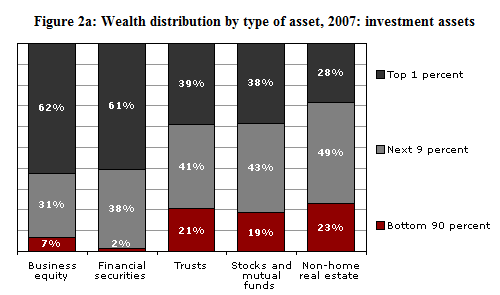

While D.C. and Wall Street burns the middle class flails – top 10 percent control 98 percent of all financial security wealth. For stocks and mutual funds bottom 90 percent controls only 19 percent of total assets.

- 3 Comment

Part of the unfortunate theatre being played out in the political arena is that little focus and energy is being placed on the issues plaguing the middle class. The interests of the big financial banks continue to dominate what politicians will discuss and the media seems content at rehashing the argument over and over like a well-trained parrot. In the meantime we have 46,000,000 Americans on food stamps simply trying to navigate their existence in a country where the middle class is faltering. The problem with our current political and financial system is that it has been solved like a Rubik’s Cube by the financial elite. It is now a jigsaw puzzle to be solved and politicians are seen merely as employees for whatever cause will increase the bottom line even if it means destroying the middle class. The Securities and Exchange Commission, the main enforcement arm against Wall Street graft has become basically an internship ground for those aspiring to big salaries at investment banks. Now more than ever wealth is concentrated in fewer hands and this era is making the irrational and spendthrift Roaring 20s look like a walk in the financially restrained park.

Top 10 percent control 98 percent of all financial security wealth

True wealth is largely based on the control of financial assets. If that is the case, we have some dramatic problems in our current system:

It is amazing that for financial securities, the top 10 percent control 98 percent of this asset class. Even more troubling is the reality that the top 1 percent control 61 percent of this asset class. True wealth is incredibly isolated in very few hands. Is it any wonder that with the stock markets up nearly 100 percent from the lows in early 2009 that the actual sentiment of Americans is at record lows? There is little to be happy about aside from watching the financial elite get even more powerful. Stocks and mutual funds have similar concentrations of wealth. The top 10 percent control 81 percent of this asset class.

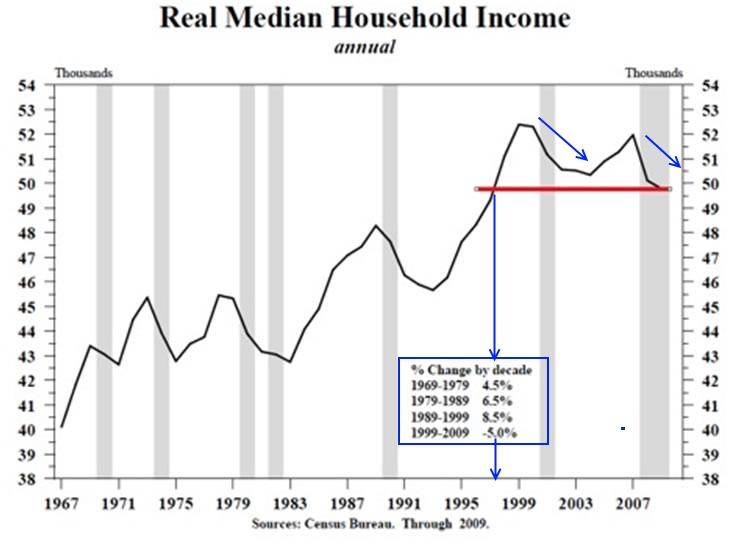

You have 46,000,000 Americans simply getting by on food stamps. The average per capita income for Americans is $25,000. Household wages have fallen over the last decade:

I’ve talked with many people that have had their income stagnant or have seen wages fall over the last decade yet the cost of food, filling up the car, or even the cost of basic healthcare has shot up. In other words they have become much poorer. This is the story for most Americans. The only group that has benefitted in the last decade has been the financial elite. The same class that has put our economy into financial peril and has set aflame the wages of Americans is the one group that has benefitted the most. Not by bringing others up but by betting against them. And they are doing this be legal robbery. The bailouts are nothing more than a targeted transfer of wealth to the top 1 percent. This group was worried about their financial securities and large holdings in stock taking a hit and tried to panic the public. Of course, this was all for show because the public never wanted the banking bailouts to begin with. Yet this was the message that was conveyed thanks to the controlled media. The too big to fail are nothing more than the reverse of Bonnie and Clyde for our generation. Instead of robbing banks, they are robbing the public for the banks.

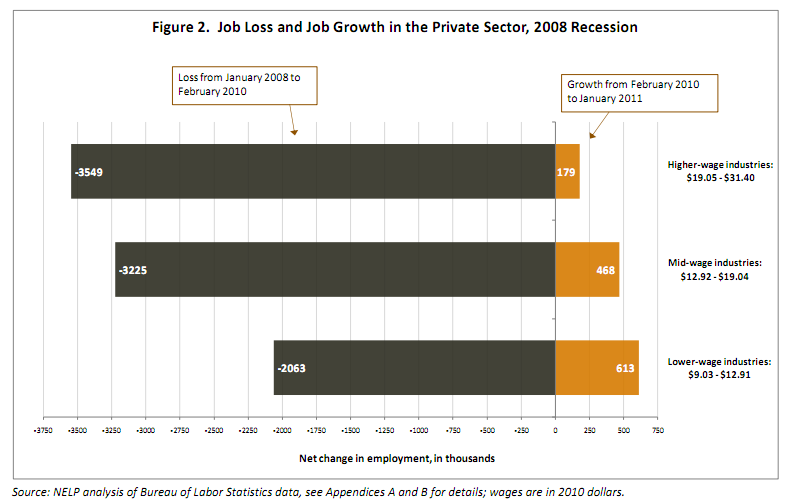

What did we gain from the bailouts on the jobs front?

