The walking debt – U.S. public debt now surpasses $15 trillion. The financial sector has wreaked disaster in the American economy. Wall Street banks cause havoc in housing and student loans.

- 4 Comment

It can be argued that the world is suffering from an epidemic of chronic debt. The financial sector loves to play on words and would rather call certain debt issues as a credit crisis as if it were a temporary thing like a mid-life crisis. This is also similar to renaming junk bonds to something more user friendly like a household pet, high yield bonds. There seems to be a naïve euphoria that the problems in Europe are now resolved. Nothing has been resolved aside from forcefully cramming down write-downs and creating more debt to bailout more financial institutions. As the markets rally on this news we have now officially crossed the $15 trillion barrier with total public debt in our own nation. The world continues to fuel a debt induced problem with more debt. Our entire system has been captured by this financialization where everything from a college education, to automobiles, to purchasing a home have become mechanisms to enslave people with ungodly amounts of debt and send profits to the few in the gilded financial class. As this goes along the elite in the financial sector become wealthier while the majority of Americans are left behind.

Crossing into the abyss of debt

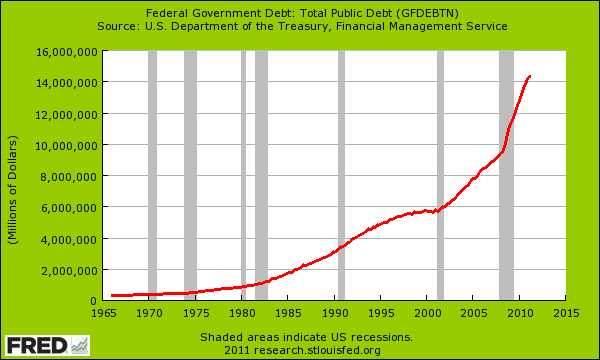

$15 trillion should get any person’s attention and we have crossed that market with the public debt auctions of this week:

This information has yet to be updated on the U.S. Treasury website but make no mistake, the $15 trillion figure has been breached. Is this disturbing to anyone else that our total public debt is roughly 100 percent of our GDP? Here you have Europe chastising nations for broaching this threshold and we simply continue to expand the debt at a feverish pitch. It is amazing to think that only a decade ago people were talking about paying the entire national debt off.  Not going to happen.

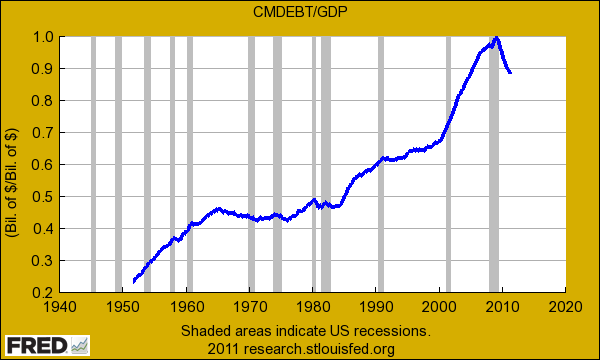

Yet this massive debt expansion is largely coming by bailing the bad debt of the banking system. As most Americans know, access to this easy debt is not available for most Americans who are actually in the process of de-leveraging:

This is the dualistic nature of our system. American households are being forced to deal with the austerity of the current crisis while the banking system has virtually unlimited access to the Federal Reserve and their digital printing press and virtual loan junkyard. Now wouldn’t it be nice if you had a place where you could dump all your housing, credit card, and education debt and simply move on? Unless you are a too big to fail bank, this pathway is not available.

Are we experiencing a peak debt situation?

