Comparing the cost of living between 1975 and 2017:Â Inflation continues to eat away at purchasing power in housing and other big ticket items.

- 7 Comment

For the most part people widely misunderstand inflation. It is a complicated topic. If you ask the man and woman on the street they would respond that inflation is the price of goods going up. This is true in some respect but what people see is merely the outcome of larger forces at work like monetary decisions made by the Federal Reserve. Generally speaking central banks want to limit inflation (but have some) and avoid deflation. Today we have seen purchasing power decrease because of the way we have allowed debt to infiltrate every aspect of our lives. Items like homes, cars, and education are all largely funded by debt. Let us see how things have changed since 1975 to 2017 by comparing the cost of living in this time span.

Examining the cost of living over time

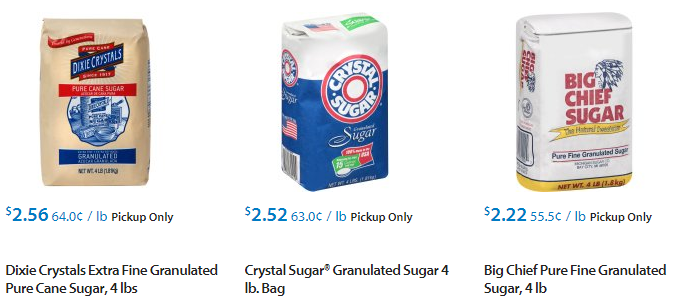

As we examine some of these items we also notice that there is some disinflation going on. For example, instead of selling five pound bags of sugar you now see four pound bags of sugar. Or you will see smaller packaging with potato chips. At least with foods, things have been relatively controlled. Where we see the cost of living shooting up is with big ticket purchases.

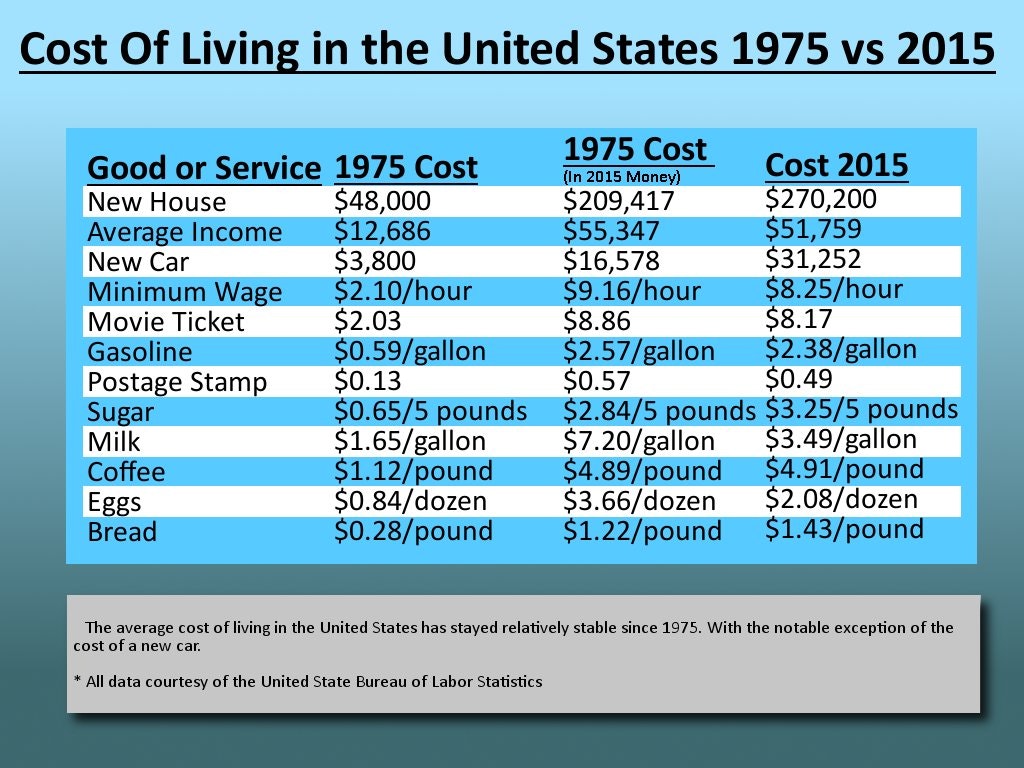

First, let us look at a chart that has 1975 and 2015 costs:

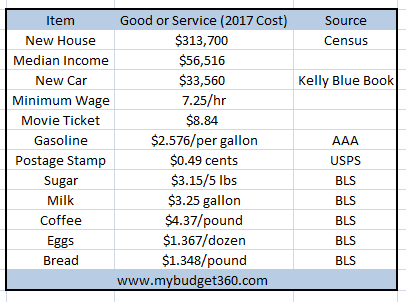

A few things should stand out to you. The cost of a new home in 2015 was $270,200. That 1975 home if we adjust for inflation should cost $209,417 in 2015. That is a real increase of 29 percent. But let us look at what a new home costs today among other items that I have updated from various sources:

A new home today now costs $313,700. So in two years the cost of a new home went up 16 percent (or $43,500). Now you tell me if you think the typical family saw their household income go up by that amount in the last two years? It has not as the above chart highlights with overall household income remaining stagnant.

