The perpetually depressed American consumer: Stock market high and bounce in real estate does not assist in boosting consumer confidence. 57 percent of Americans think economic outlook is getting worse.

- 1 Comment

Looking at the stock market and real estate prices would lead you to believe that the economy is recovering at a healthy clip. The underlying conditions of the economy may benefit the financial and real estate sectors (both live off each other) yet for most American families conditions are not rosy. In fact consumer confidence since 2000 has never recovered fully. Two mega-bubbles will do that to you. It could be that people were irrationally exuberant in 2000 but wasn’t the housing mania of 2005 through 2007 also exuberant? The big difference of course is that the housing bubble was largely masking the decline of the middle class while in 2000 wages were reaching their inflation adjusted peak via actual employment income. So Americans had a right to feel giddy at this point since their income reached a “true†high. It is no surprise that many Americans have little faith in their political system run by millionaires that simply bend to every whim of lobbyist and powerful corporations. Is it then a surprise that the latest Gallup poll shows that 57 percent of Americans feel that economic conditions are worsening? What is going on if peak stock values and a boom in real estate values no longer bolster the confidence of the American consumer?

2000 peak in confidence but also peak in income

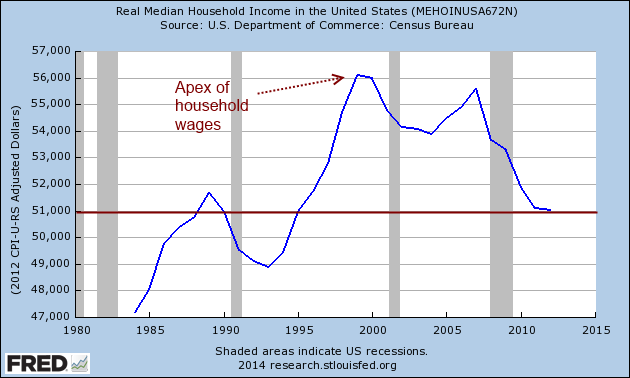

Some may recall from memory the days of the year 2000. The economy appeared to be booming on all fronts. Things were so euphoric that we were getting calls for DOW 30,000 and such other hyperbolic predictions. Not all of the noise was fake however. Household wages reached their highest inflation adjusted levels. Americans overall felt wealthier because in reality they were. They truly had stronger purchasing power.

The euphoria of this time derived by good paying jobs and a low and real unemployment rate gave us very healthy confidence numbers:

It can be said that overall, Americans reached a peak in economic confidence back in 2000 and one that we have yet to retouch. Even though the stock market is reaching new highs much of the gains are driven from massively cheap money from the Fed to the financial sector and large organizations slashing and burning through the rank and file while boosting pay at the top. You’ll notice that from the chart above, not once have we come close to reaching the days of 2000. Incomes have gone in the full opposite direction showing that stock gains have not trickled down to the public.

For most families, income is the biggest indicator of financial health. So it is no surprise that consumer confidence peaked at the same time that inflation adjusted incomes did:

Of course a large part of these gains came from the technology bubble of the 1990s which subsequently burst. You’ll notice that household wages were making another run to the top in 2006 as well during the housing bubble mania. This burst has had a deep impact on the confidence of Americans.

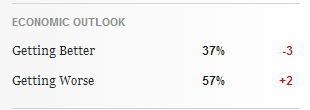

What is troubling is that Gallup’s most recent report on economic confidence shows that 57 percent of Americans feel the economy is getting worse:

Source:Â Gallup

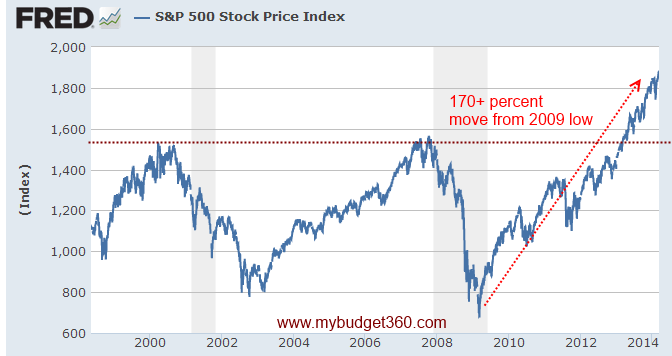

Didn’t Americans get the memo that the stock market is now up 170+ percent from the lows reached in 2009?

Unfortunately most Americans own no stocks. In fact, 81 percent of all stock wealth is held by the top 10 percent. So you can understand why Americans are not enjoying this easy money induced stock rally. What about real estate?

“Since the bursting of the bubble in 2007 roughly 20 to 30 percent of all single family home purchases have gone to investors. A domain once owned by the regular American family is merely one additional tradable asset in the hedge fund addicted world of quick gains.â€Â

This has pushed home prices up in a time when incomes are going down (see above). The net effect is that Americans are feeling poorer because in reality they are. More of their money is being consumed by items like housing, healthcare, food, and schooling. The stock market is certainly not a barometer for the health of US households and this is reflected on the overall mood of the country. No one seems to be looking out for the middle class.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Paul Vechinski said:

The Metro section of the Washington Post says it all today. The Middle Class for the most part pays property taxes, sewer/water fees, etc. . Taxes are going up with increased property values and postponed school and infrastructure needs. Wages are back where they were in 1995. As a result, folks have less disposable income. The 1% has won big time and now it is a race to the bottom. There is no recovery for the most part, yes we have more jobs, but they are poorly paid service jobs. The economy will continue to bump along the bottom until new policy decisions are put in place that favor the Middle Class, otherwise the ultra rich will continue to take more out of the economy.

March 13th, 2014 at 5:00 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!