Scorching the desert housing markets – Arizona and Nevada real estate blossomed with cheap fuel and easy access to debt. For last two years 40 percent of buyers came from all cash purchases. What happens when the well runs dry in the financial desert?

- 14 Comment

The Arizona housing market is a perfect example of what happens when the housing religion spirals out of control and implodes in dramatic fashion pushing up against environmental limits. I remember driving in the blistering summer heat through Arizona before all the housing mania launched out of control in the late 1990s and thinking that the only reason the land was hospitable was because of cheap fuel and air conditioning. It costs money to move large amounts of water to an otherwise arid region. You have months of 100 plus degree weather and electric bills that run the size of your mortgage payment. A beautiful state but one based on access to affordable fuel. The housing market has crashed for both Arizona and neighboring Nevada. These areas are no stranger to booms and busts yet this time it is different. The cheap energy model that kept these locations operating is largely coming to an end. These are commuting locations. Have you ever tried walking down the Las Vegas strip during the summer time? You might as well pack two gallons of water and a cowboy hat before making it two blocks. The market has melted in the region like rubber on the bottom of your shoes.

Investors artificially prop up Arizona market

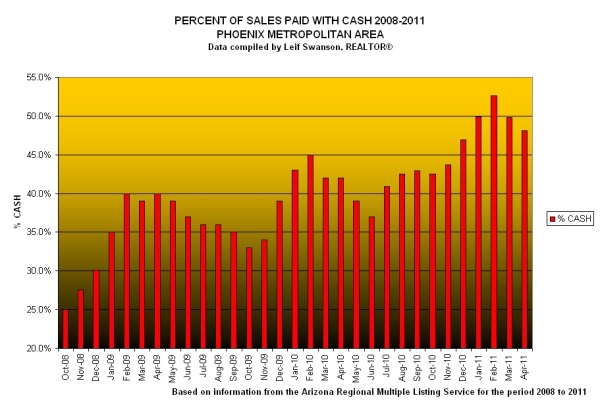

The desire to buy cheap property and low interest rates has propelled many people to purchase in Arizona. For almost two full years all cash buyers have purchased close to 40 percent of properties in the desert city of Phoenix:

Source:Â Leif Swanson

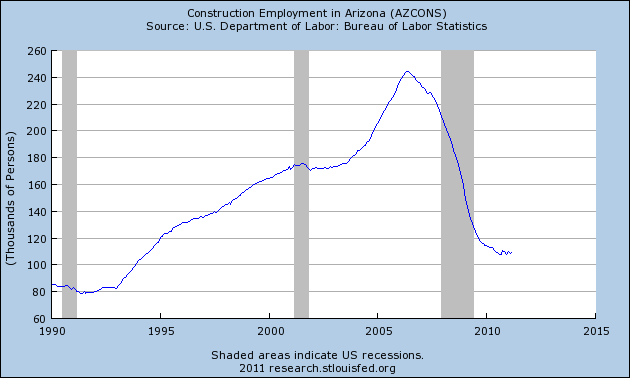

The market is saturated with investors. In fact, you have investors selling to investors trying to squeeze out profits since household incomes in the region are low and facing the pressures of a declining middle class. A large part of the economy in Arizona was based on home building and construction and much of the gains have now evaporated into the desert sun:

In past business cycles you can argue that this is merely a normal trough that is occurring and things will be on the mend soon. I simply do not buy that argument. Energy costs are rising because of global dynamics and it is unlikely we will see $2 a gallon gas ever again (at least in U.S. dollar terms). Per capita income in the state is $25,000 which falls in line with much of the middle class struggles we have talked about. What happens when a family is spending $400 a month for auto fuel and another $400 to keep the home cool in the summer? The cost for energy is higher than the housing payment on a $100,000 home (which is very common in the region):

