The story of inflation between 1996 and 2016 is of rising prices in things that you need: Prices skyrocket for middle class goods and services.

- 3 Comment

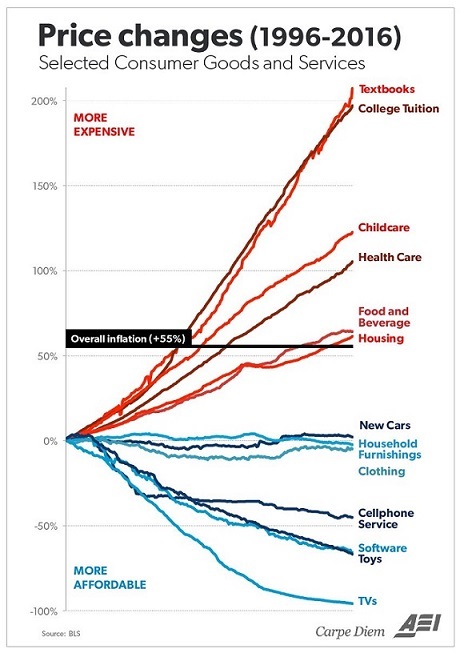

Inflation is rarely discussed in the mainstream press. Most people wake up every day and simply believe that prices go up as a natural state. These deeply held assumptions usually crack when new revelations happen like centuries ago with new scientific discoveries showing that our planet is not the center of the universe. Yet somehow people hold on tightly refusing to acknowledge that inflation is caused directly by banks, governments, and central banks. It is interesting to look at inflation data over a 20 year period, form 1996 to 2016. What you will find in the data is that prices are soaring in the items people need, especially those items to enter into the middle class. Since wages are not keeping up, it is no surprise then that the middle class over this time has shrank into a minority class.

Inflation in items you need

Here is a list of items that are skyrocketing in price:

From 1996 to 2016

-College tuition               +197%

-Childcare                           +122%

-Health Care                      +105%

-Food                                   +64%

-Housing                             +61%

And where are prices going down?

This chart is essentially highlighting the evaporation of the middle class. Many of the jobs that pay a good wage like accounting, nursing, engineering, and computer science for example all require a college degree. And the cost to get this college degree has gone up 197% over the last 20 years. Of course this is being financed via debt with $1.4 trillion in student debt being outstanding. So even for the chance of earning a good wage, many have to take on heavy levels of debt first.

Then you start working and all is well right? Well housing, your biggest expense is up by 61% and this is of course based on the owners’ equivalent of rent which is a poor measure of inflation in housing. Why? Because it looks at a home via its rental utility. Well of course if you own your home you have taxes, maintenance, insurance, and other costs that go beyond just the rental value. It is also hypothetical versus the real actual cost of owning the home (which we know).

Food is up 64% so if you eat, that might be a problem. What is interesting though is cheap food which is largely bad for you is actually fairly affordable.  You can buy a large pizza at some gas stations for $5 bucks. But eat this everyday and you’ll end up in the hospital at some point with heart issues costing you tens of thousands of dollars.

Then many have a family so childcare is up 122% and health care is up 105%. Even this year, plans under the Affordable Care Act are going up on average by 22 percent on the benchmark silver plan:

“(Slate) Just in time for the election, the Obama administration confirmed Monday that premiums on the Affordable Care Act’s insurance marketplaces are set to rise by double digits in 2017. Before subsidies, the average monthly cost of a benchmark silver plan will increase by 22 percent in states that use healthcare.gov or where data is otherwise available, according to the Department of Health and Human Services.â€

The brunt of those paying the bill with this hike in prices? The middle class. Inflation is very real. Rents are also rising as many people flock to metro areas where housing supply is tight and much of the available homes were bought out by large investors since the housing market crisis hit a decade ago.

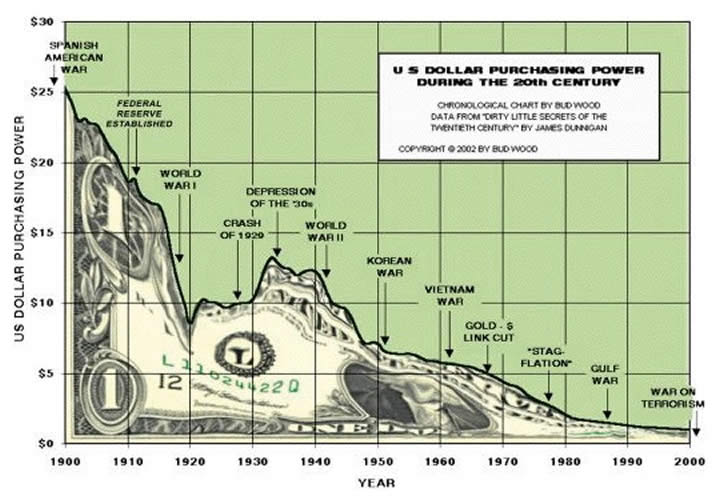

Of course what inflation does is slams the purchasing power of the US dollar:

What we do see is prices falling for household furniture, clothes, software, toys, and televisions. These are items that you can go without for the most part. You need housing. You need food. You need health care. And this is the reason so many Americans are frustrated. They are living this inflation through the real world via budget pinching. I guess it doesn’t matter that inflation is only happening in items that matter.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

laura ann said:

Couples cannot afford to raise children anymore (few exceptions; high income) and we were one of them (now retired). I chose to keep working and focused on other causes (group homes, humane soc.) This country is without hope anyway, and costs keep going up, no real reason to raise a family if there is not much hope for the younger ones to find good jobs, etc. They will have a zero future, that’s a given. I have studied globalist agenda since late 70’s and saw it coming.

October 30th, 2016 at 6:19 am -

ML-Implode said:

I like how TV’s have gone down almost “100%” … allegedly. That means they cost approximately zero. Shows one of the flaws of these types of statistics — the “deflation” is over emphasized because of hedonics; arbitrary adjustments that substitute “quality” improvements for price-lowering. There must be such adjustments for TV’s under the logic that because we have flat screens instead of CRTs and they are on average bigger, we are getting many times the value. Therefore we’re paying near-zero for TV’s “relative to before”.

But that kind of “logic” is sheer lunacy — people are still paying about the same amount of money for a TV as they ever have (maybe, for the same diameter screen, they ARE cheaper; but that just means larger screens have become standard).

A similar point applies for clothing, toys, etc. — except in reverse. These items might be nominally cheaper, but the quality is way lower. So why should we now take quality into account for the value of these items? Easy — because the cheap-o items have to be replaced more frequently.

October 30th, 2016 at 8:09 am -

Steve said:

I do not know where the Healthcare cost, for an Affordable Care Plan, is going up 22 percent this next year. Tennessee Blue Cross went up over 30% the second year and over 30% again the third year. This next year they have sent a letter, the increase is over 100%.

October 31st, 2016 at 4:39 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â