The day the credit markets awake from a slumber – $1 trillion in consumer debt currently delinquent. Student debt continues to grow adding fuel to the higher education bubble.

- 1 Comment

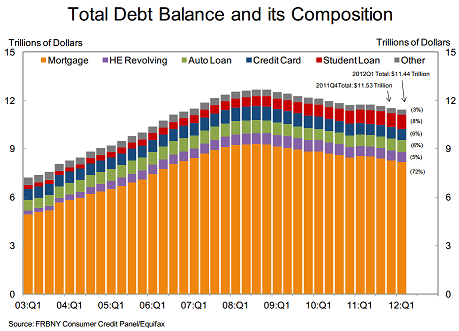

With much of the attention being diverted to the cascading financial crisis in Europe something was missed in the United States. The incredibly important quarterly consumer credit report released by the Federal Reserve highlighted some disturbing trends. The first overall point is that the American consumer continues to deleverage. Yet with a system built on massive debt and consumption this can only mean a contraction. In the report however the total amount of student debt outstanding grew a whopping $30 billion in one quarter bringing the official total to $904 billion. This should tell you a few things about debt in the US. The first point is that debt backed by verifiable income is falling based on stagnant wages and debt based on easy financing (i.e., student debt) continues to expand. The report also showed that total household debt fell by $100 billion in the last quarter highlighting the continued austerity being experienced by many Americans.

The only growth sector – student debt

We’ve been following the higher education bubble for many years now. It comes as no surprise that people go back to school during economically challenging times to retool. This is a common trend. What isn’t common is the amount of debt that is taken on. This is a new part of our economy since student debt stood around $200 billion in 2000 and now quickly approaches $1 trillion:

“NEW YORK – In its latest Quarterly Report on Household Debt and Credit, the Federal Reserve Bank of New York today announced that student loan debt reported on consumer credit reports reached $904 billion in the first quarter of 2012, a $30 billion increase from the previous quarter. In addition, consumer deleveraging continued to advance as overall indebtedness declined to $11.44 trillion, about $100 billion (0.9 percent) less than in the fourth quarter of 2011. Since the peak in household debt in the third quarter of 2008, student loan debt has increased by $293 billion, while other forms of debt fell a combined $1.53 trillion.

The New York Fed also released historical student loans figures, by quarter, dating back to the first quarter of 2003as part of this quarter’s report. These data show that student loan debt has substantially increased since 2003, growing $663 billion. Outstanding student loan debt surpassed credit card debt as the second highest form of consumer debt in the second quarter of 2010.â€

You have to ask how is student debt increasing in the current market? A large part of it has to do with the cozy relationship of government and banks for student debt. The less you have the better in many cases. Many of the for-profits highly target low income neighborhoods with some of the most costly and to be blunt, least useful degrees. In essence many people are paying tens of thousands of dollars for a piece of paper that has one of the worst returns on investment. Many students leave worse off than they started.

Yet this isn’t simply a for-profit issue although this is a good place to start. Many public universities being strained by state finances are facing the need to increase tuition as they move away from being funded from states. The burden largely falls on those living in the state but more succinctly, on younger Americans.

$1 trillion in consumer debt in default

Deeper in the report we find the problem with giving people too much debt without adequate income:

“About $1.06 trillion of consumer debt is currently delinquent, with $796 billion seriously delinquent (at least 90 days late or “severely derogatoryâ€).â€

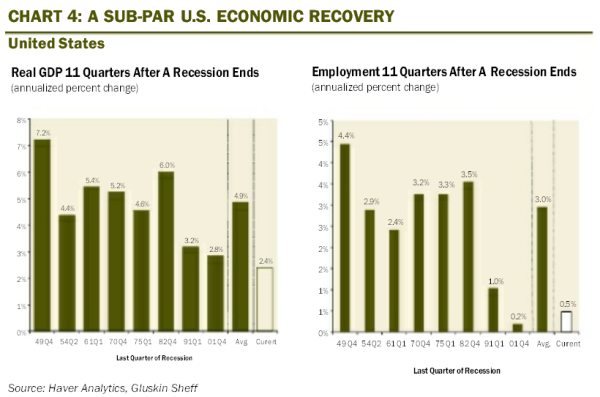

You can read that again. Over $1 trillion in consumer debt is simply not being paid. The credit crisis is still in full force in the US although in the game of cascading dominoes, Europe is in worse shape so attention is focused on their markets currently. Keep in mind we’ve been in recovery since the summer of 2009 but this is no common “recovery†if we look at this in a historical perspective:

This is the worst recovery in a generation if we can use that term. Given the data released on Friday we still see cracks in the US economy. Simply throwing more and more debt at the problem and trusting banks as the gatekeeper for economic growth is naïve and allowing the wolves to guard the henhouse. These are the same people that actually laid the foundation for this crisis to begin with! Yet we are giving them the largest bailout support via our central bank in the Federal Reserve? So what are some easy things to implement?

-1. Modern day Glass-Steagall to separate retail and investment banking

-2. Major restrictions on high frequency trading and structures that punish short-term destabilizing trading. This does not ban short sales but goes against the destructive incentives where the public provides welfare for a few billionaire hedge fund managers to skewer the markets.

-3. Seriously reform and claw backs on large banks. JP Morgan Chase’s recent billion dollar loss is just an example how we have learned very little in the crisis.

The focus is on Europe currently and rightfully so but there is distressing things going on here in the US. I would venture to say that $1 trillion in delinquent consumer debt is not exactly a healthy revelation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

torabora said:

As long as JP Morgan didn’t get a bail out using public money, who really cares whetheer they lost money. There is a winner and a loser in every trade….it’s all how you weigh it. Somebody got that billion…hopefully the IRS got 15% of it in capital gains.

June 4th, 2012 at 8:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!