Debt based delusion: Fed spending far outstripping revenues, balance of trade, and business inventories decline.

- 2 Comment

One clear symbol of our new Gilded Age is that of the peaking DOW while food stamp usage is at a peak as well. Even though the DOW is only a reflection of a handful of companies, the media focuses on this as if it were a barometer of the real economy. It isn’t. Household net worth has fallen by 30 to 40 percent since the recession hit. But isn’t the DOW at a peak? Yes. But the stock market is only a minor part of the portfolio of most Americans. Also, most Americans derive their wealth from real estate which ironically is now being inflated not by families with growing incomes, but by big banks that are accessing cheap money/debt from the Fed and buying up available properties and crowding out average Americans. The net impact is higher rents and low supply. In other words we are inflating another financial bubble that is going to harm your typical American. Over half of Americans don’t even have a retirement plan in place. The government is blowing through money it doesn’t even have. Let us examine the current state of affairs.

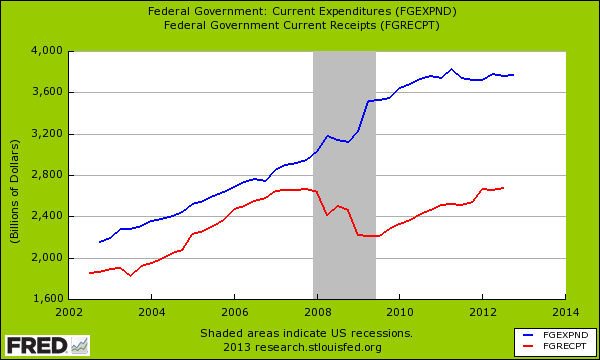

Fed spending and revenue

You would think with all the chatter of a booming economy and a DOW peak that the government would back down on their spending. Take a look at the below and you tell me:

The above chart shows that spending is still at record levels. Also, how much of the spending is boosting GDP? A lot. You have banks now using easy money from the Fed and flooding it back into the economy. Those large hedge funds with billions of dollars are buying up properties from other banks and thus adding to the bottom line. Yet is this really a boost in an organic sense or robbing Peter to pay Paul? The average American doesn’t have access to the Fed and they are essentially printing money for the consumption by large banks. As we discussed in a previous article, most of the financial wealth in the US is concentrated in a very few hands.

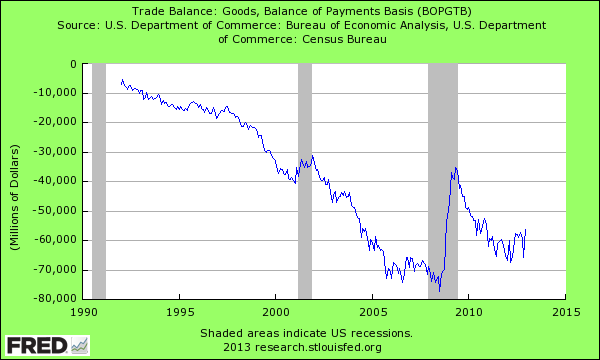

You also have a very unbalanced level of trade:

Trade is good when there is a more balanced level between countries. The US is essentially squandering decades of hard work and capital by simply selling out on the cheap in global markets. There is a price to pay. There is a reason why the middle class in China or India is growing while ours is shrinking. The middle class has been paying for it for nearly three decades. Don’t we want to see our middle class grow as well? There are going to be challenges when we allow our consumption to simply drive us to the bottom line and not focus on the bigger picture. We are seeing much of this come back and hurt us. The rust belt is very familiar with the chase for yield. Wall Street has boosted much of their profits by chopping the labor force and figuring out ways to cut fixed costs (i.e., labor). Yet those cuts are then pushed all the way to the top. Margins look good but the typical paycheck doesn’t. Some will argue that the stock then goes up thus benefitting the country. As we’ve noted, financial wealth is likely to be in the same hands of those making the cuts so really it is a win-win for a very small group of people.

We are still running about a $60 billion a month trade imbalance with the world. What this means is we are spending more than we produce. There are challenges when this occurs since no country can run these kinds of trade gaps for a very long time.

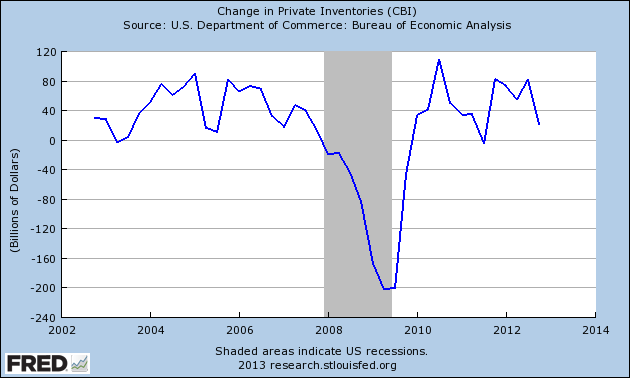

Business inventories have recently contracted:

This is a good leading indicator since businesses have a good sense of what their customers demand. You certainly don’t see this correlating with a peaking stock market that is usually a lagging indicator. You’ll notice that inventories started contracting above in 2006 and 2007 well before the official recession hit. The bottom line right now is that GDP is being driven by heavy amounts of debt. The Fed is giving debt access to banks who then speculate in the stock market and now real estate. The public is given negative interest rates only as a side effect of what is being done for member banks. The Fed balance sheet is now well over $3 trillion. We have an addiction to debt but only as long as we can get access to financing. That is a very fine line we are walking on and sometimes having access to debt confuses some to believing they have access to wealth. As we are seeing with banks taking over foreclosures and people losing their homes, you don’t own anything until it is paid off. That access to a cheap mortgage had a price just like the Fed giving out money at zero percent.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Mark said:

Another insightful commentary on the structural decay of the american economy. Thank you

March 8th, 2013 at 6:22 am -

florida sandy said:

I really enjoy your articles, as you put a lot of thought into them and they cut through the chase-it’s nice to see the facts without the media spin attached.

March 12th, 2013 at 4:52 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!