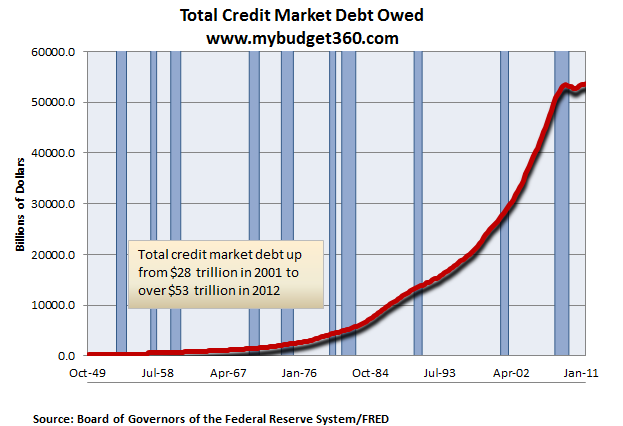

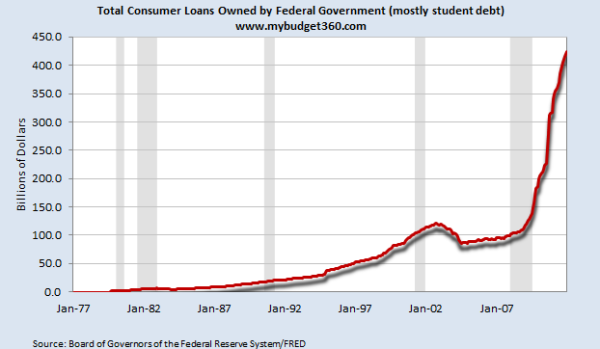

The day of reckoning for global total debt – total credit market debt up from $28 trillion in 2001 to $53 trillion in 2012. US consumer debt went up in last few months but largely because of giant amounts of student loan debt taken on.

- 6 Comment

You have to really question what passes for financial analysis these days. One financial show was discussing the recent increase in consumer debt as something positive. In the same breath this person also said that households increased savings. Now think about this statement. If you financed a $2,000 vacation on your credit card but increased savings by $500 did your balance sheet improve? Of course not. Let us not even dive into the fact that most of the recent consumer debt increase has come at the hands of student debt which is already in a massive bubble. We are simply repeating the same mistakes with a different soundtrack. We are trying to get out of a debt led crisis with more debt. The facts even show this and we have compiled some of the more troubling data by putting the entire debt market into perspective here. Is it really possible to solve a problem based on too much debt with more debt?

The total market of debt shows our addiction to borrowed money

We flat out have an addiction to borrowing. Total market debt is now up to an astonishing $53 trillion and continues to grow. Take a look at this frightening data:

In 2001 total credit market debt was up to $28 trillion. Today it is now well above $53 trillion and inching closer to slapping on another trillion dollars this year. If you look at Greece as a microcosm of the bigger issue, you realize they are treating a solvency issue as if it were a liquidity issue. Let us be absolutely clear that all of this debt will never be paid off. This warrants repeating:

“The $53 trillion in total credit market debt will never be fully repaid.â€

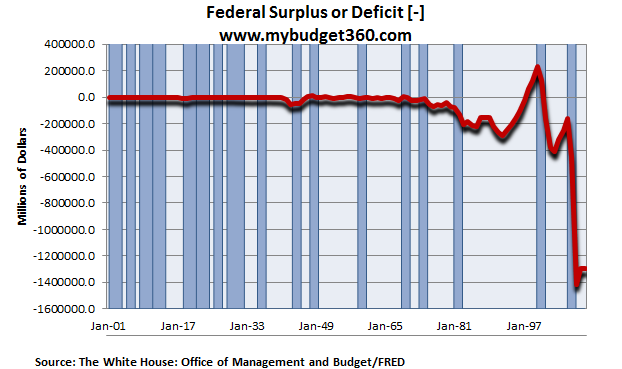

In essence the total debt markets are growing even though the debt will never be paid off. Since most thinking people get this, the banking sector is leveraging central banks to basically print money since no person would lend money out knowing they would never be paid back. Do people really think we are going to pay off our $15 trillion national debt when our deficits look like this:

We’ve been running continuous budget deficits since the late 1970s. We had a brief respite when it came to having a surplus with the tech boom but that was blown out the window completely with the real estate mania. Contrary to what most will say, deficits do matter and massive deficits really matter.

