US Dollar already went off a fiscal cliff – what does a falling dollar mean to US families? Masking de-leveraging via debt markets.

- 7 Comment

People tend to have a short-term memory when it comes to financial panics. Even when told that the US dollar has lost over 90+ percent of its purchasing power since 1914 when the Federal Reserve was first established, many just assume this is normal. Inflation is as common as air. Today’s purchasing power of one dollar is equivalent to 4 cents to put this in perspective. The Fed is trying to inflate its way out of the massive debt we are facing. We all know a fiscal cliff is approaching. We’ve known this for well over a decade. Yet we continue to spend and witness a slow decline to the purchasing power of the US dollar. Much of the current economy is fueled by debt markets expanding but a saturation point will be reached. Breaking points do happen and you need only look at Europe to see what happens when the scales tip. What does a weaker dollar mean to American families?

The impact of a lower US dollar

There is little argument that the US dollar has fallen over the last 100 years:

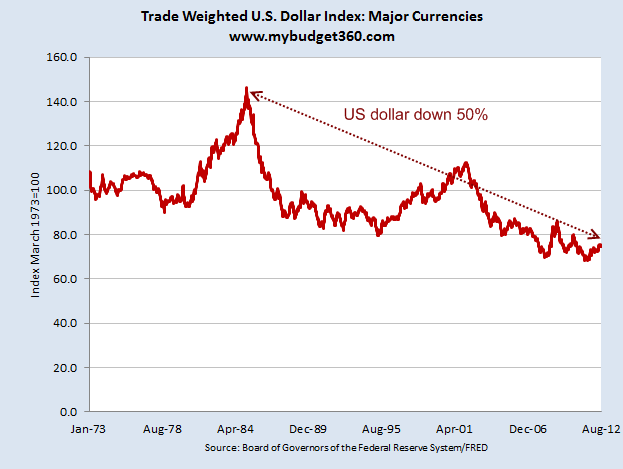

Purchasing power has fallen dramatically. Even since the 1980s the US dollar has fluctuated dramatically:

If the dollar has fallen by so much, why did households not feel the deep impact? Well, to a certain level, many did (and ask the 46 million on food stamps how the economy is doing). To a large degree much of this adjustment was papered over with access to debt. The debt bubble really hid much of the personal wallet pinching that would come about from a declining US dollar. The 2000s really culminated with a final scene where debt markets seemed to reach a global peak. Since that time, US households have been in a process of deleveraging that is continuing and will continue to unfold over the next few decades. Perfect examples of this include the student debt bubble that is saddling over one trillion dollars in debt on the backs of younger Americans.

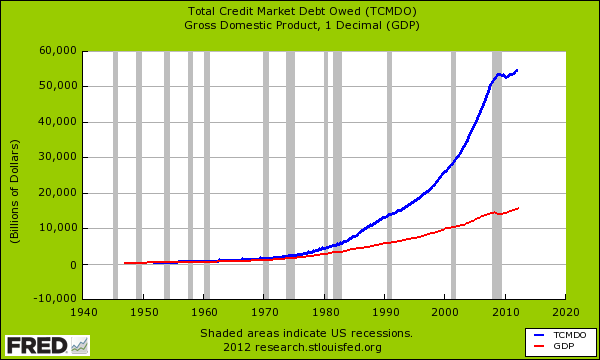

If you really want to see why the decline in the US dollar was not felt as dramatically as the charts above suggest, you need only look at the expansion in actual debt:

For the most part, this is where purchasing power was hidden with a debt binge. In order to keep the same standard of living Americans went into massive debt. The government, banks, and entire system essentially leveraged the future for short-term gains on unsustainable promises. At a certain point a peak debt situation is reached and people start realizing that the debt will never be paid back. This situation is unfolding in Europe. The US faces a fiscal cliff next year and the Fed is trying to inflate our debt away.

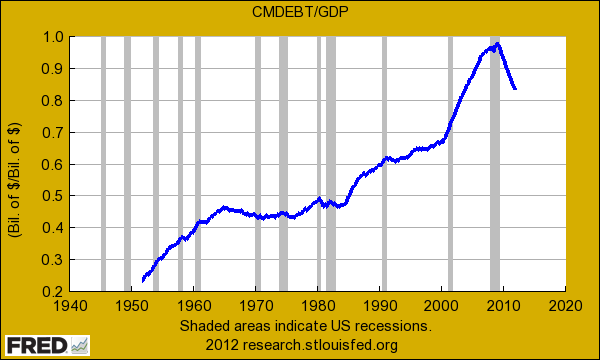

Yet as the total debt amount grows, US households (i.e., working and middle class Americans) have lived through a deep process of de-leveraging:

Total household debt to GDP continues to unwind signifying that US households did reach a peak debt situation in the current crisis. How is this being rectified?

