8 charts from a brave new banking and economic system – Federal Reserve refutes bailouts yet fails to address inflated questionable assets on their balance sheet. Do you think a $7 billion insurance fund can support the $9.7 trillion in deposits at U.S. banks?

- 4 Comment

The Federal Reserve has been going back and forth with reporting from Bloomberg regarding the massive bailouts and loans made to the financial sector during the crisis. What is rather astonishing is the ability to discuss trillions of dollars of loans made to largely irresponsible financial institutions with absolutely no oversight. Like an angry couple on Maury Povich, only an objective outsider can see how dysfunctional the relationship has become.   All of this happened in the shadows. What is more astonishing is a large amount of questionable assets that were shifted from bank balance sheets are still sitting comfortably in the balance sheet of the Federal Reserve. This is not disputed. Profits at banks are on the rise but it is hard to lose money when you have unlimited access to taxpayer bailouts and the ability to dilute the currency of the nation. U.S. banks hold $9.7 trillion in deposits with a FDIC Deposit Insurance Fund (DIF) that currently has $7.8 billion. Do the math on that one.

A glance of U.S. banking data

Here is a nice snapshot of U.S. banking data:

Source:Â Bank Tracker

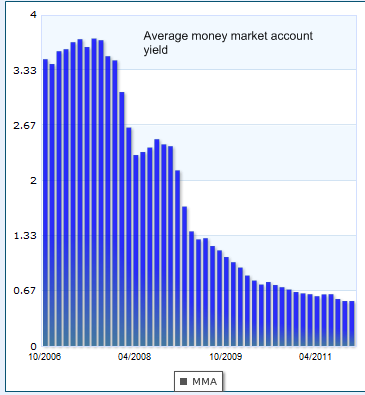

What is the most amazing fact is that over $9.7 trillion in deposits is backed by a measly $7.8 billion. This is like trying to stop a hurricane with a paper napkin. Most Americans are earning virtually nothing on their deposits at banks but what other options are available? Should they enter the highly volatile and opaque stock market? When a typical savings account is paying close to 0 percent it is hard to digest but the volatility of the stock markets for this entire year have rendered a nearly neutral result. Even money market accounts have fallen strongly since the recession hit:

“The typical money market account is down over 80 percent since 2006. It isn’t like inflation has suddenly disappeared or that our debt problems have gone away like dust in the wind. To the contrary the economy has gotten much more mired in a stagnating funk.â€

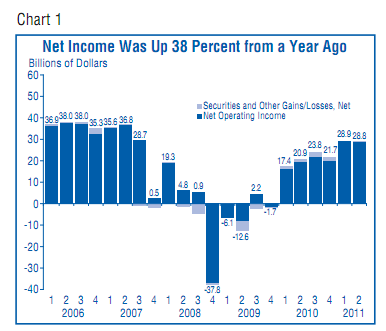

Banks are back at making profits but it is hard to lose when you have unlimited taxpayer bailouts:

Source:Â FDIC

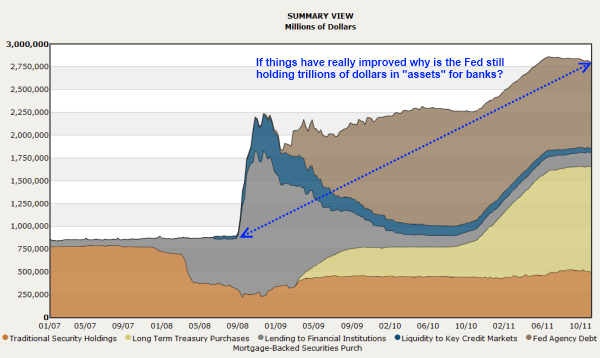

While the Federal Reserve was trying to cast doubt on the results published by Bloomberg, they failed to address the massive amount of “assets†that remain on their balance sheet. This information was never addressed closely but the inflated balance sheet still remains near peak levels:

Source:Â Federal Reserve

It is hard for the Fed to argue against this information since it comes directly from them. Yet the bigger question remains, what really is being held as collateral? As we have shown in previous articles we have seen failed hotel projects, inflated commercial real estate, and other odd ball real estate items. The exchange has been good for banks with solid ties with the Federal Reserve and most too big to fail institutions have gotten stronger in regards to political power.

