Long live the debt ceiling – approaching the fiscal cliff by spending $1 trillion more than is being taken in. A breakdown of government spending and revenues.

- 4 Comment

History does love to repeat itself especially when it comes to debt bubbles. At the rate the US government is burning through money, we are likely to breach the debt ceiling limit even before we enter 2013. We’re about $400 billion away from the $16.39 trillion limit but considering we’ve already spent $700+ billion that we don’t have this year, that lofty goal is likely to be met. We’ve talked about the fiscal cliff and how the US dollar has essentially fallen off this position decades ago. Yet the political talk is simply ignoring one of the most important items that will face this nation and we’ve known this scenario was coming for well over a decade. Things appear better than they are because we are spending money we don’t have. Does this sound familiar? In the 2000s you had people buying massive homes they couldn’t afford and leasing cars that cost more than annual salaries of most individuals. That didn’t exactly end well. Yet today, we continue to spend money that is simply not there. To think this will carry no consequences is simply naïve.

Spending what you don’t have

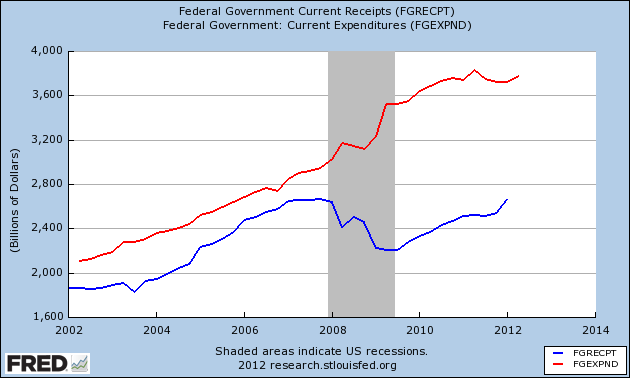

Spending more than we have is nothing new. Just take a look at government expenditures versus government receipts:

The government is spending over $1 trillion more than it is currently bringing in. This is completely unsustainable of course and that is why you hear rumblings of a fiscal cliff but no actual substantive ideas on how to deal with it. This is an election year so expect the elephants and magicians to pop out in the year of the circus.

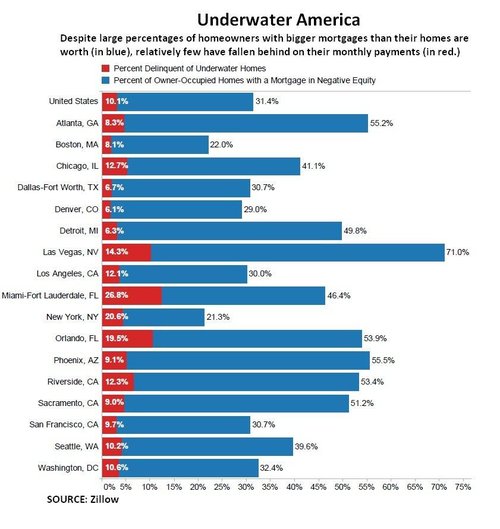

Many Americans were conditioned to believe that housing would be the primary staple of their net worth deep into middle age. So even with very little to no savings, at least many Americans would have their home paid off and a tiny Social Security check trickling in to keep them from living off of processed cat food. Yet with the housing bubble imploding we realize that many Americans did not adjust the way they lived and saw housing equity plummet thanks to the institutionalized casino on Wall Street. So you have a massive number of people simply living in homes that are underwater:

In a place like Las Vegas over 70 percent of home owners with a mortgage are underwater. In Atlanta the figure is up above 55 percent. Even in very expensive San Francisco and Los Angeles over 30 percent of mortgaged home owners are underwater. So there goes the notion that buying a home is always a good decision.

