Sticking it to Millennials and young Americans when it comes to wealth: Households headed by those 40 years old or younger see inflation adjusted wealth 30 percent below 2007 levels while older Americans recoup losses.

- 1 Comment

The evidence continues to mount on the deep pangs of financial pain faced by younger Americans before and after the Great Recession. The Federal Reserve Bank of St. Louis posted wealth information and what we find is that for those 40 years old and younger, there has been little recovery since the recession ended officially five years ago. Younger Americans were exposed to housing closer to the peak but also, did not partake in the rapid rise of the stock market which is really the domain of a small portion of the population. What is problematic with this situation is that we have a major challenge ahead of us when it comes to retirement because so many older Americans are depending on Social Security for the bulk of their retirement income. The recovery in wealth for older Americans largely is coming from the housing market moving back up. Yet the housing market is not the equivalent to an annuity or a job. There still needs to be some income coming in for items like food, health care, and probably supporting kids with higher expenses from expensive colleges and lower paying jobs. That will be an issue given that the older retiring population will depend on the active incomes of those working. The young have seen a massive hit to what little wealth they had.

Young continue to face challenges in recovery

There have been studies highlighting the importance of starting a career in a good or bad economy. The earlier you start and the better the economy, the more likely someone will be on the path to building wealth. This makes sense. You have income to save, buy a home, and also build skills and networks that will serve you well as you move up the ladder. However, a large portion of the work post-recession has been in the form of part-time work and low-wage work which has boosted corporate profits but has hurt those actually working.

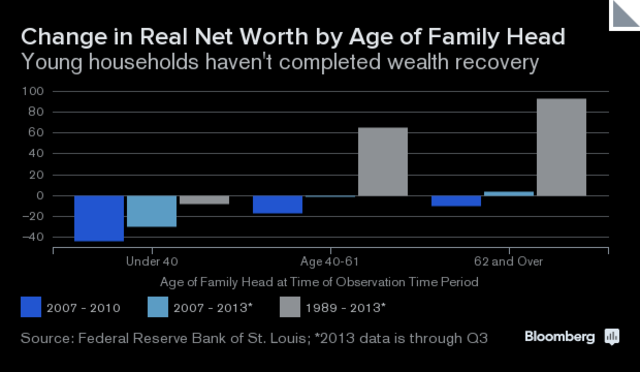

Wealth is definitely an important metric when it comes to financial success. For example, there were many real estate brokers during the boom making six-figures a year and living high on the hog. After the housing crisis and the Fed owning the mortgage market, those jobs disappeared. You have a handful that saved and were prudent to know the big incomes were likely to evaporate. But most spent every penny they had. The end result is a negative or low net worth. The macro-economy is largely out of the hands of your young college graduate. The last decade has not been kind on younger Americans when it comes to wealth building:

This is a very telling chart. For those 40 years old and younger, inflation adjusted wealth is still down by 30 percent since the recession hit and ended. For those 40 to 61, the wealth gains barely register on the chart. For those 62 and older the gains are there but they are not spectacular. It is wrong to think that just because older Americans are doing better than younger Americans that they somehow are in a good financial situation. Social Security data clearly shows that older Americans will be depending largely on Social Security income for the bulk of their income in retirement. Social Security was never designed to be the major source of income for older Americans.

The true wealth divide is at the top

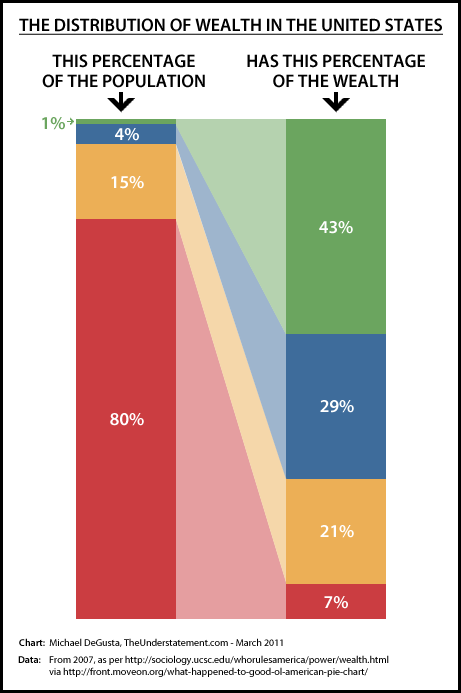

In reality the true divide in our country is happening at the top. Take a look at wealth distribution in our country:

