Nobody stays in the same house for 15 years any more let alone 30. Rent for 10-20 years, invest the money you save on mortgage, taxes, maintenance, upkeep, landscaping, lawn and garden equipment, then buy a home for cash.September 14th, 2010 at 12:50 pm -

CR Polk said:

The only factor not taken into account in your otherwise terrific analysis is the average home size. The average square footage for a single family home in 1950 was 1000 square feet, in 2000, the last year I have data for it was 2330 sq feet, an increase of over 133 %, were americans willing to downsize their buying decisions to what they were purchasing in 1980 they would be buying a house of just under 1600 square feed on average and at a much cheaper price. What might be more constructive would be to look at the price of a house of a particular size — say 1500 sq feet — and what it cost over time, I think you’ll find that while prices have increased over time, they are not nearly as dire as what your analysis indicates and in fact, buying a house is not such a bad deal considering you’re accumulating some wealth in the form of equity while at the same time using the savings vehicle over a term of 30 years. You should compare the cost of ownership over the same period to the cost of renting a similar sized structure with out purchasing. The interest you pay is no different than paying rent and you eventually will own what you are in effect ‘renting’ for 30 years.

February 4th, 2012 at 9:33 am -

AJMcRae said:

I believe that CR Polk’s comments are leading in a more useful direction. Since houses have gotten much bigger over the decades, and the median monthly cost of ownership (or monthly carrying cost) has probably mushroomed relative to median monthly income, it would be much more useful to divide median home price by median home size and then compare all other ratios based upon median price per square foot of US homes over time. Even better would be to factor in all the other carrying costs per square foot for home ownership (energy, maintenance, insurance, property taxes, etc.) to see how ever larger home sizes, ever higher carrying costs, and stagnating/decreasing median wages have all combined to make over-leveraged, dual income debt slavery the norm in America. I suspect that the numbers would reveal an unsustainable cost/sq ft curve that requires continuous & sustained increases in personal income to remain financially sound. Income increases that require high growth overseas investments to obtain them, with the necessity for American job outsourcing, downsizing, cost cutting, employee benefit reductions, and tax cuts to make the numbers actually work out. Hence the road we are now on…

September 30th, 2015 at 3:20 pm