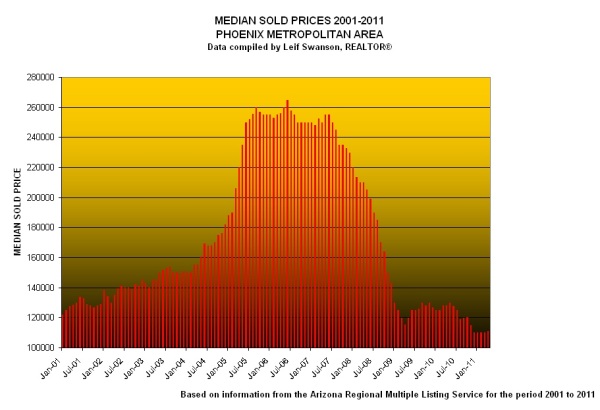

Source:Â Leif Swanson

Now why is this important? Many of the investors buying out in the region are buying for a few reasons. First some are buying for cash flow properties. Granted at these levels prices may make sense but again the entire system will crack with $150 a barrel oil. We already hit over $140 a barrel and oil seems to be settling between $90 and $100 for the short-term. What evidence do we have oil will move lower? We also have the Fed and U.S. Treasury trashing the dollar which will make oil cost more in the U.S.

You have another smaller set of individuals buying for retirement reasons. Some people think that just because you pay off a home that you have no additional costs. That is not true. You will always have the following:

-1. Maintenance

-2. Taxes (balance deficits will force state governments to raise taxes)

-3. Insurance

-4. Energy for the home

For a desert community number four can put a large pinch on retired families with fixed incomes. Keep in mind as time goes by and the Federal Reserve is bent on crushing the dollar, each monthly check you get will buy fewer groceries and will cover a smaller portion of your energy costs. The chart showing all cash investors should cause you to pause. Keep in mind that the all cash percentage has been slowly decreasing but so have prices and sales volume. The “normal†market isn’t picking up the slack because people are largely battling with a shrinking middle class. These giant McMansion suburbs were built with a richer middle class expanding in mind and perpetually cheap fuel.

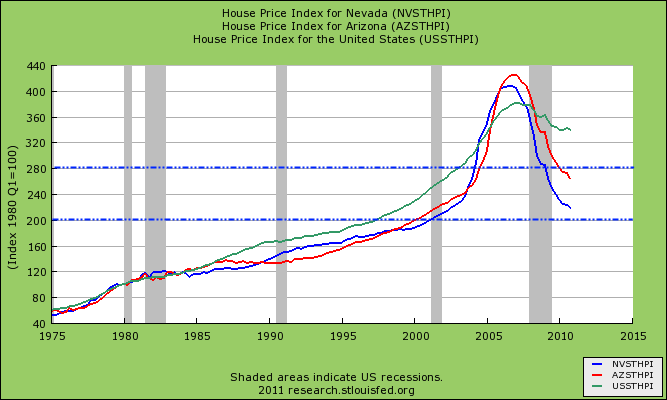

You can see the crash of the desert housing market in vivid fashion by comparing it to the U.S. housing market which isn’t exactly Miss America either:

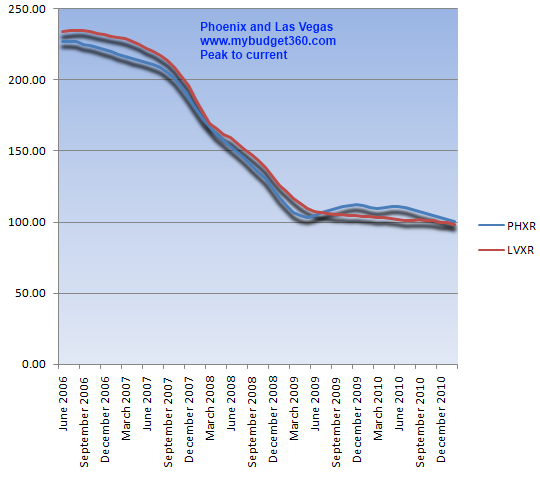

The HPI is a very conservative measure of home prices. But even using this metric, you realize how much deeper Nevada and Arizona have fallen in relation to the rest of the country. If we use the peak as our starting point and pick the two largest metro areas you can see this crash even stronger:

Source:Â Case-Shiller

Both Phoenix and Las Vegas have fallen by over 50 percent since their 2006 peak. Does it look like home prices are moving up? It is fascinating that the infusion of investors has merely moved prices sideways for a full two years. What you have is investors making a market with other investors yet the organic market is still hurting because when homes are under $100,000 many households are more focused on paying their bills, putting gas in the car, and feeding their kids. Plus, you have a flood of rentals thanks to investors tripping over each to enter the market. All the while the per capita income of the region is $25,000.

