Credit Cards the Opiate of the American Middle Class – The Withdrawal is in And the Wall Street Dealers are Raking in Trillions of Dollars. 2 Credit Cards for Every Man, Woman, and Child in the U.S.

- 2 Comment

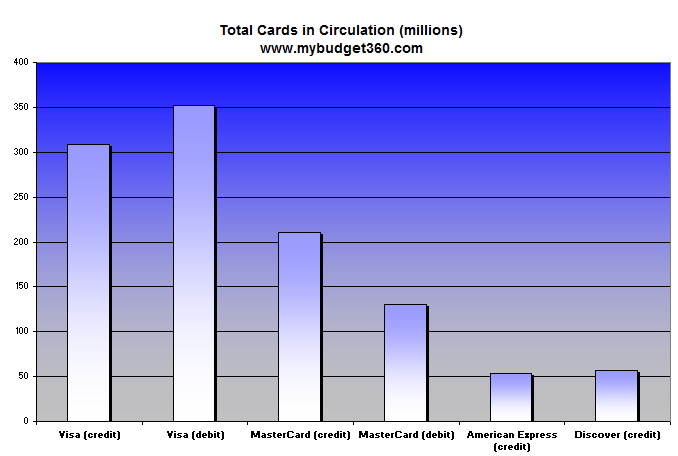

If you want to know how reliant the middle class has become on credit cards all you need to know is that in circulation we have 631 million credit cards in the U.S. For a nation with slightly above 300 million people this is roughly 2 credit cards for each man, woman, and child. Credit cards and their subsequent “plastic free†variety of home equity lines of credit caused a massive boom that really put a veil over the underlying destruction of the middle class. As Americans spent their way inching closer to the day of paying the Pied Piper, many thought they were getting wealthier when in reality, they were merely leasing a smoke and mirrors operation of transferring all their wealth to the banking sector of the economy. It would be one thing if banks were lending their own money and putting their operations at risk. When push came to shove, Americans get booted from their homes and have cars reposed while banks steal taxpayer bailout money to enrich themselves even further. In addition, big operations funded by big money are now going out there buying properties at fire sale prices with government backed money.

The credit card as we have it in the U.S. is really a unique phenomenon:

Source:Â Creditcards.com

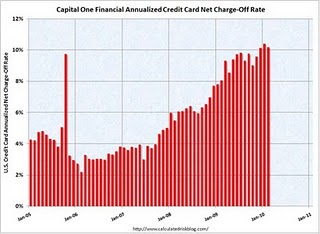

Only a handful of banks dominate the credit card industry. The credit card is really built on the premise that the gravy train can go on forever. At the apex of the credit bubble, and let us face it housing wasn’t the only thing being financed with easy money, credit card companies were offering zero percent offers to lure customers into debt servitude. Now that banks use the pretext that the “world has changedâ€, they can up those fees and interest rates and many Americans due to the weak economy are now no longer able to meet their obligations. Credit card default rates are soaring:

Source: Calculated Risk

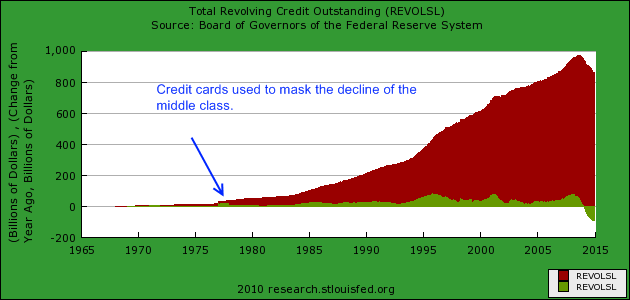

Those that can’t pay by definition will not pay and that is why we are seeing high levels of bankruptcy. A credit card was never intended to be used as a secondary source of income but that is what it has become since wages have been stagnant for over a decade. The vast majority do not pay their balance off each month. This is same misguided premise on which option ARM loans were based on. Given the option 90+ percent of the people went with the minimum payment causing an endgame that we are now dealing with. Credit card loans outstanding have been contracting at a feverish pitch:

Yet wasn’t the premise of the banking bailouts to increase credit in the market? Of course the banking system has largely captured the current lawmakers and the policy we are getting is friendly to their needs and desires while using the American taxpayer as their own form of credit card. The lie that was perpetuated was that debt equals wealth and it absolutely does not. So people in modest neighborhoods saw friends and family driving foreign cars and wondered how they were doing it with a $40,000 a year income. They were doing it by extending themselves to the point of financial disaster.  So as the disaster hits, we operate in parallel universes. The public that did over extend has to realize the marketplace reaction of cutting back, losing homes, or bankruptcy. Banks on the other hand have actually come out ahead receiving trillions in dollars of taxpayer funded money. Nothing easier than getting money in a hype of fear with politicians friendly to your cause.

