Opting out of the workforce: Federal disability payments and the rise of those not in the labor force. Since 2000, those on federal disability insurance are up 66 percent while population is up 13 percent.

- 5 Comment

The number of Americans receiving federal disability payments has doubled in recent decades. One reason for this is the aging of our workforce and the reality that with older age, more health problems occur. This only explains part of it. There is evidence that 40 to 60 percent of the recent rise has to do with structural issues where those in low wage employment sectors simply opt out of the labor force via federal disability payments. It shouldn’t be shocking when you realize that the typical American worker takes home about $27,000 per year. For example, in 2000 we had about 6.6 million Americans on disability insurance. Today it is close to 11 million, a rise of 66 percent while the population increased roughly 13 percent. Something more than old age is contributing to this massive jump in federal disability payments. With a large low wage employment sector, you simply have more people opting to not work instead of earning a very low wage. The estimates of 40 to 60 percent seem to be right given the major discrepancy between population growth and the rise of those on disability insurance. Unfortunately this is a trend that is appearing with our “not in the labor force†growth over the last decade. Many are simply opting out of the workforce.

The rise of federal disability payments

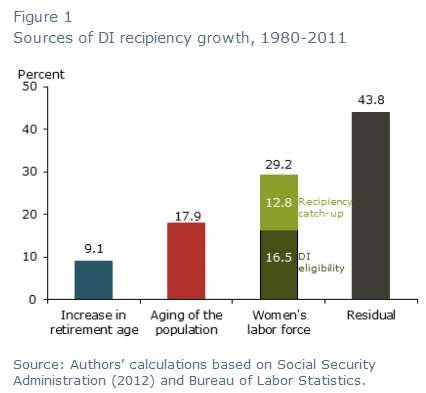

The Great Recession has caused massive structural changes to our workforce. For many workers, it is now a case where the only option available for work is in the low wage employment sector. Since in some cases being qualified for federal disability is subjective, many more are opting out this way. The Fed had an interesting study looking at the reasons for the growth in disability insurance. Part of it does have to do with an aging population. But a large part of it has to do with the residual impacts from the Great Recession:

“(NY Times) The government likes to describe the increase mostly as the result of two demographic trends. Americans, on average, are getting older, and old people are less healthy. Also, as more women have entered the labor force, the share of female workers with health problems has climbed closer to the male average.

Independent experts, however, see substantial evidence that disability insurance increasingly serves as a safety net for people who cannot find jobs – people, that is, who might still have the ability to perform at least some kinds of work.â€

This chart is interesting. About 44 percent of the rise in disability insurance has to do with residual effects. This is fully understandable given the large rise in our low wage employment sectors. But is this healthy for the economy? Is it a good thing that disability insurance is growing at a time when many are now entering retirement age and drawing on Social Security? Many Americans are old, broke, and simply unprepared for retirement.

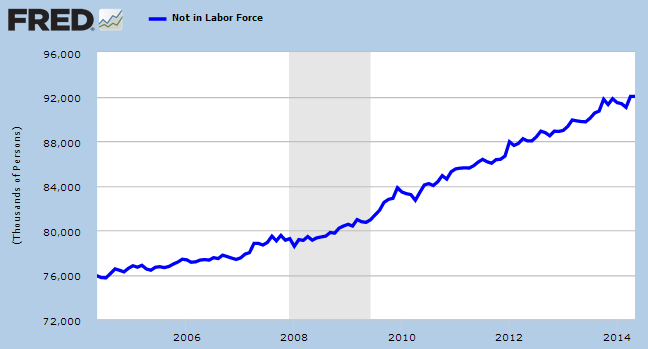

Another trend that seems to be hitting harder is the massive increase in people not in the labor force:

Since the recession started, we have added a whopping 13 million Americans to the “not in the labor force†category. While this is a footnote in unemployment reports, this is also a big reason for the actual decline. Have a smaller workforce.

