Old, broke, and financially unprepared for retirement: Many older Americans are simply unprepared for the costs associated with retirement.

- 10 Comment

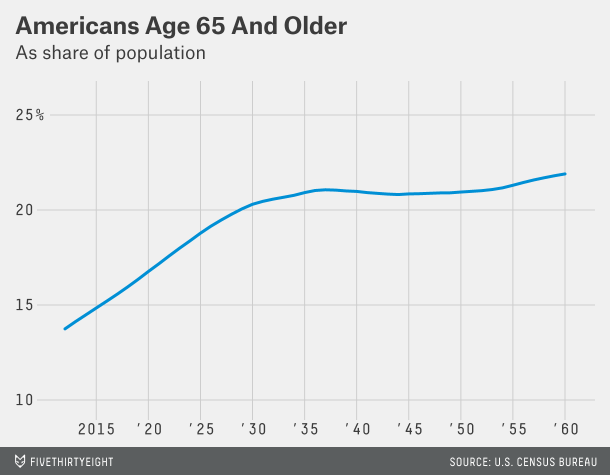

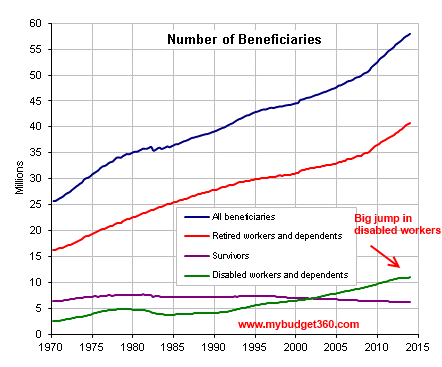

America is graying out. The massive cohort of baby boomers are now entering retirement age at a rate of close to 10,000 per day, or roughly 300,000 per month. Many are fully unprepared for the challenges associated with retiring and living a life where work income becomes a smaller source of support. The workforce during the last decade has added many lower wage jobs and this has added to the challenges of adequately saving for retirement. Saving takes work, patience, and enough disposable income to stash away. The facts are simply disturbing here. Most Americans entering retirement will rely on Social Security as their primary source of income. Since Social Security payouts come from current workers, those young lower paid workers are going to face a growing burden. This is all documented yet many Americans are entering old age fully unprepared for the economic challenges they will face. Healthcare costs are soaring but so are food costs, energy prices, and housing costs and all of these will be eaten away if your fixed income does not keep up.

The graying out of America

I’ve noticed over the last decade a larger number of older Americans working at what would be minimum wage jobs. Part of this is that the workforce is aging but also that many are simply unable to get by with their Social Security payouts. Social Security benefits are relatively little compared to the current cost of living. Also, Social Security was never intended to be the main source of retirement income when proposed. It was suppose to be a supplement to retirement savings, pensions, and then Social Security made up the final leg of a well rounded retirement plan. As you know, only about 10 percent of Americans now have access to a pension and only half of Americans own any stocks at all.

A larger portion of our population is hitting retirement age:

