The looming retirement train wreck: Pension issues, lack of retirement savings, and extending the date of retirement all part of the current economic future.

- 0 Comments

The concept of retirement is a fairly modern one. In fact, we can argue that only one generation actually got to enjoy a long and relatively healthy stay in retirement over a mass population. For most of history, life and work went hand and hand and people retired essentially when they keeled over. The only people that had any semblance of retirement were the small wealthy elite. The massive middle class in the US that emerged after World War II seemed to sell the concept of retirement to all. Long endless walks on some unnamed beach followed by bottomless margaritas. This dream seemed like a fantastic vision but they never really specified how all of this was going to be funded. It probably isn’t attractive to talk numbers with people especially when pitching this giant dream. As it turns out, in the early 1980s when companies started easing people off of pensions and into self-funded options like 401ks and IRAs the stock market was on the verge of a major long-term rally. Save a few hundred bucks per month and you would have millions for that picturesque retirement. Here we are nearly a generation later and that plan has ended in complete disaster. People did not prepare and save (or could not save) because of the rising cost of living and real stagnant wages. Since we can’t reverse time, many are now going to rely on Social Security for that retirement dream. We have a major problem when it comes to the future of retirement here in the US.

The paltry amount saved for retirement

Long walks on the beach and gourmet meals at restaurants will cost money. Even staying put and eating in is not going to be cheap. Own your house? You still need to pay utilities, buy groceries, make repairs, pay taxes, insurance, and still fork over money to keep things going. People also tend to forget that for most, medical care costs tend to soar during the later years in life.

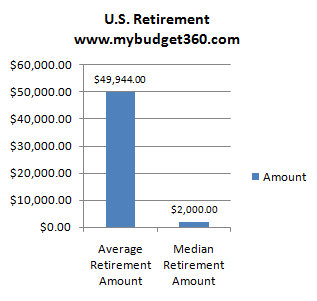

So when we look at how much money people have saved it is somewhat startling:

Across all working age Americans, the median saved for retirement is $2,000. The average amount is close to $50,000. The average is a poor metric because it takes into account the few outliers with millions. The median shows us where half of people fall below and above and the picture isn’t pretty.

Since we have a massive cohort of Americans entering retirement age everyday having decades ahead to right the ship will no longer be an option.

Greater expectations

Americans are shifting their expectations accordingly:

Back in 1996 when non-retired Americans were asked about retirement, many thought they would retire when they hit 60. As you can see from the Gallup survey above the age has slowly climbed each and every year to the current age of 67.

Perceptions mean a lot when it comes to retiring. For many, opting to retire means electing to not work. So it is also interesting to see when current retirees decided to retire:

One thing is certain and that is retirement is becoming a tougher option to do at a younger age. And why would this be a shock? Most Americans are using Social Security as their default income source. I didn’t see the blue beaches and margarita ads in my Social Security annual statement.

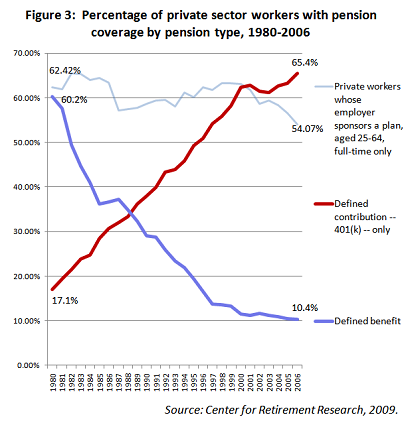

A large part of this is that forced savings like pensions are now long gone relics of the past.

Bye bye pensions

Back in the early 1980s roughly 60 percent of workers had access to a pension:

Today this number is less than 10 percent (the chart above only goes out to 2009). You also see the rise in self-funded defined contribution plans taking over starting at the same time. Yet people have clearly failed to adequately save. Part of this stems from inflation eroding wage earnings and people living hand-to-mouth just to pay bills. Those that did save, did not put enough away. The current situation has created a retirement disaster in the making. Millions are now fully retiring on a strained Social Security system as their main source of income. In other words those dreams of endless beach walks were only that, a dream to go along with the slow decline of the middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â