The financial bubble that is still popping – Home prices enter a deep double dip because household incomes are still in a rut. Housing bubbles in Los Angeles and San Francisco persist while Miami and Phoenix metro areas face double digit annual price declines.

- 6 Comment

Some people are stunned that home prices continue to sink as if a lead weight was placed on the value of housing. The mainstream press never sliced and diced the minor jump in prices we had last year because much of the increase occurred around tax credit gimmicks and the Federal Reserve using artificially low rates to drum up demand where none existed. In the end this has been a vastly expensive proposition that failed to address the main problem with housing. Home prices need to drop or household incomes need to increase. The housing bubble only occurred because of lax credit and massive speculation. Debt filled the gap of non-existent income growth. The housing bubble did not occur because real household incomes went up. It is the case that in the last decade the median household income actually declined for the first time over such a period since the grim days of the Great Depression. Keep in mind the average per capita income in the United States is $25,000 and the median household income is $50,000. How much can you afford with this income? Even areas that looked cheap last year have fallen much deeper in 2011 because of weak employment prospects.

Home prices are reflecting weak income growth

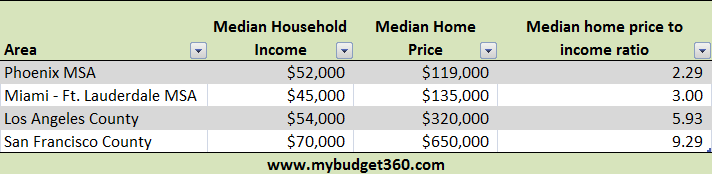

Many investors leapt head first into a real estate world without checking if the financial pool had any water. People bought in areas simply because prices appeared to be cheap after a decade of inflated prices. Everything looks low after returning from the summit on Mount Kilimanjaro. Yet prices in many of these markets were never justified. Let us take a look at two markets that on the surface appear to be cheap and two markets that are fully in housing bubbles as of today:

Source:Â Census, Data Quick

On the surface the Phoenix and Miami markets look affordable. Last year people were clamoring how cheap these markets were and many investors jumped in to pick up properties. In markets like those in Phoenix for nearly an entire year half of all home sales came from investors. Many were looking to do a quick flip or for rentals. Whether a flip or finding a renter you have to find someone living in the immediate area to occupy the home. Those who were led into the market because of the appearance of low prices actually are now dealing with the second phase of the housing correction:

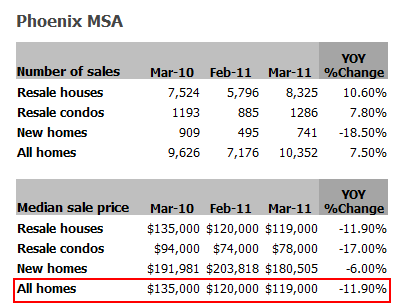

Source:Â Data Quick

The Phoenix metro area is now down over 11 percent from last year. Keep in mind that you also have many home buyers purchasing homes with FHA insured loans that only require a small amount for a down payment. These people have lost all of their equity and are now underwater. Was the tax credit worth it? Obviously not since the down payment plus additional money has vanished into thin air. The same can be said for the Miami metro area:

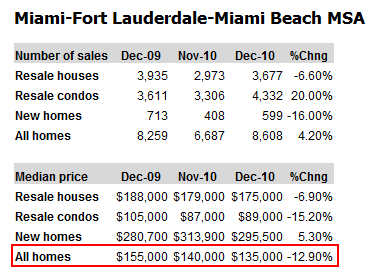

Source:Â Data Quick

I know many were itching to jump in when the Miami-Fort Lauderdale market was showing a median home price of $155,000. Well guess what? It fell over 12 percent in the last year. Many people that dove into the housing market last year are now sitting in a negative equity position. Why? Because the average per capita income in the United States is $25,000. You also have to run the numbers on the median household income:

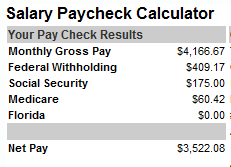

Now assume you purchase that home in Phoenix for $119,000 with 5 percent down:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $5,950