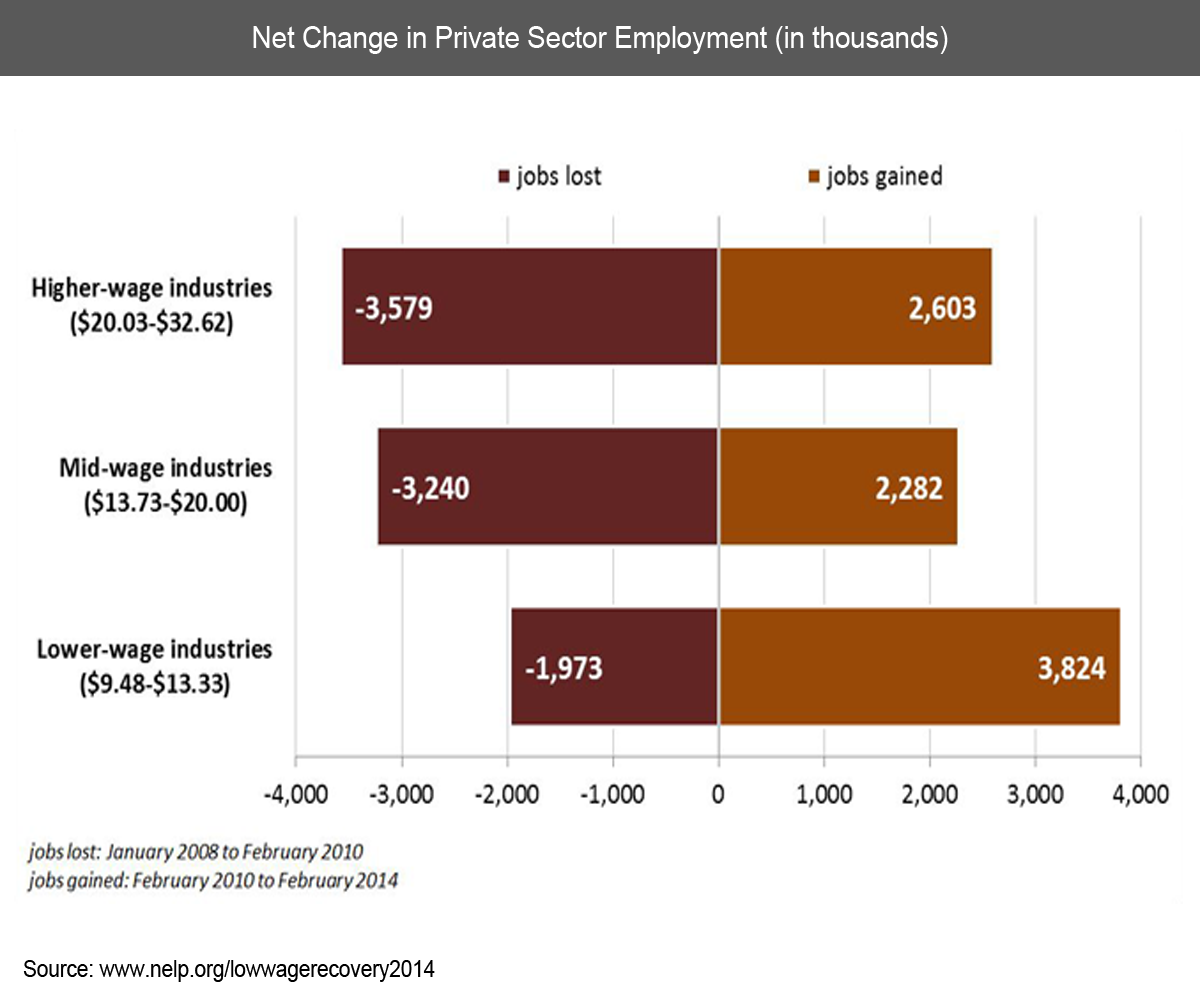

This trend is only going to continue. What is troubling is that most of the jobs added since the Great Recession ended come from the low wage employment sectors:

Source: NELP

“For example, 3.6 million higher-wage jobs were lost due to the recession and only 2.6 million jobs in this segment have been added back. We are in a net-deficit of good paying jobs by 1 million. On the other hand, we lost 2 million low-wage jobs during the recession but have added 3.8 million lower-wage jobs during the recovery. A net add of 1.8 million lower-wage jobs.â€

This is troubling given that active workers support the growing number of people on Social Security payments. More of a burden is being placed on a population that is largely unable to support the growing needs of an aging cohort:

“For most people, they are going to have to wait until they hit 67 before they can draw full benefits. This is why it is becoming more common to see older workers at places like Target, Wal-Mart, or many other retail establishments. People need to supplement their benefits with other income. Not exactly the ideal notion of walking on the beach with Margaritas riding into the sunset.â€

The stock market although reaching a peak this year, is not really reflecting what is going on with Main Street USA. You have to wonder what this is going to do in politics since younger voters have at times diverging interests and needs from older Americans. In the end, both groups need support and it would be better to understand that both young and old Americans have their own set of economic challenges. Young Americans are worried about college debt, low wage jobs, and access to affordable housing. Many older Americans are worried about rising healthcare costs, retirement savings, and being able to have enough as inflation causes prices to rise.

This is going to a big challenge for America. Many are getting older, poorer, and there is really no bailout to the passage of time. These challenges will arrive. Many are simply living day-to-day and paycheck-to-paycheck so the inevitable is likely to become reality.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

Michael Rivero said:

What they are really unprepared for is that the US Government took all that Social Security money out of their paychecks their entire life, “borrowed” it to spend elsewhere, and now can’t pay it back.

