The economic war on the young: young Americans are being priced out of the housing market, pushed into student debt, and many see no growth in wealth.

- 0 Comments

The job market continues to be depressed for young Americans. As graduation season comes to an end, many are going to start getting letters in the mail from their friendly student debt service organization. Other recent graduates continue to live at home facing a failure to launch as rents rise and the prospect of home ownership continues to fall beyond their reach. In fact, we have many people in their 30s and 40s living at home because of financial constraints. This isn’t exactly what older parents had in mind but many are battling their own lack of retirement funds as they enter into old age. Young Americans are facing a trifecta of economic depression that wasn’t present in the previous generation; they are unable to compete in this investor heavy housing market, many of the decent paying jobs of today require a college education that is becoming more expensive by the day, and finally many are unable to find a good paying job stunting their savings plan. On many fronts, while orchestrated or not, it appears to be an economic war on the young of this country.

The rent and living at home generation

There was a period shortly after World War II where most Americans with the desire to work had the unique ability to purchase a home typically on one income. Those days have largely eroded thanks to the power of inflation. While the stock market has picked up and home prices strongly rebounded last year, it doesn’t seem like this was driven by younger home buyers. In fact, many younger Americans are living at home unable to leave the nest.

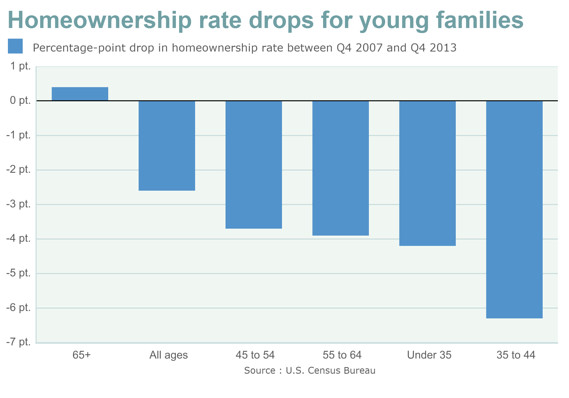

If we take a look at home ownership rates by age category we find a troubling trend:

The biggest collapse in home ownership came from those 35 to 44 and those younger than 35. The only age group that saw their home ownership increase between 2007 and 2013 were those 65 and older. But didn’t you say home prices went up in 2013? They did but this was largely driven by investors accessing cheap funds and dumping this back into the housing market. This is why we are seeing rents and home prices going up while wages remain stagnant. In the end more money is simply being sucked into housing without actually increasing home ownership.

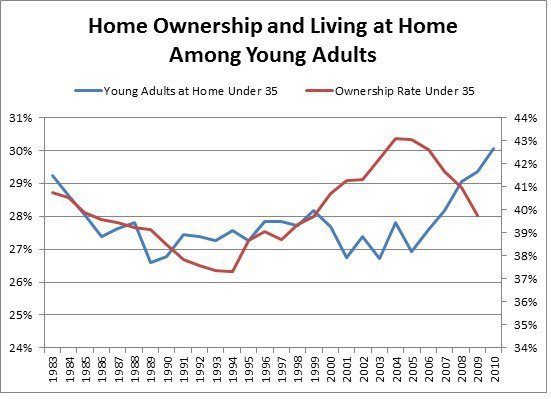

We also have an inordinately large number of Americans living at home:

We find a perfect correlation in the 2000s where young Americans simply went into massive debt to pump up the housing bubble. As this burst, more simply moved back home with their parents. With no more access to easy debt, young Americans with weak incomes are unable to move out and form households. Many young Americans don’t even have the funds for their own little apartment.

Many need to feel economically secure before making a big purchase like buying a home. With this current economy, it will take a lot of work to reverse the trend. One trend that is very much alive is the one where young people go into massive debt for college.

More are unable to afford college even with debt

Many of the better paying jobs of today require a college degree. Engineering, computer science, healthcare, accounting, or the life sciences all require formalized training. There are many other fields that pay well but most require a college education. You have many people pursuing degrees with little market demand yet students are paying the same price as these other higher paying fields.

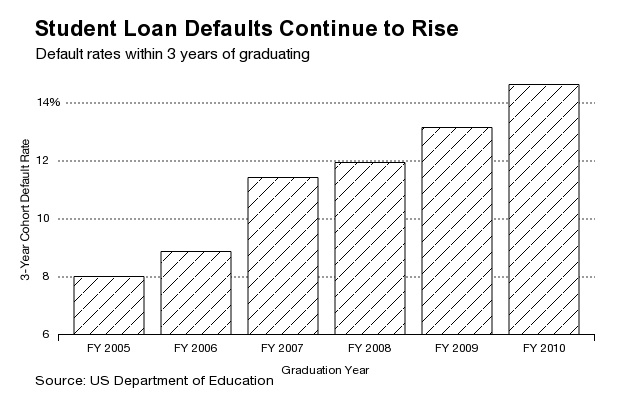

It is becoming apparent that more graduates are unable to service their debts:

The default rate on other debt items has fallen yet steadily has grown with student debt. Young Americans when they graduate are largely left to contend for jobs in a low wage economy with high levels of debt.

Another issue with student debt is that it will never go away. Purchase too much of a home? You’ll lose it in foreclosure. Overpay for a car? You’ll get it repossessed. Take on too much student debt? Too bad. You will need to pay it all back and in some cases, the fees and late charges compound and make the balance increase to even more back breaking levels.

It is no surprise that wealth growth for the young has gone absolutely no where.

Stagnant wealth growth

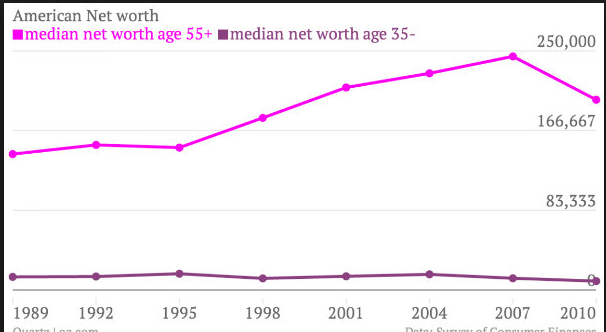

Looking at cohorts by age, we find that those 55 and older saw their wealth legitimately increase in the 2000s. For the young, they are basically in the same spot they were in back in the 1980s:

A couple of things here; first, the housing market was more reasonably priced when the previous generation bought. Even with the housing bust, the recent recovery has allowed many older home buyers to build equity in their properties. Real estate equity is the number one asset category for Americans. What did we mention before about young Americans and home buying? The home ownership rate continues to fall thus pushing their equity building years further out in the future.

There appears to be an economic war on the young and interestingly enough most politicians simply do not care.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â