The top 1 percent control 43 percent of all available wealth. The top 5 percent control 72 percent of all available wealth. The bottom 80 percent only has control of 7 percent of total wealth.Â

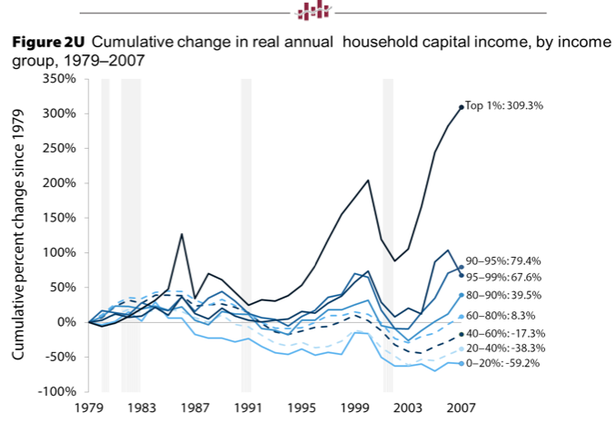

This is a big problem and with low-wage jobs making up the bulk of new jobs for younger workers, the rode to building wealth is only going to get much tougher. Not only is the inequality expansive with wealth, it is also reflected with incomes:

Take a look at real income gains over the last generation. For 90 percent of the population, real annual income barely kept up with inflation (if at all). For the bottom 60 percent in our nation real household incomes actually fell. The real gains start to be found in the top 10 percent. Yet where we see the massive divide is at the top 1 percent. Real incomes are up 309 percent for this group while for the bottom 60 percent of the US, real incomes are down and down significantly from 1979 to 2007.

Many are living hand-to-mouth and it is no surprise that we now have a looming retirement disaster coming to shore.  The young have shouldered a large part of the Great Recession but as you can see from the data, the bottom 90 percent of the US has actually faced challenges in keeping up going back a generation. There are consequences in losing a strong, educated, and financially literate middle class. D.C. and Wall Street are looking out for their own interests and the population is poorer because of it.

Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Nichole said:

The most difficult part of this “recovery” for millennials is the job market. They are forced to work for “pennies on the dollar” to compete with older experienced candidates that are are working longer and for less money.

When these millennials do find jobs with equitable pay the company undergoes major changes within just a few short years and they end up unemployed. As a millennial myself I have moved 5 times since 2008 to stay employed. I stopped working because my husband has been relocated due to consolidation within his industry. It is impossible make commitments to an employer when you end up moving in a year or two and it makes you look “flaky” on a resume.

Companies are merging, buying and selling so quick these days. They have no allegiance to their employees as most often give 60 days notice this is happening. It is simply disastrous to any young couples’ ability to build wealth. And its tiring.

How can the government expect such an unstable generation to carry the burden of an older generation with programs like ObummerCare. These people in government are so far from reality it is aggravating. They have never created a job in their life own borrowed from one generation to the next siphoning off a big portion for themselves in the process.

Since our younger generation is so educated and indebted with indoctrinated beliefs maybe they can come together to fire these tyrants in Washington that are ruining our country. We need a restoration of our founding principles. We need people who know how to fish and do things for themselves. Sadly, I know my generation will be learning the old ways of our great grand parents that lived during the depression. I do not think this is a theory. It is a mathematical fact.

Failing to plan is planning to fail.

April 17th, 2014 at 12:39 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â