June 27th, 2014 at 9:51 am -

robertsgt40 said:

Any pension, public or private, is only as sound as the entity that sponsors it. There is zip in the SS “trust” fund. It was looted decades ago. It is insolvent. Private companies won’t be that far behind when markets implode.

June 27th, 2014 at 10:16 am -

Rottweiler said:

Retirement? Don’t get too optimistic. Your government is broke and will cut all benefits like social security, welfare, food stamps and if necessary remove the money from your bank account. Every expert in economics can verify the aforementioned. What’s the surprise? It every man for himself. China and Russia are not intimidated by the West. They are taking care of their citizens militarily and economically while the leaders in the West are stuffing their personal pockets first. Of course corruption is universal, except for the fact that the Chinese and Russian crooks always throw some cheese to the mice. The rats in the west won’t share. Meanwhile the citizens who elected the mentally deranged politicians that created the S that is about to HTF, are faced with a disaster of unparalleled proportions. All the political and economic indicators point to the inevitable conclusion that sooner, not later the S will HTF. If you’re intelligent enough to understand the acronym you have the possibility of mitigating the nasty circumstances your politicians have created. The citizens voted these mentally disturbed beings into office and are partially responsible for the deadly mess they are faced with. Now

you want to know how to survive. Or maybe your head is still deeply stuck up your own ignoble orifice, and you actually think that Uncle Sam is going to be there to change your pants when the SHTF. No, no, when you find yourself starving you’re going to need uncle spam not Sam, and much more. Get a manual written by a Russian who survived the implosion of the Soviet Union. This is written for Americans who are about ready to be left up the river without a paddle. Believe me, this is cheap or free at AMAZON, it’s called Yankee Anti-Zombie Survival Manual, it gets right down to facts, 101 rules to save your self and family. This Russian has seen and smelled TSHTF in his own country. Only experience can be transferred. Read and survive.June 27th, 2014 at 10:50 am -

Stibbs11 said:

Its not that people did not setup a retirement fund or IT failed to provide.

Its that the dollar is now worthless, look at all the retirement funds that have been closed, 401K’s that failed, stock brokers that made money while MAKING OTHERS “BROKER” THAN THEM.

Anyone who did not put their hard earned dollars into gold or silver lost money every year ! ! ?

What part of this do you not understand?

June 28th, 2014 at 12:13 am -

Lucille Rothstein said:

Maybe they should have worked harder when they werre younger. Maybe they shouldn’t have spent their money on frills, and invested. That all sounds like personal responsibility being placed to the side while young and then crying when your older that you don’t have anything. Wal-Mart is hiring old people, get to work! Like everybody else!

June 28th, 2014 at 9:03 am -

Brian said:

The Social Security fund was spent into nonexistence by President Reagan, to offset some of the national debt that he doubled by borrowing to fund his so-called military build up that was in reality a make work program. Republican politicians and their banker and corporate sponsors have been trying to eliminate Social Security to divert that money into investments, and then into their own pockets. Those that voted for that senile Hollywood B-movie actor are getting the results of being fooled now. How do you you like your “smaller government / less government spending” when it means getting your money back from Social Security?

June 28th, 2014 at 12:49 pm -

roddy6667 said:

Plan A: Social Security, pension, savings

Plan B: Greeter at Walmart

Plan C: Throw a rock through the window of the police department.

3 hots and a cot, free medical, free TV and internetJune 29th, 2014 at 2:11 am -

Laurel said:

The destruction of America is intentional and going forward it will only get worse. Be well.

June 29th, 2014 at 3:19 pm -

Ametrine said:

Personally, I like to go to the line of an older, more experienced person when I’m checking out. They are generally more courteous and professional and actually N-I-C-E! They give service with a smile and will small-talk with your child.

That being said, I’m concerned for those senior citizens who are in poor health and are struggling to do the job they have. I don’t like to see someone who looks to be at death’s door pushing a cart full of re-stock.

I once heard that you can measure a country by how they treat their most vulnerable citizens-the young and old. Will America measure up in the long run? Only each person can answer this. What do you do to help the young and old near you?

June 30th, 2014 at 3:54 pm -

Thomasina said:

@LouiseRothstein (who no doubt inherited money and was never a single parent/single wage-earner) lol. That’s rather harsh, Louise!

