Engaging debt spiral – Spillover to US market from record European Union Unemployment – US exports over $260 billion to Europe every year. Why is the EU crisis no longer in the US press?

- 4 Comment

It is hard to tell why the European Crisis fell out of favor in the US media. The EU is the largest economy in the world punching in over US$17 trillion a year in GDP. The idea that things have been saved is clearly not the case. Sticking your fingers deep in your ears is not a solution. More debt is put on top of more debt like multiple layers of icing on a rotten cake. A colleague brought up Greece and was talking as if the situation had been solved. The bailouts are merely a method of extending enough credit to continue servicing the current debt. In other words, they are insolvent. The same story circulated under new packaging. This is like having a $10,000 mortgage and making $2,000 a month with no savings. Then your uncle lends you $100,000 and that will carry you a few more months but then what? There is then a constant oceanic wave of bailouts. Spain and Greece are the most obvious cases but the overall EU now has reached a record high level of unemployment. Where do we go from here?

The EU reaches an unsettling record

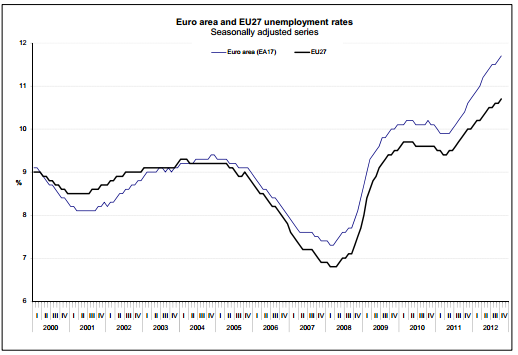

EU unemployment reaches a record level:

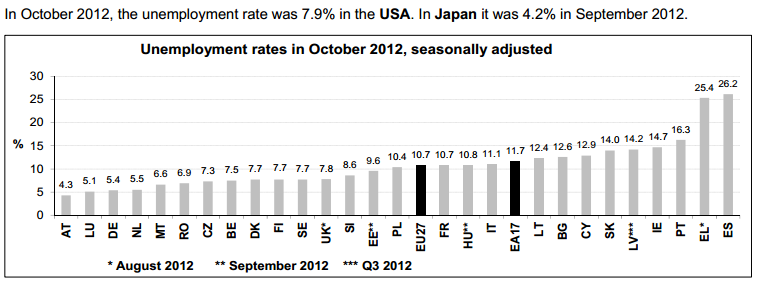

The European Union unemployment rate is now up to 11.7 percent. If we look at specific countries we see some dramatic figures:

Just imagine if California for example had an unemployment rate of 26 percent with over half the young population being out of work. These are the challenges facing the EU. Greece has an unemployment rate of 25 percent but Spain, with a GDP of $1.4 trillion is the bigger story. Let us look at Spain more carefully:

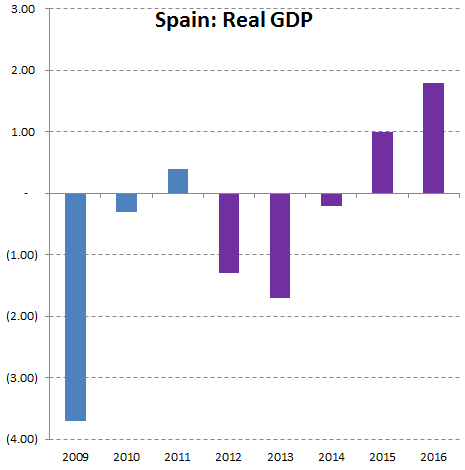

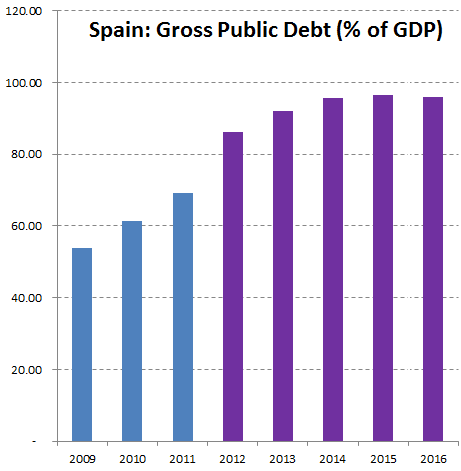

Forecasts for Spain’s growth show extended weakness way into 2015. Keep in mind that only a year or so ago many economists were predicting a very tiny recession in Spain. Predictions gone awry. That is obviously no longer the case and the European Union is facing many other countries in recession. While the press tries to state that debt is not really a big issue, just take a look at this:

Clearly too much debt can cause problems. Even in the US we are facing the so-called fiscal cliff because we are spending more than we are taking in. This entire system is built upon layer after layer of debt. There is no clear line in the sand indicating the maximum level of debt a country can take on. Yet once confidence is broken it can spiral out of control like in Spain and Greece. Japan has incredibly high levels of debt yet the markets are still willing to invest there.

US Growth

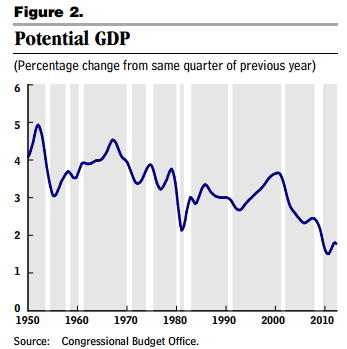

The US is going to need to figure out ways to deal with slower growth as a mature economy with a large retiring workforce:

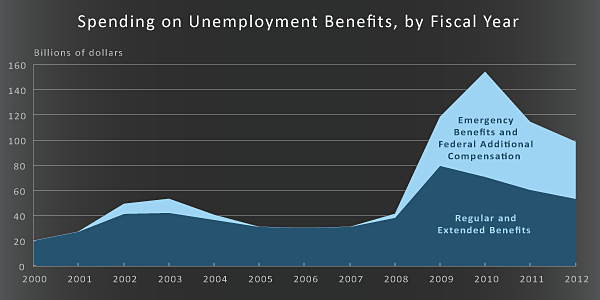

It is obvious that things are going to be different moving forward. There is no baby boomer 2.0 economic growth coming online. Young Americans are less affluent and are in deeper debt than their already heavily indebted parents. Even though the overall unemployment rate has fallen, we still have many that are unemployed:

Yet we should return to Europe because this is likely to spillover to the US.

Spillover effects

The US exported over $260 billion in 2011 and so far in 2012 has exported $200 billion. This is a large market for our products. So to think a general slowdown is not going to have any impact here is missing the bigger pictures. In terms of a longer term impact, the EU will have a larger impact on the US economy than the fiscal cliff. Fiscal cliff, EU at record unemployment, and 47 million Americans on food stamps. We are definitely in an Orwellian world where this is construed as being a healthy global economy.   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

S' said:

dumb asses, criminals with an agenda, or some missing 3rd option?

December 2nd, 2012 at 5:32 am -

stephen said:

Maybe a discussion might ensue such as why Iceland has rebounded and arrested the banksters and are moving prosecution and seizure of assets. The scoundrels like Goldmann Sacks that did the backroom deals on Greece to get it into the EU and then bet that they would go into debt default are the real culprits. In another day and age they would accuse our bankers of economic warfare. They may be right.

December 2nd, 2012 at 12:55 pm -

Hillary said:

I have wondered the same thing, it seems after the election no one is paying attention to anything.

December 3rd, 2012 at 11:17 am -

JD said:

The fiscal cliff issue is BS!

I hope Obama calls BS on Republicans to set this country on the start of a path to correct some of our serious imbalances.

We need political will to change the course of self serving manipulative policies which have emasculated America’s middle class, the bedrock of our country. If we don’t we will follow Europe into the abyss of a lost generation and the possibility of very painful corrections.

December 3rd, 2012 at 7:18 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!