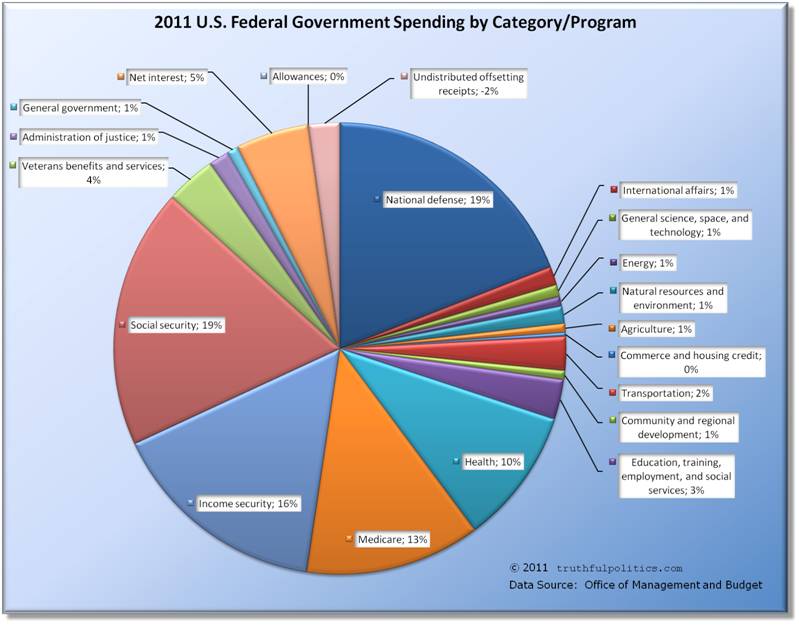

Yet this brings us back to the debt ceiling. We are spending a tremendous amount on various sectors. Let us take a look at the numbers of where this spending is going:

Source: Truthful Politics  Â

It is important to understand that Social Security and Medicare do bring in revenues via the payroll tax.   However these items are now spending more than what is coming in. Items like National Defense for example really have no direct revenue stream. When you pay federal taxes it goes into this large pot that then is distributed out to various areas. I look at how little is spent on education (3%) or with energy (1%) and then you question why we have a massive student loan bubble?

The above chart is shocking more so because we are spending $1 trillion more than what is coming in. Where will we get this funding or what areas will be cut? The bill is coming due whether people acknowledge it or not. This isn’t a Democrat or Republican thing but an American struggle.

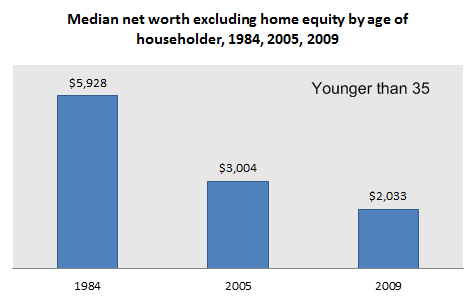

Many have very little reserves to deal with the coming contraction:

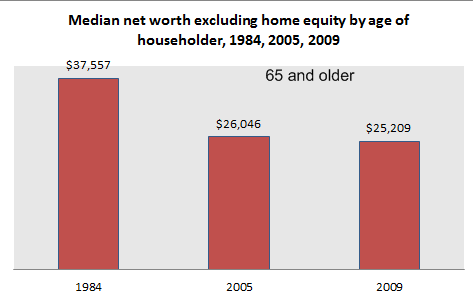

This is where you realize we are simply on borrowed time. The median net worth of those 35 and younger excluding home equity is $2,000! Essentially one month (or half a month) of actual expenses for most families. For those 65 and older it is $25,000! The vast majority of Americans are simply hoping to get by in retirement with whatever is provided to them via Social Security. Then you have 46 million Americans on food assistance. The money is coming from somewhere and right now it is coming from adding on more and more debt. As long as the world is fine with this situation then the carousel can go around a few more times. But what happens when it gets more expensive to spend money you don’t have?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

JD said:

Not a pretty sight..can’t say we weren’t warned…there is no magic fairy dust to keep this party going, just tough choices ahead for all. Sacred cows like Medicare-defense-SS- are but a few of the areas that need complete reassessment. Much like those who’s companies go bankrupt and their pension is picked up by the govt agency PBGC..you end up with almost a 50% haircut in your pension BUT 50% of SOMETHING is better than 100% of NOTHING!

August 11th, 2012 at 6:18 am -

torabora said:

Well we can short cell phones, cable TV, Disneyland, Hollywood, cruise liners, airlines (always a fav to short), education, housing builders….go long on food, medical, energy, car repair parts, people will stay home and hunker down….there will be more wear on that part of their lives so money will be spent close to home. Anything that is ‘extra’ will be discarded. $8 gas will seal the deal.

August 12th, 2012 at 7:21 pm -

observer said:

The low median net worth numbers are just astoundingly scary. People have so little backstop should another major downturn happen.

August 12th, 2012 at 9:15 pm -

laura m. said:

I agree with torabora, people right now are finding things to do in local parks, state parks and other low cost or free outdoor fun closer to home. There is no future in couples raising a family as both have to work and struggle; America is without hope; no real future. As a retiree I know the younger folks will have to struggle in the future, competing for jobs and with open borders causing job competition.

August 14th, 2012 at 6:21 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!