Is college worth the money and debt? The cost of college has increased by 11x since 1980 while inflation overall has increased by 3x. Diluting education with for-profits. and saddling millions with debt.

- 14 Comment

Is a college degree worth it? Since the debt bubble burst spectacularly in 2007 many more prospective students are questioning the worth of a college degree. For so many decades it was simply taken at face value that getting a college degree, any college degree would be worth it. Slowly this perception has morphed when annual tuition is running at $20,000 or more at for-profit institutions and $50,000 for private institutions. More to the point, most of the recent educational growth has been financed with large wallet crushing student loans. This financing of the college dream is turning out story after gut-wrenching story of college education nightmares. When a college education becomes this expensive it is important that potential students become savvy consumers. The financial sector certainly isn’t going to offer any advice on navigating the minefield of higher education since they largely have their greedy hands on this sector of the economy as well.

The soaring cost of college

In hindsight everyone seems to now agree that the housing bubble was rather obvious to spot since it far outstripped every measure of inflation and even rose while incomes fell. You would think this lesson would be learned but the cost of a college education is much deeper into bubble territory even beyond the metrics of the housing market at its peak:

Source:Â Cluster Stock

While housing at the peak rose by a factor of 4 (400 on the chart) college tuition has soared by a factor of 10 (it hasn’t stopped going up so it is now likely up in the 11x or 12x range). It is a downright startling figure especially when the incomes of recent college graduates has gone in the complete opposite direction:

Source:Â BusinessWeek

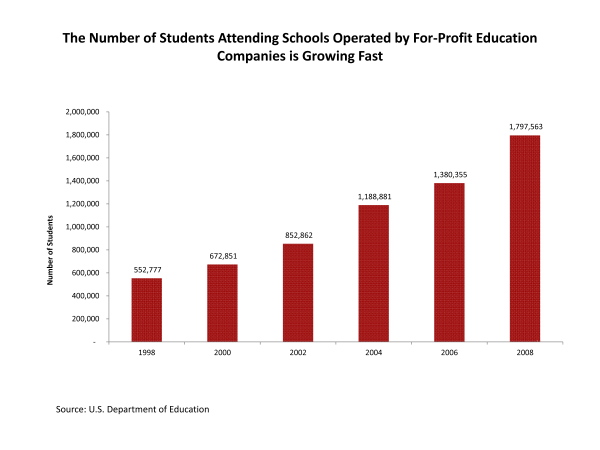

Since 2000 real earnings for college graduates has fallen while tuition costs continue to soar and put students into further student loan debt. I was hearing a few stories about states with record applicants to public universities yet with state budgets hurting, these schools are unable to meet the demand. So students are left with the option of $50,000 a year for private institutions or going to for-profits that are a step above paper mills. For this reason we have seen a giant increase in for-profit enrollments:

Source:Â Senator Harkin

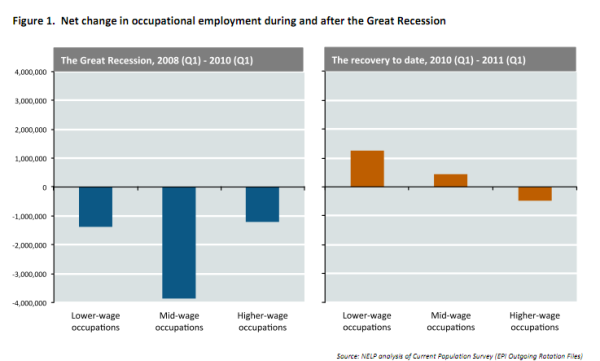

For-profits have tripled their growth since 2000 which I also believe has diluted the earnings potential of the overall college pool and has also saddled many students with incredible amounts of debt. We are set to surpass the $1 trillion mark in student debt in 2012. The recent recovery has been a low-wage employment recovery so many recent graduates are coming out with heavy debt burdens and finding employment opportunities that pay much less:

Source:Â NLEP

We have lost a stunning 5,000,000+ mid-wage to high-wage jobs and have only added 1,000,000 since the recovery started way back in the summer of 2009. Yet the pool of graduates continues to grow. Another startling fact is many state schools are seeing peek applications even though high school graduation trends show a smaller cohort. Why? You have many people going back to school trying to retool especially after losing a job. Yet going to a for-profit school for gaming, art, or some other career path may prove to be a very expensive realization that not all college degrees are created equal. In many instances students would be better set if they went to a 2-year college or a trade school to pick-up the education they require.

