The broken tassel of American higher education – College debt defaults bring up questions about repayment structure. Is college even worth the current costs?

- 4 Comment

As hundreds of thousands of young American enter the employment market with newly minted degrees, the clock begins to tick on those heavy student loans. The majority of student loans do not enter repayment until six months after graduation. Yet we are facing tectonic shifts in higher education. The cost of going to college, seemingly the only path to what remains of the middle class, has far outstripped any sensible measure of inflation. As young graduates leave school many are saddled with tens of thousands of dollars in debt and the reality is, many are entering a lower wage workforce where pensions are a thing of the past, healthcare is largely shouldered by employees, and employment security is nearly nonexistent. Keep in mind this is the market for recently minted graduates which are a small segment of our US population. There are countless horror stories of student debt including debt collectors going after parents of a deceased son. Welcome to college circa 2012.

The growth of the debt based society in college

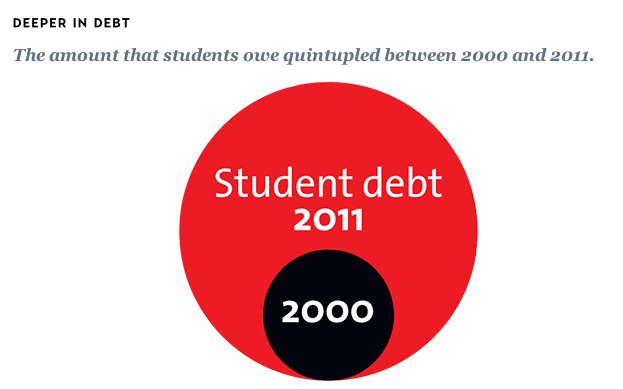

I saw this stunning chart a few days ago which really highlights how outrageous the student debt bubble has become:

From 2000 to 2011 student debt has increased by a five-fold factor now approaching $1 trillion. Our global society is now largely one giant debt based system based on pure faith. How is it feasible that students can take on so much debt for degrees especially from schools that are largely paper mills? This is the convoluted math of the system. For example, a lease on a Mercedes is very different from a lease on a Honda Fit. So why is it that the cost of attending a top-tier private school is nearly the same as going to a print-your-diploma online school? The problem of course is that the government in collusion with the banks supports this nonsense so these schools essentially target students to use as mules to funnel federal student aid to their coffers.

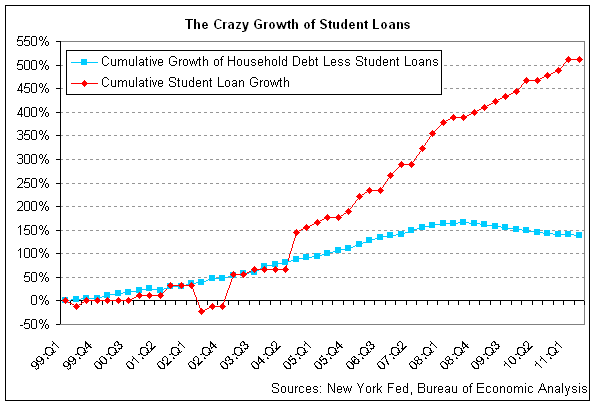

What you end up getting in the higher education system is something akin to the below:

The above chart highlights the problems that are boiling in the system. Household debt has recently fallen yet student debt keeps moving to a different tune. As the economy contracts for most as demonstrated by the flushing of 40 percent of net worth down the financial drain, the only group that saw their wealth increase was the top ten percent. So ponder the fact that from 2007 to 2010 90 percent of Americans saw their incomes contract and their net worth fall. Only one group benefitted here. A rising tide lifts all ships unless the ship is part of the current crony system of finance.

