What is the median household income in the US? A crisis spanning multiple generations and the taboo of household income.

- 5 Comment

Household income is a taboo topic even though people have a visceral enjoyment of spending their hard earned money. As we go out and spend during this holiday season many people have absolutely no clue what other family members or neighbors make. Some would argue that household income is absolutely private and I would agree to a certain point. The mainstream media is focused on getting people to spend and part with their money. At this they are highly successful. Just take a look outside your window and I am certain you will see the artifacts of spending with brand new cars and other shiny lawn toys. Yet most Americans base the success of others by their purchasing knickknacks and have little clue as to what other households pull in with their income. This taboo led us into this debt fueled crisis with Americans going into massive debt to keep up with neighbors that never had the income to support their conspicuous consumption. This article will try to paint a full picture of the income situation across the country.

The distribution of median household income in the US

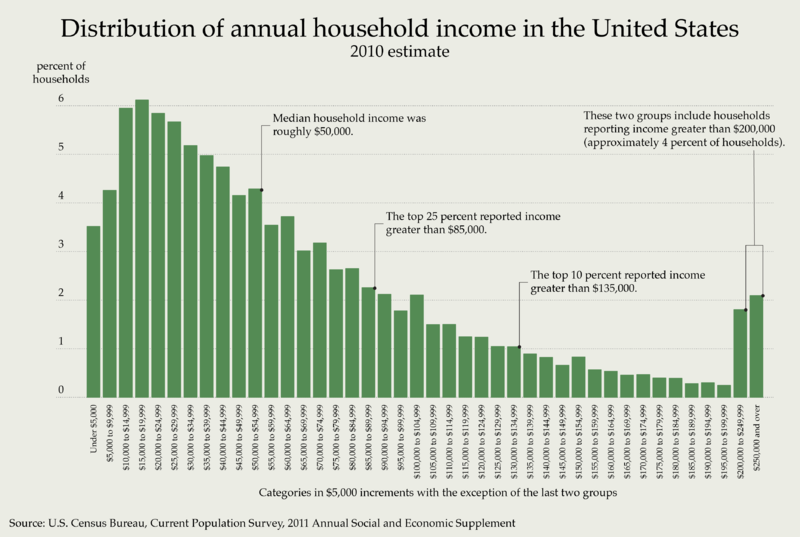

I’ve noticed a few more mainstream articles discussing life of households making $50,000 a year. Why is this important? This threshold is important because this is the median household income in the US:

Source:Â Census

This figure has held steady for many years but only until the recent profound recession did people start becoming enlightened to this fact. I’m sure many Americans have had similar thoughts over the last decade:

“Hey, how is my neighbor able to purchase a BMW when we pull in $50,000 and live in the same type of home?â€

“How was my neighbor able to take that luxurious vacation to Hawaii when we work at the same company doing the same job?â€

For the most part, a large part of it was financed with debt. As the reality is setting in we need only look at the above chart for a clearer picture of the economic balance sheet of most households. Part of the misconception of household income stems from the marketing and ornaments that people carry on the outside. Since income is a taboo subject most people are left looking at visual cues when in reality many Americans are simply getting by. This is fact. One out of three Americans has absolutely no savings account. How is that for being financially stable?

Let us examine the chart above more closely however:

-To be in the top 25 percent of household income you would need $85,000 or more in income per year

-To make the top 10 percent of household income you would need to make $135,000 a year or more in income

-Approximately 4 percent of households report an income of $200,000 or higher

-Roughly 2 percent of households make more than $250,000 in income per year

The figures are interesting and now with the subject more openly discussed because of the wicked recession, many people are realizing that many are not as wealthy as they once thought and with access to debt being limited, the faux leverage has been yanked out of the system as the graft filled financial system tries to eat up the buffet of taxpayer bailouts.

Breaking down the average income of Americans

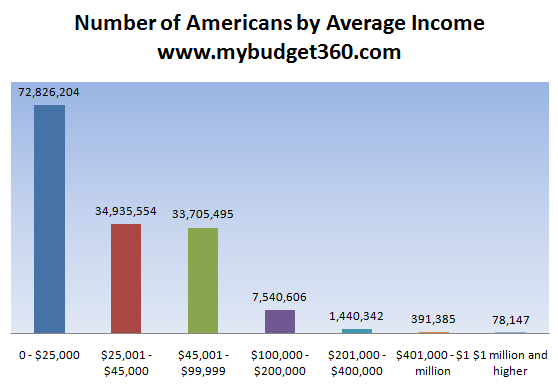

The above data examines total household income meaning a likely two or more wage earners per household. Yet how much does the average American worker make? That data is also readily available:

Source:Â Social Security

People are somewhat shocked that most Americans make $25,000 a year or less. Your typical American worker is pulling in $25,000 a year which makes sense when the typical household has two workers and the median household income is $50,000. Of course the figures shift a bit where you might have someone making $35,000 and someone else making $15,000 working a part-time job which is becoming much more common in this country.