“The difference of course is that state schools do not market to you. You have to go to them. The for-profits spend more money on marketing than they do on instruction. That should tell you where their priorities sit.â€

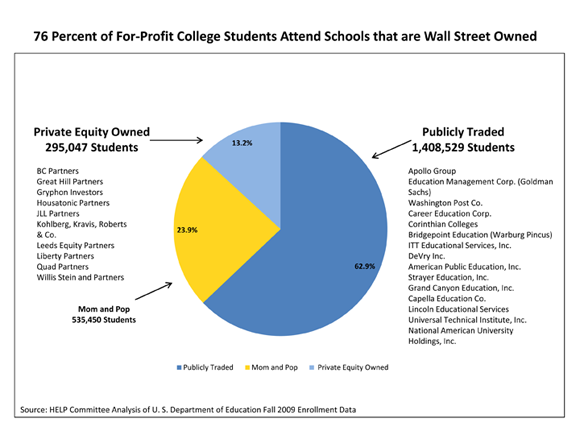

Most of the for-profits are owned by large financial institutions that had their hand in this economic meltdown we are living through:

So a lot of the dilution in educational quality has come at the hands of these institutions. However, you also have private institutions outside of the top-tier that are heavily marketing and recruiting to pull students into their expensive four year traps. There are a few rules you should follow if you are not sure how much debt you should take on when pursuing a college education:

-First, your maximum student loan debt should not pass your expected annual salary after college.

-Second, you should do your own market analysis of the field you are going into. Many of these schools promise unrealistic placement data.

-Third, if unsure, look at 2-year state schools and transferring to a state 4-year institution. Because of budget constraints and the above factors, state schools have gotten more competitive because people realize the other options are either too expensive or simply not worth it.

-Finally, If you really want to go to a private institution, consider a state school first and transferring into a graduate degree later.

The net worth gap between younger and older Americans is already large enough and doesn’t need to be bigger with the saddling of student debt:

Source: Â CNN Money

To expect a 17 or 18 year old to understand this is hard to see but parents need to step it up but with the average per worker salary being $25,000 it is doubtful many parents have the resources to run an in-depth market analysis when it comes to choosing the right school or program. As usual do your own due diligence and don’t be fooled by the notion that all colleges are created equal and that college is priceless. At these cost levels, you better believe that there is a significant price.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

14 Comments on this post

Trackbacks

-

mile said:

and 27 percent being entangled in the for profit prision industry with the creation of more nd more rules and kickbacks to make this possible, how does “schooling” get to be different.?

January 5th, 2012 at 2:26 pm -

DivaEl said:

Part of the reason for the wealth gap is that the geezers have been hell bent on ensuring that they continue to receive their overly generous Social Security and Medicare benefits at the expense of young people who have to foot the bill but can never expect to receive those benefits in turn when they get old. The geezers have been leeching off the young to expand their share of the pie for decades. This kind of intergenerational theft would unconscionable in a truly just society.

January 6th, 2012 at 7:34 am -

Bud Wood said:

Whether college education is worthwhile is the education received and the cost of that education. My education in electrical engineering and my sons’ educations in physics, EE and Chem Engrg were very worthwhile and all of us came out with no debt.

At this point, however, one needs to seriously weight the benefits. In most cases, there are few benefits for things like gender studies, race relations and political “science”. In fact, some such courses only engender disappointment at best and general disgust with our system (which has provided material benefits far beyond those of other political systems). Then some students get a bill for that – – talk about adding insult to injury!

No doubt about it. The “ivory towers” will be falling down. In most cases,young people need to stay clear and go about they own ways, aided by realistic expectations and reasonable parental guidance if that is possible.

January 6th, 2012 at 10:40 am -

Angela said:

Seems like such common sense “first thing I’d think of” advice here, but then again I wasn’t conned into buying a huge McMansion on a balloon interest rate with 0% down on a $50,000 a year salary either. I wonder where people’s minds are these days…

January 7th, 2012 at 9:10 am -

Joe Torrea said:

Hey DivaEl

Understand that Social Security is not a free gift to the geezers. Social Security use to be called Social Security Insurance, does SSI ring a bell. It was and still is a mandatory insurance policy paid by the worker and the employer. I as a geezer will never ever collect all of the money I paid into it. In addition most of my friends, hundreds of them are long dead before even collecting a single social security check. Social Security is not an entitlement but a insurance policy that the geezers were forced to pay into wheather we wanted it or not. where all the money that was payed into it went is the question. Since only 12% of the people live long enough to collect a single check and many of them collect only a few checks before dropping dead from supporting their lazy children who are still living at home at 18 years of age. I moved out of my parents home at 16 and supported myself ever since and never borrowed a single cent from my parents. Give me my God damn Social Security check, I had to pay for the stupid insurance that I didn’t want. Now give me my stupid insurance that I paid the last 50 years for.January 8th, 2012 at 5:07 am -

Bernadette Bay O'Shaughnessy said:

I am surprised by the number of college kids who insist on studying things like art, music, political science,etc. These will get you nowhere! Ditto for teaching! The so-called ‘teacher shortage’ is pure bunkum. Study something medical or technical and do your art ‘thing’ on the side! Grandma Moses never took an art course and Hemingway never went to college! Either you have talent or you don’t. Find a field in high demand, get into it as quickly as you can, then do the rest later. I am a published author(42 books so far) with 15+ years working as a newspaper/magazine reporter/writer. My parents were afraid that journalism was ‘precarious’ and insisted I take a med lab tech course(which I did!) Thankfully, between the 2 I have always found employment. Given a shortage of funds, I would have gone for the lab tech training first and taken writing courses on the side.

January 9th, 2012 at 9:25 pm -

DaBangaround said:

A lot of the tech type jobs are being “fleeced” to other countries willing to do the same work our kids go into thousands of dollars of debt to do. We’re sending these kids to college for jobs that don’t exist, or big business is too greedy to employ kids shooting for the “American scheme”, I mean dream. Truth is college is a privaledge and should be given to those who work for not those who can bank roll it. We’re finding out that parents who feel obligated to send their kids to college on their retirement money are now obligated to work at Walmart to their 80 to pay off their kids debt, AKA the gift of education!

May 27th, 2012 at 7:50 am -

Richard Fossey said:

This is a terrific article, packed with data and sound analysis. The author is right–a large part of the student-loan problem can be traced to the for-profit institutions, which are heavily financed by the federal government.

We will know that the Obama administration is serious about addressing the student loan crisis when it begins to take effective action to rein in the for-profits.

June 9th, 2012 at 7:37 am -

Elizabeth said:

Public schools are still pushing the idea that everyone must get a college degree. The times they are a-changing.

As a teacher, I encourage my students to consider getting a trade, some skill right out of high school. Welding, carpentry, construction, plumbing, barber will be skills in demand or a long time. We need to quit selling students an outdated idea and prepare them for a changing future.

I gave all my own children a fancy-shmancy private school education, and if I had known then what I know now, I would not have gone down that path. Either state school or community college and then transfer to a local state school. There’s no denying the social aspect of going away to college as a fun and growth experience. However, like I said the old ways of education are going down a new path.

August 15th, 2012 at 9:41 am -

S' said:

stupid lemmings following each other off the cliff, thanks for voting for bh0 again, the cliff is now in sight

November 10th, 2012 at 3:21 am -

DG said:

All costs which have risen beyond normal monetary inflation (federal reserve targets creating inflation) have very common traits:

Highly regulated industries which have an effect of limiting supply and financializing demand. (try starting a cost effective university embracing the internet fully and see how far the regulators let you go….and give me a break on how regulation improves education when diploma mills exist)….Education and healthcare need to be massively opened up to cost-effective markets. It is not capitalism at all. It is a corrupt, fascist, state-controlled-buddied up with monopolistic corporations so that the .1% take all. WTFU folks and see what is happening. And JP Morgan makes money doling out food stamps…they love the moronic masses….

Quit wasting your money on college and quit banking with the banks that facilitate the theft. Open your eyes. Think. Nearly every course (or its equivalent) of every college is online for free…..free….healthcare is a mess. Thanks to years of government help…Obamacare was just another big leap in “helping”. I don’t know about the rest of you, but my insurance premiums have risen since all this help has happened and my deductible has gotten to a point of stupid. Why are hospitals so nice and opulent? Why are health insurance stocks so high? The only choice you have is stay healthy. If you are fat, lose weight, if you don’t exercise, start. Quit banking with the banks that facilitate the madness. And quit relying and voting for elected officials that claim to dole out goodies to the poor when really they give the poor a little, but give the 0.1% a lot!! Wake up. Is it working for you? Has it ever?