The unemployment issue

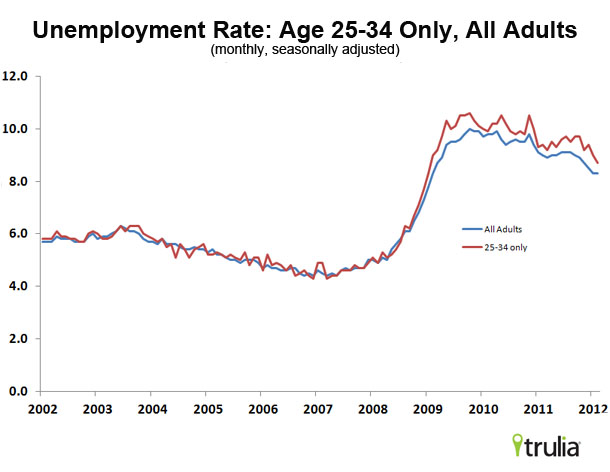

The unemployment rate remains elevated for all groups including young Americans. The below chart needs additional explanation:

From the surface it looks like both groups have it equally bad. Yet younger Americans are largely taking jobs in most cases where their degree is not utilized. Many are jumping into jobs from the low wage segment of the economy. Sure they are considered employed for statistical purposes but not in the sense that we would imagine.  So you need proof? Let us examine earnings then of college graduates:

From 2000 on college graduates have seen virtually no real earnings growth yet tuition keeps marching up. So what are students really paying for here? Or are they even paying? Obviously with the massive increase in student debt, many are simply financing this experiment with money they don’t even have.

To take a trip into the student debt rabbit hole you have to read some of the stories:

“(Salon) Now, he’s suffering a Kafkaesque ordeal in which he’s hounded to repay loans that funded an education his son will never get to use — loans that he has little hope of ever paying off. While Reynoso’s wife, Sylvia, is studying to be a beautician, his gardening is currently the sole source of income for the family, which includes his 18-year-old daughter, Evelyn.

And the loans are maddeningly opaque. Despite the help of a lawyer, Reynoso has not been able to determine exactly how much he owes, or even what company holds his loans. Just as happened with home mortgages in the boom years before the 2008 financial crash, his son’s student loans have been sold and resold, and at least one was likely bundled into a complex Wall Street security. But the trail of those transactions ends at a wall of corporate silence from companies that include two household names: banking giant UBS and Xerox, which owns the loan servicer handling the bulk of his loans. Left without answers is a bereaved father.â€

This is the kind of nonsense that is going on in the system right now. Even with housing and subprime debt, those that can’t pay lose their home. The debt is taken away and the bank takes over the home. With student debt the loan tracks you like the plague. These debt collectors are basically trying to squeeze blood out of a stone. What use is that? Do you think if banks had their own money in the game they would lend six-figure loan amounts? Schools would need to re-adjust. Then again, banks with massive government support enjoy the current system just fine.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

4 Comments on this post

Trackbacks

-

Communal Award said:

There is only about ~900 billion paper and coin dollars.

There is about ~14 trillion dollars worth of credit supplied by banks.

There is about ~55 trillion dollars in total debt, again, supplied by banks.

What backs the dollar is the faith that the 14 trillion dollars will some day pay the 55 trillion dollars off.Looks like US is operating a Ponzi/Pyramid scam on global scale since Nixon Shock.

Eventually Americans will have to suffer from “Peter principle”.

https://en.wikipedia.org/wiki/Peter_principleJune 18th, 2012 at 8:21 am -

jay said:

This is a serious situation – but we don’t need the typical band-aid solution from Washington ala the HealthCare fiasco.

We need reform – of the College / Higher Education system, higher education was not supposed to be a money making adventure but it sure is now from the Presidents/Deans to the bookstore all are at fault. The tie in between the Colleges and the student loan lending institutions are also a no-no.

So are there any politicians ready to tackle this daunting task – oh no they are too busy worrying about re-election.

June 19th, 2012 at 4:14 am -

Bud Wood said:

This college debt is a mockery of learning. There is little advantage of contributing to a fatter pay check for college administrators. Better to work as a skilled tradesperson – an apprenticeship typically pays the apprentice and provides a bright future.

The USA has become a hollow society thanks to government meddling. There are still those who are trying to grab the “American dream” and glide along like their fathers did. Guess what? It’s different this time.

We still have the old geezers in their golf carts, paid for by lavish pensions. However, that aberration is not available today. Productive efforts rather than sheepskins are what’s needed.

June 21st, 2012 at 10:41 am -

chris said:

Pensions are not a thing of the past in the public sector. They are very much a thing of the present. Not sustainable, but you cannot convince union members of that.

March 27th, 2013 at 4:53 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!