In exchange for being robbed and allowing banks to create a casino out of our financial system, the economy has gained a new low wage capitalist utopia:

The above chart is one of the most dramatic charts of the troubled economy but don’t expect the mainstream media to even talk about this. They are too busy gearing up for football season and running stories about cats stuck in trees. The economy has lost 3.5 million high paying jobs during this recession but has only recovered 179,000 of those jobs. This is abysmal. The same applies for the middle sector of the wage scale as well. The fastest growing segment of jobs is from the low wage sector. This is supposed to be the great new economy being built by the financial wizards. While banking CEOs make 800 times the average worker salary most Americans are fighting over who will get the 10 hour shift at Wal-Mart. Keep in mind there is no reason for that banking CEO even to have a job at the moment. The too big to fail should have failed yet this is what happens when you have a financial system that controls our government.

Most Americans are furious with the system because it is now broken. Money has polluted the system and now it is too easy to use bailouts and the government twists information to allow the banking sector to rob the entire population. Sometimes the best policy for the country means that the biggest financial interests will take a hit for the greater good. For instance, outlawing hedge funds from creating crap products that screw every other investor on the other side of the trade. Instead, we have a system that ignores the middle class simply to enrich those at the top. This is a wealth transfer to the top. How can you make the most?

-Who is willing to use high frequency trading to screw the mom and pop investor?

-Willing to sell subprime mortgages? You’ll get a nice commission check.

-Willing to lie to the public? You may have a job as a bank CEO.

-Can you take checks from big financial players and act like you care about the public? Politics it is.

There will always be corruption in any system. But when it is this pervasive there is simply no way it can go on without the public challenging how things are run.

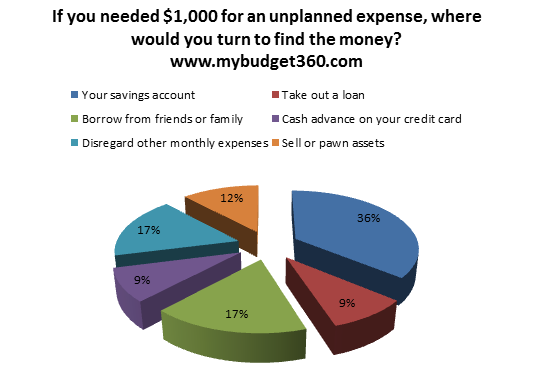

Even more troubling is the fact that you have most Americans unable to come up with even $1,000 for an emergency expense:

Aside from loan sharks and other usury emergency loans, there is little left for many Americans even for an unexpected expense. The top 1 percent especially those in finance care not about Social Security since they can simply rob the public for trillions of dollars. What are your options? Trust you can beat some high frequency trader with political connections? Good luck.

We need a strong enforcement arm to police Wall Street. The SEC has become too frail and weak to do the jobs. We must remove money from our political system and reform the lobbying process. The highest bidder doesn’t always have the interest of the country at heart – just look at the banks. If we are still a democracy with a republic form of government, then we need to wake up. We are living in a corporatacracy at the moment. If things continue this way D.C. and Wall Street will simply ignore the will of the people and let Rome burn as the middle class fizzles away. It should be obvious that both Republicans and Democrats are bought out to Wall Street interests.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Christine said:

You did a great job of summing up everything I’ve been looking at and lamenting about. Indeed we in the middle class need to be proactive in having our voices heard. It is sad though that so many Americans care more about who might win American Idol or the football game than they do about contacting their representatives at all levels of government. Until we start shouting loudly and consistently as a fed-up force to be reckoned with, it will only continue to get worse.

September 1st, 2011 at 7:07 pm -

keep it simple said:

Thanks for bringing another informative article to the internet!!!

September 1st, 2011 at 10:54 pm -

CLARENCE SWINNEY said:

America ranks 25th of 28 OECD nations on Equality

No one  no one wants to discuss it

America ranks 27th of 28 OECD nations on Least Taxed

6 Simple Numbers tell the story

Â

5% own 62% Net Wealth

80% own 15%Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 62/15

20% own 93% Financial Wealth

80% own 7%Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 93/7

25% take 67% all Individual Income

70,000,000 workers take 13%Â Â Â Â Â Â 87/13

Â

SCORE=222/35=INEQUALITY

Â

It is like $100 with          20 having $86   and  80 having $14 Â

Â

Each luckie duckie has $4.36 and po  old  Les Miserables’ have $0.17 each

Â

Now Greg that is indisputable INEQUALITY

use of math lil rusty but range is wide wide

Â

Thanks for Main Street Of America

Since 1980 Rape of 130 million workers by three so called Conservative Presidents and a Conservative CongressÂ

Let those take power and kill Safety Nets will result in

Â

70,000,000 workers marching and yelling

BURN BABY BURNÂ

Those 70,000,000 luckie duckies get 13% of individual income

In a Christian Nation. Jesus Christ would be upset

If America is a true Christ-Like nation I am Bernie Sanders

clarence swinney

olduglymeanhonest political Historian Lifeaholics of America

author-Lifeaholics-Success by working for a Life not just a Living

Â

Â

ÂSeptember 2nd, 2011 at 4:40 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!