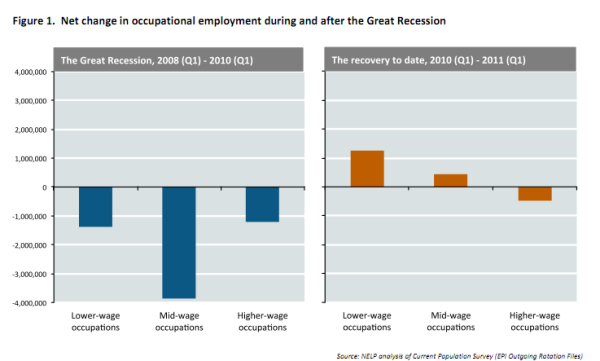

Much of the recent job growth has occurred in lower paying occupations:

Source:Â NELP

Lower-wage occupations are categorized as those paying less than $10 per hour. It is an interesting dynamic that is directly impacting the median household income of Americans. This crisis is spanning multiple generations as many younger workers are coming out with large amounts of debt particularly with student loan debt expecting to earn as much as their parent’s generation. The facts on the ground show a dramatically different reality.

There are still more workers looking for work than there are open job positions. It has also become an economy where the typical college graduate is not getting a larger return on investment even though they are sinking more and more into debt because of rising tuition costs:

Source:Â BusinessWeek

“A college education is becoming more expensive while the return on investment is falling. A similar trend hit in the housing market. Yet the gap in just one generation has catapulted into a tragic scenario. In 1984 households headed by those 65 and older held a 10 time median net worth advantage on households headed by those 35 and younger. That figure is now up to a stunning 47 today. A gap is always expected as those who are older have time to save and accumulate but the size of the gap is troubling.â€

How does the above impact the median household income? First it makes it much more difficult for younger households to begin building wealth with a large amount of debt hanging over their head. It also causes a system where income disequilibrium has been growing over time:

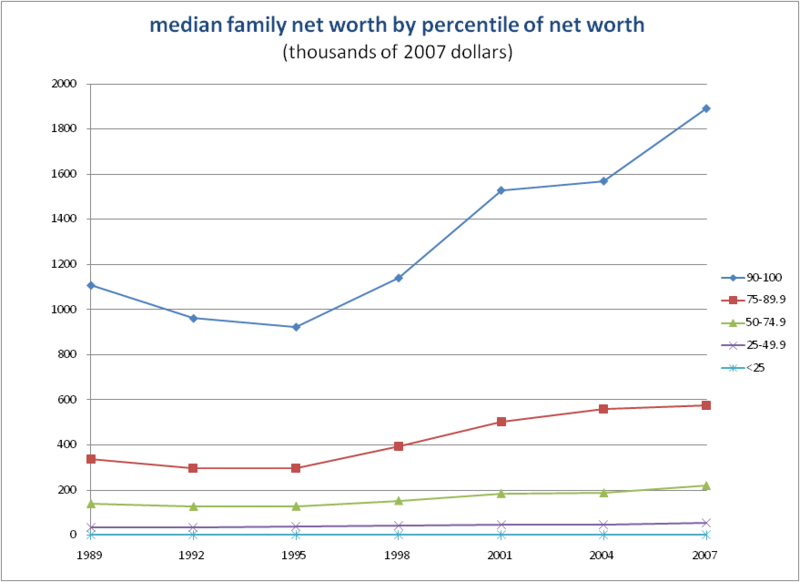

The above basically highlights the shrinking middle class in America. The above figures do not account for the recession but the trend is unmistakable. Since 1989 most of the large gains in household wealth have occurred at the top 10 percent of households. Yet if we break down actual wealth, that is saved money in equity, stocks, housing, and other assets the discrepancy becomes even more pronounced:

The top 10 percent of U.S. households control over 70 percent of all financial wealth. The median household income is treading water with the rising cost of food, energy, healthcare, and education going up faster than their income. It is good news that the median household income figures for the US are becoming more widely known. What we do with this information will be a question for the upcoming years.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

expatriot said:

The only reason they’re able to lie and say the median income is 50k is because the super rich raise it higher. Not sure that’s right but their are millions of dirt poor people in this country that probably aren’t even included. I’m thinking of homeless people.

December 13th, 2011 at 10:59 pm -

anonymous :) said:

Only (roughly) one in four thousand makes over a million a year. That’s much lower than I would expect…

December 18th, 2011 at 4:35 am -

Kyle said:

I’m glad a quit school while I wasn’t in too much debt with it. Now that I work full time and have my own business I make well over 50k a year.

August 22nd, 2012 at 9:10 pm -

Brian said:

An above comment is incorrect, median income reflects the “middle” value and is not influenced by extremely high incomes from a low percentage of people. And there are estimated to be fewer than 1 million homeless persons in the US. Um, anyway, this is a very good article with excellent graphs, thanks for the info.

April 5th, 2013 at 12:20 pm -

robert reilly said:

The rapidly rising college debt, $1.1 trillion a climbing, is perhaps the most dangerous financial problem facing typical households. This huge debt has never happened before. Sadly, it’s not needed. Today it’s easier to get an education dirt cheap. There is the internet. There are reasonably priced DVD high school and college lectures, there are great public libraries, there are tremendous courses offered by the military, apprenticeships, etc. Yet all that’s emphasized in going to college and borrowing money to it. This is because the country values a “credential” over what a person actually knows. This even though some of the most educated and accomplished people in history were self educated–such as Thomas Edison, Henry Ford, Thomas Paine, etc., and they did it at a time when information was much more difficult to accumulate.

June 12th, 2013 at 1:01 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!