The giant gamble in the desert – how Las Vegas bet big on commercial and residential real estate and lost big. Home prices in Las Vegas now down 60 percent from their peak and nearly 1 out of every 5 mortgages is in foreclosure.

- 3 Comment

Las Vegas is an economic enigma. A gambling and resort paradise planted in the middle of the barren Southwest desert like an electrical oasis. Very few areas witnessed such a large boom in both residential and commercial real estate rolled into one. In a city known for big wins and even bigger defeats the real estate debacle is exacting a painful toll on the desert region. An almost perfect storm of a crashing real estate bubble, high energy costs, and a forced austerity are forcing painful cuts in the city of splurge. It was hard to imagine the rate of growth in the area keeping pace with what experts were predicting but many rushed in buying homes sight unseen. Las Vegas home values are now down almost 60 percent from their peak reached in 2007. What came on so quickly may take decades to repair.

The manic rush into real estate

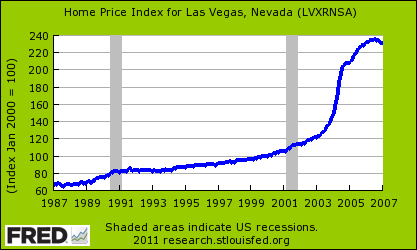

If I were to show you the below chart in 2007 you would think that there would be few investments that could compare to Las Vegas real estate:

Over the span of 20 years real estate values increased by a factor of four. In other words, if you bought a home for $300,000 in 2007 you could expect (if the trend continued) to have a home worth $1,200,000 by the time 2027 rolled around. The commercial real estate market was booming with casinos expanding not only their gaming floors, but also the prestige and level of shopping. Money was flowing easily from the Wall Street investment banks and it showed. After all few know gambling like Wall Street.

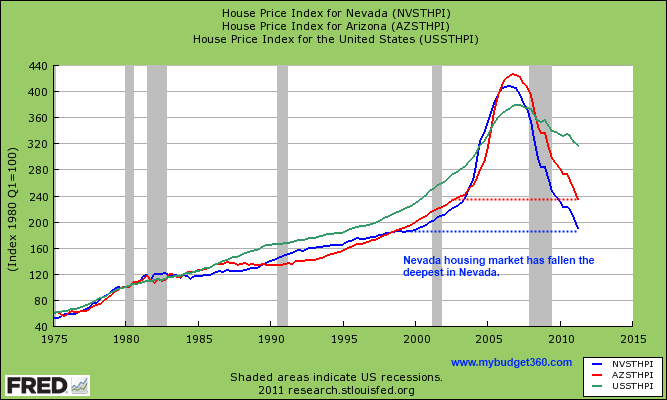

The bust came even faster than the boom:

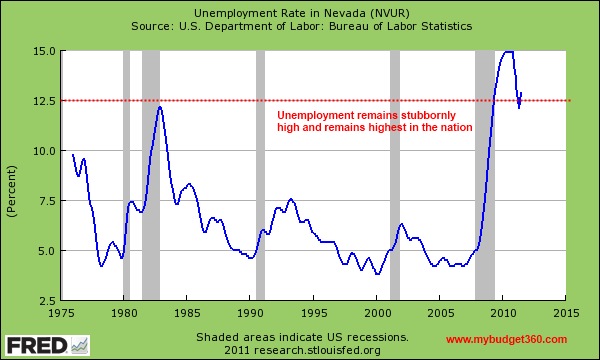

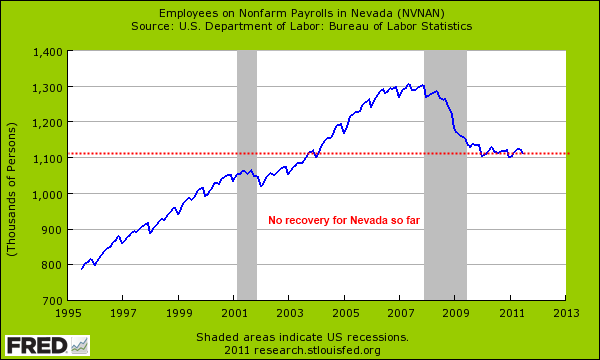

Home prices for Nevada and Las Vegas have been in a near freefall since 2007. Las Vegas is down nearly 60 percent while the state is down 53 percent. Nevada is now deep into a lost decade. The economy has not recovered and the state now holds the highest unemployment rate in the nation:

The unemployment rate is the highest in the nation but the magnitude of the cuts is astonishing. The state went from a market were nearly everyone had a job to a near depression within a few years. The unwinding of residential debts in housing and commercial real estate hit the market hard and continues to serve as a drag on the region:

Nevada has the highest percent of homes in foreclosure:

Over 20 percent of all mortgage debt is at least 90 days late! This is such a startling revelation but also highlights why banks are facing such dramatic challenges. The bubble has burst but valuations still reflect 2007 levels in many cases. The market clearly has a different value on the price of a home.  Foreclosure resales made up 60 percent of all sales last month. It should be no surprise that local companies are facing tough times:

In the last five years MGM stock has plummeted over 70 percent. Nevada now has as many people employed as it did a decade ago with a larger population:

Las Vegas however does offer a tiny bit of information in terms of what the market is demanding:

-Home sales are up year-over-year by 5.2 percent

-The median home sale price is down 11.5 percent over the year ($115,000)

In other words, people are willing to buy for a lower price. This is why foreclosure resales dominate the market. As we have noted before, the average per capita income is $25,000 across the nation. These economies have large numbers of service workers so a $100,000 home may be affordable to a working couple whereas a $300,000 home is completely unmanageable. The only reason prices reached the levels they did was because of massive bank speculation. Now, prices need to reflect a fundamental valuation of what the local economy can produce. As the above charts show, there is little reason to think those 2007 levels will come back anytime soon. We may not even see them again in 2027.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

The Cash Flow Is King said:

Great article. There are many investors that are working in the Las Vegas area, and it is still mind boggling to me. It is clear that the market as a proven track record of insane volatility with only one dimension to its economy. Not only this, there isn’t a lot keeping people in Las Vegas…If the unemployment rate is so high, and so many people have had their house foreclosed already, there isn’t much motivation for unemployed renters to continue to stay.

Who is to say Las Vegas is not Detroit?

September 7th, 2011 at 9:32 am -

well said:

as battered as it is, vegas is still the 3rd most visited and profitable gaming city in the world and still #1 within US.

as long as the big 3 gaming company is still betting on vegas.

it will continue to have action for investors.there are certain places on the planet that captures the imagination of everyone. NYC for power and money, Paris for love & romance,

Vatican for religion, and for better or worse, vegas for gambling and other “vices”..if you’all talk doom and gloom and US/world never recovers from what is happening right now..then no where in US/world is a good bet. if you’all believe there will be brighter days ahead, then vegas is a safe bet. simple as that.

September 13th, 2011 at 1:49 pm -

Kac said:

I recently purchased a beautiful home in Las Vegas. The house was originally sold by the builder for $270000 in 2007. I bought it for $125000. The price of the house calculated to a mere $64 per square foot. The home is in a lovely planned gated community with many amenities. It is not replaceable at the price I paid. This is the draw for investors. The house is insured at replacement value of $272000 per the insurance company.

I am using the house as a rental property at a very reasonable rent. I payed cash and expect a return of about 10% from rent. I sincerely feel for families who overpaid and hurt their credit. I hope that a family can both afford and enjoy my house. I believe that investors who have picked up these properties at ridiculously low prices will help to stabilize and normalize the Vegas market by decreasing the housing inventory. I had my new house painted, carpets cleaned, and window treatments added by a local Vegas contractor. I’ll bet that my experience has been replicated several thousand times over the past year.

I am no gambler but I really enjoy Las Vegas. It is warm, beautiful, tropical, yet with access to snow and a big body of water within a very short drive. The shopping is wonderful as are the restaraunts. Las Vegas is young, multicultural, and vibrant. I am betting on recovery.

June 9th, 2012 at 1:53 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!