Quantitative addiction and the allure of low interest rates – US paid $454 billion in interest payments alone in 2011. Equity in real estate for households cut in half.

- 5 Comment

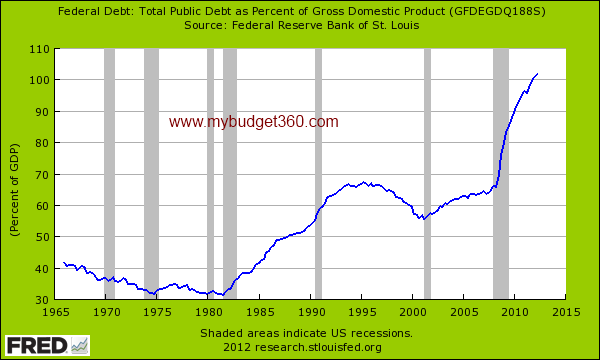

Today I was looking at the total public debt outstanding and the current figure seems surreal. The total public debt outstanding is now up to $16.27 trillion. We’ve been on this path for many decades of spending more than we earn but the problem is we are reaching a peak debt situation. It is hard to say how much debt is too much debt for a country but a generally agreed upon figure is when the debt goes above 100 percent of annual GDP then issues begin to arise. The US fortunately is able to get incredibly low interest rates on world markets by a variety of methods including having the Fed use quantitative easing techniques.  Given the size of our debt, low interest rates are sold as an aid to US households but the reality is that a more important reason is to keep payments on interest lower. What are the consequences of too much debt?

Debt versus production

Too much debt is never a good solution to fixing an ailing economy. The allure is easy and it is understandable why countries would embark on this easy path. Yet reverting back to a more normal balance is rarely that easy. Recently our total public debt surpassed annual GDP:

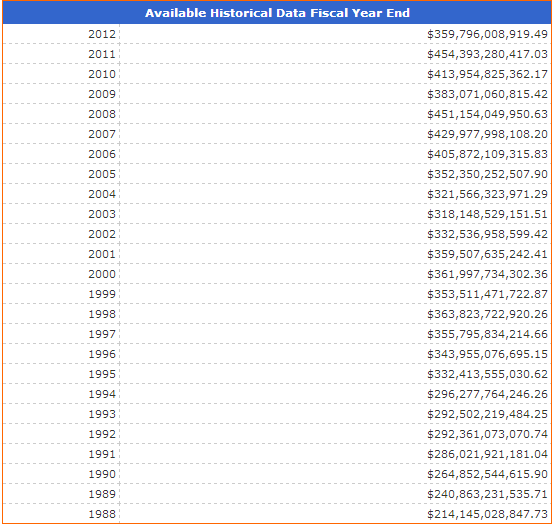

Clearly this is the worst recession since the Great Depression. On the back-end, the bailout mechanisms are still fully in place. When you have solvency issues adding more debt simply pushes out the pain deeper into the future. The Federal Reserve with Quantitative Easing sold it as a way for US households to get easier access to cheap money. But if we look at interest payments we begin to realize what is going on:

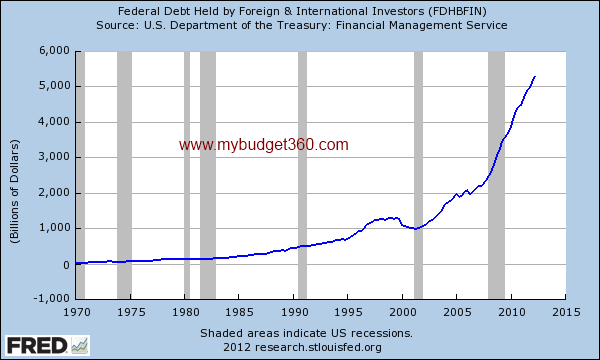

Last year we paid out $454 billion in interest payments. If you run the numbers on this, assuming a similar amount paid out in 2012, we are only paying 2.7 percent on our total debt. This is an incredibly low blended rate. Keep in mind new issuances are at even lower levels thanks to the Federal Reserve. This is really the big addiction. Say rates went up to a modest 5.4 percent we would be paying out $908 billion a year in interest alone! And a large portion of this debt is now held outside of the country:

Over $5 trillion of our debt is held by foreign institutions and investors. Given that our entire global economy is interconnected, a surge in interest payments for us is going to sap out productivity from the world’s number one economy. What do you think this will do to interest rates? Our trading partners especially with China are more than willing to lend out money at lower rates since they need the US consumption machine to keep going so more Chinese can find work. Their concerns are very much the same as our own.

