101 years of the most secretive central bank in history – Dollar has fallen over 90 percent since Fed was put into place. Fed running out of ammo with negative interest policy.

- 2 Comment

Few people realize how secretive the Federal Reserve operates even though it is the central bank to our financial system and wields a sword strong enough to be called Excalibur. The Federal Reserve came about from a secretive meeting on Jekyll Island by some of the world’s top financiers back in 1910 including the powerful J.P. Morgan. What very few know is that in November of 2010 Ben Bernanke made a trip to the island off of Georgia to commemorate the 100-year anniversary of the original meeting. This original meeting was held in the strictest of secrecy lest the public realize how the powerful bankers sought to aggregate power in a few hands. With the too big to fail becoming even bigger and the Fed blocking full out audits like a hockey goalie, it is nice to see few things change even after 100-years of destroying the U.S. dollar.

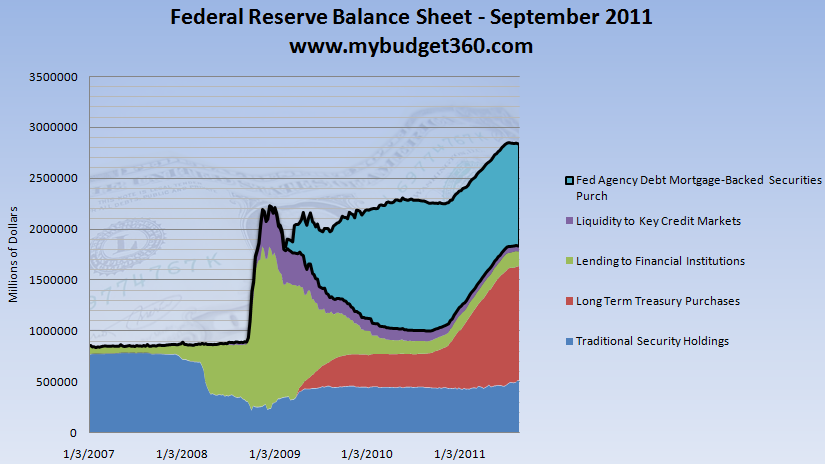

What does the Federal Reserve have in its balance sheet?

The Fed for most of its history has been rather mundane in the types of instruments it would hold as collateral. This was typically in the form of U.S. Treasuries. However, since 2008 the Fed has become rather exotic in regards to its holdings and has grown its balance sheet to a size well over $2.8 trillion:

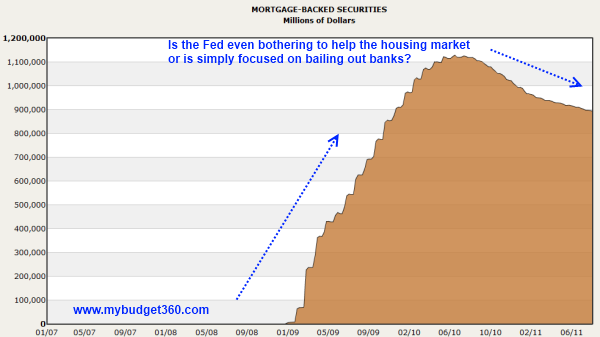

The Fed only recently has delved into the mortgage buying game and did so with the gusto of a kid in a candy shop. The Fed through Quantitative Easing has purchased over $1 trillion in mortgage backed securities from the too big to fail banks. The Fed has also inherited luxury hotels, fast food restaurants, and other failed projects that require banks to be bailed out. Of course this has come at the expense of a declining dollar. The pain being felt in the economy is simply a symptom of a central bank built on darkness and keeping the public completely ignorant to its doings. This was the purpose of the Fed from day one. Reading about the founding of the Fed is like reading about a Skull and Bones initiation:

“(The Creature From Jekyll Island) Picture a party of the nation’s greatest bankers stealing out of New York on a private railroad car under cover of darkness, stealthily riding hundred of miles South, embarking on a mysterious launch, sneaking onto an island deserted by all but a few servants, living there a full week under such rigid secrecy that the names of not one of them was once mentioned, lest the servants learn the identity and disclose to the world this strangest, most secret expedition in the history of American finance. I am not romancing; I am giving to the world, for the first time, the real story of how the famous Aldrich currency report, the foundation of our new currency system, was written…”

It was never intended for the public to even have a sense of who was behind the scenes pulling the strings to create the Federal Reserve. Just like in the Wizard of Oz, the power of the wizard comes from the smoke and mirrors. And the insistence that the housing market is fine is merely a giant charade of the Fed buying practically every mortgage backed security it could get its hands on:

