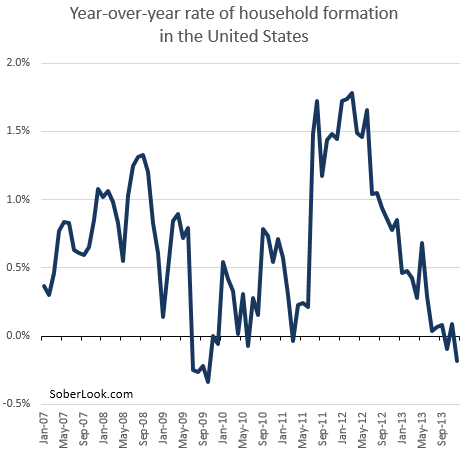

Never leave home generation: Household formation goes negative year-over-year at steepest rate since recession ended in 2009.

- 4 Comment

Young Americans have taken on the brunt of this Great Recession. Since the recession ended, young Americans continue to be saddled with tremendous amounts of student debt. With a weak blue collar sector, going to college may seem like the only viable road into the middle class. Yet one thing is certain and that is, the current younger generation in the United States is either unable or unwilling to form new households. I would go with the former rather than the latter since Americans are fiercely individualistic and staying with mom and dad late into your twenties and well into your thirties does not have a mass appeal. Yet through the fog of debt based euphoria, the economy appears to be recovering for a small segment of the population. Real estate is up largely on the backs of investors leveraging easy money from uncle Fed. The latest figures show that household formation is contracting at the fastest rate since the recession officially ended in 2009. What is going on? Isn’t the stock market recovery an accurate barometer of the health of the real economy? Real estate values going up only mean that you have fast money pushing out regular buyers and also, making rents more expensive for a generation that is already having a tough time moving out on their own.

Household formation contracts

Household formation started picking up when the recession ended in 2009 and spiked in 2011 and 2012. Yet that all changed in 2013. Sure, some will blame this on higher interest rates even though a 30 year fixed rate mortgage can still be had at historically low levels (rates are in the 4 percent range barely hovering above the rate of inflation). In reality what has occurred is that we have become a nation juiced to the gills on easy debt. Younger Americans are largely shouldering the brunt of the $1.2 trillion in outstanding student debt.

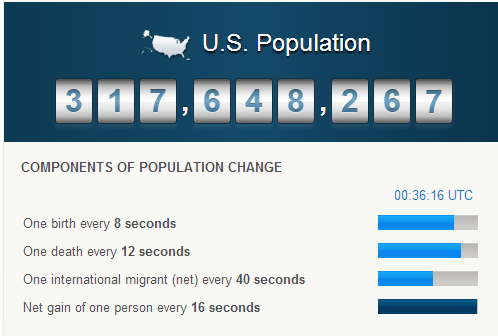

The figures are troubling but also signify some bigger changes in the housing market. First, Americans are not going out and forming households in droves even though the population is growing:

Source:Â US Census Bureau

In fact, household formation contracted in the latest figures from the Census Bureau. Higher prices are being driven by speculation, not real income growth or better job prospects. Rents going up are a reflection of investors pushing prices up and inventory being low thanks to banks hoarding properties and stunting their entire foreclosure pipelines for their own financial benefit. If Americans used the accounting chicanery of some banks they’d be called criminal. The Fed’s $4 trillion balance sheet is predominantly made up of mortgage backed securities, bad loans, and other odd financial instruments offloaded by banks during the crisis.

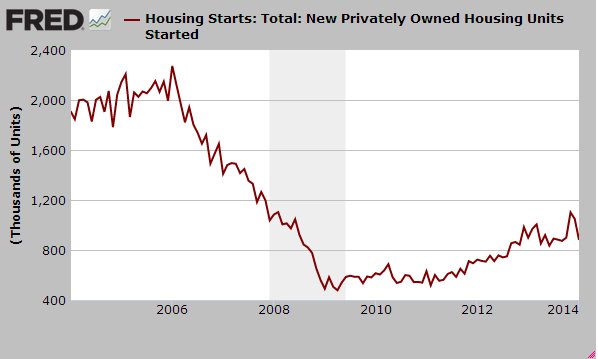

If the housing market were truly recovering on its own and younger Americans were out buying homes then housing starts would be up and up dramatically. That is not the case:

Housing starts are still down well over 50 percent from their peak reached in 2006. Why would you build if household formation is simply not coming to fruition? And why would you build more expensive housing units when many young Americans are having a tough time venturing out into a rental, let alone buying a newly built McMansion?

This is simply a reflection of the real economy and a system that is squeezing out more money out of a young generation already saddled with mega amounts of debt. Take a look at what is occurring in Sacramento for example:

You have more people living at home between the ages of 18 and 31 than you did during the Great Depression! Of course this is all part of the new economic recovery where low wage jobs are somehow the fuel that gets the stock market going up. So much for the ideals of looking out for future generations and so much for the American Dream.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

roddy6667 said:

I used to (as a joke) tell young people to live at home until they were my age. I was 50 then. Then they should put their parents in a home and keep the house.

I was only kidding, but it looks like they didn’t know it.March 7th, 2014 at 8:09 am -

Katherine said:

Since when does a job = the american dream? The persuit of happiness is the real american dream. Sure a job will get you part of the way there but because of the way our system is set up most of us are stuck doing jobs that a machine could do so much better than a human.

We have the technology to make human lives around the planet so much easier but because we are so enamored with old ideas and money all change ends up being extremely slow. Why don’t we choose to utilize automation to its full extent? Why do we continue to place the value of a person on his or her job rather than how that person interacts with other people?

As soon as we get off the “Capitolizim is the be all end all of economy’s.” boat the better.

March 8th, 2014 at 11:54 am -

Steven said:

So here’s the idea. Spread the Fed. Instead of lending interest free dollars through a few bankers hands, lend the dollars to Social Security. Let SSI collect the first two percent instead of the squids, and don’t allow the squids to charge less than double the interest they pay SSI.

It is not like anybody is printing money and carrying paper sacks to twelve regional banks anymore.

March 8th, 2014 at 2:44 pm -

Diane Ryan said:

Katherine, stop drinking the liberal feel good Kool Aid. Government is not going to rescue you and even if it does it will be with money stolen for those who earned it. Forget technology. Instead of whining, become an apprentice and use your hands (plumbing, landscaping, painting, welding, roofing, grounds maintenance and the list goes on). Learn how to actually build something yourself and become more self-sufficient.

We are in our 60s and are building our own house. It will take years but we will do it. You can too but you have to jump in and get your hands dirty.

March 11th, 2014 at 9:47 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â