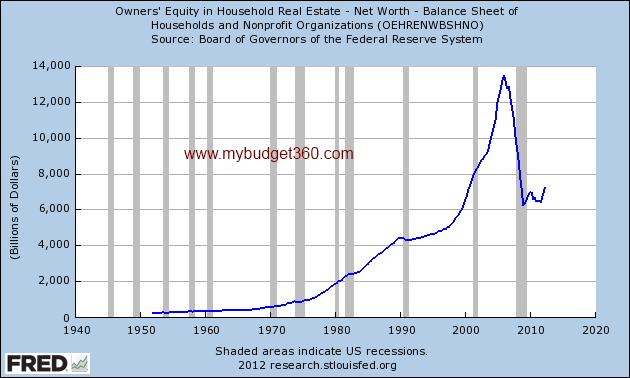

Yet if you look at places like Spain you will find the issues of solving a solvency crisis with more debt. At the core of the problem was the real estate bubble bursting. Let us take a look at the number one asset for Americans, real estate:

At the peak of the mania, US households had nearly $14 trillion in equity in their properties. Today, that number is still cut in half hovering at roughly $7 trillion. All the bailouts and other measures still have real estate wealth near the trough. This is why for most working and middle class families the recession still feels very much in place. Also, you have a large portion of recent buyers entering with low down payment mortgages so not much equity has been built up. Those low interest rates do help but again the bigger help is largely directed to banks and the government that are now stuck with the low interest rate appetite.

We have a complicated interconnected system in place. There are now more and more hints that the Chinese real estate market is taking a leg down. This is another potential problem looming. Again, too much speculation and too much debt are at the core of these issues. The problems in Europe are not gone. In fact, Europe has now slipped into another recession and their unemployment rate is at the highest level on record.  As a trading bloc, this is the biggest economy in the world. This will have larger ramifications on the global economy.

The US is now going to have Quantitative Easing into infinity similar to what Japan did. But this can only occur as long as the markets are willing to invest in such low rate levels. In Europe the market is already bailing out. If China’s economy slows a bit their appetite will pull back. Japan is dealing with their own internal issues. The core problem is still here. Too much debt and a crisis brought on by solvency.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Don Levit said:

Our total debt is divided into debt held by the public – about $11 trillion and intragovernmental debt – about $5 trillion. Interest on debt held by the public is supposed to be paid with general revenues, causing an immediate expense, and increase in the current deficit. Interest on intragovernmental debt is supposed to be paid with additional debt, with no current budget impact.

Do you have any figures of how much of the interest on debt held by the public was paid by general revenues, due to the deficits we have been running fairly continuously for over 40 years? How much of the interest on debt held by the public over the years has been paid by general revenues, with an immediate budget impact and how much by issuing additional debt, with a delayed budget impact?

Don LevitNovember 18th, 2012 at 11:30 am -

Solonsays said:

I believe the interest paid applies only to the public debt estimated at $10 trillion. The aggregate debt of $16 trillion includes the IOU interest which is an accounting entry. Therefore your implied interest rate is much higher.

November 19th, 2012 at 6:50 am -

JD said:

Ugly picture . Needs addressing but US markets are still the go to place for Europe..China..etc. so even with the destructive QE policies which hurt the middle class and retirees, the US is the place to invest. When the world markets call BS on America, the entire global situation will unravel and all of us will enter unchartered waters.

November 19th, 2012 at 5:52 pm -

will hudgins said:

What marvels my soul is that this foolishness has not collapsed the country already. Apparently the sheeple are, in mass, too stupid to see the reality of the situation. Just on radio yesterday there was a discussion about citizens purchasing bonds at a negative rate of interest. That is beyond moronic. How much longer can this society/economic laws tolerate this insanity? One more thing, even if Americans cannot see the value of gold/silver it would seem that the Chinese et al would see what is going on with the manipulation of the paper markets and extract every oz of gold above ground asap. Bill

November 24th, 2012 at 10:57 am -

Robert said:

New Year’s Resolution: Never trust anyone who talks about “Quantitative Easing.” The central banks of the world would like nothing better than to expand national debt, which is what QE really is, and in so doing lend money virtually interest-free to the very banks which own them. This also involves paying no return- no interest- to those who in ethical times would expect some reward for the act of deferred gratification known as savings. (And it is taught in the Samuelson edition of Econ. 101 that “savings is the engine of investment.”) This is the reason we are now witnessing nominal GDP growth even as private sector manufacturing and jobs decline: every dollar of deficit spending is counted as a dollar of GDP.

Central banking is nothing but a combination of legalized theft combined with a control economy- they will determine which distressed industries dying on the vine to take over for pennies on the dollar, for their own private benefit, with the trillions being created through “Quahtitative Easing” Citizens must demand balanced budgets, with constitutional Treasury departments and no central banks, and demand that lawmakers live by the same laws that apply to everyone elseNovember 24th, 2012 at 8:33 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!