The chasm between the real economy and stock market: Baltic Dry Index down 60 percent and CNBC viewership near record lows. Where is the wealth in the US?

- 2 Comment

There is a continuing divide between the stock market and what is happening in the US economy. Many of the S&P 500 companies derive a large portion of their profits from growth abroad and many companies have increased their bottom-line by slashing wages, hours, and benefits domestically. Not exactly a plus for working and middle class Americans. It is also interesting to see that the Baltic Dry Index has fallen by 60 percent year-to-date and is now down near record lows. This index is important because it is a measure of what it costs to move raw materials across the seas. You would think that a booming economy would have a large need for raw materials and this would push shipping costs up. Obviously fuel is a big input for these operations so the near record low cost flies in the face of what is occurring in the stock market. We also know that inflation is hitting harder on the pocketbooks of most Americans even though the CPI appears relatively tame. There is a chasm between the stock market and what is happening in the real economy because the stock market is largely being driven by hot money and financial institutions that trade massive amounts of financial instruments while the public holds very little in true wealth. This is probably why today CNBC sees near record low viewership at a time when the stock market is near a peak.

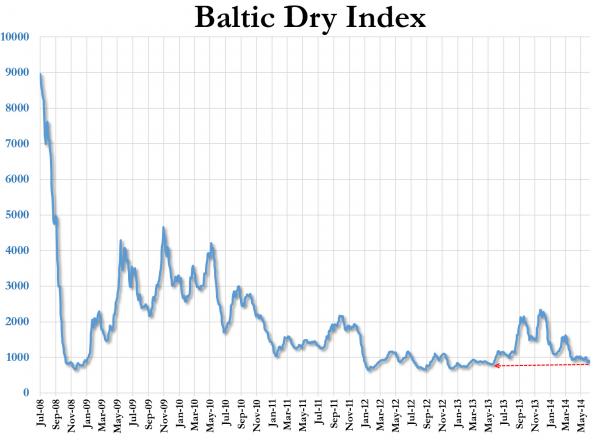

The Baltic Dry Index and shipping raw materials

The Baltic Dry Index is down a whopping 60 percent year-to-date and this is in the face of rising fuel costs. What we do know is that there is large amounts of shipping capacity that is far exceeding the demand of actually needing to move raw materials across the oceans. In the US, large banks and investors are happy to trade houses amongst each other using easy debt financing from the Federal Reserve while for most working and middle class Americans rents and mortgage payments go up even though incomes are stagnant.

The Baltic Dry Index drop is significant because it is a better indicator of true demand in the real economy in terms of raw material required when an economy is booming, that is if the stock market is a sign of a boom:

The index never fully recovered from the Great Recession when prices were fully inflated. But the year-to-date drop of 60 percent is troublesome. You have to wonder what is going on behind the scenes to causes shipping prices to fall so dramatically even in the face of higher fuel costs.

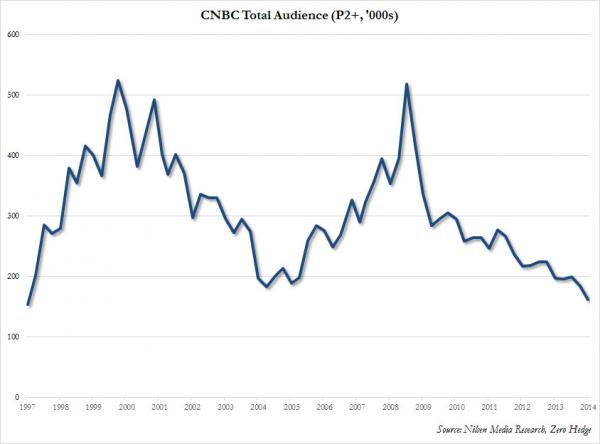

CNBC viewership

Another sign that most people are being left in the dust is that CNBC, the stock market focused network is seeing ratings at near record lows while the stock market is at near record highs. You have to assume that as more wealth is simply aggregated into viewer hands that your audience will also dwindle:

This is interesting to see because in the previous two bubbles, you saw viewership spike near the peaks of each market. There was public interest versus CEOs and bankers following the charts as if they were in Las Vegas making bets on the ponies. You can see the tech boom and real estate boom very clearly. Where is the boom this time? This stock market recovery has been disconnected from the working person on the street and the bailouts have largely gone to financial institutions that are now funneling money into large players that simply recycle it back into the economy for real goods driving prices up. Do you really believe we have no inflation? What about housing costs, food costs, energy, healthcare, and college tuition? All of these areas have seen massive increases in price over the last decade.

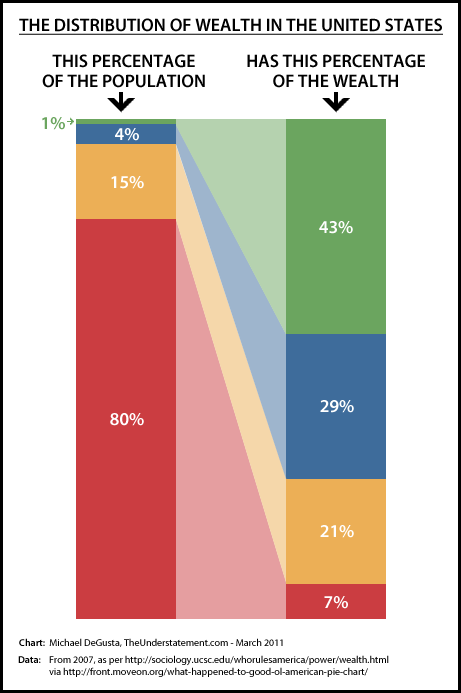

Also, half the country does not own one single stock. So the stock market is largely a sideshow. Take a look at wealth distribution in the US:

“43 percent of all wealth in the US is held by the top 1 percent. The top 5 percent control over 72 percent of all wealth. The bottom 80 percent? They control 7 percent of all wealth and most of the true wealth in the economy is based on stocks, bonds, and other financial instruments.â€

Most Americans are living paycheck to paycheck so watching CNBC must be comical to most. The last two bubbles gave people a feeling they were wealthier but it was merely one bubble to another. What is interesting is the stock market hitting a peak this year did not show a spike in viewers. The massive rise in real estate values in 2013 didn’t really cause sales to shoot up since most of the buying was coming from a smaller number of investors versus families.

The stock market is a very poor indicator of what is happening on the streets of the US economy. To some, inflation is merely a tiny bit of “noise†and is nothing to worry about. Unemployment looks much better than it should because you have many simply dropping out of the labor force. In other words, if your measurement tools are off, you have to use multiple sources of data and common sense to really get an idea of what is happening in the economy. Because according to the stock market, everyone is partying like its 1999.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

2 Comments on this post

Trackbacks

-

Paul said:

We need to get this in front of our government leaders. The USA is beginning to look like the joke of the world.

June 25th, 2014 at 7:19 pm -

Gonzalo said:

No is not USA, is the whole world looking like a giant joke…the problem is What next?

July 12th, 2014 at 2:03 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!