There is little reason to pick Jekyll Island instead of say New York to hold this meeting but the bankers needed a place obscure enough to stay off the radar:

“The utmost secrecy was enjoined upon all. The public must not glean a hint of what was to be done. Senator Aldrich notified each one to go quietly into a private car of which the railroad had received orders to draw up on an unfrequented platform. Off the party set. New York’s ubiquitous reporters had been foiled… Nelson (Aldrich) had confided to Henry, Frank, Paul and Piatt that he was to keep them locked up at Jekyll Island, out of the rest of the world, until they had evolved and compiled a scientific currency system for the United States, the real birth of the present Federal Reserve System, the plan done on Jekyll Island in the conference with Paul, Frank and Henry… Warburg is the link that binds the Aldrich system and the present system together. He more than any one man has made the system possible as a working reality.â€

The Federal Reserve is simply a system that is intent on keeping the banking powers established no matter what ills are committed by their banking brotherhood. This is why after many years in this crisis nearly every penny of the bailouts has gone to aiding and focusing on protecting the banks. The banks in turn lobby and pay Congress to protect and paper over their misdeeds of the past decade. A few op-ed pieces covered the troubling nature of how the SEC actually destroyed suspicious files on many of the banking giants early in the 2000s. Those in the organization who played their hand well enough managed to land lucrative positions at the big banks. Those in big banks have direct connections with Ben Bernanke.

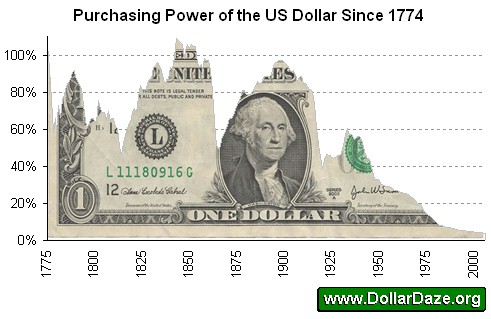

The 100-year anniversary of the Fed goes hand in hand with the purchasing power decline of the U.S. dollar:

The dollar has fallen dramatically over this time and this is reflected through the cost of goods.  At one time in history one U.S. dollar was redeemable with one ounce of silver. The cost of silver is now well over $40 an ounce today. The Fed has no restraint as to what it does and Congress is impotent in regards to auditing even our own central bank.

The end of the road after 100-years?

Once the mystique of the Fed wears thin, it is hard to gain it back. The Fed usually pulled on the strings of the economy with interest rates but what happens when rates go below zero?

The Federal Reserve is now in uncharted territory with QE1 and QE2 and potentially QE3 with zero jobs being added in the latest month. Yet how much bigger can their balance sheet go? Is $2.8 trillion large enough? Banks are still loaded to the gills with toxic residential and commercial real estate loans.

Ultimately the Fed was built and designed in a time when it was much easier to keep secrets from the public. Those days no longer exist. Information is freely available and people can question and seek out what is really going on. 46,000,000 Americans on food stamps. Over 23,000,000 unemployed and underemployed. Over a decade of declining household incomes. Yet somehow the banks get bigger and wealthier over this time. You need to ask yourself who is the Fed really serving? If the U.S. dollar has fallen over 90 percent in the last 100 years where will it be in another 100 years?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Tom Baxter said:

One really can’t blame the Fed for all inflation, which has been mostly caused by war. The Civil War, WWI, deflation during the Great Depression I and more inflation during and after WWII and the Cold War and post WWII hot wars. There was a big bout of inflation during Vietnam, which methed the economy up for JFK, LBJ, and RMN. Carter got to hold the crash, as Obama dos today. Under Reagan/Bush value of the dollar was cut in have, even though all the investment in oil had came on line along with the S&L fraud kept the economy afloat. The PC revolution increased productivity along with women going into the workforce in droves during Clinton. The pumping up of the real estate bubble kept the economy up during Bush 43. The bubble popped and even War Keynesisn which boosted the economy for decades hasn’t helped Obama.

September 4th, 2011 at 7:49 pm -

Paul Verchinski said:

While the Republicans complain about Obama Socialism, the Fed is the star example of Central Planning in the US. It is nothing else but a bank representing the interests of the “Too big to Fail” banks. Bernanke with QE1, QE2, and maybe QE3 is still pursuing his Depression era Theories. However, as someone has said ” Doing the same thing over and over again expecting a different outcome is the height of insanity”. I’m afraid that we are now caught in the infamous Japanese style Liquidity Trap and until the Zombie banks are liquidated, Main Street will be left high and dry of needed capital.

September 5th, 2011 at 6:40 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!