A College Siren Call – Going to a for-profit college today is like purchasing a home with a subprime loan at the peak of the housing market – The massive student debt bubble expanded from $200 billion to over $960 billion from 2000 to 2011 with a big push from for-profits at a time when incomes contracted.

- 0 Comments

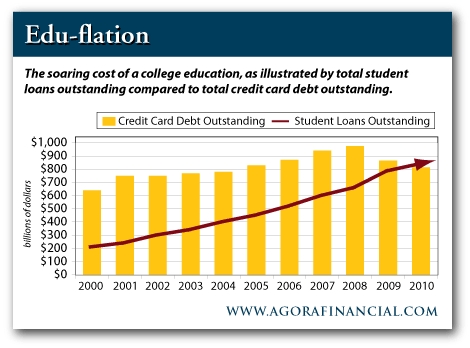

The college debt problem is boiling over and spilling hot water onto an already weak economy. This is no longer a petty niche issue when we are quickly reaching $1 trillion in outstanding student loan debt. What is more problematic is the acceleration in tuition over the last decade. Most of the combined data is looking back deep into the past when most of the problem has hit in the last decade. How bad is it? In 2000 total student debt was roughly $200 billion. Today it is above $960 billion. So in a matter of ten years the amount of student debt has gone up over 380% while household income has actually fallen. The players in the student debt market are largely connected to the big financial institutions and the government is willing to grease these juicy wheels just like it did for the mortgage debt crisis. The integration between government and the big banks is like a marriage made in graft heaven.

The student debt keeps moving on up

Virtually every sector of household debt has contracted during this crisis aside from one, student debt:

Source:Â FinAid.org

When we track this debt growth with other items we can see how quickly student debt is raging out of control:

It is now a memory that student loan debt has far surpassed total credit card debt. Student debt is also more ominous in the sense that discharging it is nearly impossible. Even mortgage, auto, and credit card debt is easier to discharge in bankruptcy. You now have a growing number of people being sucked into usury levels of student debt and many are being pulled in from the for-profit institutions that have placement rates that are abysmal.

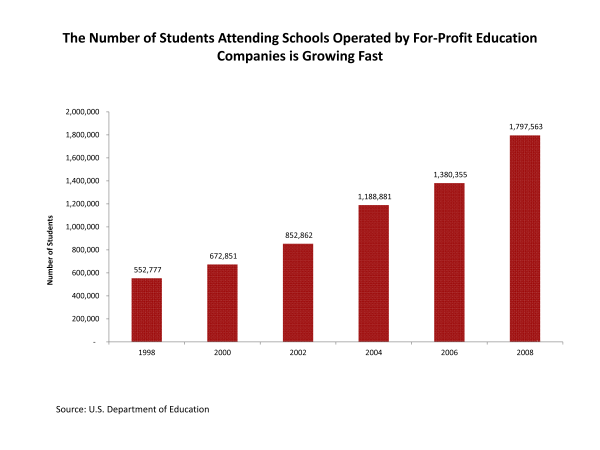

This is the argument that is largely missed from those who look at aggregate data. The student debt market has turned into a predatory circus in the last decade. You have for-profits that now have true default rates in the range of 40 to 50 percent even with the more restrictive laws of discharging student debt. And business has been extremely good at the for-profits:

Source:Â Senator Harkin

It is no coincidence that in the last decade where student debt jumped from $200 billion to the current $960 billion, that enrollment at the for-profit paper mills increased from 670,000 to 1,790,000. During this time, for-profits went from enrolling roughly 2 percent of all college going students to an astonishing 10 percent. Like the subprime market in mortgages, this high wheeling has completely spilled over into private and public institutions that now feel that they can charge $40,000 to $50,000 a year and not necessarily increase the rate of return for students paying these outrageous costs.

