Home on the bear market range – the United States will face a 10 to 15 year real estate bear market. Hard to believe but we are already 5 years into this economic trend. The failure of Quantitative Easing in Japan.

- 4 Comment

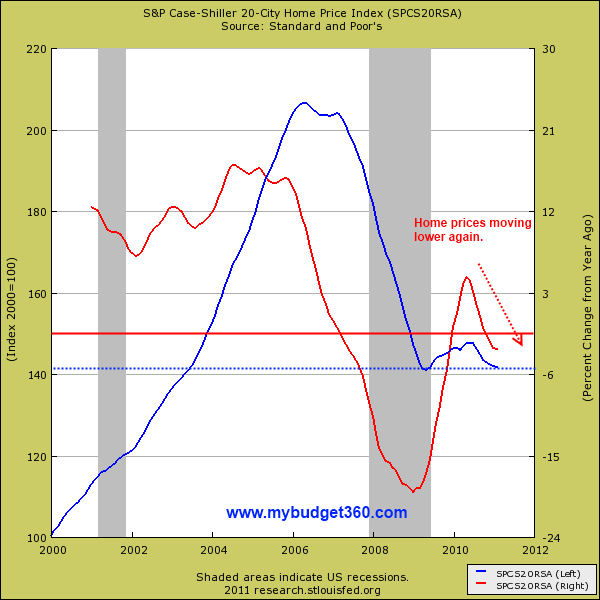

Can Americans cope with a 10 to 15 year bear market in real estate? On this front I have good news, and bad news. The bad news is that we are likely to face at least a 10 year bear market in real estate thanks to a lost decade in household income and the continued erosion of the middle class. Home prices can only reflect the underlying income of households paying the mortgage. Clearly with record foreclosures many cannot accomplish this financial Herculean task. The good news is we are already 5 years into this correction (so either we are half way or one third closer to a bottom). For the United States this is a new experience because we have never seen an annual drop in home prices on a nationwide basis outside of the current crisis. People point to the Federal Reserve as the knight in bailout armor for housing but look how far that has gotten us in the four years since the crisis started. It is safe to say that home prices will face a 10 to 15 year bear market so let us examine the details carefully.

Case Shiller reaching new lows

Don’t look now but home prices have fallen by 3 percent (-3.3 percent to be exact) on an annualized basis. This might not mean much to some but keep in mind we are talking about an asset class that has a track record of never reporting one negative year for multiple decades (that is until the recent housing bubble occurred). What is more disturbing is we are reaching new lows and the peak was reached back in 2006. To regain the 2006 peak home prices would need to rise by a stunning 45 percent. How likely is that with stagnant income growth and mortgage rates at rock bottom levels? The Fed is running out of ammunition here and this story has already taken place in history and not too long ago.

Japan had a massive housing bubble with too big to fail banks where the Bank of Japan jumped in and bailed out the financial sector. These banks failed to recognize their losses and the banking and real estate industries turned out to be a superb drag on the Japanese economy. Sound familiar? Of course some will point to the low unemployment in Japan as a sign of good times. However, 1 out of 3 workers in Japan work in what is considered a contract basis where they are assured no worker protections. This is similar to our part-time workers who would like full-time employment but are unable to find a spot.

Japan boom and bust

[japan re]

Source:Â ZemPower

Let us first count the ways how we are similar with Japan:

1. Massive real estate boom and bust

2. Intervention by central bank to bail out banking sector

3. Enormous government spending and debt

4. Big liabilities thanks to demographic shifts

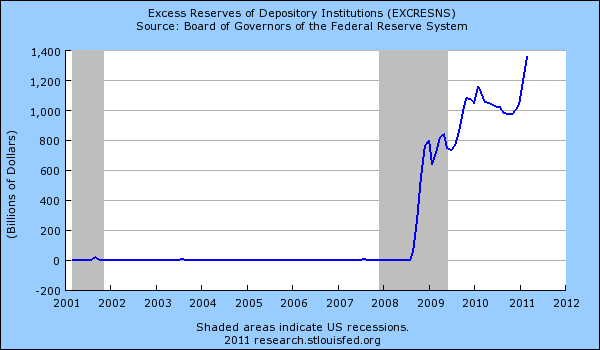

Clearly there are substantial differences between the two countries. But it is obvious that the real estate bubble bursting has been a drag on the Japanese economy. The bailed out industries have served as a drag on the economy. If you look at the above chart, real estate prices dove into a 15 year bear market and overall home prices have not even come remotely close to their former peak price. The banking industry is following a similar model with our Federal Reserve injecting massive liquidity into the too big to fail banks. Just look at this brief overview of what occurred:

“(Wikipedia) Quantitative easing was used unsuccessfully by the Bank of Japan (BOJ) to fight domestic deflation in the early 2000s.[8][14][15][16] The Bank of Japan has maintained short-term interest rates at close to zero since 1999. With quantitative easing, it flooded commercial banks with excess liquidity to promote private lending, leaving them with large stocks of excess reserves, and therefore little risk of a liquidity shortage.[17] The BOJ accomplished this by buying more government bonds than would be required to set the interest rate to zero. It also bought asset-backed securities and equities, and extended the terms of its commercial paper purchasing operation.â€

Now take a look at this chart for our banks:

The fact that housing prices are still moving lower and wage pressure on the downside is still prominent, it is likely that we have many more years ahead of a weak housing market. One point to make with say food or oil and their rising prices is that we have a falling dollar thanks to this spending but also the ease of shipping these items around the world. You cannot ship housing around the world. It is a local good. People in the nearby area will have to live in the place. Sure you have a small fraction of homes used as vacation or second homes but this is tiny. There is no exporting a home in Florida to Japan.

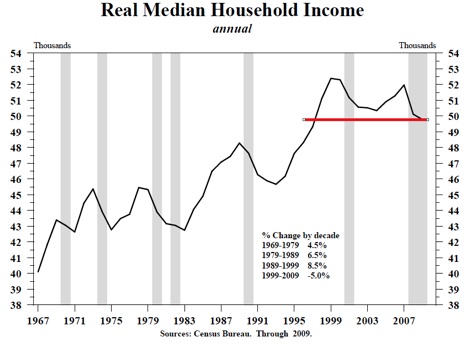

The wage question

This is probably the biggest reason why home prices will see a 10 to 15 year bear market and it revolves around household wages. The 1970s saw real household income grow by 4.5 percent. The 1980s saw it grow by 6.5 percent. The 1990s saw it jump by 8.5 percent. The last decade of the 2000s saw it drop by 5 percent. The above chart shows the reality of the middle class hitting an income wall. As more jobs are added in lower paying sectors, it is a reality that home prices have to be cheaper to accommodate this new reality.

The Federal Reserve has done nothing innovative to help the American people. It merely has saved the too big to fail banks and their bad real estate dealings on the backs of the American people. The Bank of Japan did the same to the Japanese people and their economy is reflecting this poorly done policy. Instead of dealing with the problem head on the Fed has made it worse for the majority of the population. Home prices need to be cheaper because unfortunately Americans are making less. Who benefits by keeping home prices inflated and wages going lower? I know many have a hard time seeing a 10 to 15 year American housing bear market but we are already half way there. Those who fail to listen to history are doomed to repeat it.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Jmac said:

What a relief to read an article that objectively looks at the true state of the housing market. I believe you have nailed this analysis dead on. We’re looking at some time around 2018-2020 when the firm bottom in housing is finally put in. Great article. No spin. No gloom and doom. Just a realistic look at the state of the market.

April 28th, 2011 at 9:44 am -

gale tulveg said:

magnifico!

see “silver jumps” Western bks INsolvent.

debates on DEF . or HYper …inflation. 18 mil emt houses.

etc. keywords global fin crisis etc.April 28th, 2011 at 1:14 pm -

Jay said:

This article makes some very good observations, but it also makes some very long shot presumptions. For example, the 10-15 year projection doesn’t take into account the fact that we will not even be using dollars any longer as soon as the New World Currency is established. It would be a major guessing game to try to establish the value of dollars in terms of the new currency. Throw in a few other variables like war, famine, disease, radiation, earthquakes, foreign troops and family breakdown in general and the price of housing becomes a non-issue. I’m told that you can buy some houses in Detroit for a dollar a house in the worst case scenarios just like it was during the first depression, only things were better back then.

April 28th, 2011 at 5:13 pm -

Tony said:

I enjoy the analysis. I was wondering if there was any data available on the change in household debt for “the middle class.” Middle class families are hard workers, indeed, the back-bone of the consumer economy. The problem is they are the ones that lived way beyond their means going into debt pre-housing market. By definition, “Upper-class” people have a very small debt to asset ratio and “lower-class” households do not have access to accumulate debt in the traditional “middle-class” sense (this is why there are so many Pay Day loan operations in lower income areas. Real wages not rising are the DIRECT RESULT of reduced bargaining power of the “middle-class” worker because of their reliance on their existing income to make payments on stupid purchases. Lose their job and lose EVERYTHING since they don’t actually own it. Instead they keep their mouths shut (because they have to or they’ll get fired), take what is given to them by their employers (free market), compalin about how they’re getting screwed and how little they have. Serfs!! HIgh net worth people get that way from not taking on tremendous amounts of debt. I like your stuff.

April 29th, 2011 at 4:28 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!