The Fed largely rescued banking profits

Net income at banks came back quickly once the Fed and banks figured out how to game the system:

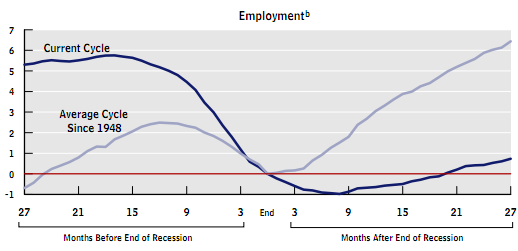

All the while household income was falling like a rock and unemployment was skyrocketing:

Source:Â CBO

It should be clear where the energy of the Fed was focused. Their main mission and purpose is to protect the too big to fail banks. 7,500 banks may seem like a lot to many people but the United States had over 20,000 banks prior to the Federal Reserve. Part of the goal was to concentrate power and allow for direct control at a central level with no congressional oversight. This is why nearly five years into the crisis we are only finding out what occurred. It is largely what we suspected and that is the working and middle class were sacrificed for the good of the financial sector. The above data highlights this troublesome fact in absolute clarity.

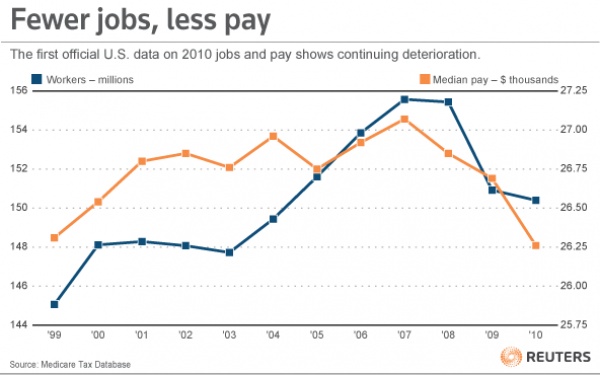

So while net income is back up for banks and bonuses are healthy for executives in the financial sector, wages for most Americans has gone south:

Source:Â Reuters, Social Security

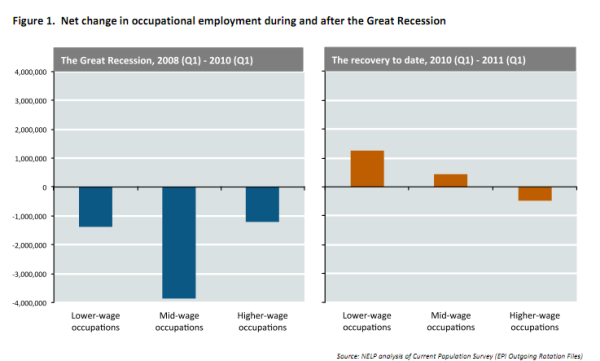

As we have highlighted before most of the recent job growth has occurred with lower paying jobs:

Source:Â NELP

The Great Recession chopped out over 5,000,000 mid-wage to higher-wage jobs yet has only added 500,000 to 1,000,000 jobs in these two categories. Most of the growth is in the lower-wage occupations. This is reflected in the crushing blow to wages.

Keep the above in mind when you hear about jobs being added and banking profits moving up to the executive level. The financial system has lost its way and should be nothing more than a catalyst for real economic growth. At present the financial system is designed as a shadow economy, almost like a virtual reality on computer screens to our real economy. The media fails to cover most of this information but most Americans know this is true simply by looking at the raw figures. What an odd time we are going through especially when the mainstream press is silent on this topic.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

laura said:

Since banks and credit unions are paying zero to one percent interest not keeping up with inflation, people aren’t buying anything unless needed, meaning not giving gifts for the holidays. Stocks and corp. bonds pay higher dividends than banks. Many retirees are dipping into their savings to live on whereas before the interest was extra spending money. When that money is gone, they will get on public assistance. Many are going without house insurance and quit cable and internet and now use wi fi. Some are even regifting, including myself, or buying less expensive gifts.

December 8th, 2011 at 8:16 am -

J Borden said:

I think that you had better move the troubled asset figure up by a factor of 10-50x as Banks are carrying trillions in home loans that are in despute as to ownership, as well as totaly bogus assets such as Bank of Americas alleged $ 70 billion in good will. How much good will do Citibank, JPM, and Goldman Sachs carry. Of course what would you pay for all this good will. $0.00 is what it is actually worth. What a laugh! Let’s not even consider all the litagation over fraud, extortion, wrongful eviction, Security fraud, etc. Makes me want to put what little money I have left in gold, silver, beans, rice, or just under the mattress. Wake up out there.

December 10th, 2011 at 8:12 pm -

mile said:

and while fed reserve member bank owners by way of shareholding get 95 percent less dividends and share prices have fallen more than 85 percent, bonus time arrives discounting the multi million dollar salarys the help voted for themselves..!!!!!!!!

December 11th, 2011 at 6:33 pm -

expatriot said:

If you put banks and credit unions in the same sentence you’ve got a great deal of learning to do.

December 11th, 2011 at 10:46 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!