Refinancing debt into prosperity – most mortgage activity for refinances with applications up 97 percent from last year and car sales are down by over 50 percent from 2001.

- 0 Comments

Shuffling papers around on your desk does not mean you are being productive but might give the appearance of activity. Refinancing debt in countries in an insolvent position may feel good for the moment, but ultimately the position is unsustainable.  You buy yourself a window of opportunity. With the Federal Reserve pushing mortgage rates to historical lows and allowing banks to borrow at virtually interest free terms, the market is creating a window of time to exit this mountain of debt. Is this even feasible? Not likely and millions of Americans have already lost their homes via foreclosure. Many are using the current opportunity to refinance debt but is it stimulating real economic activity? If we look at some data, the current housing boom in the headlines does not look so mighty.

The hoopla in the housing market

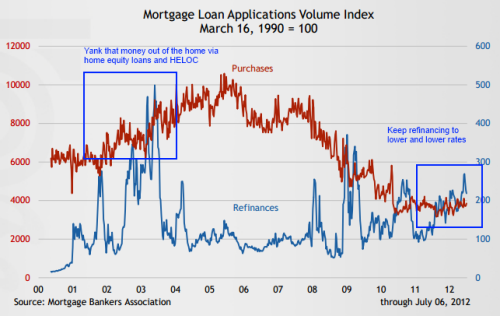

It is interesting to take a look at mortgage loan application data. Applications for refinances are up 97 percent for the year:

Yet look at the purchase data. We are near the bottom. So where else are the home sales coming from? A big portion of the sales are coming from investors and many times they purchase homes without mortgages so they do not show up in the above data. Yet the big jump in refinancing activity is essentially just freeing up money for people that already own a home. This is good for those that can take advantage of the low rates created by the Federal Reserve but housing demand is not as robust as it would appear in the mainstream press.

The housing market is struggling because Americans are in a tough economic situation. The employment situation is still very fragile. We still have 46,000,000 Americans on food stamps and another 1 out of 6 are receiving Social Security benefits. Another one out of three has zero in savings and is unlikely to be prepared for the years ahead in retirement. The picture of retirement is likely to include work. Shuffling employment numbers might look like something is happening but the recession is still very much alive for many Americans.

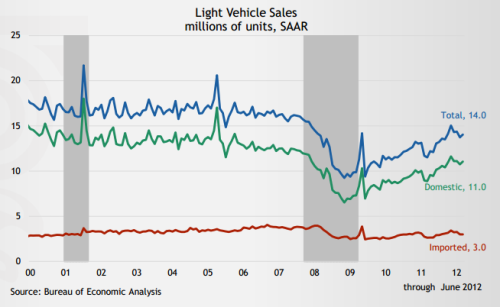

Let us examine vehicle sales:

At some point in the insane bubble days we were selling well over 20 million vehicles a year. This figure was reached in 2001 and 2005. Those days are long gone. Even today with massive incentives and additional perks we have managed to get back on pace to a 14 million annual sales figure. Not bad but we are still lagging the 2001 figure by over 50 percent. In 2001 gas was under $2.00 a gallon. Today gas is over $3.50 a gallon yet wages are actually lower. Is it any wonder why vehicle sales have fallen so dramatically?

The working and middle class is being squeezed. Since the debt bubble popped, most of the bailouts and proposals to fix the problem have revolved around reshuffling or refinancing debt. Take Greece and Spain for example. Bailout after bailout is basically providing additional time for the country to create a GDP pace that can never catch up to the insurmountable debt on their books. This window of opportunity is really to provide the large banks a window of time to exit stage left while someone else is left holding the bag.

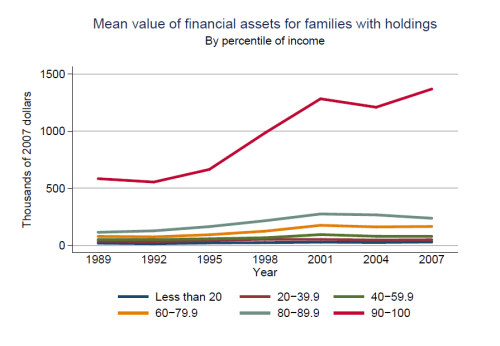

The reshuffling is happening but some are making out:

Only the top 10 percent have really done well over the last few decades (more to the point, it is really the top one percent that has scored major net worth gains while your average family has seen their net worth plummet by 40 percent from 2007 to 2010). The economy has become one giant game of denial. Does anyone believe we’ll ever payback the $15 trillion in debt we owe as a nation? To the contrary, we are going even deeper in debt. Europe is simply extending more loans to countries that simply cannot produce their way out of their massive obligations. Banks do not want to negotiate so they rather squeeze the public dry. Like the first chart, we are in a refinancing fury but not much is really changing. It appears some are opting to believe in the refinancing to prosperity mantra.             Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!