Why the stock market is a sham for regular investors – Based on historical price to earnings ratios the stock market is overvalued by fifty percent. Only half of Americans own any stocks.

- 0 Comments

The stock market is largely seen as a barometer of economic health to the US economy. Turn on any business program and they report market prices as if reporting on it being a sunny or cloudy day. The financial markets are fully juiced on our current debt based system. Unfortunately it is taking more debt to get minimal returns and the reality is the juicing of the market is simply causing more wealth inequality in our nation. Financial institutions have first dibs on the easy access of debt provided by the Federal Reserve. This is why the housing market is now largely dominated by investors and banks cutting out regular home buyers. Young Americans are competing for positions in the low wage environment that is subsequently created. Yet the stock market is largely a sham for most Americans. Most do not have access to high frequency trading techniques that favor quick trades over buying and holding and corporate profits are up largely up on the slashing of wages and benefits. When we look at historical price-to-earnings ratios, we find that stocks are currently overvalued by at least 50 percent.

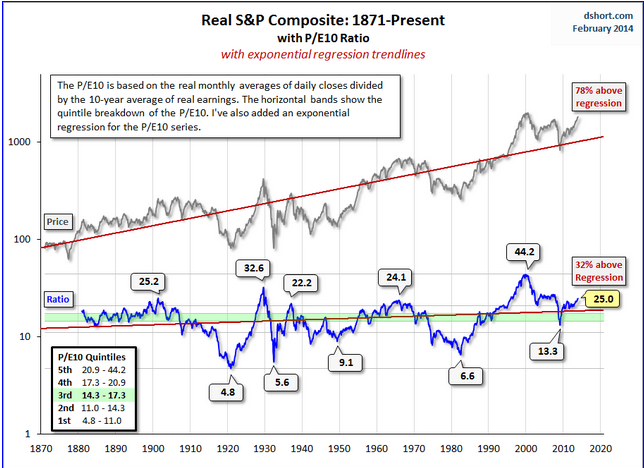

S&P 500 overvalued by 50 percent

It should be noted that the recent boom in the stock market has been pumped up by debt steroids. Since 2009 the Fed opened the spigots to member banks to essentially allow them to do the following:

-A freeze of mark-to-market accounting

-Access to very low rates and generous debt restructuring agreements

-Little new regulation and lack of enforcement

-Availability of more debt but debt is now being used by banks incestuously versus lending to small businesses and the public

This is why this record stock market run has not trickled down to most Americans. Also, prices seem inflated at the moment:

The historical P/E10 ratio going back to 1870 for the S&P 500 is 16.5. Today we are at 25. We are currently 50 percent higher than our historical average here. You have to look at price-to-earnings ratios because this will tell you how profitable a company is, at least in the short-run. The problem with the short-run is that most of these gains have come from cutting wages, slashing benefits, and leveraging mega amounts of cheap debt. This trajectory has led to record levels of wealth and income inequality.

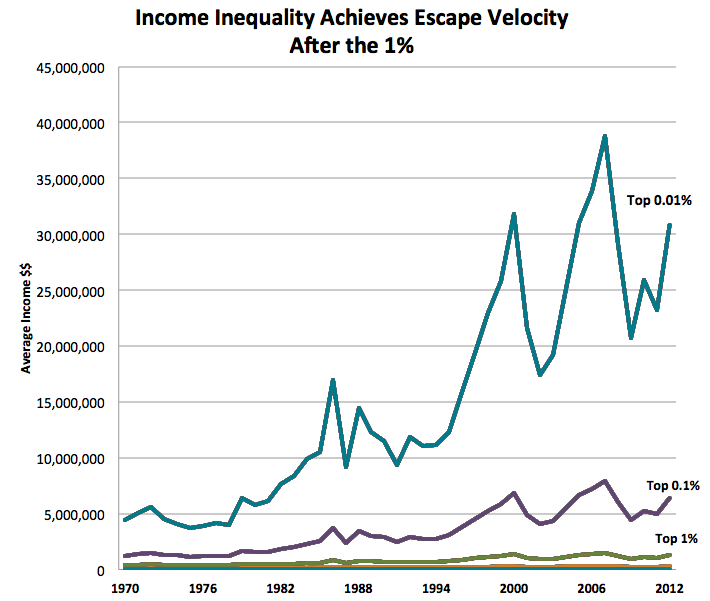

The rise of income inequality fueled by a stock bubble

What is interesting is that even within the top 1 percent, there is major inequality here when you begin to look at income:

Those in the top 0.1 percent and 0.01 percent have done exceptionally well since the crisis ended. Contrary to the belief that these people are hardworking business owners these are typically people connected to the FIRE portion of the economy. Some are part of the reason we had our crisis in the first place. A study done in 2010 found that of those in the top 0.1 percent 61 percent were bankers and executives. The rest were lawyers (7 percent), doctors (6 percent), and those in real estate (4 percent).

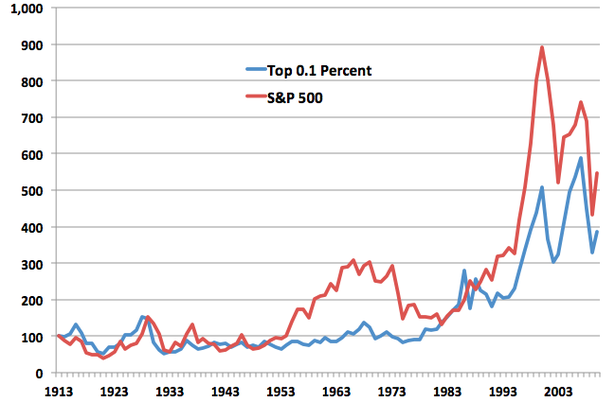

Also, the rise and fall of their wealth goes hand and hand with the stock market:

Of the 400 richest Americans, an IRS report showed that 50 percent of their income came in the form of capital gains. What is more interesting in these figures is how the FIRE side of the economy is essentially cannibalizing everything else. And the reason the stock market is largely a sham is that most Americans don’t even participate in the stock market.

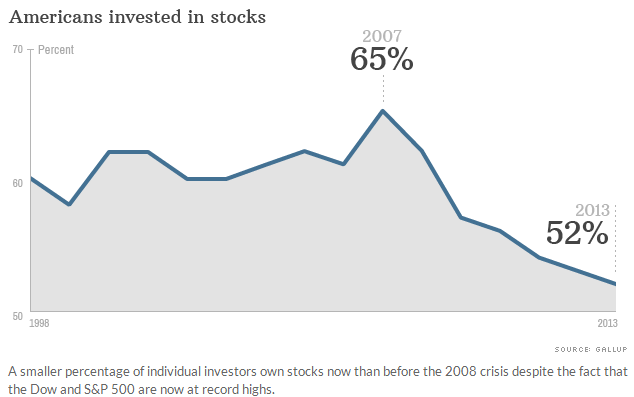

Lack of Americans invested

While the stock market has rebounded on maximum debt leverage to the connected, the public has not recovered and most are not vested in the market:

Part of it is the distrust of the market but a larger reason is that Americans in those low wage fields simply have no money left over to invest after paying the bills. The health of the economy should be measured by the quality of jobs and the number of these jobs available. Sure, the press is obsessed with stock values but you can easily inflate these numbers away with central banking policies that favor member banks. It certainly doesn’t seem like this triple digit run in the stock market has trickled down to regular Americans. Why? Because the profits are largely on their backs.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!