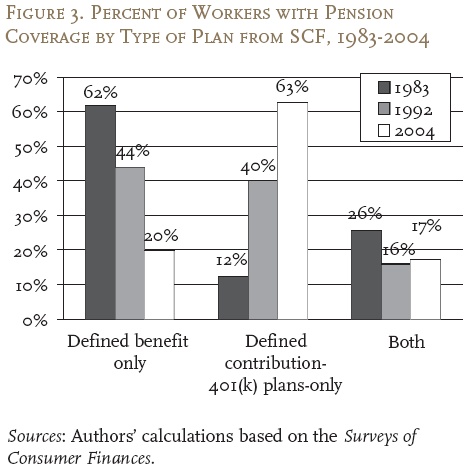

Welcome to the new model of retirement. No retirement. In 1983 over 60 percent of American workers had some kind of defined-benefit plan. Today less than 20 percent have access to a plan and the majority of retired Americans largely rely on Social Security as their de facto retirement plan.

- 7 Comment

As many Americans enter into retirement they are realizing one unfortunate thing. The new retirement plan is no retirement at all. Over the last few decades Americans were promised the idea of a comfortable retirement yet none of this has materialized because of financial swindling and a real estate bubble that will go down in the record books. On the flip side, many Americans went into massive debt and consumed their future nest egg today with big purchases outside of their budgets. So what are we left with today? We are left with over 75,000,000 baby boomers entering into retirement with very little saved. One out of three Americans has absolutely no money saved to their name. In 1983 over 60 percent of working Americans had some sort of defined-benefit pension plan. Today that number is below 20 percent. With the average worker making $25,000 a year the media designed idea of retirement is largely just another fantasy.

Good-bye to defined-benefit pension plans

Many large pension funds had models built on absurdly optimistic stock and bond market returns. These accounts did well in an era where the stock market roared ferociously because of the prime position the U.S. had after World War II. Those pension accounts are becoming a relic of the past:

Source:Â Surly Trader

This is a rather dramatic shift in events over the last 30 years. In 1983 62 percent of working Americans had some sort of defined benefit plan. In 2004 it was down to 20 percent and today it is lower. Americans have been forced to play the stock market game through their 401ks. This has actually turned out worse for average Americans as they try to compete with high frequency swindlers and investment banking crooks. Clearly someone is making profits as investment bankers pull down million dollar bonuses all the while the stock market has gone into reverse over a decade.

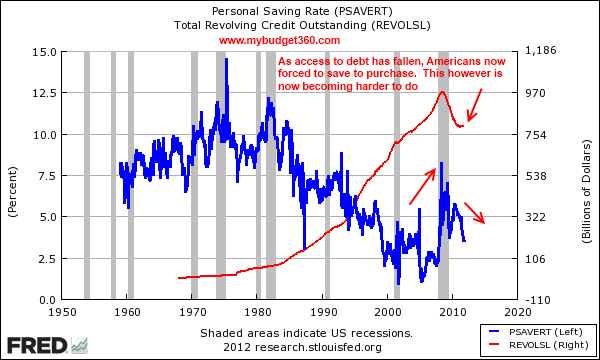

As access to debt declines Americans forced to use savings to consume

Since the end of World War II many Americans were given access to debt on an unparalleled level. This ability to borrow served as a supplement to a stagnant paycheck. As time has gone on and with the debt bubble bursting Americans have now seen their access to borrow severely curtailed:

It is no coincidence that as borrowing increased the savings rate went so low as to go into negative territory for a year. However, it has recently gone up not because of choice, but because the debt bubble has popped and now many need to actually save to purchase items. This has made the recovery extremely sluggish because saving to spend on a $25,000 income is hard to do. The typical household pulling in $50,000 will have a giant portion of their funds going to housing, food, energy, and healthcare before any discretionary spending is done.

Where does this leave retirement?

Many Americans rely completely on Social Security for their retirement. The idea of sipping unlimited Margaritas on some Caribbean island is largely a myth:

“(Market Place) Monrad is 73 years old. She has a bachelor’s degree and a master’s in linguistics, but she tended bar for most of her working life.