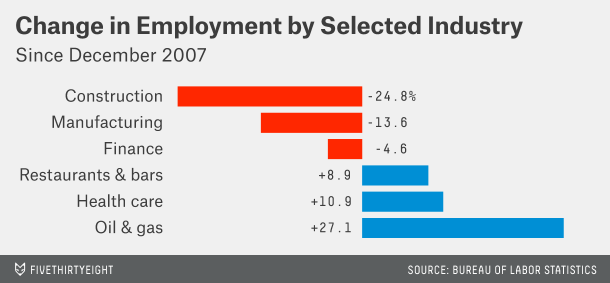

Looking at employment growth also helps to shed light on what areas of the economy are growing:

Construction and manufacturing are still having a tough go at it. This makes you wonder if the rise in disability payments also has to do with the fact that many of these were manual labor jobs. Building homes may not have a direct transferable equivalent if we are suddenly going into a low wage service sector economy. However, with the current financial structure in place we certainly have a demand for more affordable housing. We can put a large portion of this group back to work if we didn’t incentivize banks to trade homes with one another instead of helping Americans with buying their family a home.

The sectors that are increasing include food, health care, and energy. Inflation is eating away at those with fixed incomes, including those drawing disability insurance. It is troubling to see so many opting out of the workforce. There is something larger going on here. Many Americans are simply unable to find work in this current economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

roddy6667 said:

Disability is the new welfare. There is an army of lawyers out there to get you on board the gravy train.

Even if you only get $1000 a month it is tax free because it is insurance. You also get total insurance coverage for free-no monthly payment, no deductible, no anything.

You also qualify for housing assistance, food stamps, etc. If you take a small baby-sitting job for cash, you end up with more than half the people in the US who work.July 1st, 2014 at 4:16 am -

A Minch said:

I have worked in the mental health field 15 years. I can tell you for a fact that probably 2/3 of the people collecting SSI for “mental disorder” really don’t qualify – they’re drug addicts and people with personality disorders, a type of mental un-illness that is a clinical, nice way of describing assholes or people that aren’t sick but just plain odd. Many of these are chronic criminal types who the prisons don’t even want anymore, so the prison psychiatrist deems them “bipolar” and they are given SSI as they leave the prison, a sort of bribe if you will so they have an income and incentive to stop getting into trouble. It’s also overwhelming the public mental health system so badly, that the truly needy with legitimate mental illness can not get the services they need. SSI is the new welfare.

July 1st, 2014 at 7:29 am -

Arizona said:

WHY on earth would a country of BLOOD THRISTY killers want to help their own people ,WHEN they can take that same money and use it to bomb out villages in countries ,NO ONE EVER heard of,KILL all their children and totaly destabize the life they once had,HEY maybe if we spend enough money on bombs and war,THEY’ll get together and NUKE AMERICA,boy the people in america would really enjoy seeing dead people in every street wouldn’t they?maybe even their own children BLOWN TO BITS all over their side walk……………

July 1st, 2014 at 10:47 am -

Mary Brown said:

You DO NOT get free insurance on SSDI, SSI goes on local medicaid if they qualify. SSDI I pay the same medicare payments anyone else would if they retired.

And yes I am one of them who is not faking it, I have had back surgery once and need it again, facing neck surgery, had rotator cuff twice on the right, carpal tunnel twice on the right, right knee and now it needs replacement, also had left hip surgery. I live on pain meds so if you think it is fun and easy try again.

SSDI is insurance I paid for from my paycheck for 27 years, I earned it. Those on SSI are basically on an extra form of welfare they can collect on top of regular welfare. So before making comments make sure you know the difference between SSDI(earned) and SSI(unearned). SSDI puts me on medicare, people on SSI go on whatever medicaid the state they are in offers.

July 1st, 2014 at 5:25 pm -

maria said:

I know about 20 people on SSI who also work under the table.

One woman is on SSI for her legs, telling them she can’t walk— and yet she runs six miles a week.

There is a ton of fraud going on. She gets Medicaid, in home services (more payment for being unable to walk–yet she runs six miles per day)

She cannot afford to let go of her free, Medicaid, and chooses not to work at all. She babysits for cash.

There is no way she wants to get a paying job like at Safeway, she would lose a bunch of free benefits.

July 3rd, 2014 at 6:38 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!