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $900

After the house payment this household is left with $2,600. Yet what about the rising cost of fuel? These are largely commuter markets and the average cost of fuel has risen to $500 per month, over half the monthly home payment. What about two car payments at $300 and insurance of $150 per month? Now you are down to $1,350 a month and we have yet to add the rising cost of groceries. Throw in $500 for this and you are down to $850. I think you get the point that even the seemingly cheap price of $119,000 gets eaten away quickly because incomes are losing purchasing power in other areas thanks to the Federal Reserve hammering the dollar down.

What is more troubling is the big bubbles in markets like Los Angeles and San Francisco. Without a doubt these markets are facing drastic housing bubbles. While Miami and Phoenix are quickly coming down to Earth and are facing more nuanced issues like fuel or food cutting into family budgets, markets in L.A. and San Francisco are still fully in housing bubbles. Refer to the chart above and you can see the home price to income ratio and the number is outrageous. Keep in mind the Phoenix MSA market peaked at $264,000 in June of 2006. Prices are down 54 percent since that time yet they are starting to make more sense because they are coming in line with incomes of those areas. Los Angeles and San Francisco still have ratios that signify a bubble that is yet to fully burst. And as we have seen in Miami for example, home prices will go much lower than you expect because our economy is shaky.

It is all about income

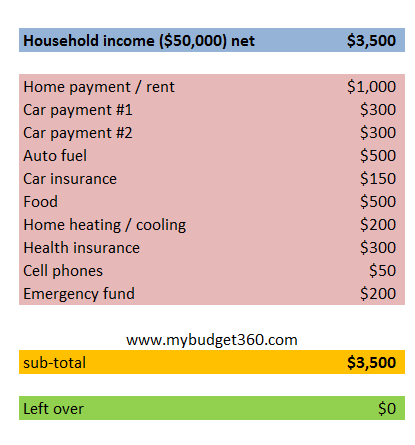

I can’t emphasize how important it is to analyze local area incomes when it comes to housing. It is amazing that every mainstream story ignores household income. This is intentional in the sense that the media just wants to ignore the fact that the middle class is disappearing. Experts on television never bother to even run simple numbers to give people an idea of how quickly money is disappearing. Let us for example show how quickly $50,000 a year can disappear:

I know some will argue about certain line items above but this is merely to show how quickly money can flow out. We are using a modest $1,000 a month line item for your mortgage or rent payment. The above is showing how rising fuel costs, health care costs, and food inflation is hammering the monthly budget of many Americans.

The bottom line is we are facing a double dip housing recession because incomes are not going up. No amount of Federal Reserve hocus pocus is going to make home prices go up without making household incomes go up.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

mile said:

nice to get a nearly new condo for 20,000…….and refuse to pay any bid up more so its nice to get a nearly new condO 2bd/2bth 1 cg somewhat restrainaBLE ASSOCIATIVE….

May 10th, 2011 at 11:04 am -

mile said:

YOUR NUMBERS UNDERESTIMATED HEALTH INSURANCE COSTS OVERESTIMATED CAR NEEDS. AND MISSPENT IF EXPECTING DISTRESS

May 10th, 2011 at 11:15 am -

DisabledVeteran said:

A very perceptive article! Some great points. Thank you for explaining this issue.

May 11th, 2011 at 4:56 am -

MarkJ said:

As you know, your list probably understates expenses for the “typical” two wage earner family and for a single income household expenses clearly exceed income. Three items that could make your list are retirement savings, child care and educational expenses. The addition of any two of these expenses would easily deplete the emergency expense fund in your example.

Kudos for your BLOG.

May 18th, 2011 at 6:21 am -

Robert said:

You LEFT OUT “HOUSE INSURANCE”!

In Miami $4,500 to $6,900 A YEAR! Subtract another $500 a Month!

May 24th, 2011 at 2:43 pm -

chapman44 said:

nice to get a nearly new condo for 20,000

May 31st, 2011 at 11:03 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!