The dual income conundrum – Americans need to work two jobs to make up for stagnant wages and the sinister impact of a middle class being eaten away by inflation.

- 3 Comment

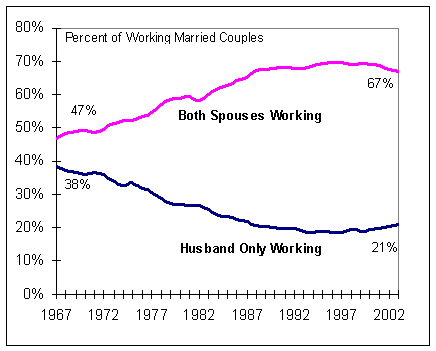

In the United States the dual income household is the status quo. In the late 1960s dual income households were not common. Today however two income households are the majority largely because many Americans require two incomes just to stay afloat. This has been labeled as the “two income trap†and in many ways, it is more like the two income illusion. You would think that by adding two incomes you would be doubling your purchasing power but since the 1970s male wages have collapsed while more women entered the workforce. When household incomes combine these figures the collapse in income doesn’t look so dramatic but it is. The added wage of another worker simply masks the impact inflation is having. It is a new reality for many families struggling to enter the middle class. Inflation has a powerful eroding impact on your purchasing power. If your income is stagnant and housing prices just went up by 10 percent that means more of your disposable income is going to be eaten up by this sector. If tuition is outpacing wage growth that means many people are going to finance higher education by going deep into debt. With the dual income household situation in the US, one plus one doesn’t necessarily equal two. In many case the illusion is that one plus one equals one.

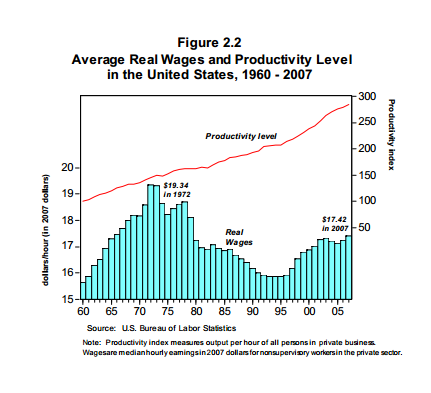

Productivity up but wages down

One could argue that the widening gap in wealth and income disparity in the US is largely being driven by weaker productivity growth. This couldn’t be further from the truth. As mentioned before a typical Amazon worker is tied to close to $600,000 of revenues for the firm. That is pretty productive. However, you then have many retail stores closing and unable to compete with this massively efficient system.

Productivity is up because we are able to do more with fewer workers. For those still working more is being squeezed out of them. The bottom line looks great and executive pay couldn’t be any higher. Yet blaming productivity for the lack of wage growth is simply untrue:

American workers have never been so productive. The only problem is that none of this is translating into wage growth.

Two workers for the price of one

Here is how the trap works:

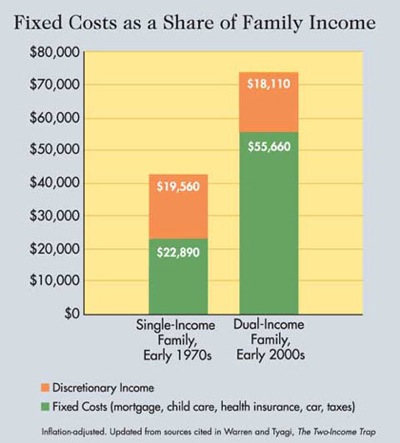

While incomes nominally are up for households, your dollars have lost a tremendous amount of purchasing power. The chart above is very illuminating. What it highlights is that the single-income household of the early 1970s had more purchasing power than the dual-income family of the 2000s. Why? Because inflation has pushed housing prices up, the cost of higher education is astronomical, energy costs have soared, and wages have gone stagnant:

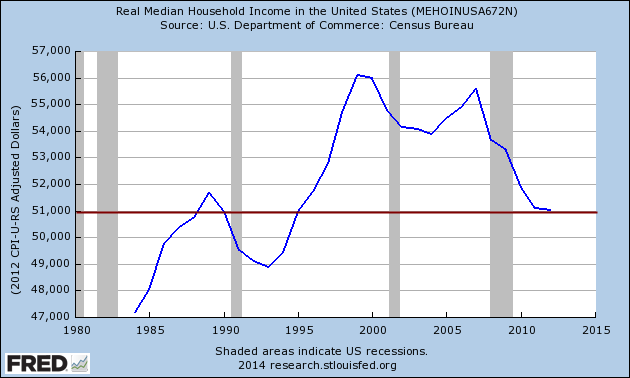

Your typical household today is making (inflation adjusted) what a family of the 1980s was making. This is not an issue if the cost of other items tracked a similar path. They have not and the financial sector has created enormous asset inflation in real estate once again. This matters because the biggest expense for most Americans is housing via mortgage payments or rents.