December 1st, 2012 at 8:28 am -

Chaz said:

The following is excerpted from a recent message related to MOOCs (Massive Open Online Courses) and an interest expressed in bringing more entertainment values or art, which could be aimed at reducing any “dropout” “problem”. In this year it is acutely relevant to the question of whether physically attending brick and mortar colleges is worth it:

“We should, however, go far beyond the educational establishments that are still clinging to their victims, which are indeed all of us in the global society that suffers them, but particularly students. There is nothing there for us who are in the new technologies. They must come, more humbly and respectful, to us for survival and not claim that their institutions are anything but failures at expanding individuals’ opportunities for unfolding their lives. This may seem radical to some, but please consider the ways that this proposition can be true.

Universities are among examples of obstructions, toll takers, greedy gatekeepers that filter and assess lives without supporting learning or true education. They brag about their selectivity in admissions, which should be their shame as it shows that they are unable to support individuals’ evolution into learning and educated human souls. Higher education particularly is about serving power and financial constituencies other than the learning being, or beings truly living as humans. Thus it it safely asserted that the current global educational establishment is a complete failure at its ostensible purpose of forwarding learning, culture and human life beyond what would occur without their intermediation and interference. In short, what currently passes for education must go.

(I feel like interjecting here that if you want to see some of what is dysfunctional in learning, occupations and living these days, just suffer through a “Harlem Shake” compilation video on YouTube and look at the colleges, workplaces and living situations involved in the backgrounds)Established control and limitation of learning to only a useful relative few must succumb to the process of disintermediation that communication technology now makes not merely feasible but imperative. Objections are frequently made by those with no vision that the live in-person classroom provides a more complete experience with greater interaction, but ask students how often in the typical university lecture course they are able to ask the graduate student standing in for the professor listed for the course any question at all, not to mention the simplest and most basic kind.

The possibilities for such “interactions” are far greater and more varied with online learning, since one can, for example, be searching the Internet or looking over a website referred to by the lecturer and asking questions via text and video that can be woven into live online lectures and presentations, and a student can be communicating with other students in the course in ways that would be considered disruptive in traditional classrooms where note passing and chatter between students is discouraged. Even interactions seeming to be irrelevant or trivial, such as exchanges about traffic or weather or breakfast cereals or other concerns, can be woven in and orchestrated by an adequately trained or inspired and artful teacher and by a well crafted system of apps to enhance or optimize the learning experience.

Some additional quick notes I jotted down:

Unnecessary student housing expenses are part of what is killing true learning opportunities. Student loans to afford overpriced real estate near classes or at least near campus are only part of that exploitation. Student housing, for example, student housing cooperatives, and other options, could could be repurposed to enhance the web centered learning of residents that could form a more intentional community, not one aimed at merely surviving the financial disasters created by universities with ridiculous tuitions that are enough to create ones own college, or at least hire one’s professors directly. The web changes all that. So here we have a solution to student finance and the student loan catastrophe that financiers would oppose, if they could not see how to profit from the current $18 billion a year online education business without robbing the poor yet again. All the securitized batches of promissory notes might diminish too quickly for private central bank consortiums to develop new backing for currencies.”

I note that many of the commenters who are typical for these kind of articles seem to be web bot personas hired to denigrate the surviving emblems of middle class life, which were, as studies have shown, private home ownership, college education and, interestingly, vacations, paid, and particularly family vacations like in the old days in the summertime. Times have changed, I know, but people pushing narrow technical training are more likely to be working at a government installation monitoring web activity. Just saying, believe them to be people like you or me at your peril. They are here to confuse the issue and achieve various policy goals, including diverting attention away from their protection of a criminal financial establishment that benefits wrongly from such as the present student loan situation. One way for them to achieve such aims is by pandering to our prejudices. I hope you can think for yourself instead.

March 17th, 2013 at 3:56 am -

KaD said:

I’m looking for a job and shocked at the positions that aren’t requesting or demanding a bachelor’s degree-like receptionist. WTF? The posting listed the pay at under #30K a year-likely less than the COST of a bachelor’s degree. To answer phones!

October 13th, 2013 at 7:01 pm -

KaD said:

Joe Torrea: your facts are all screwed up. People who are retiring NOW will be the first generation of seniors who will have paid MORE into social security than they will get back. IF you are already retired you will get back MORE than you paid in: http://blog.aarp.org/2012/08/06/the-takeaway-todays-retirees-first-to-pay-more-into-social-security-than-theyll-get-back/

October 13th, 2013 at 7:08 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!