The young and the broke – 37 percent of young households held zero or a negative net worth in 2009. The median net worth of those 35 and younger is $3,600.

- 4 Comment

It is hard to imagine a future generation of Americans were those moving forward are actually poorer than the current generation. Yet that is precisely the world we are diving into. Those that purchased homes in the pre-bubble days and also attended college in less inflated times have a massive head start on the current younger generation that is contending with a bursting housing bubble and a financial system that might as well be a roulette wheel. One startling figure from a recent Pew Research report shows that 37 percent of young households hold zero or a negative net worth. This is not a good way to build a healthy financial future. The wealth gap between previous generations is also becoming increasingly large. This narrative ties into the overall systemic pilfering of the middle class.

How large is the net worth gap?

The gap between younger and older Americans has never been so large:

Source:Â CNN, Pew Research

“(CNN Money) In 1984, households headed by people age 65 and older were worth just 10 times the median net worth of households headed by people 35 and younger.

But now that gap has widened to 47-to-one, marking the largest wealth gap ever recorded between the two age groups.â€

A large part of this gap has to do with the timing of the housing bubble. Many younger Americans bought during inflated times while Wall Street banks were pillaging the entire system. Older Americans purchased homes during a time when Glass-Steagall was still in place and the bulk of loans made in the housing market came from stale fixed rate mortgages. Yet I would also argue that the cost of college today is sapping out a large portion of future earnings. We have seen a diminishing return on investment for college graduates:

Source:Â BusinessWeek

A college education is becoming more expensive while the return on investment is falling. A similar trend hit in the housing market. Yet the gap in just one generation has catapulted into a tragic scenario. In 1984 households headed by those 65 and older held a 10 time median net worth advantage on households headed by those 35 and younger. That figure is now up to a stunning 47 today. A gap is always expected as those who are older have time to save and accumulate but the size of the gap is troubling.

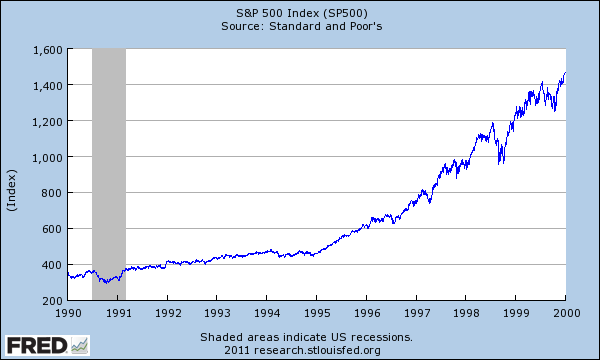

You also have to factor in the casino that is now our stock market. Take a look at the S&P 500 performance from 1990 to 2000 and then from 2000 to 2010:

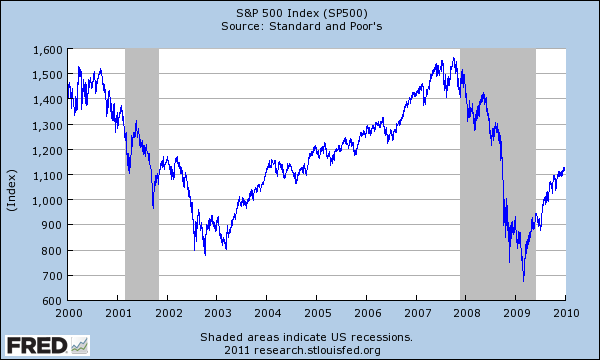

And then the last decade:

This was a tough decade in regards to wealth building for younger Americans. The traditional means of building wealth through home equity and the stock market have largely been co-opted by hedge funds and investment bankers for short-term profits and graft.

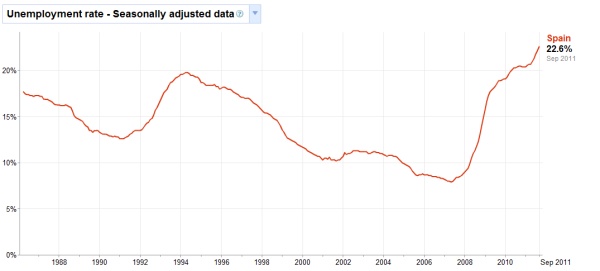

The trouble of course is the social friction that occurs when massive wealth inequality occurs especially when it occurs through social welfare for the rich and protecting failed businesses like our too big to fail banks. The last time we had anything like this was the years before the Great Depression. You have places like Spain where younger workers have unemployment rates over 40 percent and a headline rate over 20 percent:

People are waking up and asking for tangible solutions. Here are a few solutions that we need to start with:

-1. Take systematic lobbying out of politics

-2. Break up the banks. Bring back Glass-Steagall

-3. Large surcharges on short-term trading to curb high frequency gambling

-4. Tax hedge funds and investment banks with regular income tax rates just like most Americans pay

These would help in getting a financial system designed to help the economy instead of an economy built to bailout the financial system like we currently have. Expect the gaps to grow larger and the middle class to dwindle further if nothing is changed.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

kennyg said:

SLAVERY IS THE FUTURE FOR ALL EXCEPT THE ELITE…..WE ARE NOW GOING THRU THE FINAL STAGES OF THE TRANFER OF WEALTH THRU TAXES AND INFLATION……… AND WE THE SHEEPLE ARE EXCEPTING THIS SCULLDUGERY WITHOUT A FIGHT………. OR A BLEEP.

November 13th, 2011 at 9:59 am -

Dumbfounded said:

Baaaaaaaaaa…now pass the remote.

November 14th, 2011 at 10:14 pm -

laura said:

I’m glad that credit cards weren’t available when we were young and starting out. I got my first credit card in 1978 at age 33. Credit was hard to get on anything. Large down payments on houses and cars were mandated. We always had some in savings for emergencies. Pay was lower, but money went further than now. America is without any hope because puppet elite controlled politician scum bags are trashing the country.

November 15th, 2011 at 12:33 pm -

clarence swinney said:

A. Fed Fund Election–6 months–3 primary-3 general

Free equal tv time–a debate a week gives 12 or enough to evaluate candidates. No personal or other $$$B. Congress + White House employees can take nothing–O–of value

Not even a free lunch. BYE BYE K StreetC. Progressive Flat Tax–burn tax book start anew- this will yield 2000B + of addiitonal revenue and balance our budget

It can be done A NEW AMERICA. Top-Middle- Bottom.

Wealth distribution 30-60-10 not current 80-20-0Studies show that Happiness in a population is in a direct proportion to Equality in distribution of wealth.

America ranks in bottom 5 in oecd on Equality

One cause–We rank third in Least Taxed nation.

Our corporations rank second.Please cut tax for top 2%..

2% own 50% financial wealth–get 25% individual income–include incomes of 4000M-3000M-2000M-1000M-500M-100M etc

Please help them.

write checks ($10,000 min ) to clarence achmed swinney Room #106 Camp Butner NC Center for Mentally Deranged. Boom.December 13th, 2011 at 7:49 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!