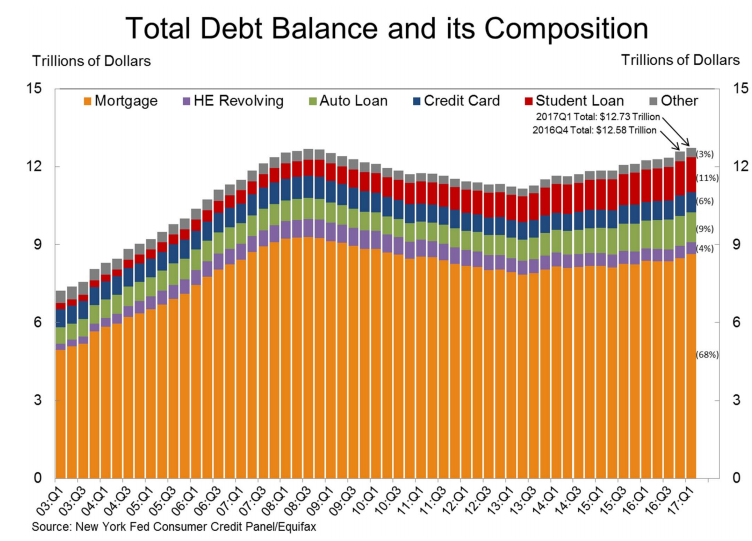

The cost of a new car has now gone up to $33,560 from $31,252 – an increase of $2,308 in two years. This is why you have so many people going into subprime debt to finance their vehicles. Income is stagnant while the cost of big ticket items is going up. You might think that $2,308 isn’t much but it is when you are not earning more. So what do people do? They go into more debt:

Total household debt is at a record level. What is more troubling is that we now have three debt categories in the trillions – student debt ($1.4 trillion), auto debt ($1.1 trillion), and credit card debt ($1 trillion). So people are going into big debt to purchase items while the cost of food remains stable.

But there is some disinflation in food as I had previously mentioned. Take a look at sugar:

Notice something? These are now four pound bags. I’m sure most don’t notice but the five pound bags slowly disappeared. You see a lot of this occurring in grocery stores but most people don’t pick up on this. You also have dollar stores offering name brand products but in unique packaging that offers less for cash strapped consumers.

So what can we take away by looking at the cost of living in 2017 versus 1975 and 2015? Big ticket items financed by debt continue to move up.  Household debt continues to move up as well to finance these purchases and to make up for stagnant income. Does this story sound familiar? It should because that is what led us into the last credit crisis.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

7 Comments on this post

Trackbacks

-

matt said:

Coffee use to be sold in a 1 pound can. You still get the can but only 12 oz of coffee.

Import beer has gone to 11.2 oz bottles, same price less product.

To keep sticker shock down, same size package, less product, same price.

I have noticed this for YEARS.

They are bleeding us dry, one dollar at a time.

September 24th, 2017 at 6:48 pm -

Danny Wilder said:

You noted that sugar is in 4 lb bags now. I’ve noticed this downsizing in other categories. For instance, Breyers ice cream no longer comes in half-gallon (64 oz) size. It is now 48 oz. Still, the price keeps going up.

September 24th, 2017 at 7:10 pm -

Fred762 said:

I remember back in the early 1960s..I was working 3 part time jobs to WORK my way thru a state university in the south. The MW was $1.25/hr and I made upwards of $2.75/hr at a couple of my jobs…still sounds crappy, huh? Well, remember that the MW was $1.25/hr..THAT was five 1964 quarter coins per hour! They were 90% silver coins then. IF you had some of those quarters TODAY in 2017, ( I do, don’t YOU?)..you could take 5 of them to any coin shoppe and the nice man wd trade you about 17 paper Federal Reserve Notes(FRNs) for them..ie those 5 coins are worth $17 today. The funny thing is…liberals whine about trying to get everybody to “pay” a MW of 15 FRNs/hour!!! What crap..even IF the boss could afford to pay that amount, it wd still be less than the MW in buying power compared to 1964!!! You know..back when gas was 25 cents and a Corvette was $3500 LOL on us, huh???!!!

September 25th, 2017 at 6:43 pm -

kayle said:

let it be

September 27th, 2017 at 10:01 am -

roddy6667 said:

The cost of health care is not on the list, but it has undergone the same changes as the coffee and ice cream packaging. They can keep the cost of the premium down by raising the deductible and the co-pay. The amount you pay out of your pocket is staggering now. My brother’s wife had a mastectomy, chemo, and radiation over 10 years ago. It cost $130,000, the same as what they paid for their house. Out of pocket they paid less than $1000. Now that same treatment costs almost $300,000. They have an $8000 deductible and a 20% co-pay. They would pay the first $8000 and 20% of the balance, or another $58,400. Total out-of-pocket expense now would be $66,400. That’s a huge increase that is not reflected by the monthly premium. For most people this situation is called “losing the house and going bankrupt”

October 2nd, 2017 at 1:21 am -

Rusty Brown said:

Manufacturers and suppliers of food and such are not deliberately scamming us by reducing package size – they are just responding to the increased costs they have to deal with, seems to me. It’s just a simple fact that our money is losing value at a steady rate, as the monetary authorities want it to.

October 8th, 2017 at 6:26 am -

DearSX said:

I am doing ok thanks my tech background and my wife’s great skills and education.

Many I know are not so doing as well. They look for saving in other ways, like used cars, cheaper neighborhoods and longer distance for higher paying jobs.

Health care is a big one. I think the rest is ok in my area if you use common sense and budget well and have a full-time job at pays 15/hour or so. Not as easy if you don’t have certain skills or secure a higher paying job somehow.

October 13th, 2017 at 10:23 am