The looming student loan bubble – Almost half of all student borrowers were not making payments. 1 out of 4 in debt repayment past due on student debt.

- 3 Comment

The aggressive growth in student debt is setting the country up for another debt fueled bubble.  Higher education costs have expanded so quickly that Americans now carry $1 trillion of student debt. Most of this expansion has occurred in a time when the return-on-investment for a college degree has fallen. Over the last ten years student debt outstanding has grown from less than $300 billion in 2002 to $1 trillion in 2012. The cracks in the student loan bubble are already forming with large numbers of students defaulting on their loans. And the pipeline is only increasing. Almost half of all student borrowers are not making payments. Many are in school and many are simply unable to pay. Yet with a weak economy the prospect increases that many younger Americans are going to enter a market where job growth is weak yet student debt payments are high.

The massive growth of student loans and tuition

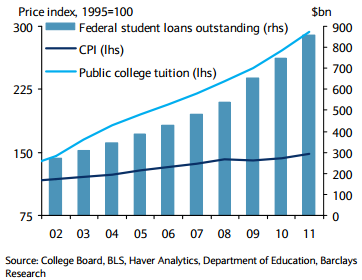

The issue is that college tuition even at public universities has far outpaced the growth of the overall CPI. College earnings for recent graduates, those who left school in the last decade, has been marginal since many younger Americans are carrying a big load of this recession:

Source:Â Sober Look, Barclays Capital

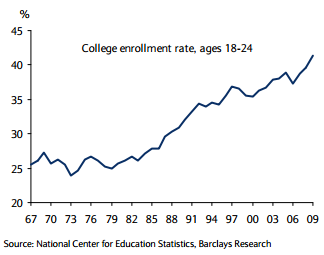

Higher debts and lower wages. The risks do run high because many younger Americans are now going to college at far greater rates:

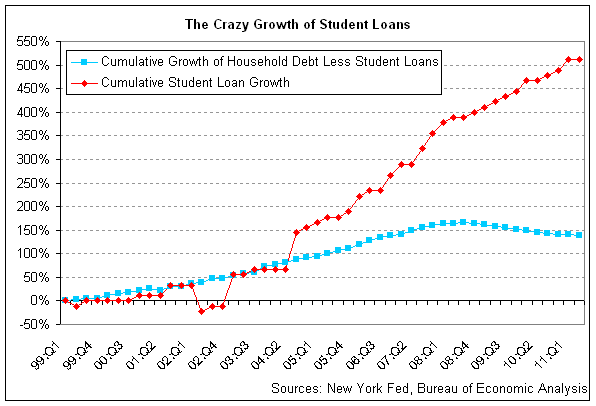

Before saying how great this is think of the millions enrolled in for-profit paper mills that are basically giving you a piece of paper for tens of thousands of dollars. The risks are getting large and larger. The debt explosion has far outpaced the growth rates of any industry including the insane housing market. Even in a decade where US households went debt crazy, student debt growth went on a separate and even more insane path:

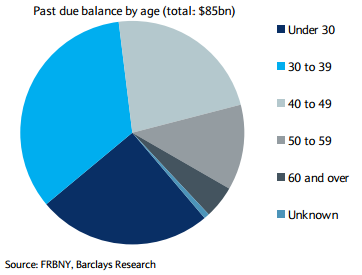

A large part of the growth has happened in the last decade when many young Americans are opting to go to college. Yet are they doing this modestly with degrees that have some value in the marketplace? College of course goes beyond the degree you get and many argue there is a signaling impact as well. Yet the market is speaking otherwise. And with college costs at many private 4-years institutions at $50,000 a year you better ask what the return of your degree is going to be. Much of the debt is being taken on by the young:

Of the $85 billion in past due student debt, over 66 percent comes from those 39 and younger. Some of the more troubling aspects:

“(SoberLook) Barclays Capital: – The Federal Reserve, with the help of Equifax, created an extensive data set providing a snapshot of student debt in Q3 2011 that was released in March 2012. According to this study, 14% of all borrowers had past-due balances, and 27% of those who had entered the repayment cycle had past-due balances. Almost half of all student borrowers were not making payments; 47% were either still in school or in deferral, forbearance, or grace periods as of Q3 2011. This means that a significant number of borrowers who are not currently in repayment are set to enter the payment cycle in the next few years. Given the weak labor market and increasing dropout rates, there is little reason to think that their delinquency rates will lower the current national average.â€

Just another bubble gearing up to burst in the debt machine we know as our higher education system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Rachel said:

I think a large part of the problem is that most parents and grade schools emphasize education as part of getting a job. While this rang true in large part for other generations, it simply isn’t the case today and people need to accept this and then make the moves that will pay off for them. Not taking this into account and still going for the major in art history (and similarly non-profitable majors) is downright dumb unless you’re financially well-off.

Even worse, there are people who willingly allow themselves to be badgered by for-profit schools or choose to attend schools where their work doesn’t transfer. At the very minimum, if that schools credits don’t transfer to other possible schools you’re thinking of attending within the next decade, forget them and find a REAL school. Also, people need to get off of this online college kick, that’s getting a lot of people into debt at for-profit mills.

Many have been told all their lives verbally and non-verbally that if they get a degree they’ll be comfortable financially. Millions are seeing this myth shatter in their faces after years of effort.

July 14th, 2012 at 2:08 pm -

beresponsible said:

Lets face, if you can’t afford it, you don’t deserve to go to college. Nobody is entitled to college nor is it worth it going deep into debt.

HS graduates need to be realistic and financially responsible in their decisions. That and no worthless or fun degrees or party schools.July 26th, 2012 at 3:16 pm -

chris said:

When you can see a crisis developing, the prudent thing to do is take evasive action. The government should be tightening standards for student loans. I do not see them acting responsibly in this area. It will blow up in our faces and the govt will bail out the borrowers. You can watch this train wreck happening in slow motion.

March 27th, 2013 at 4:46 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!