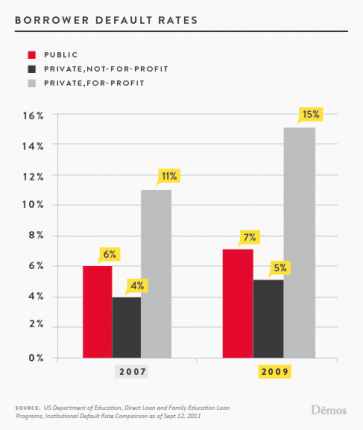

Defaulting into the horizon

Default rates are soaring even under the absurd cohort model of measuring defaults:

As we mentioned before, if we really used true default models many of the for-profit students are defaulting in the 40 to 50 percent range.

“What is troubling is that jumping into a low quality institution right now is like buying a home at the peak. There is some built in mantra of college education and the banks and government realize this and are squeezing working and middle class Americans into a dungeon of problems. Just like housing, the bill will be passed onto taxpayers when this bubble pops but not before Wall Street banks and for-profits skim unholy amounts of profit.â€

Just because you can finance it doesn’t mean you should. Unlike housing however, there is no walking away from student loan debt. The law gives lenders the ability to garnish your wages, tax refunds, and even future Social Security payments. This is no decision to enter lightly.

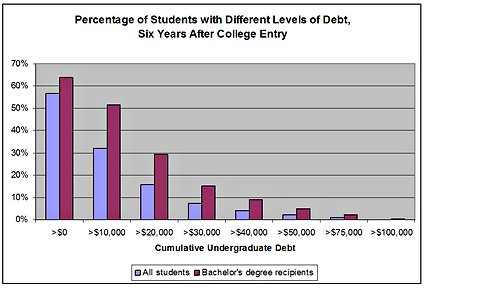

There are some that look at overall data but it is misleading. Take for example this chart:

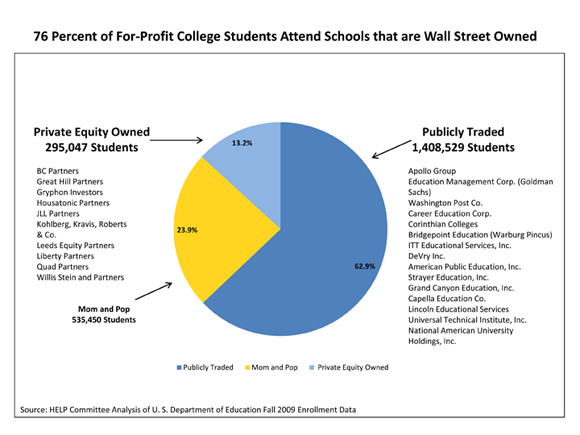

The problem with looking at data like this is that it doesn’t separate out debt by for-profits and also decade. Most of the problems we will be dealing with for years to come have occurred after 2000. Think about it, in 2000 only $200 billion in student debt was astounding and in the last ten years we have added well over $760 billion! So all the students that finished prior to this time don’t even have an amount close to what was added in the last decade. What happened in the subprime mortgage market is happening at the for-profits. These institutions heavily rely on taxpayer money:

-enroll 10 percent

-take 25 percent of all government funding for colleges

And who owns these schools? Some very familiar names on Wall Street:

Younger Americans are having a tougher time dealing with the current economy and net worth figures reflect this:

Source:Â CNN Money

Those 35 and younger have a net worth figure adjusted for inflation that is over three times smaller from those in 1984. Things are definitely going backwards for younger Americans but this is setting up a crisis of generations. Millions have moved back home and are entering households that have seen home equity evaporate. The stock market casino largely benefits those with inside connections and high frequency traders with hedge fund affiliations. The average American stands no chance and is regarded as a pawn by investment bankers.

This is why the student debt bubble is so troubling because it is allowed to go on. We have a template already given to us with the subprime debacle and how Wall Street banks made out thanks to trillions of dollars in bailouts. Here we have another glowing example of what is happening yet it is allowed to continue. There is no slowing down on what some of these for-profits are doing in terms of milking every penny out of students. So the game continues and we march forward to a crisis of young versus old instead of building bridges to fix a clear problem.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!