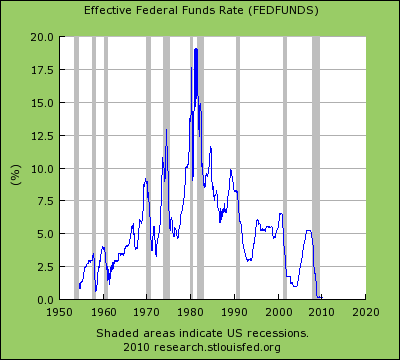

Much of the easy lending environment was given the blessing by the Federal Reserve and U.S. Treasury:

The above is really the story of the housing bubble, credit bubble, and easy money world we had for over a decade. That is now completely changed and I often wonder if people realize that we won’t be going back to how things were. We can’t. The underlying issue is the amount of debt being serviced now. GDP includes this as a “positive†but we are now transferring this additional wealth to the banking sector on merely servicing preexisting debt. This is like being happy that banks made billions of dollars in overdraft fees. How is this good for the economy or most Americans? The math is so distorted that many Americans are wondering how in a country where 20 percent are underemployed we can have a 73 percent stock market rally.

The too big to fail banks are also at the center of the credit card word:

U.S. general purpose credit card market share in 2008 based on outstandings

(Note: 2007 ranking in parentheses)

1. JPMorgan Chase – 21.22% (17.74%)

2. Bank of America – 19.25% (19.36%)

3. Citi – 12.35% (13.03%)

4. American Express – 10.19% (11.40%)

5. Capital One – 6.95% (6.95%)

6. Discover – 5.75% (5.65%)

7. Wells Fargo – 4.21% (3.07%)

8. HSBC – 3.47% (3.65%)

9. U.S. Bank – 2.14% (1.84%)

10. USAA Savings – 2.02% (2.01%)

Source:Â Creditcards.com

It is no accident that they are now putting the vice on average Americans while sucking in trillions of dollars in bailouts. And what is the big reform? They now provide a sheet that shows you a breakdown of how you are getting screwed in different formats! This is the idea of reform right now from the corporatacracy. Until we get solid reform credit cards will continue to operate in a loan shark environment ripping off the middle class until one day Americans will wake up and realize that there is no longer a middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Danielle E. (Beth) Lyles MS said:

Last month My partner who is a senior citizen and disabled ordered her meds at a mail order drug company at the insistence of her part D insurer. She is always overdrawn at that time of the month but was willing to eat the 25$ nsf fee when they billed her for the small copays on her meds. Even though they were ordered all together at the same time the drug company billed her account for 16 separate purchases meaning that the bank charged her 400$ in nsf fees. Now we have absolutely no money for food this month. The thing that bothers me most though is that of all the people I have told not one has expressed the slightest outrage that three large corporations got together and looted the slender resources of a sick old women. No one cries out at the injustice but act as if we should just bend over and take it without so much as a gob of spit. Damn this country and may God send it the destruction that it well deserves.

April 4th, 2010 at 7:55 pm -

inv said:

I am tired of all the economic negative news. I think the reason the economy sounds bad has less to do with an actual recession than media sensationalism and doomsday pessimism. Everyone was in a panic in 2008 because the price of oil was rising, but the sky did not fall. I don’t think the media should lie about a high unemployment rate, but I would like to hear more positive news stories.

http://www.usnews.com/money/blogs/alpha-consumer/2009/1/8/did-the-media-cause-the-recession.html

I did some research and found that there is plenty of good news out there:

The recession officially ended in June 2009:

http://money.cnn.com/2010/09/20/news/economy/recession_over/?section=money_latest

The stock market has risen 53% recently and is still cheap:

http://www3.signonsandiego.com/stories/2009/oct/15/cautious-optimism/?uniontrib

Wells Fargo, Apple, Ford, SkyWest, Adidas, Men’s Wearhouse, Kroger’s, General Mills, AutoZone, CarMax, Walgreen, Dell, and Disney are some of the many companies to have declared profits recently:

http://www.bloomberg.com/apps/news?pid=20601100&sid=az6fjhaa_gsg

http://www.usatoday.com/travel/flights/2009-11-05-skywest-q3-profit_n.htm

http://www.sanluisobispo.com/topnews/story/906588.html

http://blog.seattlepi.com/microsoft/archives/182538.asp?from=blog_last3

http://www.latimes.com/business/la-fi-earns22-2009oct22,0,1394503.story

http://www.nytimes.com/2010/09/15/business/15kroger.html?src=busln

http://www.washingtonpost.com/wp-dyn/content/article/2010/09/21/AR2010092101256.html

http://www.fayobserver.com/articles/2010/09/22/1033100?sac=Bus

http://www.nytimes.com/2010/09/29/business/29walgreen.html

US housing starts have increased:

http://blog.al.com/breaking/2009/10/us_housing_starts_rise.html

Business confidence has risen:

http://www.bostonherald.com/business/general/view.bg?articleid=1203965&srvc=rss

Factory orders have increased:

http://www.telegram.com/article/20110203/NEWS/110209884/1002/busines

Consumer confidence has risen:

http://money.cnn.com/2010/08/31/news/economy/consumer_confidence/index.htm?section=money_latest