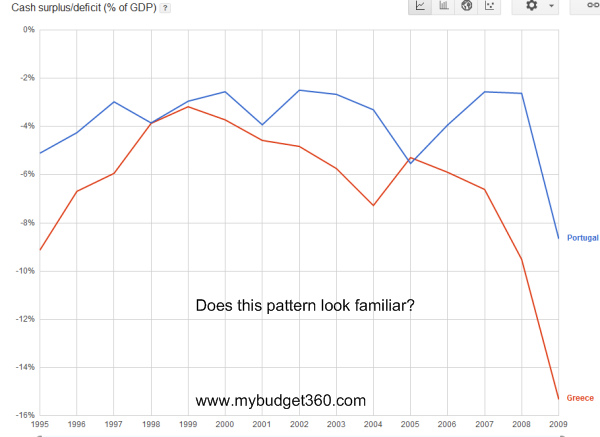

Let us be abundantly clear that the total market debt is incredible. You now start having this challenging race where you are trying to avoid having your total debt surpass your annual GDP. The US has passed that mark and so have many other countries. The results in the long-run are never positive especially when people wise up and start asking for their money back. Since most don’t have the funds, they pay for it via inflation and a devaluation of their currencies. A few articles have circulated where Greece is trying to enforce stronger tax collections yet their system on collecting taxes is so corrupted that they have no way of achieving this without completely revamping the system.

If you think Europe is done just look at Portugal since they are next in the debt grinder queue:

To the debt increase in the US

The access to easy debt creates massive amounts of bubbles. We saw this in housing and now we are seeing it here in the US with the giant higher education bubble:

Keep in mind this is only a tiny part of the student debt market.  This year we will surpass $1 trillion point for student loan debt. I believe this will be another crisis that will hit and many indebted students are already feeling this. Many are being sucked into paper mill for-profits that are essentially scam factories that raid the government backed student loan funds. They lobby Congress to make it easier for them to report horrific placement data and change the metric on default reporting so it doesn’t look as atrocious. Even with these softballs from our bought out politicians, the data is still horrible.

A debt bubble cannot be solved with more debt. That should be obvious just like saying savings increased but people went into more debt should cause you to pause. Yet few in the financial media ever take a timeout and many missed the tech bubble bust, the housing bubble bust, and gear up because they will miss the other debt bubble bust as well.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

6 Comments on this post

Trackbacks

-

clarence swinney said:

THANKS ALWAYS GREAT CHARTS I USE ALL

February 15th, 2012 at 9:33 am -

The Cash Flow Is King said:

Some really interesting charts here…

The Federal Surplus – Deficit chart is pretty shocking.There is one question I keep coming across, and I can not find a good answer. Most of us know that there is a “student loan bubble.” We know now for the first time that student-debt have surpassed credit card debt as the number is now in the trillions. The question is, what does this mean? What is going to be the outcome?

Do to the fact that college is essentially a very social exchange, I feel like that there will be a wave of seniors and graduate level graduates that will simultaneously realize that they have made a poor choice going into debt to go to seek higher education, and this ideology will ripple through the sector. However, it might take a LONG time as the slow-moving, market-preventing, government that has played such a huge role in the creation of this bubble, tries to step out of the market and then blame an opposing political party for the bubble in the first place.

Does anyone have any thoughts as to what will happen when this bubble bursts? Will it be a long drawn out downtrend until the regression towards the mean occurs, or will there be some spontaneous bust?

February 15th, 2012 at 1:00 pm -

Miles Reed said:

The realization that total debt can never be repaid is a very powerful thing. The debt must be serviced with income from production from resources that may be scarce going forward; I account for innovation when saying this.

May 19th, 2012 at 11:01 am -

JRW said:

We need to declare Jan 1 a Jubilee day as described in the bible.

On this day, all debts are forgiven and we would start over.Then all gov budgets must be balanced.

Now those buying risky paper would receive their just rewards for

their greed-big profit or big loss! The taxpayers would not have to

bail them out.August 16th, 2012 at 1:16 am -

j7915 said:

Greece has a tax collecting problem. Germany et al have a problem with Greek bonds that are defaulting. The money that would pay of the bonds, is owned by greeks and held in European banks…how about helping a member of the EU enforce their tax laws? Freeze the assets and then hold them until their legal, ie tax status is clarified?

The US twisted Swiss banker’s arm to recover untaxed assets.

January 3rd, 2013 at 8:56 am -

j7915 said:

Forgot to add:

“the US is addicted to borrowing” start paying something on the IRA/Roth/401k and regular savings accounts. Stop letting Wall Street take the saved and retained earnings from prudent people and then loaning them out at outrageous percentages.“recover untaxed assets” should have been unpaid taxes.

January 3rd, 2013 at 9:01 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!