(See the section below re: early employers who didn’t pay my SS taxes and then closed up shop and I didn’t know, and the joys of getting sacked when you know too much about a crooked company run by a well-connected Republican and are trying to take care of your seriously ill Mom in a state that can ignore FMLA because they are in a “right to work” [read: right to be fired for knowing too much ] state.

Anyway, that being said,

I checked out the Yankee Anti-Zombie Survival Manual and it seems well worth the money.heh. But I’m one of those rare animals who doesn’t own a Kindle and I’ll have to get my sister to download it.

The author makes sense, but it’s hard for this optimist to swallow…sigh. Not to mention it stridently argues against any and all spiritual teachings I have embraced.

I’m one of those old biddies who have zero dollars in any savings account..no wait..I have a couple hundred bucks, and even though I “own” 3 houses (2 whole houses plus 2 half-houses owned jointly with a family member, one of which is currently uninhabitable in the mountains–house, not family member). I owe approx 160k in cards and (mostly) mortgages. Had it not been for the love and foresight of our incredibly savvy but, sadly, now deceased Mom (who never earned more than $25k in any year of her very long life as sole family breadwinner) I would be up that creek we all are talking about. God bless Mom!

I’m living in a house of cards and I am only too aware of that. My SS check is laughable, since at least 3 employers I had early on simply didn’t pay the SS taxes withheld (nobody was checking back then, or sending us those nice SS estimated benefits statements we get now) and those guys are now dead probably and definitely out of business.And I was forced to refi my home during that “just sign the paper” heyday of the mortgage bubble (after losing my job for no reason other than that I discovered that the company I was working for was hiding my commissions and was evading taxes and money-laundering, but that’s another story) to take care of Mom for the last years of her life.

But I have had a strong suspicion for a while that it’s time to sell one or two houses, pay off the mortgages and hide the rest in my mattress in gold and silver bullion –no wait…maybe hide it in the wheel well in the trunk of my car. But, sadly, my main fault, other than incurable optimism, is that I’m a procrastinator. I can only pray that my recent anti-fatigue discovery, massive doses of B12, will be my salvation.

Other than all this, I’m good. 🙂But other things that contribute to the sad state of our nation’s affairs and which I don’t understand are:

Why do all those people on SS disability never get reviewed or observed to see if they are faking it? How come that just because a lawyer was involved they get to receive full benefits like..forever, even when they are known to be working because they REPORT it, and still are considered eligible? Insurance companies paying disability check on the recipients all the time in cases of “alleged” disability that really isn’t. SO why doesn’t the SSA?

We all probably know someone who is receiving SS disability yet works, earns a nice income for the “allowable” time each year in addition to his disability income, and then takes a vacation to continue to remain eligible for a SS disability check. Yep, that’s the law and they’re allowed to do it. How come?

[In one example, I know someone who had a “bad back” disability and is currently preaching the Bible to prostitutes, walking the streets all the time, yet she had surgery to fix her back several years back and is doing just fine now. How come she is still receiving disability checks? Is SS really that dependent on the honor system of reporting? ]And how come Medicare vendors are allowed to charge –and often are paid–ridiculously high prices for stuff that is so marked up it borders on theft?

And how come hospitals were allowed–and are probably still allowed– to charge HUGE amounts to individuals who have no insurance or insufficient insurance for catastrophic illnesses and totally screw up their credit when they can’t afford to pay, and yet they cheerfully negotiate gigantic discounts with insurance companies when someone is “covered” by insurance? (this of course is mentioned because of the devastating impact it has on individual people’s budgets because the government doesn’t address this hole in the system).

And why do public servants who are removed or resign in disgrace from office still get their pensions and benefits?

And why are we financing Michelle Obama’s apparently frivolous world travels with her extended family and drunken security guys to the tune of millions? (Which could be better spent on expanding school campuses that are fast becoming trailer parks.)

And is ANYBODY with a brain going to buy ANYTHING from Hobby Lobby now? (Did you know that their retirement fund is heavily invested in contraception companies? Guess they’re going to see profits go up up up now that folks will have to pay un-negotiated retail prices for birth control. Sheesh. Check out Mother Jones website for the facts).

Just a few of the things that pop up in my head every now and then. I don’t know how all these things actually addressed AND corrected would affect our bottom line, nationally speaking, but, anyway…

Happy 4th of July! God bless America! (such as it is)July 3rd, 2014 at 10:03 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!