Kabuki financial theatre – Congress net worth up 15 percent from 2004 to 2010 while the average American sees their net worth decline by 8 percent in the same timeframe. Welcome to plutocrat USA.

- 0 Comments

We truly have the best government money can buy. From 2004 to 2010 members of Congress increased their median net worth by 15 percent while the average American saw it fall by 8 percent. Yet this fall in net worth does little justice to the rising cost of food, energy, healthcare, and college expenses that have eaten away any iota of progress families try to achieve in a prosperous nation. The fact that Congress presided over a Wall Street pilfering of the middle class and income inequality never seen in the history of the United States, we are starting to get a full understanding of what it is to live in a full-fledged plutocracy. The reason people are frustrated with government is that it no longer looks out for their own interests and is narrowly focused on promoting the aggregation of wealth into fewer and fewer hands.

The rise of low wage capitalism

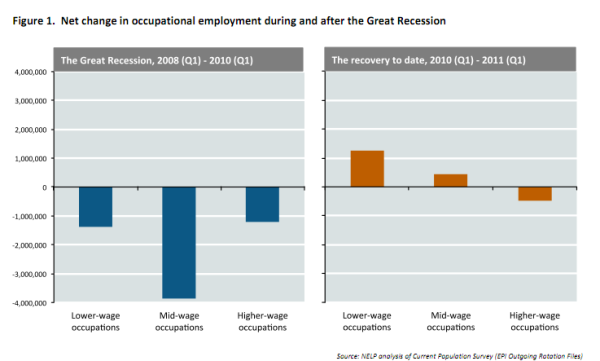

It is a fascinating exercise in consumer behavior that Americans are out spending in full force even if it is with other people’s money. The economy is still in bad shape and those who were fortunate enough to land jobs in this recession are likely in employment that now pays much less. Most of the jobs that were lost during the recession were higher paying jobs yet most of the jobs that have been added have come from the lower wage sectors:

Source:Â NLEP

To sum up the above chart, over 5,000,000 mid-wage to high-wage jobs were lost yet less than 1,000,000 have been added since this recession supposedly ended in the summer of 2009. Where does this leave most Americans? It leaves them further and further behind while their elected officials continue to practice an ancient art of dog and pony show yet most Americans are waking up from the fog. This is why there is so much fragmentation in the current political system. The mainstream press is built on a clean and simple two party battle. Ultimately this allows the system to continue to pilfer the majority and keep people as docile spending vehicles. Yet that game is no longer holding up.

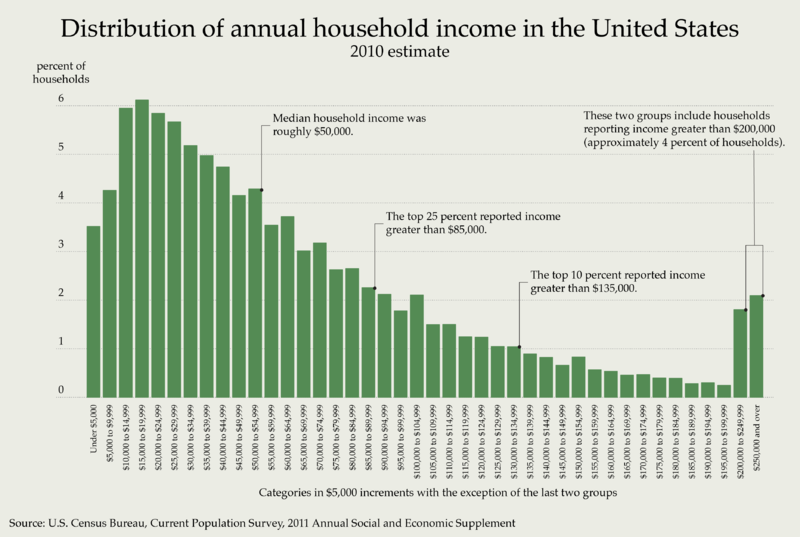

The cracks in the median income

The median household income in the United States is $50,000. This figure has actually moved backward in the last decade while the cost of things like food, fuel, healthcare, and a college education have all soared. In other words Americans are much poorer and many are realizing this. Take for example the cost of fueling up a vehicle. The days of $20 or $40 a barrel oil are long gone. Remember when it was affordable to go to a state university? The nostalgia is largely there because the pangs of a lighter wallet are real.

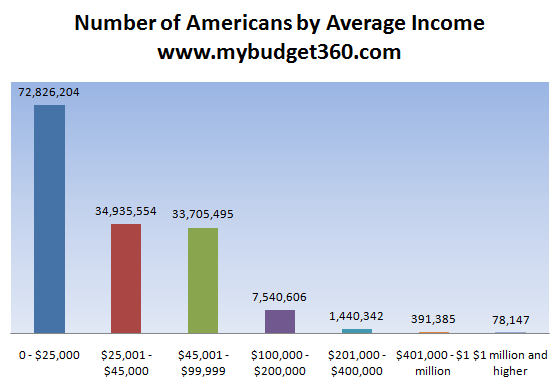

Take for example the average per capita income of the American worker. The average salary of an American worker is $25,000. People seemed stunned when they hear this especially if they live in a large and expensive metro area. They sometimes forget that the United States is built up of 50 states and with over 300,000,000 people:

Source:Â Social Security

All you need to do is look up the data yourself. The media if it were doing its job correctly would be driving this point home every single day. Yet they would rather talk about how people went out and blew every little penny they had or went into credit card debt yet again. Since when did the holidays mean blowing all your money? The underlying assumption they are pushing is everything is fine and dandy because people are out unloading their cash this holiday season.

As Congress becomes more and more like those it represents, expect more frustration from a population who is no longer being represented in D.C. All you need to do is look at the banking gamblers and you can tell where the interests of our Congress reside.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!