One of the more mind numbing figures is coming from the student loan market. The average student loan debt for a graduate is now:

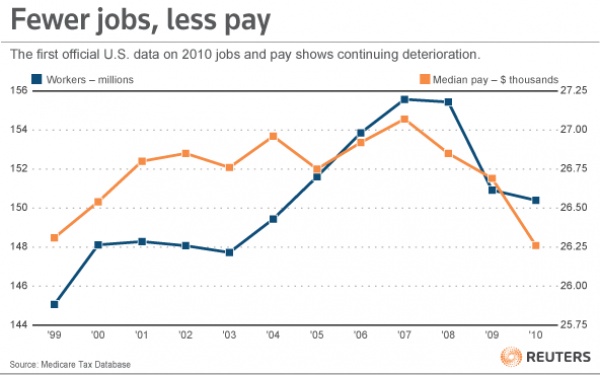

And the median wage for Americans is almost the same amount:

Source:Â Social Security, Reuters

This is the problem with simply going into a system where everything is run on giant levels of debt. The notion of saving to buy a car or even to pay for an education have become horribly distorted because easy access to debt has inflated the prices beyond any reasonable market levels. Think of the housing market and how prices imploded. Why do these massive debt games implode? Because at a certain point the financial sector decides to scam the system and get away with it. With housing it was the introduction of toxic loans and the industry became so corrupt, that it became comical in regards to no-doc, no-job loans. Similar parallels are now occurring with student loans and the higher education market. It isn’t that the market is pushing prices to these levels, it is because access to student loans are so easy to get. In fact, the less you have the more you are likely to get. No surprise that we will soon cross the $1 trillion mark for student debt.

Very few are becoming rich because of this financialization of our country. A folly and a con job has taken over our nation for decades. People are now waking up. $15 trillion is no joke unless you enjoy being a zombie nation simply surviving because of debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

clarence swinney said:

TWO CONSERVATIVE PRESIDENTS LED THIS WRECK.

REAGAN BEGAN REDISTRIBUTI ON WITH 60% TAX CUT FOR TOP 1%.

1 750B TAX CUT AND BORROWED 1700B TO PAY FOR IT.BUSH CUT TAXES 1700B AND BORROWED 600B TO PAY FOR ITPLUS ALLOWING HOUSING DEBACLE AND FINANCIAL DESTRUCTION WORLDWIDE VA GAMBLING DRIVATIVE CASINO

October 28th, 2011 at 5:48 am -

clarence swinney said:

SEND BANK DEPOSITS BACK TO COUNTY LOCAL OWNED BANKS.

RESTATE GLASS STEAGALL. COUNTY BANKS LOCAL OWNED LOCAL DEPOSITERS AND LOCAL LOANS. S&L WORKED WELL WITH 400 LOCAL OWNERS AND LOCAL LOANS ONLY.

MONEY CIRCULATED THROUGH THE COUNTY.

TODAY OUR MONEY CIRCULATES WORLDWIDE DOING LITTLE TO IMPROVE OUR STANDARD OF LIVING.PUBLIC FINANCED CAMPAIGNS. NO OUTSIDE $$$ TO CONGRESS OR WHITE HOUSE. NO USE OF PERSONAL WEALTH.

TAX WEALTH.October 28th, 2011 at 5:54 am -

OccupyNews.net said:

I have to add some important figures to your calculations.

Americans had around 14 trillion dollars of home equity in 2006. Since then, U.S. homeowners have lost 7.3 trillion dollars in home equity.

The additional problem is that a trillion dollars in credit card debt leveraged against 14 trillion dollars is not so bad, but when leveraged against 7 trillion dollars in home equity, that is not so good.

The answer to this mess is to allow people to restructure their debts without first being forced into a default by the banks. Not everybody would eligible for a debt restructure without first being defaulted upon, but probably well over 50% of the population would be.

Anybody with a student loan, credit card debt, medical emergency, are caretaking for a family member and cannot work as a result, anybody who has lost a job, ALL should be eligible to restructure their debt without first being forced into a default.

Nuances would be added to this basic rule, but this basic rule would instantly five consumers equal footing against the banks.

October 30th, 2011 at 9:39 pm -

Communal Award said:

“Give me control of a nation’s money supply, and I care not who makes its laws.” –Rothschild

Just print up your own money exclusively for your friends/family/community.

Hitler did the same(Reichsmark). Abraham Lincoln did the same(Greenback).https://en.wikipedia.org/wiki/Chiemgauer

https://en.wikipedia.org/wiki/Reichsmark

https://en.wikipedia.org/wiki/Greenback_%28money%29June 18th, 2012 at 12:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!