Stock wealth

One of the more disturbing facts about the recent trend is that even though we have more dual income households, they have been unable to amass any life altering wealth (meaning enough to be in the middle class versus being stuck in working class mode):

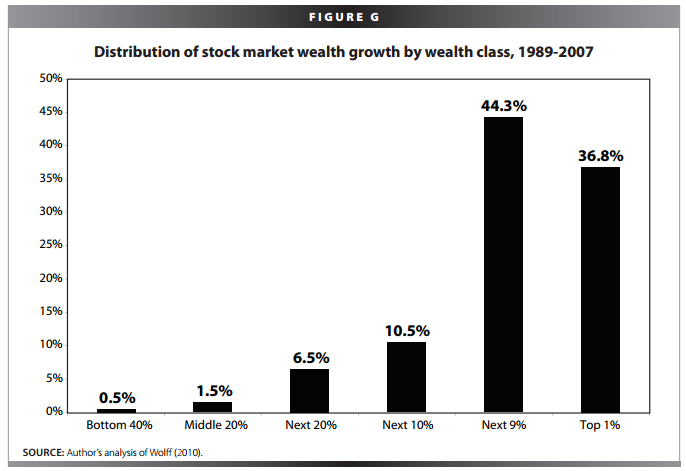

You’ll notice that dual income households are now the norm. You may even have three incomes in a household as many younger Americans are staying at home for much longer durations. It would appear that having more than one income is simply a necessity to keep up. With the stock market reaching record levels, you would think the wealth would be spreading around but it is not:

Half of Americans own no stocks. The bottom 47 percent of Americans have zero wealth. That is, they have a negative network or zero to their name. The chart above highlights that over 81 percent of all stock wealth is held by the top 10 percent in the country. This is why in spite of a record in the stock market and the 2013 jump in housing prices Americans still feel like they are struggling. In many cases, they still are.

“Inflation is largely a monetary condition. The Fed has done an excellent job propping up the financial sector. Executives have done a great job slashing wages and benefits increasing corporate profits for stock holders. In many cases, they are the large stock holders as the chart above highlights. This creates a feedback loop that is only causing more and more wealth inequality. With this extra wealth, they are able to tilt politicians and laws to their favor many times at the detriment of the population at large.â€

In essence the dual income household is one of economic necessity, more than choice. If you begin to throw in childcare costs you can understand why so many people are living day to day. Unfortunately with the system being largely run by big money, those with no voice have very little say in the current political process. The fact that both parties don’t have the middle class front and center on their agendas is problematic especially during a major election year.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Roddy6667 said:

Back in the Sixties when dual income households were not that common, people “needed” a lot less to spend money on. Homes were about half the size of today’s homes. One car was the norm. Nobody spent money on college loans, cellphones, Internet, cable TV, health club memberships, video games, multiple credit cards and a lot of things considered necessities today.

March 9th, 2014 at 11:36 pm -

Ametrine said:

I grew up in the 70’s and early 80’s. My dad worked and mom stayed home. In the recession, dad was out of a job for four months and we nearly had to go on food stamps to make it. Things were tight and extras nearly non-existent. But we also didn’t require as much as parents of today. No iPhones, internet, pay tv, two cars, lots of clothing requiring a walk-in closet (and subsequently a larger house with it’s big mortgage), and of course child care and eating out expenses.

There’s a website I like to go to for reminiscing the “good ol’ days” called 1980sflashback. They have a category called Economy/Prices that will make you cry…and realize without a doubt that inflation is a real and GROWING beast.

How to get off this trajectory to destruction? I don’t know.

March 10th, 2014 at 1:37 pm -

Rickee said:

Inflations were the result of government policies which highly inflated the cost of doing businesses eventually, resulting in consumers footing whatever price increases in commerce. Singapore is one great example of this vicious circle which the consumers have no control over.

March 13th, 2014 at 9:08 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â