Arizona and Nevada have beautiful scenery but they are scorching Southwestern deserts that really are inhospitable to many living things without affordable fuel. The abundance of cheap energy was a reason these regions blossomed for many years. But how do you make these markets affordable to lower income families that are now facing rising energy costs? Importing high cost items might make sense for high income markets but for these desert communities it is much tougher. As an investor, the short-term cash flow may be dwarfed by longer macro trends. Just look at places like Detroit where a complete shift in industry and population has left many homes selling for one dollar and a few hundred dollars in back taxes. What got us into this housing bubble was not looking at the macro changes in our global economy. It seems many are making the same mistake again.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!14 Comments on this post

Trackbacks

-

Sharkie said:

Viva Las Vegas!

The difference between a ten year old desert home and others are huge. After ten cycles of 90+days per year above triple digit heat, often with 30-45mph dust storms, summer monsoon rain that flood, winter temps below pipe breaking / plant/tree killing freeze, the homes here are hammered. On top of that, the majority of exterior walls here are just 3 ½ “thick. Garage areas are considered non livable therefore are not insulated. Even in 2001, low-e windows were an option. If you get ten years on an AC/furnace system consider yourself on borrowed time.

Constant use of explosives for excavation practices have rendered most slabs/driveways/sidewalks cracked or fatigued. Because they never heard of “Truck Routes†here, heavy/overweight-size vehicles are allowed down any street they choose. The result being cracked pavement that looks prematurely old. Faulty plumbing, resulting in a thriving re-pipe business, and several instances of sewer pipes never connected or cracked/ damaged now root infested are all too common. Construction defect litigation is a past time here.

The crumbling neighborhoods of Vegas are inundated with vacant foreclosed /short sale/reo homes. Some of the higher end neighborhoods, especially retirement communities, struggle to maintain price discovery. Prices continue down and I would venture to say most of your cash buyers/bottom feeders that have kept this illusion of home prosperity in denial for the last few years are themselves holding real estate worth less then what they paid for it. No matter the neighborhood, the bloom is definitely gone.

May 17th, 2011 at 1:48 pm -

Sharkie said:

Viva Las Vegas!

The difference between a ten year old desert home and others are huge. After ten cycles of 90+days per year above triple digit heat, often with 30-45mph dust storms, summer monsoon rains that flood, winter temps below pipe breaking/plant/tree killing freeze, the homes here are hammered. On top of that, the majority of exterior walls here are just 3 ½ “thick. Garage areas are considered non livable therefore are not insulated. Even in 2001, low-e windows were an option. If you get ten years on an AC/furnace system consider yourself on borrowed time.

Constant use of explosives for excavation practices have rendered most slabs/driveways/sidewalks/tile-floors cracked or fatigued. Because they never heard of “Truck Routes†here, heavy/overweight-size vehicles are allowed down any street they choose. The result being cracked pavement that looks prematurely old. Faulty plumbing, resulting in a thriving re-pipe business, and several instances of sewer pipes never connected or cracked/ damaged now root infested are all too common. Construction defect litigation is a past time here.

The crumbling neighborhoods of Vegas are inundated with vacant foreclosed /short sale/reo homes. Some of the higher end neighborhoods, especially retirement communities, struggle to maintain price discovery. Prices continue down and I would venture to say most of your cash buyers/bottom feeders that have kept this illusion of home prosperity in denial for the last few years are themselves holding real estate now worth less then what they paid for it. No matter the wind strapped neighborhood, the bloom is definitely gone.

May 17th, 2011 at 1:54 pm -

Dave said:

Interesting article and conclusion. I tend to agree with your points but had an epiphany as of late.

I was talking with my classmates at nursing school. Most of them are a bit older then the average college student because it is a community college. ALL of them rent and ALL of them dislike renting and want to buy their own home.

As I said before I agree with your positions and have been watching this implode since 2006 but at the same time their is a % of the population who do want to buy….. eventually equilibrium will be found.

Just as it was stupid for the realtors and investors to believe prices only ever go up (buy now before you are priced out forever) it is stupid to believe prices will only go down until they are worth nothing.

