Financial panic button for younger Americans – The sandwich generation saw a 59 percent decline to their net worth as they deal with college aged students living at home and elderly parents.

- 4 Comment

Unfortunately more data pointing to the deterioration of the middle class came out this week regarding net worth figures. One of the more ominous data points regarded the sandwich generation of those taking care of college aged kids and parents. The net worth figures this time released by the US Census coincide with the information released by the Federal Reserve. In short, American balance sheets are in a deep panic. Over 90 percent of Americans have been crushed through this recession if we examine net worth data. They have seen their wealth decline from a net worth perspective but also their incomes have fallen. Not the ideal sort of combination for economic prosperity. The information released is troubling but beyond that, it must serve as a push for a panic button to fight for the middle class. Whether people acknowledge or not, the middle class is being lost day by day.

Being crushed in the middle

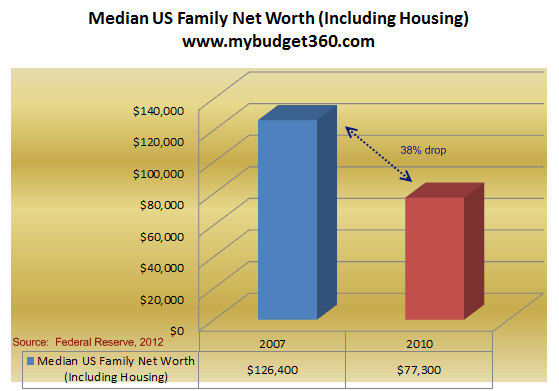

The Federal Reserve report showed that overall households lost 40 percent of their net worth between 2007 and 2010:

That is a crushing blow. Yet data released from the Fed shows those in the middle, those from 35 to 44 saw a stunning 59 percent hit to their net worth:

“(LA Times) Household heads ages 35 to 44 — the group usually saddled with a mortgage and college-bound kids — have watched their median net worth slump 59% from before the recession.

It’s the most painful decline among age groups studied by the Census Bureau. Overall, American net worth took a 35% dive from 2005 to 2010, according to data tables released Monday.â€

This generation is largely taking care of elderly parents but also paying the high college costs for their children going to college. Many are also dealing with their young adults coming back home from college since they are unable to pay for bills with the work they are landing (if they even land work). So some of these households have grandpa/ma, dad/mom, and son/daughter all living under one roof. This has been a big reason for slower household formation growth.

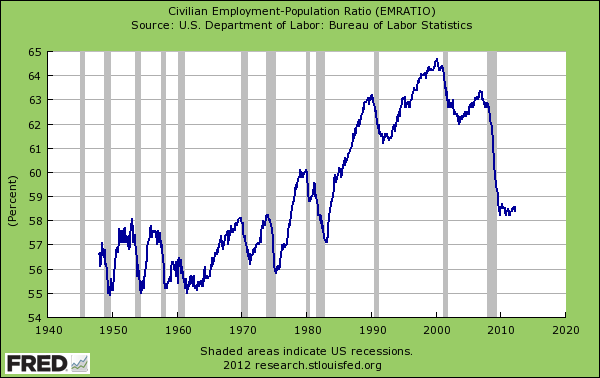

The employment-population ratio is still at very low levels:

What is deeply troubling regarding these reports is that it shows that those that go to college do earn more over a lifetime:

“And the chasm is widening. College graduates made nearly twice as much as those with only a high school diploma in 2000. In 2010, they were making nearly 3 1/2 times as much.â€

Yet this data is largely skewed by those who went to school prior to 2000 when student loan debt was below $200 billion for the country. Today it is near $1 trillion and the job market and stock market are the weakest they have been in over a generation. If we break out earnings for recent college graduates we find something very different:

So it is important to look at the entire picture before simply saying that anyone that goes to college is better off. Does someone going to a for-profit paper mill and dives into $50,000 of debt for a worthless bachelor’s make more sense than someone going to a local community college for a few hundred dollars per class to learn a marketable vocational skill? The higher education bubble would like you to believe that yes, any college degree is worth the money. The more degrees the better. The market is telling us something very different.

The young in our country are going to face a challenging decade ahead unless a reinvigoration for middle class protection is brought into place. Otherwise, we should get used to these declining wealth figures for the majority of Americans. It would even look worse if we adjust for inflation and factor in the weakness of the dollar.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

CLARENCE SWINNEY said:

IN BUSH 8 WE LOST 54,000 MFG PLANS AND ONE THIRD MFG JOBS

ENTIRE INDISTRIES AND SUPPLIERS LEFT AMERICA

HUNDREDS OF SMALL TOWNS TAX BASE DEVASTATED

HUGE EMPTY PLANTS HERE–NO VALUE

MULTINATIONALS RAPED AMERICA

CONSUMER BARGAIN?

SMALL DECREASE IN PRICE SOLD HERE

80% MARKUP FROM OVERSEAS GOODS VS 20% LOCAL MFG

BIG PROFITS=NO BARGAIN HEREJune 21st, 2012 at 5:06 am -

Martin Zehr said:

What we are observing here is nothing more or less than the responses of young people to the economy. It should be said that we already know that the economy has not improved significantly but those living in the economy have responded. What is significant in the responses is that they are only moving in one direction at this stage.

Survival behaviors adapt to existing circumstances and need to be directed towards self-sufficiency. This generation has become used to a sense of having their needs met before viewing their role in terms of how to contribute to the family needs. How many parents of the baby boom generation dropped out of school in order to become independent or support the family needs? How many students of this generation who have dropped out viewed things from this perspective? Young people have been provided with the most upgraded technologies, often at the expense of their parents, regardless of their own financial circumstances. From the statistics shown here, this behavior is now impacting on the standards-of-living of parents.

Deferred gratification is a value that has virtually disappeared from our common cultural values as Americans. Now is the time for young people to re-define their roles within their families and find ways to contribute in addressing the common difficulties. The change in the response is significant and its impact will be significant. “Ask not what your country can do for you. Ask what you can do for your country”.

June 21st, 2012 at 2:33 pm -

Sherry said:

Only the student is responsible for informing themselves, asking questions, and checking accreditation. The people who make the bad decision of going to paper mill type schools deserve what they get and the cost shouldn’t be handed off to taxpayers.

In addition, those that do not properly research the employment outlooks/trends in the fields for which they are going to college are also digging themselves a deep grave. They may be training for a field that will have no openings when they graduate or they may have debt that the pay of the job will not service.

People should go to colleges and universities whose credits will transfer to other colleges and universities. Getting any degree entirely online is a horrible idea because the student will not get any interaction with others and could likely fall behind where communication skills are concerned.

Communication skills are also extremely important in getting a job and should be taken into account when seeking an education.

June 21st, 2012 at 3:45 pm -

Frank said:

It is important to keep in mind that employment trends can change over time. During the time it takes to earn the degrees needed for your career the employment outlook can change substantially.

Also, unless one has a great deal of training, tracking and interpreting trends it is easy to be misled regarding future employment trends.

Additionally, one must bear in mind that those who are seeking a degree do not necessarily already have a great deal of expertise in any particular thing usually (unless they already have a career and are returning to school), so they may not have expertise tracking and interpreting trends.

For these reasons, it is very hard for the students to do some kind of expected return on investment forecast.

July 20th, 2012 at 6:58 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!