-1. Foreclosures

-2. Bankruptcies

-3. Job losses

-4. Tighter credit markets

Yet overall access to debt to government and banks has remained open. Debt is part of our system but at a certain level it becomes unsustainable. We reached that point during the peak of the crisis. While households are going through this painful adjustment, some other segments of the economy seem to be delaying the inevitable. When we examine the crushing blow being felt by the middle class the above charts make more tangible sense. The cost of everything from education, housing, and automobiles seems high because purchasing power has fallen. A lower US dollar is only beneficial if the standard of living for many Americans increases. Look at the last few decades and try to see if that holds true.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

Neo1 said:

The Great Tomato Bubble-how the central bank does it to you

http://www.tomatobubble.com/id39.htmlAugust 7th, 2012 at 9:06 pm -

william hudgins said:

Great article. Still, I would really like someone to speculate in terms of the possibilities in the event of a full blown deflationary or inflationary spiral, in detail. In other words, we know the effects of the last depression; what if it occurs again. only worse? globally? Would we have no elec. power? war? starvation such as in Africa? Bank collapse? Weimar republic? A subject for a book or movie; yes in deed. Would there be martial law? No drive zones? What about the 6 million rounds of 40 cal hollow points purchased by homeland security? This should tell us that they know something we don’t? !

Funny how no one can get a handle on it in terms of whether we will have deflation or hyperinflation. What about this; neither one. Perhaps hyperinflation will cancel out the debt/deflation and we just muddle along for the next 20 years. Someone do some speculating and I will be the first to read it. Thanks, BillAugust 8th, 2012 at 3:41 am -

Zain said:

A currency ultimately depends on common sense and the model chosen for the US Economy. When you chose the easy-money “financial model” instead of the traditional “Power and Production” Model, your currency was destined to fade.

August 8th, 2012 at 5:48 am -

Don Levit said:

Thanks for posting the Total Credit Market Debt Owed to Gross Domestic Product.

You have posted this before, and I kept it (including the link), for it is so telling of how: 1. GDP gets less bang for the buck from debt;

2. It is debt which has kept all sectors from a financial meltdown.

Don LevitAugust 8th, 2012 at 6:47 am -

douglas said:

The depreciating dollar doesn’t matter that much if you are in a position to have your wages keep pace. The people that get hurt are the retirees and pensioners who have no ability to increase their monthly income to keep up with the destruction of the dollar.

August 8th, 2012 at 7:00 am -

RUSS SMITH said:

Hi!, Patrons Of My Budget 360 Et Al:

Lest we forget it, OUR present fiat money indebtedness is not measured in specie gold and/or silver coins for example but in intrinsically worthless paper & ink; regardless of the charts showing that the US $ still retains some purchasing power which is only temporary, as economic events continue devaluing the $ towards its’ true instinsic value which is exactly zero. Can you immagine how much human labor, savings & investments have been captured & stolen from OUR Middle Class using this fiat money basis of immoral payment of wages plus all other forms of indebtedness and/or investments etc.? The decades of lost demands for precious metals production needs to be thought about too, because the miners weren’t called upon by OUR US Treasury Mint to deliver any specie to it for minting into specie gold and silver coins as mandated in Article 1; Section 10 of OUR US Constitution. This means billions of US $’s in lost income to the miners plus loss of purchasing power to OUR US citizens that can NEVER be recovered. Purchasing power lost in the world of economic loss of jobs, for closures on millions of homes which translates into tremendous losses of revenue from uncollected property taxes etc., loss of major corporations’ domestic presence, loss of OUR Nations’ tripple AAA credit rating, the pending loss of OUR US $’s world reserve currency status, loss of faith regards foreigners buying OUR Treasury Debts placing that role into the hands of Helicopter Ben, the destruction of the Middle Class’s savings and collaterial base, the pumping up of over 1.4 quintillion $’s worth of unsustainable derivitives markets that sooner or later must collapse on all OUR shoulders, the continuing inflating of OUR Comsumer Price Index measured in higher prices for food, fuel, services, insurance costs, utility bills, mortgage payments, broken marriages/homes/families, police state policies, strategic, costic blowback responses from foreigners etc. and the list is endless but too long to list it all here alone. We have as a Nation abandoned OUR decisively objective Constitutional moorings for the pavlovian, subversivenss of OUR master dictators now feasting upon OUR indebtedness to them through the Fractional Reserve Banking Systems worldwide they now control which induces everything you see listed above. To get more iformed, please dear reader go to the Von Mesis Institute website and look up their more than 70+ page treatise, Fiat Money Inflation In France, by Andrew Dixon White (How It Came; What It Brought; and How It Ended) who was the co-founder of Cornell University or please order their paperback copies for around $10. It was Daniel Webster who, in observing from history what inflation has inflicted upon mankind, who said: “Of all the contrivances ever designed for cheating the laboring classes of mankind none has been more successful than that which deludes them with issues of irredeemable, fiat, I Owe You Nothing, paper money. The Sr. J, P, Morgan decades ago went before OUR US Congress to say: “Gentlemen, only gold is money and all else is credit!”

RUSS SMITH, CALIFORNIA

resmith@wcisp.comAugust 8th, 2012 at 9:40 am -

laura m. said:

If the derivities mkt collapses, everything else will collapse, meaning a meltdown. The economy collapse has driven many more families on EBT cards, SSI, etc. There is no future in raising a family at this point. It takes both people to work and just meet expenses.

August 10th, 2012 at 10:56 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!