May 18th, 2011 at 3:58 am -

Paul Meleng said:

Hello from Australia where we all live on the edge of inland deserts.

One australian dollar buys 1.05 US

We are paying $1.50 a litre for unleaded petrol which I think is about $6.70 a gallon.

But our average income is around $65000 and family income around 85,000. Average earnings in the mining industry are around $105,000. Here is Western Australia most mine workers family homes are in the costal cities and the guys do “fly in fly out” to over 600 inland mining base camps or small towns servicing over 1000 mine sites. Houses are typically large single story family homes with 4 bedrooms and 2 bathrooms, a family of games room, outdoor liesure area and a double garage and the median price is not far short of $500,000. House prices and payments (at typical interest rates of 6.9%) are at a very high multiple of earnings and are starting to fall as even though there is a lot of work, the new buyers cant make the stretch any more.

I am into sustainability. I remember a feature article in National Geographic in around 2000 or thereabouts showing the vast tracts of new houses spreading out from Las Vegas and predicting disaster. Exactly.

May 18th, 2011 at 8:23 am -

Jmac said:

What if a new ultra low cost energy system were to arrive on the global stage? I’ve been following the work of Andrea Rossi and his E-Cat generator for some time now. Some radical change may, and I emphasize “may”, be in our future. Reading on a daily basis, every article that pops up on a Google search over several months now, it seems that a change in our energy future may be coming. I am still quite skeptical but evidence is mounting that the E-Cat could be the real deal. If it is for real than it is a total game changer. Read about it. You may find it quite interresting.

May 18th, 2011 at 8:57 am -

Joec said:

You fail to mention that the largest nuclear power plant in the USA is right ouside PHX, cheap power is not going anywhere fast.

May 18th, 2011 at 9:18 am -

Joec said:

You fail to mention that the largest nuclear power plant in the USA is right ouside PHX, cheap power is not going anywhere fast.

JoeMay 18th, 2011 at 9:19 am -

Mike said:

Excellant post. I travel to Phoenix twice a year on business. It clearly struck me that if the power were to go out for 24 hours in the summer, people will DIE.

People there run from their air conditoned home, to the air conditioned car, to the air conditioned office. Then they talk about how great the weather is.!!

If it were not for air conditioning, Phoenix would still be a small town, not the 10th largest city in the country. In San Diego I was talking to a motel owner. He mentioned that in the summer, nearly all of his customers are from Phoenix area, looking to escape the heat.May 18th, 2011 at 12:26 pm -

mel said:

I’m glad I live in Tucson where I put solar electric on my house so my bill is a fixed $7/mon and I’ll soon get a plug in car and I’m running on sunshine. Come to Tucson where you can live with sunshine as your ali

May 18th, 2011 at 8:35 pm -

Mr. Cat said:

Yes, Las Vegas and Phoenix are very hot during the summer, but they have mild temperatures the other 8-9 months out of the year. I don’t see the difference between desert climates cooling their homes in the summer and colder climates heating their homes in the winter. Heating bills are quite expensive in the Midwest and and East Coast. Unless you live on the California coast (i.e. San Diego) where it’s 70 degrees year around, you will have to use energy to either heat or cool your home. Why is AC seen as a luxury, but a heater a necessity?

June 6th, 2011 at 11:15 am -

Mr. Cat said:

One other thing, I’ll take 110 degree heat over snow and ice storms any day. I live in California where I have neither (just fires and earthquakes…. LOL)

June 6th, 2011 at 11:17 am -

zonie said:

Gee….how much does it cost to heat a home back east up north?

Our summers here in the fifth largest city (not 10th)are shorter than the winters back east.While you shiver in January….I’m growing a garden and my electric bills take a 3/4 dive from the usual three month increase (june, july, aug) so many seem to believe is year round.

June 7th, 2011 at 10:18 am -

G said:

Arizona needs to securitize hectares of their sun-drenched land into REITs. Speculators like myself will buy them up knowing well that their position in the SW is prime for solar farms, which will expand rapidly in the coming decades.

June 11th, 2011 at 9:40 pm -

Mike said:

move to chicago welcome tax are hight $$3.500 1000sq fit home no yard

November 27th, 2012 at 9:41 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!