Ultimate money magician in the Federal Reserve and the art of shadow bailouts – The continuing secretive bailout of the $3.5 trillion commercial real estate market.

- 0 Comments

The Federal Reserve is the ultimate magician in concealing bad bets for the flawed banking system. Few in the history of the Federal Reserve have called them out on their shadow bailouts but people are starting to wakeup no thanks to the mainstream controlled media. Think about how insane it is to have a central bank that does not even report to the people of the country it serves and is able to destroy the currency by bailing out bosom buddy bankers at the expense of the population. How is that even possible? Since this is the architecture of the system it becomes possible to create mega shadow bailouts like that occurring in the commercial real estate market (CRE). The CRE bailout is largely a sign of what is wrong with our broken financial system. Sure, with residential real estate the argument can be made that this impacts most American families. Of course even in that arena it has been a failure for the public but the CRE market is strictly a big money and big banking issue. The market imploded from being valued at $6.5 trillion a few years ago down to $3.5 trillion today. Yet why is it the responsibility for average Americans to bailout banks for bad bets on luxury hotels and failed strip malls?

The continuing bailout you are not hearing about

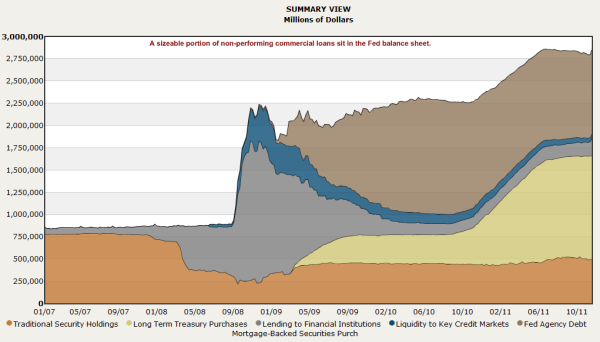

There is a false narrative flowing in the market that the bailouts are winding down and somehow we have turned a profit. All we need to do is look at the Federal Reserve balance sheet to see that this is not the case:

*Update December 2011

The Fed balance sheet is at a peak nearly reaching $3 trillion in a mix of toxic loans and odd backdoor bailouts. A large part of this is bad bets in the CRE market. Think that the bailout money is only going to poor segments of our economy. How about aiding the Ritz?

“(WSJ) The developers of the Ritz-Carlton Highlands hotel at Lake Tahoe apparently have leaned a little too far over their skis. Bank of America Corp., the lead lender in the hotel’s $157 million mortgage, has filed a default notice against the property.

Developer and owner East West Partners, based in Avon, Colo., is “talking daily†with its lenders to resolve the situation, East West senior partner Blake Riva said. At issue: $10 million of the loan has matured without being paid, and the lenders want East West to pitch in another $8 million of capital.

Otherwise, East West and Ritz-Carlton, a unit of Marriott International Inc., say the hotel is doing well. Like many mountain-resort businesses, the Ritz is temporarily closed and slated to reopen by mid-May, after the “mud season†passes and vacationers return to the area on the California-Nevada border.â€

Isn’t it amazing that these shadow bailout are presented as some sort of method of keeping lending going to average Americans? Instead, major CRE projects are defaulting and banks are simply ignoring the losses or are passing the bad notes over to the Fed as a sanctuary of bad bets. The public does not have this convenient access of course. Accounting trickery seems to be an area of expertise of the Fed and their fellow big bank friends.

Little relief in the CRE bust

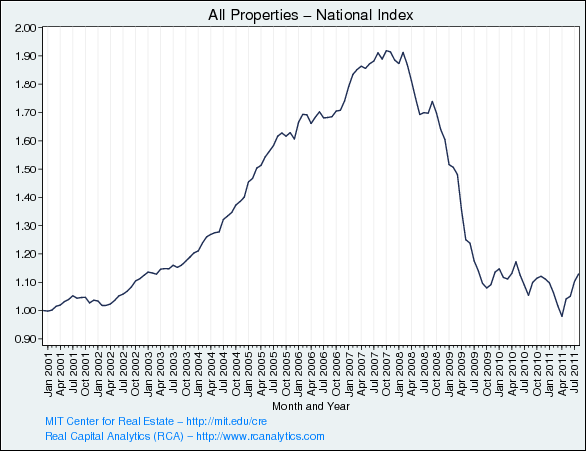

The commercial real estate market is still near a trough:

Source:Â MIT

The little bump seen in the chart above is a bit deceptive because recently better quality projects have been picked up at rock bottom prices. Ironically these deals are made to other banker buddies with inside connections. More stories are being leaked on the inside deals being made by the financial sector and their connected allies. Free market? Not for the financial sector and the Federal Reserve that purposely has created an opaque financial system to benefit the few.

The chart above highlights this favoritism and connecting this to the Fed balance sheet we realize exactly what is occurring. The Fed is simply shifting bad assets off bank balance sheets and placing them in their hard to audit financial system. In other words, it is a de facto bailout.

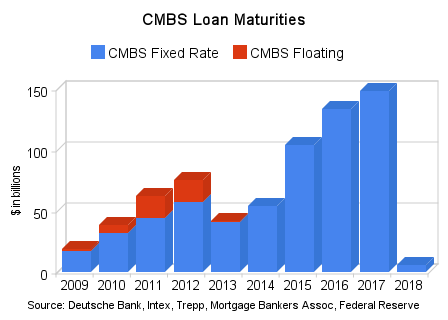

And many of the problems in the CRE are market are still to come:

Source:Â Â Â Â Â CRE Console

Many of these notes are simply being rolled over internally on bank balance sheets. Imagine if you had the ability to simply avoid paying your bills each month. This of course is a benefit of being part of the Fed’s exclusive list of financial buddies that can take on this limited benefit. Yet it comes at the cost of the real economy as we are seeing with 46,000,000 million Americans on food stamps.

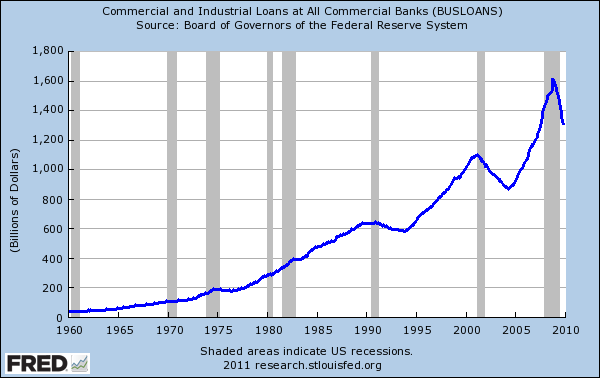

Even banks know how bad the CRE market is. Loan volume has imploded for this segment of the market:

If the market was so healthy, wouldn’t banks be back to making loans in this arena? Of course. Yet most of the market is over saturated and there are trillions of dollars in bad loans simply sitting on the Fed balance sheet. In other words the market still has a massive amount of hidden supply yet the Fed was hoping to engineer a miraculous price bubble again to aid the big banking sector. That never materialized and the Fed balance sheet is up to nearly $3 trillion. For such enormous amounts of money you need to ask yourself why is the Federal Reserve rarely (if ever) mentioned in the mainstream press? The press goes nuts for million dollar Ponzi schemes yet avoids talking about trillion dollar bailouts. Hidden bailouts and a silent press seem to be status quo but the public is becoming more aware of the truth and is realizing the secretive nature of the current financial system. Magic in the end is simply an illusion and distorts reality.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!