Monrad: I live on Social Security. I get $1,040 a month. So I don’t turn on my air conditioner. I’m dying of heat.â€

Over 58,000,000 Americans receive some benefit from Social Security and most rely on this payment as their primary source of income in retirement. Remember that only one out of three Americans have even a penny to their name? Do you think the young with a tougher market are saving enough?

Source:Â CNN Money

“(CNN Money) In 1984, households headed by people age 65 and older were worth just 10 times the median net worth of households headed by people 35 and younger.

But now that gap has widened to 47-to-one, marking the largest wealth gap ever recorded between the two age groups.â€

So the problem is only going to be exacerbated with this upcoming generation as they try to invest in their 401ks (if they can) into a stagnant and declining stock market. It is looking more and more that those assured 7 to 8 percent historical returns were largely a mathematical aberration thanks to a strong position after World War II. The big gains now are largely allocated to the well connected financial sector and our wealthier politicians that simply represent the interests of special lobbyists and groups. The new retirement is looking a lot like no retirement at all.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

7 Comments on this post

Trackbacks

-

Hector Avellaneda said:

Wow.. I had not read the statistic mentioning that the average American is making $25K per year.

This is very sad because we have a generation of young people who have been sold on the idea that the only way to succeed in life if to go to school, get a good education and and enter the work force.

To do that however, you need money and in times when a college education keeps rising every year, that only makes things harder for the average American.

I would assume that most people would still go for a college education however, financing their future with student loans.

The san part about that is that I personally have started to see a shift in big corporations preferring to hire contingent workers over full time workers.

Contingent (contract) workers historically have lower wages and do not qualify for vacation, sick days, time-off, retirement plans, health-care plans, bonuses, stock purchase programs and other incentives.

To me, this tells me that Americans who are no smart about their finances starting NOW will be largely effected by, what I believe to be, a steep decline in the American standard of living.

January 2nd, 2012 at 6:22 pm -

Bud Wood said:

This “retirement” thing is a somewhat recent effect. Apparently, retirement is an outgrowth of the 19th and 20th centuries. Seems that very few people retired prior to that time – – maybe older people just oversaw what they had created and their children took over, caring for the elders.

I have made it so that I enjoy my work. Now, at 85 years of age, I am still working and wouldn’t have it any other way. Working is creative and satisfying. The sooner most workers realize that they, too, can be creative and satisfied (as differentiated from “getting a job”), the sooner they will enjoy life.

Yes, I realize that many people are not able to work. But probably those who didn’t “burn the candle at both ends” when younger can. Also, the break-up of families, orchestrated by “progressive” governments has broken any social contract between generations. Now, we grab funds across generations aided by the power of tax collectors. It’s difficult to comprehend the stupidity of people going along with such government (tax and elect) schemes, but here we are in the final throes of so called democracy.

January 6th, 2012 at 11:09 am -

FrankBonham said:

I agree with the start of what Bud Wood wrote. The whole I idea of “retirement” is such a recent thing. Especially, this idea of just putting your feet up and living a better lifestyle than you did during your working years. I am not sure that ever was attainable for the true middle class…

Not sure if I disagree that we are in the final throes of democracy. Much of Europe enjoy a higher standard of living based on higher taxes and more services from them.

January 6th, 2012 at 2:58 pm -

Vicky Meyers said:

We were going strong in the 70s-80s when things were still “normal”. My husband lost his job and was unable to find another in 2007, so we lived on my “socially responsible”, low-paying job for two and a half years. Credit cards were a big factor in our being able to afford food, if you can call it affording, although I kept everything current. Flash forward to 2010 when my husband got another, really good job and so did I. One of our credit card providers switched the due date on the bill to the first of the month, when it had been due on the 20th of the month (MBNA) for over twenty years. I couldn’t get it there in time, so they raised my interest rate to 29.9%, as did every other credit card issuer we had. We had also borrowed to send our kids to college (They’ve done very well) and I could no longer afford to make the payments. We declared bankruptcy, but were amazed to find that we were now “high-income” earners, as well as being very close to retirement, so bankruptcy wasn’t an option for us. We had to declare Chapter 13 and pay back every penny. You may think it served us right, and maybe it did, but with only one chance to get back on our feet, it pretty well killed us. My husband is still working and will continue to do so until he either drops dead or the company closes. I lost my job, mostly because I turned 65, and the pension plan evaporated. I get (honestly) $12 a month. We went for years struggling, living under the poverty level, and when good times came back, it didn’t help. We’ve never had food stamps, Section 8 housing, or any unusual help from the government. 35% of our gross income goes to the bankruptcy which will be paid off in 2014, and while I don’t know that I would have saved all that money, I could have saved most of it. Instead, we’re looking at crippling poverty as soon as my husband has to quit, but you can be sure the banks got theirs. Our house in not paid for and there’s no way I can make house payments on a very moderate house with social security, and who knows how long it will last? Either way, you’re going to lose and for those who are gleeful about our story, Karma will get you.

September 19th, 2012 at 3:36 pm -

Robert said:

I lost my house and my car and now i live off of dissability , 860 dollars a month for the rest of my life.I have bi polar and when i lost everything, my bi polar got worse because i couldnt afford the medicine because i no longer had medical insurance . I live on the streets now and occasionally stay with friends for 10 bucks a night on thier couch so i an take a shower .I ride a bicycle and i do smoke but i go to the local grocery stores and pick up the butts to smoke .

I still must pay 228 dollars a month for the next 5 years after the bankrupsy occured so i live off of 632 dollars a month .Have any of you tried to live off 632 dollars a month ? Try it sometimes and you will know in one month exactly how it is . Another 200 is spent at friends house and so i spend several days at a time on the streets.I hang out at star bucks because i can stay their when they are open and i dont get cold or rained on and have free internet accesss .I also wait until they close and dig in the trash and get thier outdated food , the food still taste good but sometimes i have to fight the other homeless for it , depends on when my money runs out and how much longer between checks , If i have like 5 days to go , I have to be very aggressive and defend my food supply .Needless to say i occassionally get arrested but they take me downtown and book me and then release me as they know i have no means to pay any fines and i told the Judge one time, send me to jail ,i need dental work done and have some other medical problems that need to be taken care off and id like to stay for 60 days or so and save up my checks so when i get out ,i can survive for a few months without haveing to come back . The judge didnt like that and told me to get out of his court .

October 21st, 2012 at 12:05 pm -

Donnie said:

The above stories are enough to break your heart. Hard working Americans, who by all rights, should be enjoying their golden years. The reason I felt compelled to comment on this is because I retired in 2003 with my wife to live overseas.

I was the sole breadwinner, so there is no dual family income here. We had no choice, as my savings and pension precluded living in my US domicile Honolulu Hawaii.In Hawaii, to live with any sense of dignity requires at least $4000 in monthly take home pay (money in fist).

So, we elected to move to Asia where we are now retired. Our housing costs are a fifth of the US cost, and the medical is as good or better, at one third the US cost.

Additionally, and it may jar our American readers, but I’ve met many Europeans who are comfortably retired with full government medical and dental services. US Medicare is useless beyond the shores of the US or its possessions.

My friends from England, Australia, and Europe shake their heads in dismay as I relate the dog eat dog attitude of America towards its senior citizens.

Sad…November 10th, 2012 at 5:09 am -

Michael S said:

The only retirees (other than the extremely wealthy) who are not suffering these days are those from the public sector, with their taxpayer-guaranteed defined benefit pension plans (now virtually gone from the private sector).

Speaking of HI, I have a friend who worked for the State of WI as a file clerk. He can afford EVERY winter to go from WI to HI, for the ENTIRE winter staying in B&B’s on the three islands that he visits while there! He has done this annually since he retired at age 55, about 25 years ago. My understanding, from those familiar with HI, is that B&B’s there cost at least $100./day.

Had he worked at an equivalent job in the private sector, he would be near-destitute today. By working for the State in WI, he can live in a guaranteed easy upper-middle class lifestyle until he dies!

Unions are nice things, but they’re only available to those in the public-sector today. That situation can’t go on!

August 1st, 2016 at 9:02 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!