Consumer spending is up:

North Dakota has an unemployment rate of just 3.7%. South Dakota and Nebraska have unemployment rates of less than 5%. Unemployed people who move there will find work and need to buy homes, food, and services creating more jobs. If you don’t have a job, move. If you can’t sell your house at the price you want, you shouldn’t have paid so much for it. If you don’t want to move and make trade-offs, I guess that you aren’t that desperate for work.

http://online.wsj.com/article/SB10001424052748703803904576152630710927512.html

http://www.jamestownsun.com/event/article/id/81609/

The United States will face a labor SHORTAGE in the next few years as millions of baby boomers retire. There are 76 million baby boomers, but Generation X only has 46 million people.

http://seattletimes.nwsource.com/html/nationworld/2002185894_boomers21.html

http://www.argusleader.com/article/20091107/business/911070331/1001/news

If you really want to stay where you are and haven’t found a job, think of a way to make money from your hobbies. Find a need and fill it. Do you like to cook? Are you good at fixing things? Do you like to paint? I strongly believe that if you do what you love, the money will follow. Just because someone says there is a recession, doesn’t make it true. Just because most people used to believe the world was flat, did that make it true? If you are feeling negative, I highly recommend the book “You Can Have it Allâ€:

http://www.librarything.com/work/508754

You might also feel less sorry for yourself or the economy if put your life in perspective. Would you rather live in Zimbabwe where the GDP per capita income is $200 per YEAR?

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html

Even if things are really bad for you and you become homeless, there is a safety net of food banks, shelters, general relief, and food stamps. You could join a commune or a monastary.

America needs a good pep talk instead of negativity. I really think Obama would be more helpful to the economy by talking about the positive sides instead of pushing expensive stimulus programs. People should live within their means to avoid crashing the economy, but even when overextended, the United States has managed to pay the massive debts of the Depression and WWII.

Americans need to think more like immigrants. Politicians are too afraid to say it, but Americans should stop whining, get up, take responsibility, lower their standards, bite their lips, tough it out, and get busy. Americans should stop buying SUV’s and McMansions they can’t afford and pay off their debts. I have no sympathy for the sheep who went in debt to buy expensive restaurant meals, clothes, vacations, cars, and overpriced homes when times were good instead of saving for a rainy day. Buy LOW and sell HIGH. If people had put their money in the bank instead of wasting it they would still have it. The United States is capitalist not Communist. There is social Darwinism and survival of the fittest here. If Americans want a handout, they should move to Sweden. I have seen refugees from places like Vietnam immigrate to the US with NOTHING and own houses and cars five years later, while some lazy Americans who haved lived in public housing and on welfare for GENERATIONS complain about how poor they are. Why can a third world immigrant who doesn’t speak English make more money in five years than some Americans who have lived in the US their entire life?

http://www.sfgate.com/cgi-bin/article.cgi?f=/n/a/2010/09/27/financial/f063017D17.DTL&ao=all

http://online.wsj.com/article/SB10001424052748704895004575395491314812452.html

The negative thinking about “tough times†and the supposedly “decline of the US†kills me. The USA is by far the richest and most powerful country in the world. Who invented the assembly line, telephones, movies, light bulbs, airplanes, air conditioning, elevators, skyscapers, television, the atomic bomb, the pill, calculators, microwaves, lasers, the Internet, mobile phones, the space shuttle, and landed on the moon? What country wins the most medals at the Olympics despite having only 5% of the world’s population? If the United States is dying, why do so many people want to immigrate there?

http://www.statemaster.com/encyclopedia/List-of-United-States-inventions

http://englishrussia.com/index.php/2010/02/14/russian-or-not-russian/

http://sports.espn.go.com/oly/summer08/medals

I think the best years of the United States are ahead of us, not behind us. I would be shocked if the USA won’t be the first country to put a person on Mars, invent mass-produced hydrogen and solar cars, and cure cancer. Americans who worry about the future are ignoring the facts and aren’t doing anyone any favors.

While I am not blind to the difficulties that may exist in the present economy, I just think people should be more optimistic and look at the good sides. I remember when I was in middle school in the mid 1980’s and had a teacher who asked my classmates whether the USA was on the way to the peak of power, at the peak, or on the way down. I was the only student who said the US hasn’t reached the peak yet. A few years later the Soviet Union collapsed, the Japanese economy crashed, and America was the only superpower.

I am not sure if there is a recession, but if there is one, I think it will be over soon.

http://www.nytimes.com/2010/07/05/opinion/05douthat.html?_r=1

February 26th, 2011 at 8:21 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!