How Americans go poor by spending money on housing and related expenses: Americans spend 33 percent of their income on housing-related items.

- 0 Comments

People tend to think that buying a home means only paying principal and interest. Most conveniently forget the other myriad of expenses associated with being a homeowner. As Americans find less disposable income in their bank account each month, less Americans are becoming homeowners. The middle class is moving away from the American dream because of the slow process of inflation. Beyond the principal and interest, people spend money on taxes, utilities, furniture, repairs, insurance and other costs that come with being a homeowner. Even non-homeowners spend an inordinate amount of money on housing. Overall Americans spend 33 percent of their income on housing-related items. This is probably why Wall Street has an insatiable appetite to buy up properties to convert them into rentals. Americans are now seeing a large share of their income going into the housing pipeline.

How much do Americans spend on housing-related items?

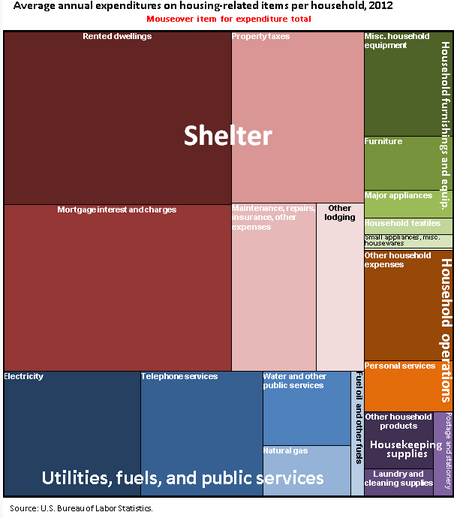

In total, Americans spend $16,687 a year on housing. This amounts to 33 percent of total income on housing-related expenses. We can break down the numbers as follows:

-Households spent most on shelter (59 percent)

– 60 percent of expenditures on shelter were on owned dwellings. These expenses consist of:

-Mortgage and interest charges ($3,067)

-Property taxes ($1,836)

-Maintenance, repairs, insurance, and other expenses ($1,153)

These are the most upfront costs but there are many others:

Source:Â BLS

As you can see from the above chart, a large portion of money is siphoned off into merely being in a property. Homeowners have higher expenses in the form of property taxes, insurance, maintenance, and other items that a person renting may not encounter. With incomes being stagnant, Americans are seeing more money flowing into the housing industry.

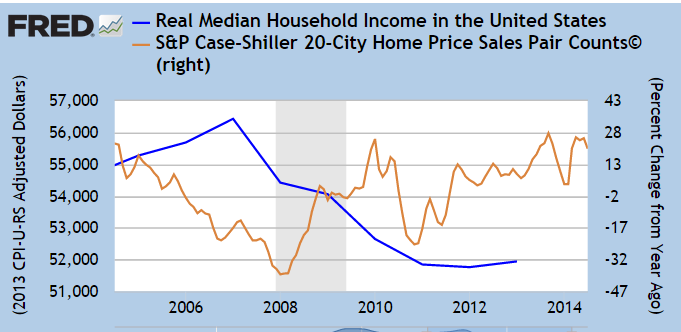

Home prices have jumped while wages have remained stagnant:

While home prices are up nearly 20 percent year-over-year, household incomes remain stagnant. What this translates to for many families is that more money is going into the housing expenses category. Their dollars are no longer going as far as they once did.

It is a big shift for many Americans that believe owning a home is part of the American dream. In many metro areas, home prices have priced out many families from buying. Even though many are eager to buy, they need to realize all the other expenses that go with owning a property. I’m not sure many think this through when sitting at a bank to buy a home.

It is understandable how many Americans go poor by being homeowners. In many cases, you have older Americans living in a paid off modest home and barely scraping by. Social Security goes to pay property taxes, insurance, maintenance, and other costs that never go away. House rich and cash poor continues to ring true for many homeowners.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â