The dark financial clouds engulfing Europe. CBO projects massive deficits yet Treasury Bills move lower on global mattress bet.

- 1 Comment

The Congressional Budget Office released national debt projections showing the US Federal debt will surge to over 200 percent of GDP in the next two decades. Or maybe it will go under 100 percent. It is an interesting wide range projection. You only have a few options to remedy the situation and for the moment it appears that we are simply gliding on momentum. In Europe the markets seem to think that simply adding more debt to a debt crisis is somehow the solution. As if Greece will grow out of their predicament just because central banks extend more loans with more obscure terms and conditions. While this front is presented to the public behind the scenes money is quickly preparing and gearing up for a second phase of the financial crisis.

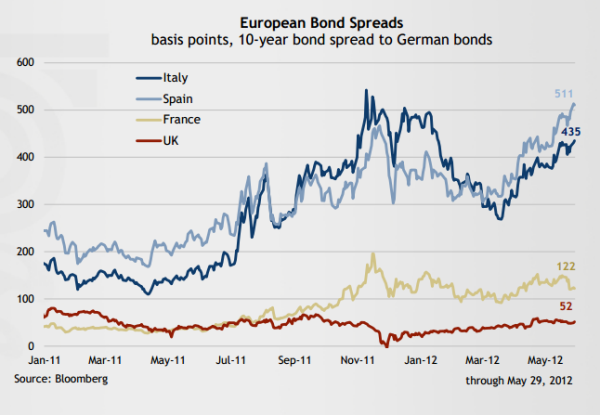

European Bond Spreads

Risk is now being priced in across the European continent. Money is flowing out of one nation into another as those with funds quickly realize the unwinnable situation. Who better to understand than those on the ground in their respective economies? Bond spreads are back to crisis levels:

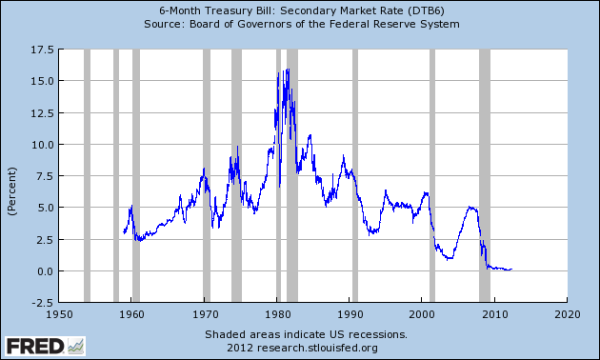

We haven’t heard much about Italy but behind the scenes, markets are sensing some challenging times ahead for the nation. The market is now focused on Greece and Spain. The panic across the Atlantic has caused the US to become the global mattress for funds:

6 month T-bills are paying virtually nothing as money rushes into the United States. Although this rush into markets perceived as less risky came at a time when the CBO stated that the Federal debt was set to go over 200 percent of GDP in the next decade or two. The market is starting to feel like the days prior to the Lehman Brothers crisis. Rumors and volatility are back and people are once again realizing how ludicrous the amount of debt floating around the world has become.

The true story – poor employment prospects for middle class around the world

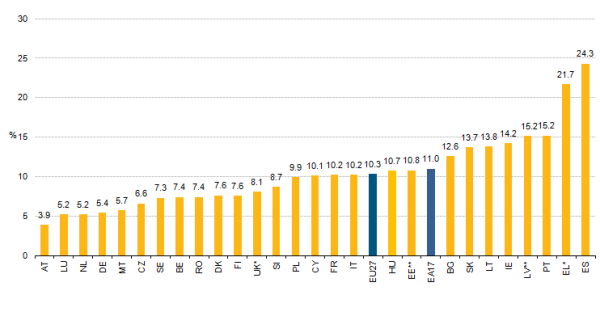

The headline story is that Greece and Spain are facing banking problems. That is always the case since the goal is to simply make bigger loans while ignoring the underlying fundamentals of what is truly happening. The real crisis is one in which industrialized nations provide a healthy enough market where middle class jobs reside for their residents. In Europe this metric is an absolute failure:

The unemployment rate in Spain is now virtually 25 percent resembling the US during the Great Depression. It is also the case that the Spanish banking system has only started to collapse given the massive big bets in domestic real estate. Greece has too much debt connected to their smaller GDP economy.

The markets are having a tough time digesting any of the current news. They still want to collectively believe that more debt is the solution to a crisis brought on by debt. What we hear is that all will be well but if we look at the above behind the scene metrics of big money, the feeling is that darker financial clouds are on the horizon.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

ted Kramedas said:

At some point in the near future, the world economy

is going to seize up and events will unfold faster than governments

will be able to deal with them. This so-called ‘hitting the wall’ has

taken a long time getting here, but when the ‘wall’ comes into

plain sight, there won’t be enough time to hit the breaks.June 7th, 2012 at 6:21 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!