Smoke and mirrors economy – 47 percent of the members in Congress are millionaires. 67 percent of Senators. Fed and Treasury money close to $7 trillion.

- 0 Comments

The Federal Reserve is really deep into uncharted territory. In no other time in history has the Fed been so intricately involved in the overall economy. The Fed balance sheet has expanded to an incredible level under very little scrutiny by the public or elected officials, many who have a vested interest in keeping the status quo. The banking system has been bailed out but the working and middle class still struggle. There is an interesting narrative going on in the press. Since Wall Street is on the mend and hefty banking bonuses are once again making the rounds, every corner of the country is now somehow celebrating in this same process, at least in theory. That is simply not the case in actuality. The system has been decoupled internally. Profits are made globally with local banking subsidies. The public is left holding the bag on massive speculation and is shifted out of any prosperity. It is odd what passes for good news. The fact that Congress acknowledges that they will deal with the fiscal challenges facing our nation is applauded even though this is their job and most are already millionaires. The Fed is still deeply intertwined in the current economy.

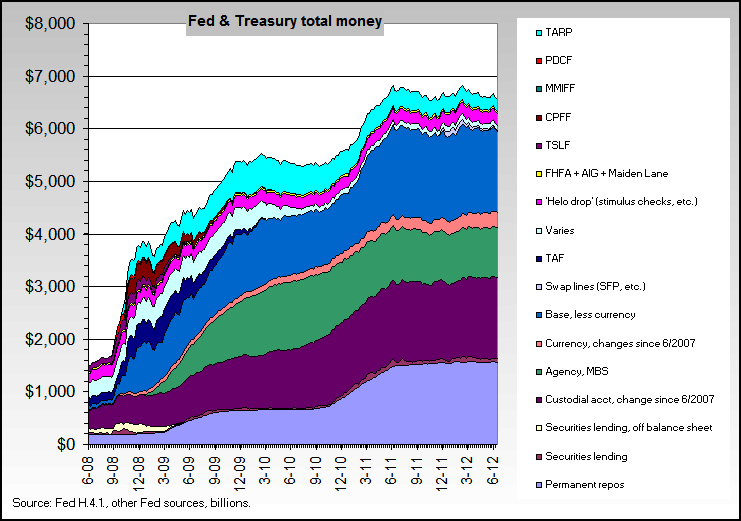

Fed and Treasury Total Money

There is an interesting chart examining all Fed and Treasury Money out in the economy. The Fed has introduced a historic amount of measures to bailout the current market. In 2008, this mixed bag of funding was at $1.5 trillion. Today that figure is near $7 trillion:

Source:Â Nowandfutures

Does the above look like the Fed is unwinding? In fact, you can rest assured this is only going to increase with QE3 now in full bloom. The risk of course is that the unwinding of these mechanisms back into the market is going to cause inflation. Some argue that there is no inflation so why worry. Well just look at the above. Can the Fed permanently keep that near $7 trillion on its balance sheet forever? That seems to be the plan and banks are happy with this approach since they can keep churning profits in the meantime.

The issue of course is that working and middle class Americans are being left behind. The middle class has demonstrably shrunk over the past few decades. This trend is unmistakable. Some of it is simply due to the fierce competition globally but a lot of it has to do with internal banking welfare and an antagonistic view towards labor. The same people that disparage working class Americans in the same voice talk about the need to grow jobs.

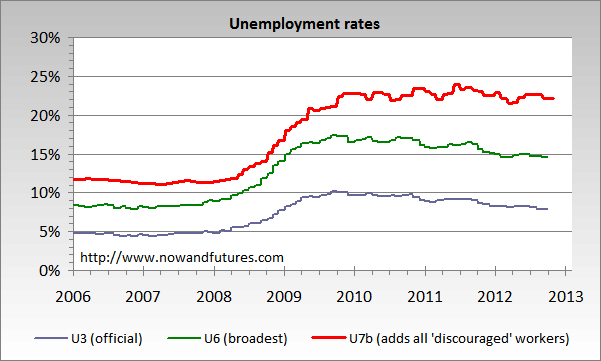

I think a lot of people in the public have bought into the narrative that inequality is simply a result of their own fault. You didn’t tug hard enough on those bootstraps. Yet the above balance sheet is simply a sophisticated method of picking winners (i.e., banks) and conversely allowing some to lose (i.e., working and middle class Americans). This is why in spite of all this intervention by the Fed unemployment is still very high:

It should be expected that our representatives are far detached by the issues of most Americans. Roughly half of Congress comes from the millionaire ranks:

“(TheDaily) Forget Wall Street. With riches like these, “Occupy Congress†may make more sense.

That’s because 250 members of Congress — or 47 percent — have a net worth of more than $1 million, according to a new study by the nonpartisan Center for Responsive Politics.

The study, which analyzed data from legislators’ financial disclosure forms, found the average senator had a net worth of about $2.63 million last year. That’s up 11 percent from $2.38 million in 2009 and 16 percent from $2.27 million in 2008.â€

We’re not talking about a tiny disconnect but a dramatic difference. About 67 percent of Senators are millionaires. There is nothing wrong with success or being a millionaire but keep in mind these are the folks rubbing shoulders with banking lobbyists that will likely bankroll their campaign. In essence, they are working for big money and not the public. So it would be hard to relate with the 1 out of 6 Americans on food stamps or the millions that have lost their homes in foreclosure. The Fed’s balance sheet is enormous and if the Fed even unloaded a tiny amount, it would definitely cause short-term havoc. So the solution? They simply keep going down the same path and increasing the balance sheet via QE3.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!